Toronto Condo Market

The Toronto housing market continues to accelerate as the pandemic eases. Although the 416 area code sees growth last quarter and in September, it’s the 905 area code that is seeing big increases in condo prices.

Toronto’s condominium market fared poorly during the pandemic as few wanted to risk high density living during the period. And has jobs were temporarily halted in the GTA, there was no requirement for many to live in the 416 area code. The return is making the forecast for condo prices head upward.

Last February Oxford Economics forecast Toronto condo prices could fall between 5% and 10% this year. Well that’s certainly not going to happen, in fact, there are two more months for prices to rise further. We can expect bidding wars and Realtors helping clients get their price and more.

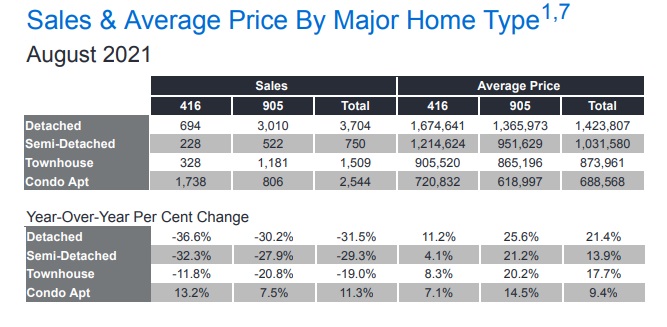

3rd quarter condo sales results showed the pandemic sales drought has ended and a sellers market now exists the GTA. While the prices of Toronto detached homes continues climbing out of reach, buyers are looking to the condo market for the next home. With interest rates remaining low, but with intended rises planned for 2022 in Canada, we might see more of a rush to buy a condo in the GTA.

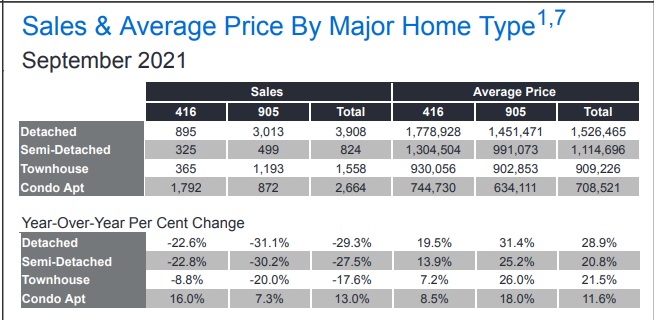

September’s condo sales dropped as the usual fall season drop happens, and as fewer condos are available. See the September condo sales report below.

