The Dow Jones and its 4 Indices

Retail and institutional investors both are scrambling in the face of another market collapse to find investible securities in this last quarter of 2022.

It’s in these darkest hours of the markets that everyone rethinks where the real opportunities are. We often don’t record our change of perspective, but events are all investors, including Warren Buffet and Cathie Woods adjust. This month’s market rally exemplifies that well.

You have a wide range of possibilities in the S&P 500 stocks and even NASDAQ tech stocks, or perhaps the forex markets and even bonds. But for some, there is a case for investing strictly in the best Dow Jones stocks.

What Goes Down Comes Back Up!

There is a case for optimism. Consider the huge drop in the DJIA in previous crashes, and how markets always come back at some point, and you have a case for big returns on the best Dow stocks over an extended period. You just have to be patient, and be reassured that these blue chip companies are perhaps the safest place to park your money. And when the US dollar begins to fall, you’ll want to be ready to move into equities.

American investors are sitting on mountains of cash, and when the dollar plunges, it’s going to be quite buying frenzy.

Is the Stock Market Finally Bottoming?

If you’re of the opinion that the stock market is nearing the bottom, and you’ve now stretched your investment horizon beyond 6 months to the 5 year outlook, then you have to decide on which stocks can safely give you a ride back to the top.

Yes, some stock experts don’t believe in the “buy the dip” opportunity and point out how the market is still falling with their pessimistic outlook. But we know it’s going to come back. The economy has strength that’s being crushed by the Fed.

Even if the Fed doesn’t pivot on its poor decision, the economy will hard to snuff out. That realization may be the key to them giving up. The government is realizing they need a whole new strategy. For the Dems facing election in 5 weeks, it might be too late. A political change could inject huge optimism into this country and in the markets.

The Underlying Market Demand Fundamentals are Still Strong

There’s no doubt the economy will improve and recover within 5 years. Global demand combined with the enormous population of Gen Z’s and Millennials (with children) means big demand for everything in the next 20 years — including housing. Consumer demand will not die.

So why investigate the Dow Jones Stocks? Does the Dow Jones index or Dow Futures really tell you much about where those companies are headed?

The Dow is composed of four fundamental groups called the Dow Jones Indices. Amongst this grouping of Dow stocks, you find some with huge potential in security, safety and growth. And some even pay dividends.

One way to invest for experienced, knowledgeable traders is the Dow Futures. The DJIA futures or Dow futures are a basket of stocks trading like options with an expiry date. Learn more at dowfutures.org. You can also in the DIA SPDR Dow Jones Industrial Average ETF, to play it really safe.

Right now, during these extremely insecure times (pre-recession), the Dow Blue Chip look to be the safest and may actually be the wisest place to put your money. Contrast that with S&P small caps, oil stocks, and NASDAQ tech stocks, and it seems a no brainer.

Oil & Gas are Pivotal to the Outlook

While oil & gas stocks look good for the 3 month to 6 month period, a huge global supply of oil exists with demand plummeting. The Russian war could keep oil prices high, and well up from the current price, yet this issue could be resolved within a few years. Politically it’s not sustainble for Europe.

If the Democrats go down in history for anything after sabotaging their own political survival, it will be their obsession to kill the Texas oil bonanza, and hit at the heart of the Republicans.

And if Russian oil comes back on the market and fracking returns, oil and gas will become cheap thus injuring the price the Texas people get for their carbon energy bonanza. That would launch a new economic revival, and energy prices would drop.

High oil and gas prices are at the heart of inflation and recessions, so the reverse is true too, that everything could reverse. Oil is a key commodity in the Dow Jones stocks.

If the Rebublicans win the house and senate, they could prevent tax increases and more regulation and possibly force the Fed to lower the cental bank rate. That means mortgages would become cheaper and perhaps the banks would be willing to lend again. The banks are in pretty good condition right now.

So, the recession could conceivably pivot on November 9th.

