The Best Stocks to Buy

The Dow Jones, NASDAQ, S&P and Russell 2000 are rising of late, and the outlook for 2024 is promising. Lingering inflation, debt ceiling, and international trade issues will plague the markets.

However, 2024 with lower interest rates, should be a great year, which means moving money from the money markets to stocks could be a life changing decision for many investors. And long term, stocks should at least hold their value. Investing in the stock market remains a great decision for those saving for a down payment on a home.

It’s a pessimistic mood driven by rising rates, the Russian war, looming issues with China, high commodity and oil prices, and the withdrawal of big Fed stimulus money.

The Fed plans to raise interest rates further, and we know the markets will not like that. The most likely direction of stocks then will be down, unless the Fed sends new signals that it’s backing off trying to cool inflation via monetary policy.

Some experts have suggested the Fed will pivot or ease off the brakes and this month’s market rally might be indicating a slow in rate hikes, yet oil prices are expected to rise once more, making inflation a very difficult trend to stop.

With that in mind, where are we to find the best stocks to buy? When will the bottom of the market finally appear, to give us one of the best buy the dip opportunities of a lifetime. Those investing in their 401k may come out with substantial gains over the 5 year and 10 year terms.

Over the short term, gamblers might find oil stocks could bring a good return, however the political risk is very high. The recent sabotage of gas pipelines in Europe sends a message that Europe will be desperate for natural gas this winter and nat gas prices in North America will climb high too. That means Nat gas drilling and production stocks look very good right now.

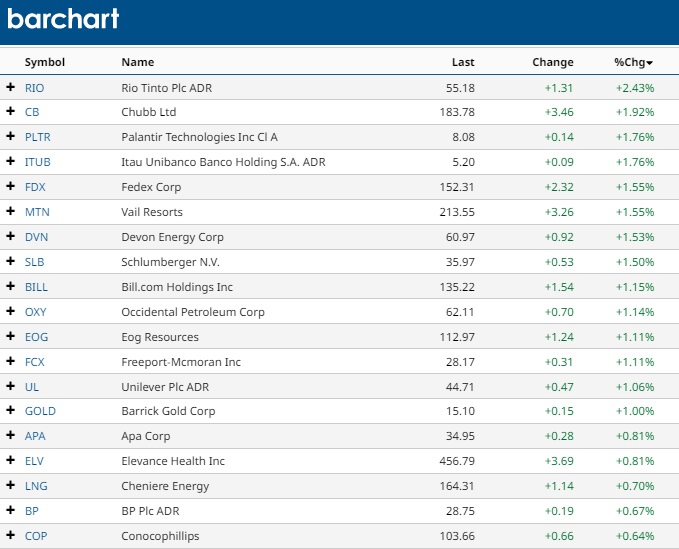

Highest performing, high volume/price Stocks

The very best performing stocks the last 30 days are worth a look:

Should you be buying stocks on the Dow Jones, S&P 500 ,NASDAQ or Russell index in the next 3 months?

Money Crasher’s posts their best picks for October:

- 1. Amazon.com, Inc. (NASDAQ: AMZN) ecommerce retail distribution and sales

- 2. Devon Energy Corp (NYSE: DVN) oil and natural gas exploration and production

- 3. Meta Platforms Inc (NASDAQ: META) internet advertising

- 4. H&R Block Inc (NYSE: HRB) tax services

- 5. ASML Holding NV (NASDAQ: ASML) semiconductors

- 6. Exxon Mobil Corp (NYSE: XOM) Oil and Gas production

- 7. UGI Corp (NYSE: UGI) gas distibution

- 8. Duke Energy Corp (NYSE: DUK) electric power provider in Florida

The Florida hurricane brings on some interesting possibilities as the rebuild and clean up begin.

US News Top Defensive Investing Picks:

- Occidental Petroleum

- Mckesson Corporation

- Conoco Phillips

- Exxon Mobile Corp

- Lilly (ELI) & Co

- Chevron Corp

- EOG Resources Inc.

- Cigna Corp

- Pioneer Natural Resources Co

- Equinor

- Torm Plc ordinary shares

- Diffusion Phamaceuticals

- TherapeuticsMD Inc.