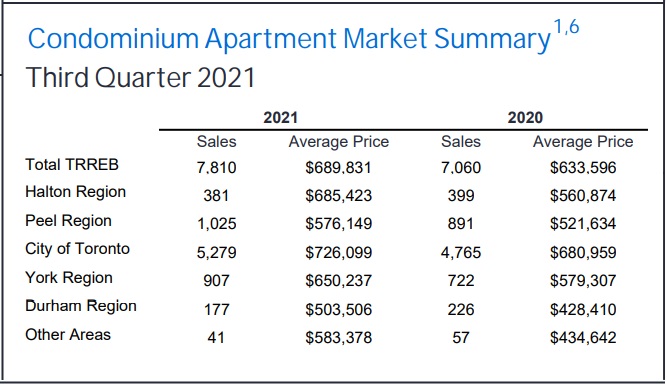

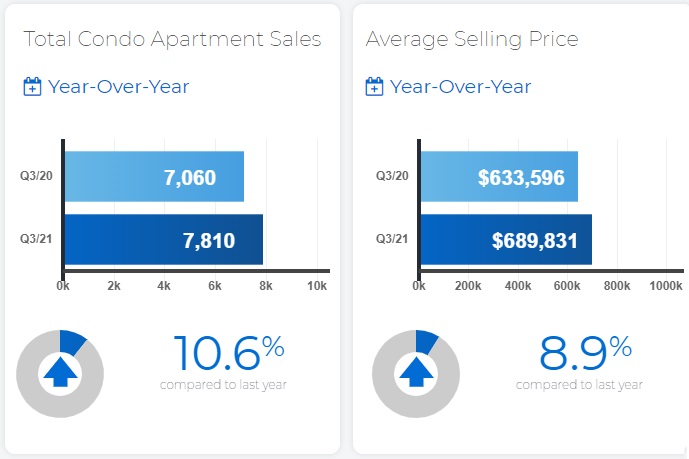

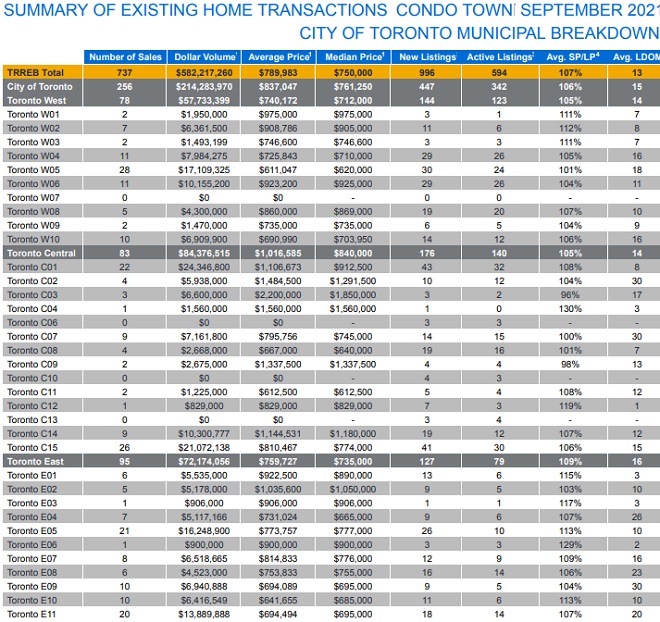

The Toronto Real Estate Board’s Q3 sales report just released showed 7810 condominium apartment sales up 10.6% compared to Q3, 2020. The average selling price last quarter was $689,831, up 8.9% from last year same period.

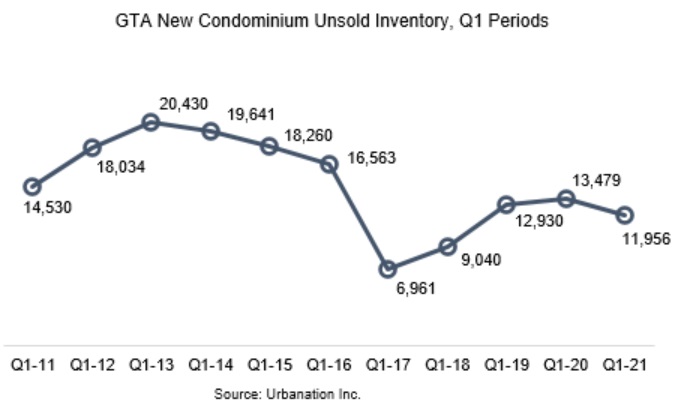

Given construction will not keep pace with returning demand, we can expect higher prices for Toronto condos in 2022.

“Price growth in September continued to be driven by the low-rise market segments, including detached and semidetached houses and townhouses. However, competition between buyers for condo apartments has picked up markedly over the past year, which has led to an acceleration in price growth over the past few months as first-time buyers reentered the ownership market. Look for this trend to continue,” said Jason Mercer, TRREB Chief Market Analyst.

Condo Apartment Summary. Screenshot courtesy of TRREB.