Focusing on the DJIA and best Dow stocks might be a solid investing strategy. Sure the S&P and NASDAQ tech stocks will revive, but they’re still risk on investments. The Republicans could bring in a Pro USA economic strategy which the tech community would not like. NASDAQ stocks could get obliterated if things continue with higher interest rates and growing global recession-based protectionism. And the European recession will push misery into the US.

If this stopped, the DJIA index would climb.

What are the Dow Jones Indices?

The DJIA is composed of four main groupings:

- Industrial stocks

- Transportation stocks

- Utilities stocks

- Composite stocks

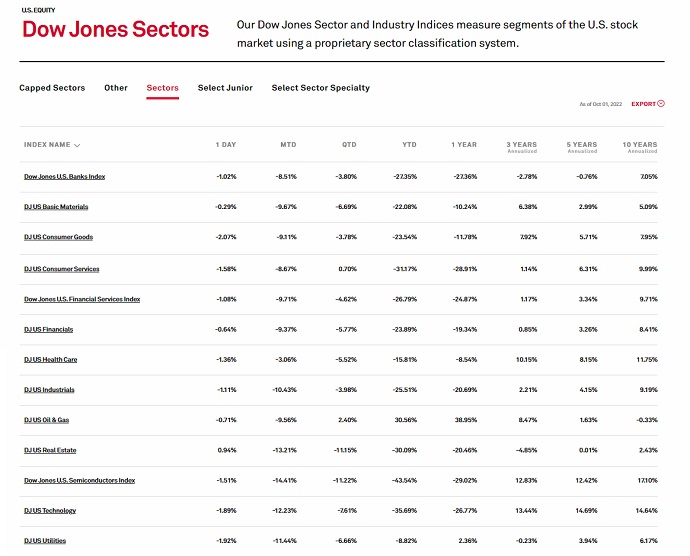

And there is yet another way to look at Dow Jones sectors. Notice in SPG Global’s proprietary service, how shocking the YTD losses have been. That might be a cue to what might recover even within 3 years, should there be political change.

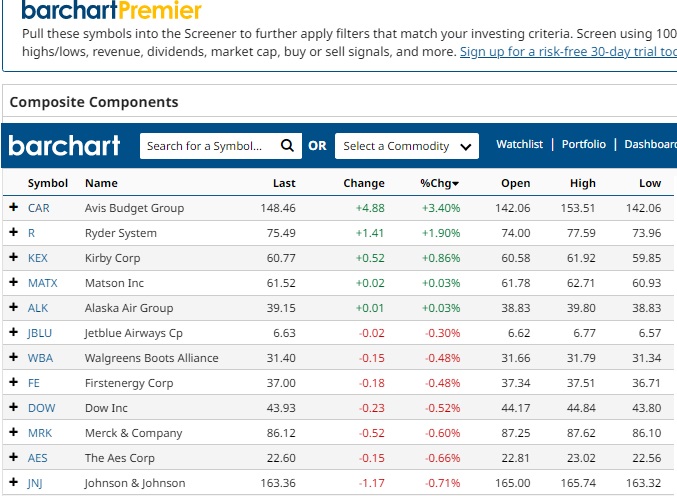

You can visit Barchart (barchart.com/stocks/indices/dowjones/) to view all the Dow stocks in each category. I think you’ll like Barchart who have the easiest to view information online. Quite a bit of it is free while you can subscribe to Barchart Premium, and it’s well organized and helps you gain clarity.

