Top Stocks to Not Buy

Investment advisors will often talk about finding the best stocks to buy, those with the best outlook. But what about avoiding the worst stocks? It’s a wise decision for most stock trading enthusiasts.

Purchasing a few really poor performing stocks, such as those that might tank during a sell-off, downturn or even a stock market crash, could ruin your investment portfolio.

Experts advise against emotional investing, and to invest in companies or industries you know, and falling into psychological traps. Laughably, this isn’t why people buy the worst stocks. It might even be why they invest in the best stocks.

They make unwise stock buying decisions due to a lack of information. Few stock market information sites speak in terms investors can understand. They might as well speak in a foreign language. The result is investors lose interest, or just make an impulsive stock purchase, when they really needed to research more. Stock investors may lack access to an advisor with a good record of picking winners — someone who understands what is going on with the post pandemic economy.

And for the thousands of self-directed stock investors who are winging it on their own, reading reviews on stocks is wise, since experts have reviewed these companies. Their commentaries should tell you whether they’re for you. If stocks keep showing up on the do not buy list, then it might be wise to heed their warning. We’ve got some lists of those do not buy stocks below.

And for the thousands of self-directed stock investors who are winging it on their own, reading reviews on stocks is wise, since experts have reviewed these companies. Their commentaries should tell you whether they’re for you. If stocks keep showing up on the do not buy list, then it might be wise to heed their warning. We’ve got some lists of those do not buy stocks below.

There are those who say don’t pick individual stocks at all. They say it’s a losing game, and you’re better off with an ETF fund for safety. But most individual investors don’t want to rely on the Cathie Woods of the stock empire because they lack faith that they’ll get a good return.

ETFs and Hedge funds are for wealthy conservative investors or groups who just want a safe and reasonable return.

So the small investment enthusiast is more likely to gamble on their favorite race horse. They might not pick a winner, but if they avoid the worst stocks to buy, they might break even at worst. So if you are a stock market gambler, you could pick a list of 100 best picks and then turf out any that show up on too many sell rating lists.

Which stocks to avoid might also depend on your timeline. Airlines, restaurants, hotels, Uber, might look awful for 2021, but buying low and waiting 5 years might pan out well. Consider too which stocks will tank if there is a correction or stock market crash.

Stocks To Avoid

Some stocks to avoid right now would be those that excelled during the pandemic. As the economy recovers, consumer spending and business spending will be radically changed. Of course, Amazon, Tesla, and Google might remain as solid investments. In fact of late, tech stocks are really taking off.

If you’re investigating some stocks that are rated as poor check them out thoroughly because the stock market experts often miss. They were advising selling Tesla, Amazon and Uber, but these stocks still look strong. It’s surprising not to see Cannabis and Crypto stocks not a the top of don’t buy lists. These have weak performances and are very volatile from speculation.

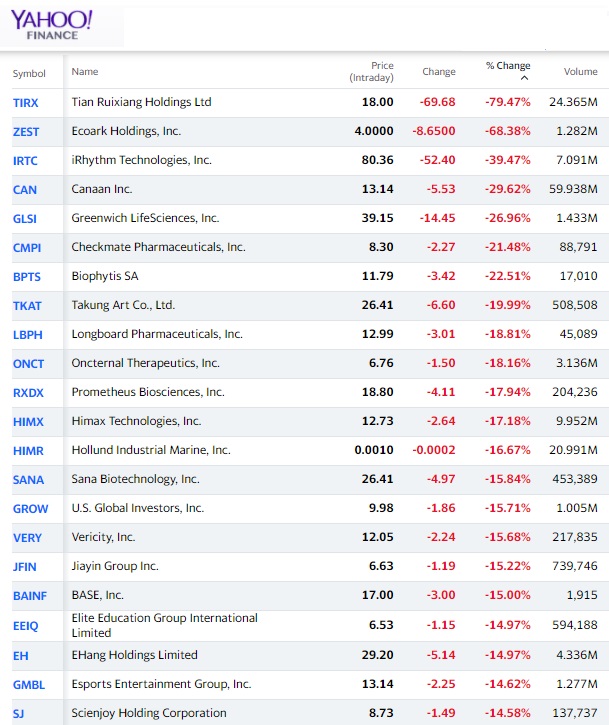

Worst Performing Stocks Right Now

Much thanks to Yahoo Finance for the list of losing stocks above. Checking in on the top losers on Yahoo Finance should be part of your daily investment research.