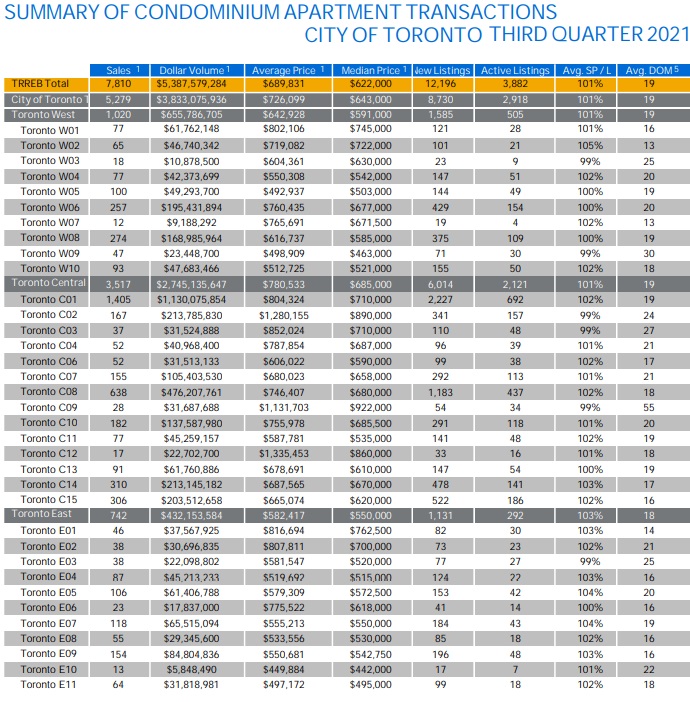

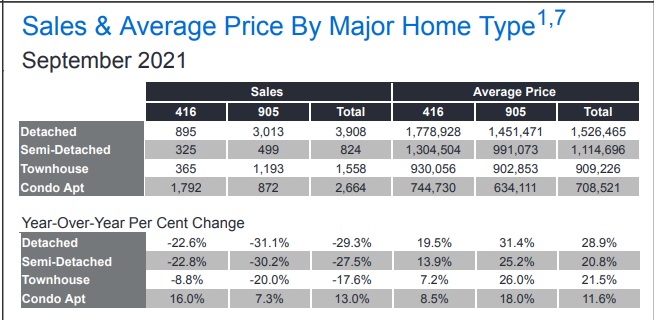

City of Toronto Condo Sales & Prices

Full 3rd quarter sales chart City of Toronto. Screenshot courtesy of TRREB.

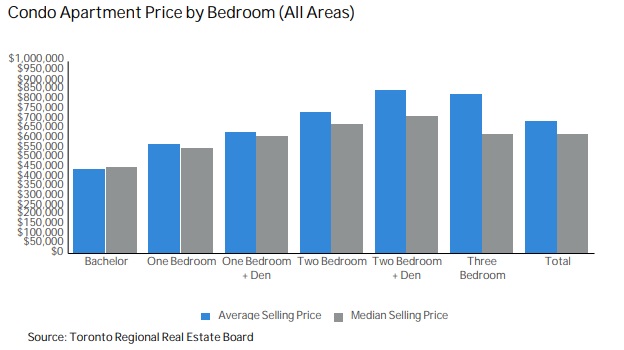

Screenshot courtesy of TRREB.

Screenshot courtesy of TRREB.

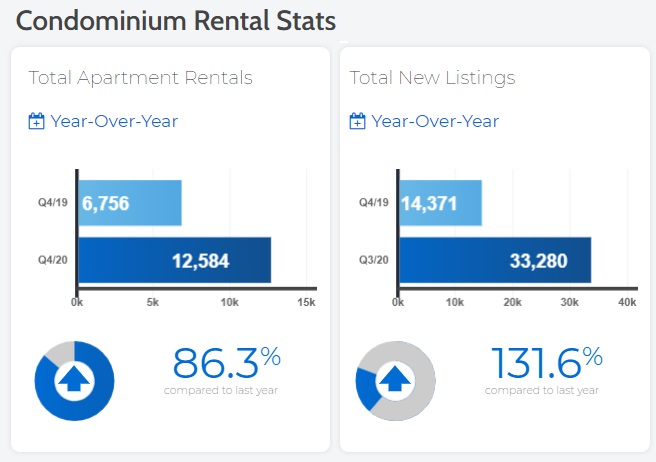

Condo Listings Q3

The volume of listings in the quarter fell 30% to 12,196 units, while active listings have dropped 46% to only 3,882 listings for sale currently. Average condo price reached $689,831 which is up 8.9% from last year same time.

Condo Prices in Q3 2021

In September, 416 area condo condo prices rose 8.5 year over year, while sales plummeted 16% in the 416 area code. The return of the 905 area code was even stronger with prices rising 18% year over year.

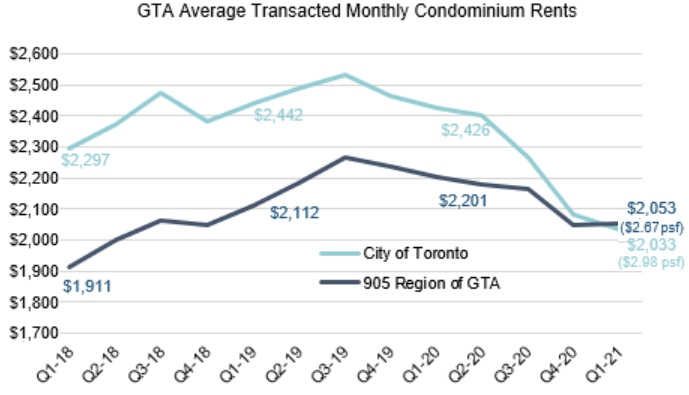

TRREB reported that apartment rents in Toronto had fallen in Q1. 13,168 condominium apartments were rented via TRREB’s MLS® System during the first quarter and this is an increase 81.6% from Q1 of 2020 when 7,251 rentals ocurred. Condominium rental apartments listings rose 78.8% year over year.

