How Far Will Florida Home Prices Fall?

Hurricane Ian may become the 5th most expensive hurricane in US history. Although smaller in size, it packed sustained 150 mph winds and big storm surge to overwhelm neighborhoods in the Port Charlotte, Fort Myers and Naples region on Wednesday.

Southwest Florida had a wonderful 30 year growth boom that may have been broken yesterday. Southwest Florida’s housing market will be devastated for months and this will drag the Florida housing market outlook downward for 2023.

Home prices will fall significantly in the affected areas, creating potential bargains for investors.

In fact the event has already caused cancelled closings, and showings and sales will obviously not take place as they did. The only activity is insurance adjusters scanning the damage as many residents pack and leave for good. And homeowner insurance will be a big issue going forward, with one expert saying the average policy premium could jump to $8000 a year. With one more Fed rate hike, the Florida real estate market looks like it will go cold. Where inventories were tight, new listings have doubled of late.

Governor Ron DeSantis called it a once in 500 year flooding event.

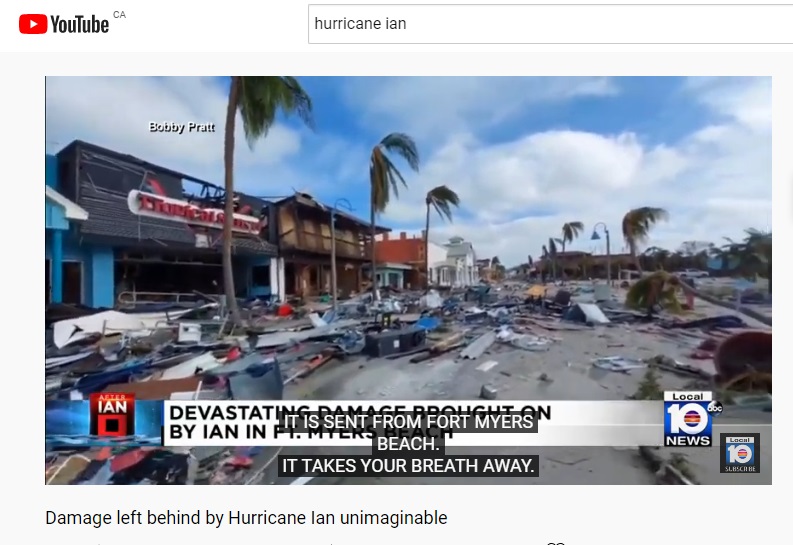

“Carnage is what I can describe it as. I was just in shock,” he said on Thursday in the aftermath. “I could just see that it was going to be bad, worse than I could have ever thought it was.” — Bobby Pratt, Fort Myers, Florida Resident. — from NPR Media report.

$120 Billion in Damage Estimated

It’s too early to estimate the damage in dollars, however some are already suggesting it might reach $120 billion. In inflation adjusted dollars, hurricane Katrina was estimated at $320 billion.

Estimates of deaths range in the hundreds as many Floridians decided to stay in their homes rather than fleeing to the north. 2 million residents are without electric power. In fact, power grids were so badly damaged, electric power experts say it is better to rebuild the whole electric grid rather than repair it. It hints at the tremendous expense to rehabilitate the affected areas.

In some cases, Florida’s power service was below standard and there was always work for Florida Power’s army of linesman. It’s expected power won’t be restored for at least 3 weeks in some areas. Florida Power and the power distribution companies in these counties will need some innovative approaches to resupply power.

Florida’s era of cheap electric power may have just come to a halt.

Federal infrastructure spending would benefit the region greatly. Governor De Santis is requesting Federal aid.

Complete Destruction for Many

Houses, buildings, marinas, manufactured homes, mobile homes and bridges were severely damaged in the central Florida region. Fortunately, the Tampa Bay and the Miami areas came out relatively unscathed.

Biggest issues for the Florida Housing market?

- jump in foreclosures and banks take a bath

- rising unemployment threaten solvent homeowners ability to pay rent

- complete write off of homes creating huge tax write offs for millions of Floridians

- huge losses for insurance companies

- inability for homeowners to acquire insurance to buy a home or keep their mortgage

- strained operating budgets for cities and counties will raise taxes locally

- costs overwhelm homeowners left with damaged homes

- cost of cleanup is in the billions

- business losses and companies shut down as customer base disappears

- supply chain disruptions

- rental housing availability falls dramatically

- tourist season in complete jeopardy for this coming winter reducing revenues

- pour off of chemicals from inland will pollute the gulf killing sealife (red tide)

Amidst this terrible crisis is opportunity for real estate investors to help rebuild central Florida and capitalize on vastly diminished property values. While Hurricane relief funds and Federal disaster relief will flood into the area, tens of thousands have lost everything. Many will be moving back to New York, Boston, New Jersey, Philadelphia and other destinations with literally nothing.

How badly with this affect the Florida housing market? No one knows this for sure, but reports already showing pending sales are down 50%. Given the current drop in home prices nationally, this region should hit historic low property values by late winter. The cleanup will take months at least.

Given the full US housing market might slide significantly against fast rising mortgage rates, this disaster resides on top of the downward trend.

Florida Cities Hit By Hurricane Ian

The main regions hit by Hurricane Ian were the Fort Myers, Cape Coral, Lee County region. Beautiful cities such as Punta Gorda, Sanibel Island, and Estero, Bonita Springs, and Naples to the south as tidal surf rose to 18 feet. It’s easy to predict home price falls of 30% overall in the region. After the storms, the land will regain its value, however the losses could bankrupt many of the land holders.

CoreLogic’s data analysis Wednesday projected that 1,044,412 single-family and multifamily homes in the region had a reconstruction cost value (RCV) of approximately $258.3 billion.

Southwest to Central Florida’s post hurricane rebuild should inject significant funds into the local real estate market and economy.

Southwest Florida’s rental market is very constrained, and this will create severe shortages of housing of any kind. Task a closer look at Florida’s real estate predictions.

US Real Estate Housing Market | Florida Housing Market | Boca Raton Housing Market | Tampa Housing Market Forecast | Atlanta Housing Market | Miami Real Estate Forecast | Florida Home Listings Falling | Housing Market Downturn | California Housing Market | Home Prices | Will Home Prices Fall? | Dallas Housing Market | Houston Housing Market | Realtor Leads | Software as a Service Marketing | Bleisure Travel Marketing | Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel Marketing | Travel SEO