Homes For Sale: The Quest for Buyers

The latest reports from NAHB suggests US home builders are ramping up construction of new homes for sale, yet demand is expected to far exceed supply this spring.

If the US administration’s stimulus plan and budget are successful, it could make this spring’s housing market one of the hottest housing booms in history. Already the home builder companies are flourishing and bidding wars are growing. Demand is fueling big production, especially in cities which had been suffering economically for decades.

For stock market investors, home builder stocks are worth a look at.

From a report in Forbes, Nanayakkara‑Skillington, associate vice president, forecasting and analysis, at the National Association of Home Builders (NAHB) said “Builders are going to be really busy (in 2021). There’s a renewed interest in housing after (people have been) crammed into a small apartment or house during Covid lockdowns. Now, more than ever, people want more space. New construction on single-family homes could exceed 1 million (in 2021).”

“Without a sea change from the government and the construction industry itself, inventory will remain below needed levels” said Robert Dietz, senior vice president and chief economist at the NAHB.

Supply Bottlenecks + Huge Demand = Much Higher Prices

Although house construction has increased strongly, if house prices grew so strongly during the pandemic recession, they will grow faster when the recovery begins in earnest this spring.

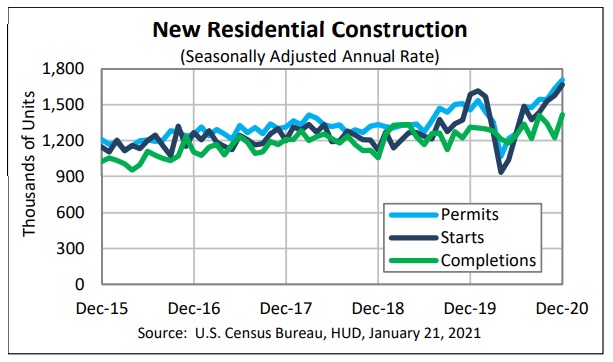

1,452,000 residential housing building permits in 2020, a rise of 4.8% above the 2019 permit numbers issued of 1,386,000.

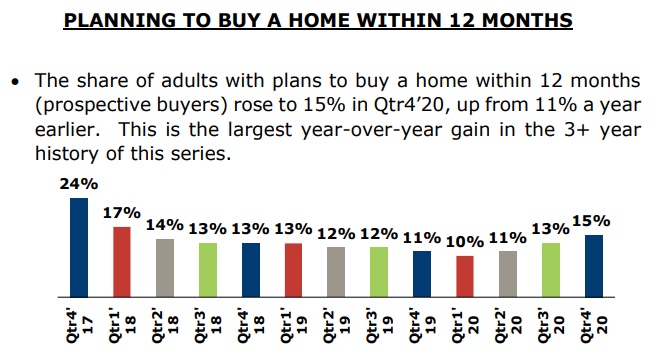

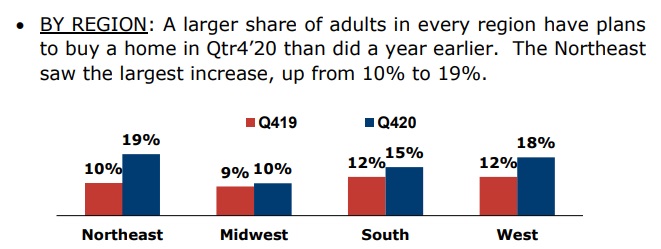

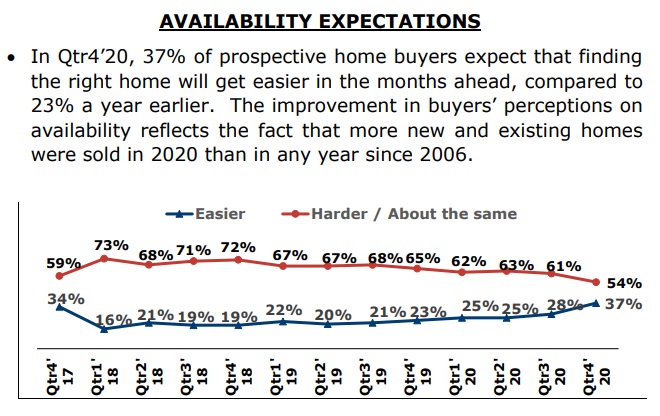

As we’ll see below, home buyers are way too optimistic and aren’t ready for the home price run up that’s going to happen this spring buying season.

First Time Buyers and Millennials are a Force

There are millions of millennials searching for homes for sale. They’re at that age range where they’re forming families, and have a good amount of savings, and resources from their parents still, where buying a home makes sense. They want to build equity now.

It was Nearly Impossible to Buy a House in 2020

During the pandemic, first time buyers could not purchase a home and immigrants were not able to get in and buy. Home showings plunged for most of the year due to infection fears. The market was very depressed and won’t recover until the vaccinations make home buying possible.

Home sales last spring plunged and the demand from that period has actually never recovered. It’s common sense that given the economic uncertainty that young buyers would have to put it off. Banks weren’t giving out mortgages and loans carelessly, even at historic low mortgage rates.

With the vaccinations ramping up, the economic recovery can begin. By July, CDC experts believe a good portion of Americans, particularly those who are vulnerable to Covid 19, will be vaccinated. As herd immunity is slowly reached, we’ll see people traveling again and booking hotel rooms, attending sports events, eating at restaurants, and shopping retails.

As Americans being spending their savings and perhaps even selling their stocks, they’ll be doing all of these things.

And they’ll be hunting for homes for sale, in a state of euphoria. Affordable homes will be in hot demand, but there are none to be had.

For homeowners who want to sell, 2021 will bring incredible selling prices. Estimates range from 6% to 20%. Some cities have already reached high growth in home sales prices.

It’s very likely we’ll see record home prices across the country.

Back to the Shortage of Homes for Sale

It isn’t a demand issue, home loan qualification or an ability to buy issue. It’s the weak supply of homes for sale that is going to send home prices through the roof this spring.

Although young buyers think finding a home will be easy, they’re not seeing the facts. There is a shortage of homes outside the city where they want to live. Most available housing supply was bought up last year. Supplies are at record lows, and builders can’t keep up. As home prices rise, they won’t be able to qualify for the jumbo home loan.

In NAHB’s survey, 40% buyers last year reported that being outbid by other buyers was their top reason for not being able to buy a home. Last year, only 19% of buyers said that.

Supply Constraints Aren’t Going Away

The conditions that caused the housing shortage are still active and suppressing construction. There are regulations galore, NIMBY resistance, land shortages, financing hurdles, materials shortages, construction labor shortages, and more.

Add to that the recent demand brought on by work at home movement. Home buyers want bigger more spacious homes, not an apartment or subdivided house. They need the room for an office, kids and a better lifestyle. The Covid shelter at home period hurt a lot of Americans emotionally.

With deaths and aging seniors providing some housing stock, it only kept Realtors slightly busy. Today Realtors have a boatload of buyer clients, but few have anything to sell.

The big task in real estate this year is finding homeowners who want to sell. Some will but they’ll want a premium price to part with their secure residence. Many will struggle to find somewhere to move to. So the resistance to supply continues. See more on housing supply and home sales last month.

Good luck rustling up some homes for sale. You may have to wait a few years to get your dream home. By then, home prices might come down a little.

3 to 6 month Forecast | Stock Market Today | 10 Year Stock Market Forecast | Real Estate Market 2023 | Florida Real Estate |Boston Real Estate | Los Angeles Real Estate | Forecast for Housing Market | Housing Market News