The average 1bedroom condominium apartment rent dropped 16.8% year-over year, from $2,187 last year to $1,820 this quarter. And as well, the average 2 bedroom condominium apartment rent fell 13% year over year, from $2,812. to$2,447 to

Toronto Condo Market Stats

“While the condo market was slower to recover compared to low-rise market segments, many Realtors have noted a marked increase in condo interest since the beginning of 2021. This interest will likely continue to increase as the economy improves and vaccine take-up accelerates, resulting in more confidence for first-time buyers,” said TRREB President Lisa Patel.

The fact is, the Toronto real estate market is heating up and this spring could bring huge price gains. CMHC has apparently backtracked on their previous warning about a potential housing market crash. However if the economy does falter in 2022, we’ll likely see them reiterating that earlier warning.

Toronto suffers from a severe housing shortage, and the glut of apartment and condo units on the market now, will be bought up and renters will begin to return to Toronto, out of their parent’s houses and shared living situations.

Toronto Condo Rental Market

A big glut of condo rental units came onto the market courtesy of China’s Covid 19 virus. Without condos for sale, we’ll see rental prices rise again, which draw investment buyer’s interest.

“The GTA rental market began to resemble pre-COVID times during the second quarter, which is a testament to a strong foundation of demand that will only grow going forward as immigration recovers, schools and offices reopen, and expensive ownership housing leads to greater levels of renter household formation. While new construction activity is also on the rise, the level of supply underway is expected to lag behind demand, creating conditions for rents to continue rising towards pre-covid levels and beyond in the months to come.” said Shaun Hildebrand, President of Urbanation.

Return of a Roaring US Economy?

And when the US economy roars, Toronto’s economy purrs. With oil price forecast predicting continued low prices, even dropping as low as $5 a barrel, the international business for Ontario and Canadian companies is unparalleled. These could be very good times for the Toronto housing market ahead. Realtors should be very happy as long as they can find sellers which they’ll do through marketing excellence.

Serious condo buyers will be on the hunt for new or resale condos in the 3rd and 4th quarters Toronto in 2020. As this chart reveals, they’re likely to find very limited supply and soaring condo prices. You can see the strong price appreciation in the charts below.

Some are happy with the low mortgage rates, high construction releases, and Corona Virus deflation factor because it opens up availability and affordability.

Some real estate experts fear strong price deceleration and a bursting housing bubble. For now, due to supply issues, the forecast for the summer ahead is still for rising rents and condo prices in Toronto in 2021, if the Corona Virus pandemic is abated. So far the stock markets are worried but Toronto employment should come back strong.

With few single detached homes in the affordable range within the Toronto housing market, most buyers will heading to Toronto’s condo market for an investment condo or a place to call home. All signs to point to much higher prices this summer.

| Toronto Condo Market Price Chart | ||||||

| Area | Toronto Condo Prices February 2020 | Toronto Condo Prices November 2019 | Toronto Condo Prices March 2018 | Toronto Condo Prices August 2017 | March 2012 | Price Change over 8 years |

| City of Toronto | $666,358 | $659,855 | $651,100 | $550,299 | $361,800 | 45.7% |

| Toronto West | $612,453 | $580,616 | $494,400 | $434,218 | $286,366 | 53.2% |

| Toronto Central | $805,982 | $723,398 | $656,000 | $615,680 | $422,396 | 47.6% |

