Real Estate Vs Stock Investing

With the stock market so hot of late reaching yet new highs in valuations, are you considering divesting and buying something else with your recent fortune?

Or will you stick with the stock market forecast and buy Tesla, Bitcoin, or some Faang stocks and do something risky?

If the thought of buying property hasn’t crossed your mind, then you might only lack confidence or some comparative analysis. There are lots of assets to turn to, and real estate – land, rental property, houses, condos, apartments, and commercial property are worthy options.

The advantage of real estate as an investable asset is its price persistent appreciation ability to help you lower your taxes and gain extra rental income.

The Scarcity and Essentialness of Real Estate

It’s the scarcity and regulation of real property that makes it create such whopping returns. If not for government (NIMBY) interference and price fixing, real estate would likely fall in value. But those manipulative hands of the rich and political will never lose control of the price of real estate. The fact they covet real estate and obsess over it is an important investment signal for you.

This is why most millionaires made their fortune in this sector. Sure many more millionaires and billionaires are becoming wealthy via software now, but creating and financing a software success isn’t for the faint hearted. Global competition is intense in software development and marketing but the ante to play in that market is really steep.

Real estate in many countries is protected from foreign predation and speculation (taxed, restricted) so citizens might have a better chance to buy property if it is available. Of course, with NIMBYism preventing land use and development, more money is chasing fewer properties. NIMBYism is the key to rising house prices. If property development was opened up, prices would drop.

However, with such intense demand for homes, home prices might keep climbing for the next few years and rent prices might not be affected at all (except for lower class rental properties).

Will the NIMBYs be beaten and will land use be opened up for development. In some places, this is happening, but if industry and people aren’t moving there, then building houses, retail buildings, and condo buildings doesn’t make sense. You must look for cities and neighborhoods that are growing fast, such as Texas, Florida, Arizona and other progressive regions that are drawing business.

Suffice to say that in a growing economy fueled by post pandemic fiscal stimulus, real property might be a better asset if you have the funds to purchase it. There are fractional ownership schemes available but let’s not go there. It might be too scammy to make money long term.

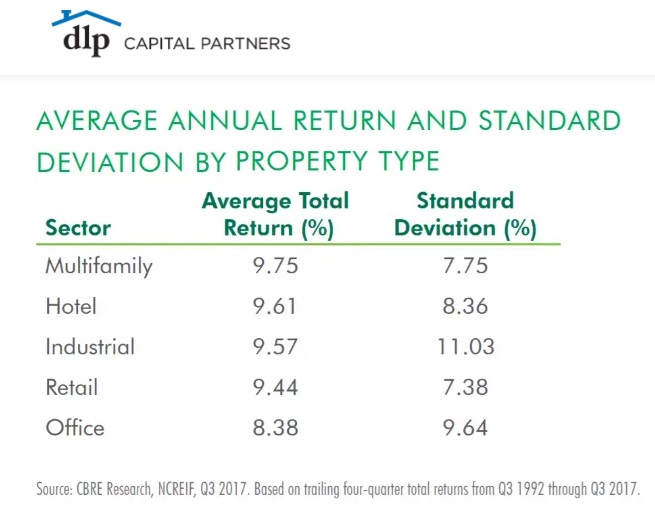

Compare the returns in investing in real estate to currency, gold, oil, ETFs, stock equities, bonds, and other instruments, and real estate comes out shiny. Although a report from towardsdatascience.com found that both rental property and stocks came out with an average 7% return traditionally.

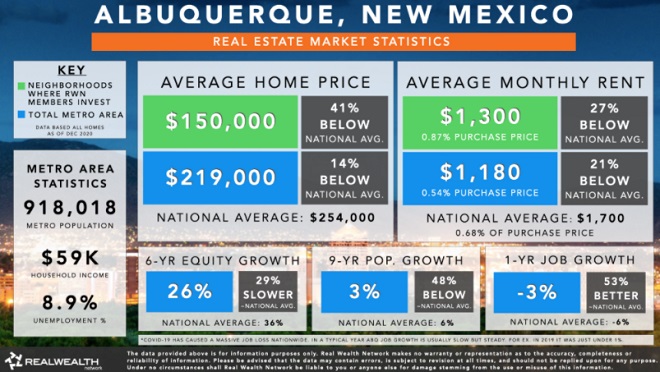

Realwealthnetwork has a good look at the top cities to invest in, in the US, and Albuquerque comes out tops because it has solid job growth, steady population growth and affordability. It highlights the fact that you’re not bound a specific city to invest, you can find the best cities to buy properties and buy there instead. Some cities have a very good outlook and real estate prices are reasonable.

Check out the housing markets in Denver, Austin, Colorado Springs, Salt Lake City, Tampa, Atlanta and Dallas for demand and price trends.

Of course, real estate in some cities has had much better returns of recent, and certain stocks have high returns too in the last 12 years. But the boom stock years are perhaps just about behind us, and the question you should have, is “if a recession happens, which is better to own.”

It doesn’t look like we’ll suffer another recession unless the US government makes grave errors, or there is another war.

Look at this chart from FRED showing house price growth:

Sure there are housing crash possibilities, but as the chart shows, long term growth is almost certain. Real estate retains its value even during recessions. Hang onto your investment and it grows faster than most investments. And investing in rental properties is often considered passive investing (if you hire someone to manage it) and there are fractional crowdsourcing ways to invest in real estate.

With property you can write off mortgage interest, Realtor fees, and defer capital gains. You can write off costs associated with maintaining rental properties and upgrading of the property. That means you pay less tax as you beef up the value of an asset you can sell. There are taxes of course and issues with managing rental property. Since you own a tangible asset that is less volatile and you could even live in if you had to, real estate is a less risky investment choice.

Real Estate Demand Factors

The rising number of working Millennials starting families is the most significant factor powering house price rises, and the return of the economy is boosting condo sales and will help commercial and retail property values return as well.

Let’s focus on the residential real estate market though.

3 to 6 month Forecast for the Dow S&P NASDAQ | Tsla Stock | Stock Trading Platforms | Stock Trading | Reverse Mortgages | Stock Market Today | 10 Year Stock Market Forecast | Real Estate Market 2024 | 5 Year Stock Forecast | Dow Jones Forecast 2024 | Software as a Service Marketing | Bleisure Travel Marketing | Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel Marketing | Travel SEO