Best Performing Dow Jones Stocks October

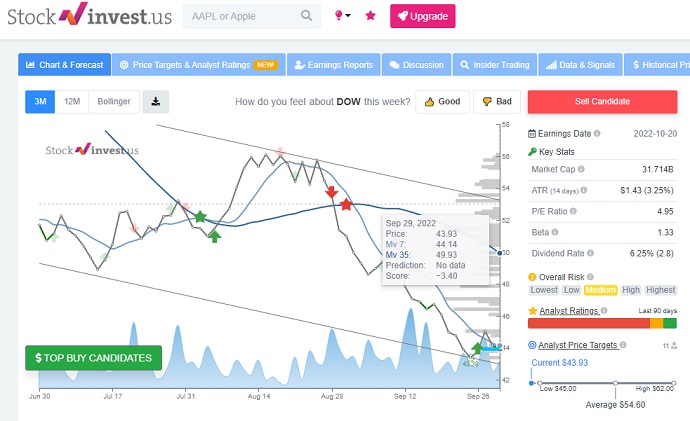

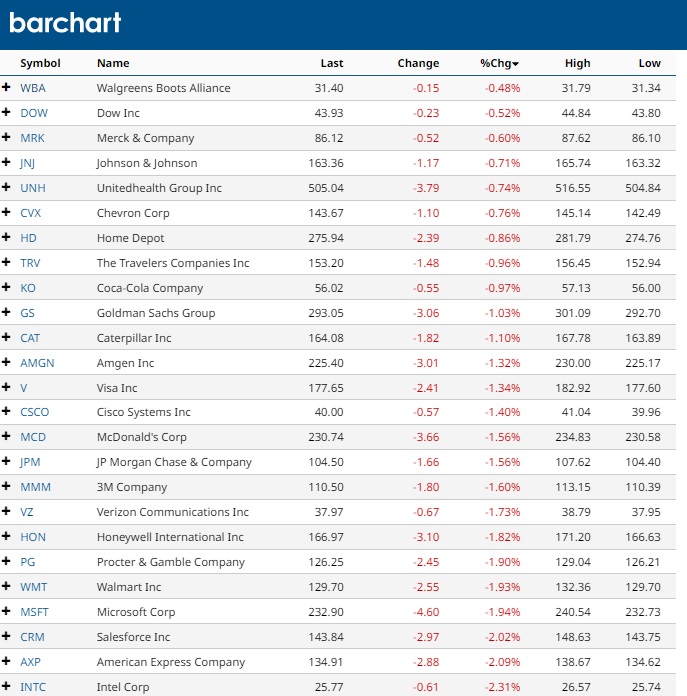

This chart from Barchart.com shows only 5 stocks in the DJIA (DOWC) are in the green. All the rest red.

That reflects the current stock market forecast that we may not have hit bottom yet. In fact, Tom Lloyd on SeekingAlpha shows his technical forecast today, which suggests we have not seen the bottom. It seems historical trends are speaking.

Yet, history is changed by sudden political events.

He advises on selling 7 dow listed stocks: Coca-Cola (KO), Goldman Sachs (GS), Visa (V), McDonald’s (MCD), 3M (MMM), Intel (INTC), Dow (DOW) and Verizon (VZ).

Which Dow Stocks to buy requires a lot more research. This isn’t something you jump into but rather create the most realistic context first, then establish solid sectors, then look at expert stock reviews to find a cluster of stocks that are safe with good upside potential when the economy returns.

Consider the growth of the Dow over the bull run in the last decade. It’s gone from 13,000 to 36,000 during that time, and produced individual gainers way beyond that growth. If the DJIA sinks below 29000, there is significant upside potential. With forecasted political turmoil, the Dow might even slide well down, sweetening the potential outcome in 5 years or 10 years.

Nothing shows it better than this graphic courtesy of Yahoo Finance:

If the current US administration botches the economy, we could see the DJIA reach surprisingly lows. It’s unlikely but no one is sure where the bottom is.

Please do check out the 5 year forecast and 10 year forecast reports for a unique perspective on the economy and where investment opportunities might appear. There is no easy road to map out for big stock portfolio success. There is data and common sense in seeing the clear path ahead.

Stock Trading Platforms | Market Rally | Stock Trading | Tsla Stock Price 2024 | Lines of Credit | Reverse Mortgages | Low Mortgage Rates Today |Stock Market Forecast for Next 5 Years | Forecast for Stock Market | Stock Forecast Best Picks 2024 | Best Stocks to Buy 2024 | Dow Jones Forecast for 2024 | S&P Forecast for 2024 | NASDAQ Forecast for 2024 | TSLA Forecast | GOOG Forecast 2024 | FB Forecast 2024 | Bitcoin Forecast