| Toronto East | $525,756 | $491,626 | $411,000 | $403,028 | $237,909 | 54.7% |

| Halton Region | $531,706 | $522,795 | $465,300 | $528,579 | $442,625 | 16.8% |

| Burlington | $510,174 | $494,802 | $520,300 | $476,222 | $370,667 | 27.3% |

| Halton Hills | $507,400 | $469,667 | $486,300 | $446,971 | ||

| Milton | $533,600 | $502,667 | $432,000 | $427,594 | ||

| Oakville | $556,871 | $572,066 | $442,100 | $523,507 | $485,800 | 12.8% |

| Peel Region | $528,851 | $494,852 | $423,600 | $395,188 | $433,780 | 18.0% |

| Brampton | $445,420 | $424,987 | $360,000 | $350,401 | $351,500 | 21.1% |

| Mississauga | $547,524 | $513,566 | $435,000 | $402,344 | $453,250 | 17.2% |

| York Region | $584,451 | $556,203 | $507,000 | $500,456 | $537,903 | 8.0% |

| Aurora | $519,167 | $506,325 | $477,000 | $685,874 | $525,000 | -1.1% |

| Markham | $592,115 | $600,954 | $509,000 | $503,455 | $527,518 | 10.9% |

| Newmarket | $475,111 | $420,214 | $536,000 | $400,340 | ||

| Richmond Hill | $555,734 | $504,187 | $475,400 | $470,076 | $596,667 | -7.4% |

| Vaughan | $627,684 | $595,726 | $531,000 | $521,400 | $554,211 | 11.7% |

| Durham Region | $442,154 | $524,450 | $407,800 | $376,250 | $274,350 | 38.0% |

| Ajax | $409,750 | $441,113 | $396,000 | $379,431 | $281,688 | 31.3% |

| Oshawa | $310,100 | $267,408 | $358,000 | $315,075 | $210,667 | 32.1% |

| Pickering | $534,654 | $460,784 | $501,000 | $402,316 | $340,667 | 36.3% |

| Whitby | $472,053 | $441,467 | $410,000 | $457,143 | $294,350 | 37.6% |

City Of Toronto Condo Prices

Compared to the peak, condo prices in some districts is down considerably. Lots of upside for higher prices later this year.

| TREB District City of Toronto | Avg Price February 2020 | Avg Price August 2018 | Avg Price November 2017 | Average Price April 2016 | Price Change Since March 2017 |