- Neovasc Inc.

- Alkido Pharma Inc.

- Barfressh Food Group Inc.

- Naas Technoology Inc.

- Aeterna Zentaris Inc.

- Huadi International Group Co

- InVivo Therapeutics Holdings Inc.

- US Well Services Inc ordinary stocks

- Western Asset Mortgage Capital Corp

- Minerva Neurosciences Inc

- Pyxis Tankers Inc

- Invesco Morgage Capital Inc

- Pulmatrix Inc

- Toughbuilt Industries Inc.

US News Top Earnings Stocks (this year):

Blackstone Inc. BX

Stock Price: $116.05, 1 year returns: 63.38%, 5-YEAR returns: 38.79%, P/E RATIO 15.91

Encore Capital Group Inc. ECPG

Price: $62.04

1 year returns: 56..5%

5 year returns: 15.7%

P/E Ratio: 5.52

Extra Space Storage Inc. EXR

Price: 196.51

1 Year returns: 55.22%

5 Year returns: 25.04%

P/E Ratio: 36.6

Mckesson Corporation MCK

Stock Price: $281.23

1 Year returns: 53.96%

5 year returns: 14.78%

P/E Ratio: N/A

Old Dominion Freight Line ODFL

Stock Price: $306.38

1 year returns: 35.25%

5 year returns: 28.53%

P/E Ratio: 40.33

Signature Bank SBNY

Stock price: $289.25

1 year returns: 31.4%

5 year returns: 15.45%

P/E ratio: 21.52

Telus Corporation TU

Stock price: 26.16%

1 year returns: 27.8%

5 year returns: .27%

P/E ratio: 24.05

Essex Property Trust, Inc ESS

Stock price: $336.02

1 year returns: 26.7%

5 year returns: 11.86%

P/E ratio: 46.93

High Tide Inc. HITI

Stock price: $4.47

1 year returns: 647.49%

5 year returns: N/A

P/E ratio: N/A

General Electric Co. GE

Stock Price: 91.33

1 year returns: 646.94%

5 year returns: 39.68%

P/E ratio: N/A

Byrna Technologies BYRN

Stock price: $9.97

1 year returns: 638%

5 year returns: 146.3%

P/E ratio: N/A

Lightwave Logic Inc. LWLG

Stock price: $8.69

1 year returns: 636.44%

5 year returns: 66%

P/E ratio: N/A

CYREN Ltd CYRN

Stock price: $6.80

1 year returns: 631%

5 year returns: 26.5%

P/E ratio: N/A

Destination XL Group DXLG

Stock price: $4.20

1 year returns: 520.38%

5 year returns: 10.9%

P/E ratio: N/A

Vertex Energy VTNR

Stock price: $8.90

1 year returns: 501%

5 year returns: 50.3%

P/E ratio: N/A

Discover more on money.usnews.com/investing/stocks/earnings-gainers.

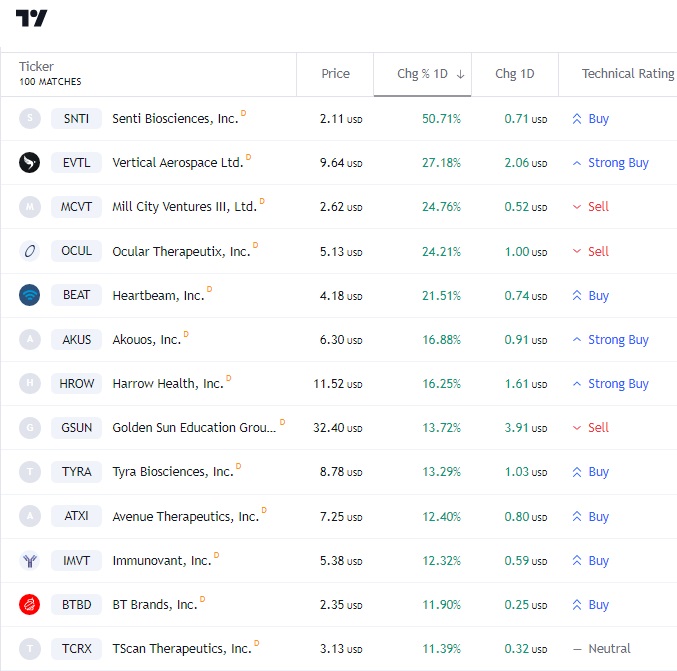

Here’s the top performing stocks of late (October) from Trading View:

Please do check out stocks to avoid, the best stocks to buy, best tech stocks, and the forecast for the next 6 months.

