Stock Prediction for Investors

Any investor would love to have a crystal ball to make well timed, well chose stocks picks. Those with the data and forecasting tools have a big advantage, and those who are close to the newsmakers can achieve an unparalleled performance in stock picking.

And with the stock markets continued volatility, stock picking is the game, and one that most people get wrong and lose their money. So the real goal is to find a stock prediction system that can inform investment decisions in a powerful and timely way.

AI Stock Prediction Software

Artificial intelligent stock screening software is a big thing these days as daily trading data is scanned for cues, signals and signs. AI stock prediction software can filter through much more data on thousands of stocks and come out with insights on future price trends. But economic and market conditions never stay the same and influences come from just about anywhere – unique factors (that the data doesn’t reflect) shapes the stock’s price.

AI stock prediction software companies do boast about their successes, but no one seems to believe them. Many of them are struggling financially which might suggest the evidence doesn’t quite validate them. Still, I think these companies, the best of them, might be a takeover target for larger investment firms.

Few of the big stock advisory firms are mentioning AI forecasting as a big part of their portfolio management services. I’d like to know why.

AI could use some insider trading knowledge too. With data, you’re just observing price and volume behavior, oblivious to what’s really causing it. Although, some of the AI stock prediction software companies integrate news events in the algorithm. But then, a news event still doesn’t tell you why something happened.

The reality is, that stock prices are controlled by humans and human emotion. The decision to buy and sell is very emotional. The decision made is always based on a feeling which is a cluster of factors, memories, and expectations. It’s basically a guess, but that’s all we have right now. Smart people with inside knowledge making guesses.

Using emotion to predict price and decide on dumping a stock or buying the most recommended stock is actually wise. Why? Because all analysts and traders are left with a list of signals ranked by weighting. AI prediction software does the same thing, only it knows more and is more precise.

Where’s the Proof of Stellar Investing Foresight?

There isn’t a lot of published info about stock price forecasting successes. They probably didn’t the best stocks and don’t want that news to get out, or they’re they don’t want to reveal they’ve figured something out important. Not everyone is a generous publisher.

The truth might be that stock prediction is a process that involves the opinions of analysts and experts in each field who have “knowledge” of the companies involved and the sector they do business in (.e.g. Tesla and electric vehicle manufacturing).

Didn’t See That Coming

Consider first that many stock analysts/advisors bought stocks near the recent peak. Why didn’t they foresee the dangers ahead given all the stock analysis tools, history, and experience they have? Why did their forecasting fail?

Investors, hedge fund managers, and others all want to plan their investments, improve their investment strategy and minimize risks. Foretelling market trading volumes, pricing, and short positioning among other things, then can add to trade timing and ramp up profits.

Are Market Swings Caused by Algorithmic Trading Bots?

It’s estimated that about 60 to 70% of all stock trading is done via automated algorithmic trading. This is where computers are used to make trades automatically based on a defined and weighted set of parameters such as price, quantity and timing. But that system is guided by stock analysts and also, increasingly, by other computer models including artificial intelligence systems.

Some of the wild swings we see in the markets are likely caused by short sighted algorithmic trading. Computers weak understanding of context, time and events makes them poor judges of the longer term future. That leaves them vulnerable to mistakes or potential huge losses.

For example, a couple of weeks ago, some investors using algorithmic trading systems bought at the highest price ever only to see the Dow Jones, NASDAQ, S&P, FTSE, TSX, Russell, and other indexes crash. They lost a third of their portfolio value.

There is Demand for Better Stock Price Prediction

Which markets do you think will rise better after the Corona Virus epidemic in 2021 or for the next 5 years? Well, if you don’t have Warren Buffet, Jim Cramer a crystal ball, or a host of stock market experts, you’ll need some prediction services or software tools to help you carve a path to investment success.

This post is about stock prediction. Why are some forecasters so good at predicting stock price trends and crashes? They’re likely very experienced and focused on a industry, one they know well. They have information you don’t have. They also have a sensitivity to trends and an open mind to see what’s important. Closed, narrow minds are blindsided by political, biological, and technology trends.

Seeing the Markets Path in the Next 5 Years

Knowing where the economy, business and stock prices are headed gives you a decided advantage in buying and selling stocks. You don’t have insider information which others do possess. You’re not going to obtain hidden information. It’s hidden for a reason.

It’s all about acquiring more information or data. And stock market data is available which stock prediction services use. This includes new AI stock prediction services.

However, there may be a variety of stock prediction tools that can help you make better decisions whether you’re a day trader or a long term retirement investor. They might be technical charts, latest stock market news releases, commodity reports, expert videos, helpful blog posts and of course your stock futures reports, etc.

They can all help inform you and help you create a clearer picture of 2021, 2022 and the next 5 years. So you can see where this is going — if you possess the right resources to build a reliable picture.