| Toronto W01 | $1,126,333 | $1,527,178 | $1,269,500 | $1,405,442 | -20% |

| Toronto W02 | $1,219,137 | $1,291,146 | $1,256,500 | $1,331,780 | -8% |

| Toronto W03 | $904,551 | $769,639 | $774,021 | $666,904 | 36% |

| Toronto W04 | $816,226 | $863,846 | $819,469 | $786,951 | 4% |

| Toronto W05 | $636,666 | $835,118 | $800,063 | $749,333 | -15% |

| Toronto W06 | $821,347 | $1,080,539 | $914,017 | $795,840 | 3% |

| Toronto W07 | $1,487,111 | $1,102,601 | $1,086,386 | $1,112,233 | 34% |

| Toronto W08 | $909,547 | $1,439,304 | $1,378,995 | $1,204,013 | -24% |

| Toronto W09 | $813,362 | $981,972 | $886,872 | $839,479 | -3% |

| Toronto W10 | $620,795 | $746,907 | $691,261 | $613,488 | 1% |

| Toronto C01 | $890,335 | $1,661,600 | $1,597,750 | $1,528,085 | -42% |

| Toronto C02 | $1,711,636 | $2,900,875 | $2,109,010 | $1,580,181 | 8% |

| Toronto C03 | $1,332,572 | $2,302,956 | $2,327,333 | $1,761,787 | -24% |

| Toronto C04 | $2,057,487 | $2,265,493 | $2,204,173 | $2,033,140 | 1% |

| Toronto C06 | $1,099,083 | $1,316,250 | $1,293,688 | $1,318,750 | -17% |

| Toronto C07 | $1,081,867 | $1,601,680 | $1,609,066 | $1,657,822 | -35% |

| Toronto C09 | $1,748,221 | $3,153,333 | $3,538,371 | $2,998,401 | -42% |

| Toronto C10 | $1,223,586 | $1,348,333 | $1,856,406 | $1,864,333 | -34% |

| Toronto C11 | $1,090,923 | $1,730,650 | $2,344,375 | $1,542,867 | -29% |

| Toronto C12 | $2,423,824 | $3,921,393 | $3,729,125 | $3,141,244 | -23% |

| Toronto C13 | $1,050,883 | $2,085,556 | $1,342,464 | $1,926,266 | -45% |

| Toronto C14 | $1,089,039 | $2,140,941 | $2,235,856 | $1,996,137 | -45% |

| Toronto C15 | $827,503 | $1,700,385 | $1,587,250 | $1,766,219 | -53% |

| Toronto E01 | $1,155,904 | $1,213,600 | $1,102,667 | $1,164,343 | -1% |

| Toronto E02 | $1,224,341 | $1,498,600 | $1,457,515 | $1,333,475 | -8% |

| Toronto E03 | $1,083,049 | $1,068,716 | $913,430 | $947,611 | 14% |

| Toronto E04 | $757,448 | $773,338 | $777,377 | $717,890 | 6% |

| Toronto E05 | $798,142 | $940,400 | $899,419 | $991,136 | -19% |

| Toronto E06 | $844,270 | $926,850 | $822,917 | $766,782 | 10% |

| Toronto E07 | $639,461 | $914,842 | $911,018 | $874,280 | -27% |

| Toronto E08 | $748,926 | $966,582 | $930,974 | $810,560 | -8% |

| Toronto E09 | $695,431 | $741,992 | $714,451 | $664,378 | 5% |

| Toronto E10 | $840,530 | $886,408 | $821,381 | $821,126 | 2% |

| Toronto E11 | $617,348 | $807,083 | 794,238 | $720,672 | -14% |

Zoocasa’s recent report shows prices of condos in some Toronto neighborhoods have grown at phenomenal rates. In Scarborough’s Scarborough Village and West Hill, prices are up 147% in the last 5 years.

Should You Buy a Toronto Condo in 2021?

The price of a median home in Toronto is predicted to rise above $1 million soon. Few buyers will be buying at those prices. Which means, as usual, they’ll be buying new construction and existing condos. That will put big price pressure on condo sales. Buyers will not be liking what’s coming to the Toronto condo market in 2020 or the next 5 years.

Although few economists will admit it, the next 4 years look bright for our top trading partner south of the border. And that economic forecast will spill over into Canada. We won’t see a true recession until 2025.

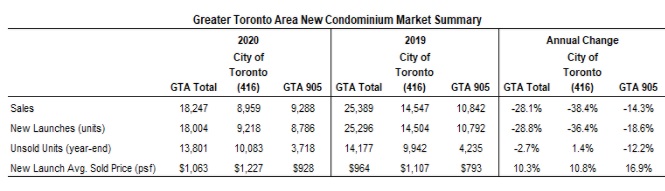

Urbanation New Condo Report

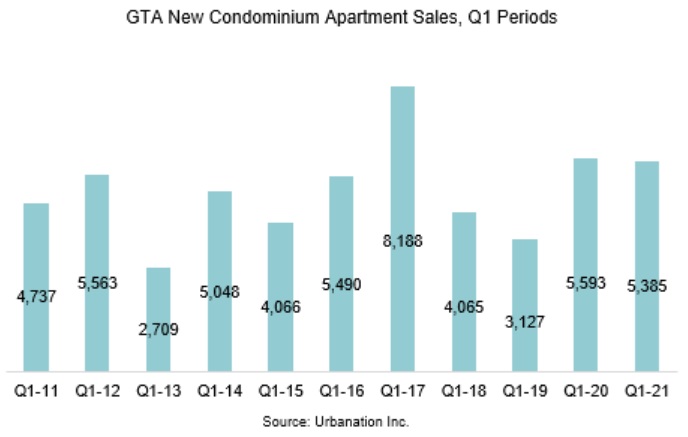

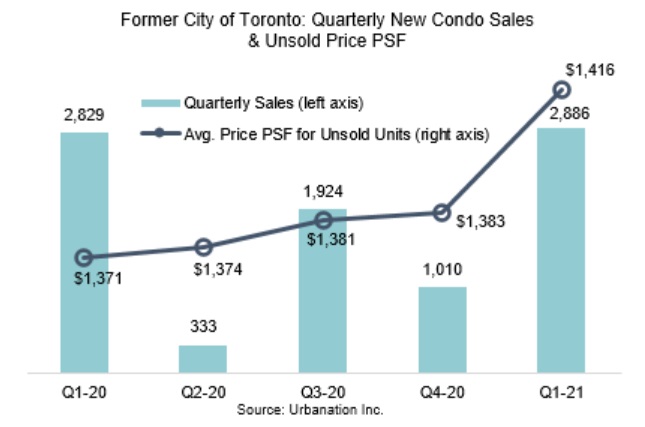

Toronto’s new condo sales roared ahead as Toronto’s employment scene returns to normal and buyers lose their fear of the Covid 19 virus.