The confusing thing about which stocks to avoid and which to buy is with the changeover in the economy, and to cyclical stocks. Investors were moving out of high growth to value stocks, but the consensus from experts seems to change.

Airlines and hotels seem to be a no brainer given tourism is about to explode this summer, but when businesses launch again, their real earnings vs costs might disappoint. Hard to imagine businesses not doing well as the economy begins to launch forward but debt and costs will interfere. It seems like all is rosy and business disappointments or stock market crashes can’t happen.

Yet forward looking investors had better have a good understanding of economic, political, trade, and climate forecasts because they have huge impact on stock prices. And the top gainers seem to benefit from good conditions.

Lists of Stocks to Sell or Avoid

Yahoo Finance list of companies to avoid:

- Intuitive Surgical

- Nvidia

- United Dominion Realty Trust

- Illumina

- Vornado Realty

- Avalon Bay Communities

- Dexcom

- Regency Centers Corp

- Iqvia Holdings

- Marriot International

- Service Now Inc

Kiplinger’s says to avoid these stocks:

- Harley Davidson

- National Oilwell Varco

- Nielsen Holdings

- Simon Property Group

- Snap-On Tools

Market Beat says to dump these stocks:

- Tata Motors (NYSE:TTM)

- FactSet Research Systems (NYSE:FDS)

- Ubiquiti (NYSE:UI)

- Cullen/Frost Bankers (NYSE:CFR)

- Deutsche Bank (NYSE:DB)

- Macy’s (NYSE:M)

- Stifel Financial (NYSE:SF)

- Franklin Resources (NYSE:BEN)

- Southern Copper (NYSE:SCCO)

- HSBC (NYSE:HSBC)

- Eversource Energy (NYSE:ES)

- GameStop (NYSE:GME)

- Unilever (NYSE:UL)

- Xcel Energy (NASDAQ:XEL)

- Globe Life (NYSE:GL)

- Vornado Realty Trust (NYSE:VNO)

- Appian (NASDAQ:APPN)

- GSX Techedu (NYSE:GSX)

And the Fool.com has their no buy picks:

- AMC Entertainment (NYSE:AMC)

- Zomedica (NYSEMKT:ZOM)

- GameStop (NYSE:GME)

- Cassava Sciences (NASDAQ:SAVA)

- American Airlines Group (NASDAQ:AAL)

Investor Place Top Stocks to Avoid are:

- Federal Realty Investment (NYSE:FRT)

- Carnival Corp. (NYSE:CCL)

- Slack Technologies (NYSE:WORK)

- Marriott International (NASDAQ:MAR)

- American Airlines (NASDAQ:AAL)

Morningstar’s Worst Stocks to buy include:

- Lululemon Athletica Inc (LULU)

- Caesars Entertainment Corp (CZR)

- Wayfair Inc (W), Shopify Inc (SHOP)

- Beyond Meat Inc (BYND)

- Netflix Inc (NFLX), Adobe Inc (ADBE)

- Advanced Micro Devices Inc (AMD)

- Intel Corp (INTC)

- Salesforce.com Inc (CRM)

Hopefully, if you’re a self-directed stock trader, this post has inspired you to subscribe to an investment service, and see more of the warning signals from experts who are deeply connected to those stocks and market sectors. Stock market experts aren’t always wrong. Sometimes the obvious is true.

6 Month Stock Market Outlook | Tsla | Stock Market Predictions 2023 | S&P NASDAQ Dow Jones Today | Dow Futures | Stock Market Downturn 2023 |3 Month Stock Market Predictions | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ Forecast 2023 | S&P Predictions | Stocks Next Week | Stock Trading Platforms | Stock Trading | Reverse Mortgages