What will be different in 2023?

To get a clearer picture of the 2023 stock market outlook, check out the 3 month, 6 month, 5 year and 10 year forecast posts. And see the hedging strategy post to find tips on managing a stock market correction.

- interest rates will continue to as inflation persists into 2024

- stimulus funds still infusing into the economy

- GDP will fall for 2023

- wages will grow only slowly or begin to fall

- unemployment will rise

- housing market could hit bottom in spring 2023

- US dollar is strengthening as production moves back to the US to avoid risk

- energy prices will rise to cripple GDP

Yes, you’ll want to check out the standard opportunities which include oil stocks, 5G stocks, Google, Facebook, Bitcoin, Tesla, Apple, and you may want to avoid penny stocks for the time being. And you’ll find some good stocks on the Dow Jones, NASDAQ, and S&P reports.

Tech stocks and Google, Facebook, and Amazon have lagged this year as the pandemic fizzles out. They are facing anti-trust and monopoly charges, and big taxes, along with controls on tax evasion, so parking your money with big tech is a sketchy decision.

If there is a stock market crash in 2023, you’ve got 18 months to pick some suffering stocks that can last the long run. Which stocks are those? Take a look at the stock market forecast page for some ideas.

Although the NASDAQ has stayed steady and the Dow Jones stocks have excelled, it may be S&P 500 stocks are your best bets. Take a look at the S&P 500 forecast and it’s top stocks.

Should you just stick to the best of the Dow Jones, S&P, and NASDAQ? Tech stocks are sketchy right now however Google, Facebook might be the safest. See some best stock picks.

Kiplinger cites 10 cheap stocks with good potential:

- Sirius XM Holdings (SIRI)

- Infinera (INFN)

- Mobile TeleSystems (MBT)

- Comstock Resources (CRK)

- Viking Therapeutics (VKTX)

- Amneal Pharmaceuticals (AMRX)

- Veon (VEON)

- Annaly Capital Management (NLY)

- TrueCar (TRUE)

- SmileDirectClub (SDC)

How To Spot the Best Stock Picks

- checkout their P/E ratio — those which had the biggest drop are ripe for the highest rebounds

- trending prices or momentum means investors believe they’re onto something

- low priced stocks with high volume – means everyone is evacuating

- stocks that thrived during the last rapid price growth phase

- Russell index where lots of small caps will be decimated and then return with vigor in 2021

- good estimate of the 5 year and 10 year outlook

- stocks in high growth sectors such as EV cars, 5G, software, automation and artificial intelligence

The real estate sector has performed alright and there might be still be some home builder stocks you might buy. The 5 year forecast for housing though is good and the 2022 real estate market should be a good one despite the current severe housing shortage. It’s that shortage that will draw in more investors.

The top losing market sectors are energy and financials. Google stock price and Apple Stock price will bounce back too, but percentage wise you might not get the same growth as with smaller companies that were hurt more by this recession.

You can see the full list at barchart.com/stocks/top-100-stocks/bottom where they have plenty of additional data to guide your stock picks. See the full picture on the stock market forecast post, along with report for the next 3 month and 6 month periods.

* the information in this post is offered purely for entertainment purposes and no recommendations about stock purchases or any securities is implied. Investors should seek guidance from their investment advisor.

Housing Market Crash 2024 | Housing Market Predictions for 2024 | 5 year Housing Forecast | Market Rally | Tesla Stock Forecast | Stock Market Today | Stock Market Crash | Stock Market Forecast 2024 | Florida Housing Market | California Housing Market Forecast | Boston Housing Market | New York Housing Market | Los Angeles Real Estate | S&P Forecast | Stock Trading Platforms | Stock Trading | Lines of Credit | Reverse Mortgages | Low Mortgage Rates Today