Stock prediction is a lot more than technical or fundamental analysis. Since the Saudis, Russians, and Joe Biden and the Democrats make decisions emotionally, irrationally, and then confront the results in real time, the outcome is fairly random. So for analysts or AI computers, analyzing past market data has less meaning in the short term.

The daily futures price quotes in the morning are often the exact opposite of the index level at the end of the trading day. Relying on stock futures reports is not a good idea.

Even the long term forecast is skewed by politicians, periodic epidemics, new biological miracles, weather events, tech breakthroughs, trade tariffs, and de-globalization. As an example, who knew Elon Musk would be so effective in EV and battery production? Who knew when the Saudis and Russians would gang up on the new fracking producers?

A lot of these issues have never been seen or confronted before. So if we rely solely on AI prediction tools and software, we still don’t have clear mastery of the unpredictable, emotional side of business today.

Trends and Data You Need to Know

In your own self-directed analysis of future macroeconomic and market trends, you can look at:

- economic predictions

- weather forecasts

- stock market outlooks

- expert opinion

- banking and government debt issues

- interest rate factors

- trade and tariff factors

- demographic profiles

- consumer buying trends

- technology innovation

Right now, it looks as though NASDAQ stocks will rise faster in the recovery. Tech companies listed on the S&P may be less affected by commodities trade, tariffs, and a lack of face to face selling. Do investors know this?

Which countries are forecast to thrive in the next 5 years? It looks like the United States will enjoy further boom times as the Tariff walls protect all US companies and startups. Which trading partners will thrive with the US? Likely Canada and Mexico, and given currency changes, you might see some companies from these countries do very well, after the pandemic is finished.

Who knew Mexico would be so irresponsible about the Corona Virus pandemic spread? Yet these are the things a professional forecaster would be considering. Will the Saudis and Russians keep oil prices down? Are oil stocks the best long term bet? Could the Democrats unseat President Trump and open US borders to Chinese imports and renewed technology theft? Lots of possibilities and risks where a different type of intelligence is needed.

When investors overbought stock just a month ago, they were confident in their technical reports and expert advice given. And then what happened? It seems macroeconomic factors shouldn’t be ignored, nor should personalities and political news. These affect your individual company stocks and ETFs more than do earnings trends and reports.

How is Stock Price Forecasting Done?

Stock forecasting is done three ways:

- Fundamental analysis

- Technical analysis

- Machine learning (AI stock prediction)

Fundamental Analysis

Fundamental driven stock analysts look at the company behind the stock. The firms past performance and the condition of its financials are reviewed. Many financial ratios are studied such as the price earnings ratio. FA tries to find the true value of a stock compared to the it’s current market price. The full future value of a company can be assessed and then discounted back to its value in present time. Fund managers may rely on fundamental analysis.

Fundamental analysis may also take a top down look at a company beginning with the global economy then national economy, then sectors, and finally the company itself.

Technical Analysis

Technical analysis assesses the past performance on a market, market sectors or company to formulate a future stock price. Technical examines data points and looks for patterns, resistance levels, and moving averages. You’ll see this often on many stock forecasting websites and it’s generally only understood by experts. Technical analysis is more often used in the commodities markets for short term forecasts, where volatility is much lower.

If everything is known about a company and a market, the forecasting its future price would be easy. But random events such as an elected leader, global pandemic, or technology breakthrough can make historical data misleading.

AI and Machine Learning

The most recent and interesting form of stock price prediction is AI and machine learning. This is the realm of algorithms, AI neural networks and genetic algorithms.

You can read this Stanford University project on AI predictions in the stock market. they combined regression models with technical analysis to achieve positive results.

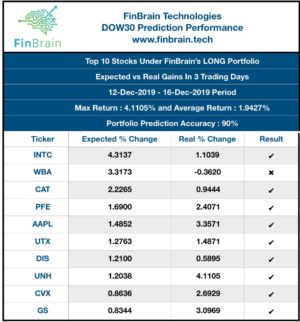

There are companies already using AI stock prediction software. I Know First and FinBrain are two of the most well known AI stock market prediction companies. The techniques they use are beyond the comprehension of most investors and stock analysts. Insights are drawn from massive and sophisticated data processing, and will only become more complex.

AI stock prediction services are combining many different algorithms to identify the most successful paths to high stock prices.

It’s not difficult to see that AI stock prediction will outperform classic spreadsheet analysis. And when a major events occur in the economy, many stock analysts are caught off guard because the analytical tools and models they use aren’t good enough.

The profession of predicting stock prices is competitive and whoever develops the most sophisticated systems to handle the vast amount of inputs and see trends correctly will win.

Check out I Know First and FinBrain now.

3 to 6 month Forecast for the Dow S&P NASDAQ | Tsla Stock | Stock Quote | Stock Market Today | 10 Year Stock Market Forecast | Real Estate Market 2023 | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ 2023 Forecast | Stock Trading Platforms | Stock Trading | Lines of Credit | Reverse Mortgages | Low Mortgage Rates