New condo apartment sales in the GTA grew 550% (to 9,001 units) in Q2 of 2021, the third highest quarterly total on record. The 905 area code led new condominium market activity with a 58% share of sales in Q2-2021.

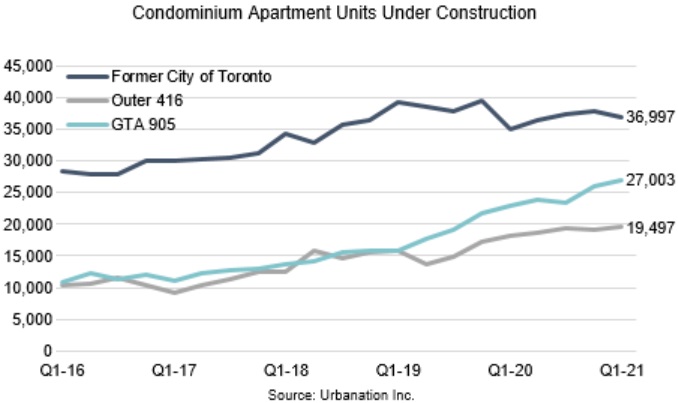

And Urbanation also reported the number of new condominiums under construction in the GTA grew 10% year-over-year to a record high of 86,149 units. There are an additional 22,857 units started in the pre-construction stage. 4,317 condominium units were completed in Q2 2021 and 10,741 unit are expected to be completed by the end of 2021. That will make a total of 19,006 new construction units finished in 2021 total. That is down 15% from the record high 22,473 units comstructed in 2020.

Build To Rent Market

The built to rent market is growing in all North American housing markets and will in the Toronto housing market too. Construction will begin to grow.

Toronto’s rental condo market has seen the strongest surge in building since the 1970’s. In a Toronto Star report, Urbanation reported that 12,367 apartments were built at the end of 2019. To put it in perspective, there were only 18,602 units built during all of the 1980s and 1990s.

And there was a 43% yearly increase in the number of development applications for purpose-built rentals in 2019. This may add another 17,082 units to the housing supply. 69,564 apartments were under construction or proposed for development at the end of 2019. They add that it could take many years before those condos are occupied. So for now higher rents and intense competition for stressed out renters is the rule.

According to padmapper.com, the average rent in Toronto is now $2300 per month, almost $200 higher than congested Vancouver.

Millennials Are Driving The Toronto Condo Market

They’ll need more creative mortgage financing and improved condo searches to find condominium they can afford in Toronto. To save they might have to search further to Brampton or Ajax. Although the mortgage changes in 2018 will put an extra burden on them, and force them to stay in the rental market, they will likely have more money in the spring to buy a condo.

There’s big investor demand for condos too. Student housing is in a severe crunch in Toronto and Vancouver. Investors are well aware of the rental potential of condos and many may be investing in the Vancouver condo market and here in Toronto because of so much rental demand.

If you can’t earn a profit on capital appreciation, you can still make it on rental income.

Big Demand for Condos as Entry Level Homes

Most home buyers in the Toronto area can only hope to own a condo. Homes are averaging over $1.5 million in some areas in the GTA. And condo developments are offering more for tenants. And perhaps the key feature of Toronto condos is their proximity to work, leisure, restaurants and shopping and freedom from the grinding commute that many Torontonians face each day. So there are good reasons to buy a condo in Toronto.

Oddly, the condo market in Toronto is much less volatile than the single housing and townhouse market in Toronto. Her foreign buyer tax and rental price controls look like they’ll miss the mark.

Where are Toronto’s Best Investment Condos?

As the graphic above shows, the top location for investment condos may be Toronto Central (where home prices are highest too), Toronto West and Mississauga. The bulk of these listings are in huge mega-sized condo towers and there are more of them being built. Toronto Central is also close to the U of T, Ryerson, and other colleges where off campus housing is in hot demand.

It’s the same situation for Vancouver condo rental and investors should take note.

Housing Market 2024 | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ Forecast 2023 | S&P Predictions | Backyard Offices | Realtor Marketing | Florida Real Estate | California Real Estate | Boston Real Estate