Is Self-Managed Stock Trading a Wise Choice?

When I worked for a large stock brokerage many years ago, stock trading was very different. There was no internet, no apps, no Youtube, Yahoo Finance, and information was controlled by stock brokers.

I was blown away at the rich commissions the broker and the account managers made. It seemed unfair, like a tax on investors. And any time a rally occurred, it was a huge profit for fund managers and stock brokers.

There may have been a reason for such high account charges and fees, but that precluded investors from buying and selling. Each trade took a chunk of their investment. With profits slim, it was often better not to trade. That high cost problem needed a solution and today we have many commission-free, self-directed trading platforms and online broker services available.

More investors are choosing to go it alone with their investments, mostly because the stock market has been surging for 10 years. Almost all stocks have been growing in value. Now, self-directed traders have to be careful in the coming years particularly after 2022.

Right now, self-directed investing can work well given you have stock prediction software to help you and apps that offer a stock price forecast and you can get forecasts for next week, next 3 months, next 6 months , in 2024 and over the next 5 years. and 10 year forecast periods.

We’ve taken a look at some of the most informative and helpful stock market investing sites. They’re great for self-directed, do it yourself investors who need quick sources of stock market information, trends, news, and stock charts, as well as reviews of experts.

If you’re thinking of opening a self-directed stock trading account, like many millennials are today, you’ll enjoy the low or zero commission trading platforms and services. These companies include Robinhood, Charles Schwab, Merrill Edge, Etrade, Interactive Brokers, Questrade, TDAmeriTrade, TradeZero, Tradestation, Vanguard, ZachsTrade, Ally Invest, Webull, Fidelity, and Wealthsimple.

Let’s take a look at them now, so you can investigate and determine which might be best for your investing needs.

Whether you’re using AI predictive software or using a seasoned stock market investment advisor or a stock broker, you still need to keep current with stock markets and be in control of your investment.

The stock information websites can help you shore up on weaknesses in your economic, business and political awareness.

Which are the best online brokerages offering self-managed stock trading? You’ll need to weigh each yourself based on what kind of trading you’ll be conducting. Your usage might different from a day trader or someone dabbling in commodities, options, and forex.

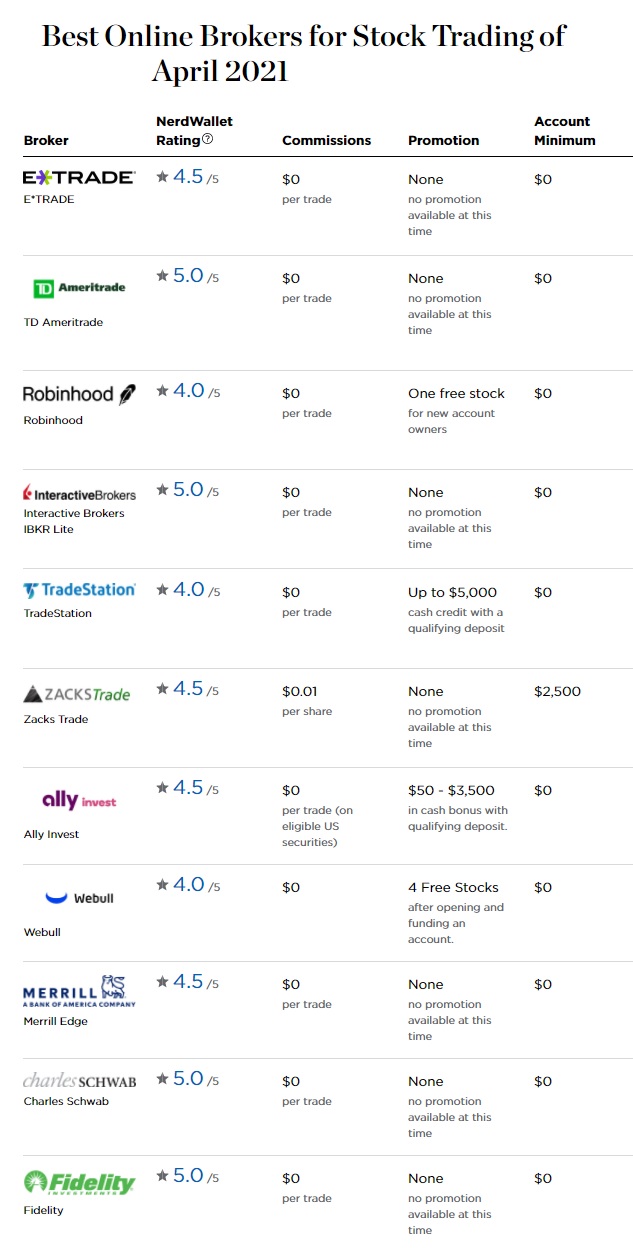

Most self-directed account users will choose based simply on price. NerdWallet suggests comparing on these features:

- Commissions

- Reliability

- Account minimum

- Account fees

- Pricing and execution

- Tools, education and features

- Promotions

And NerdWallet has produced this great infographic of the various zero or low commission trading platforms. You can learn more on their website

You can visit the Motley Fool for their indepth reviews of the online trading platforms listed below.

Apps, Software and Services for Self-Directed Investing

Self-directed traders revel in the risk, but these coming years will bring much more difficulty in picking winning stocks and avoiding losing ones. Some will create fortunes, while others might face disaster because they were lax in some area of their investing knowledge, alert system or awareness of opportunities and markets.

The whole point of self-directed stock trading is to invest where you prefer and trading when opportunities appear.

The low commission or zero commission services all have built profit generators to ensure they actually do make money on their apps and businesses. Read the fine print and read reviews before being fully invested in them.

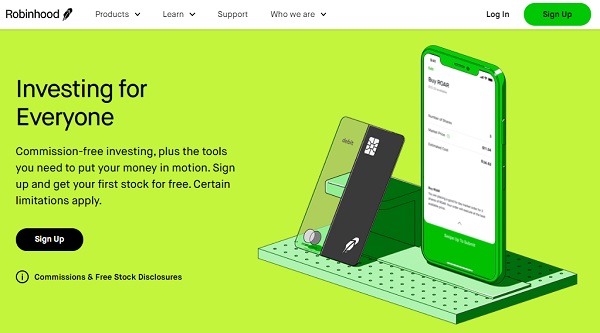

Robinhood Self-Directed Trading Account

Robinhood is a commission-free stock, ETF, cryptocurrency and options trading platform. They offer fractional trades and recurring investments for long-term strategies.

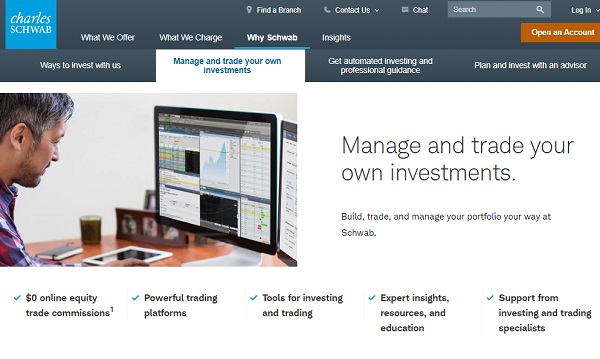

Charles Schwab

Elevate your digital experience with Charles Schwab’s powerful yet easy-to-use trading platform. You’ll enjoy $0 online stock, ETF, and options trade commissions, $0 account maintenance fees (other charges may apply), and up to 4,000+ no-load, no-transaction-fee mutual funds (when traded online).

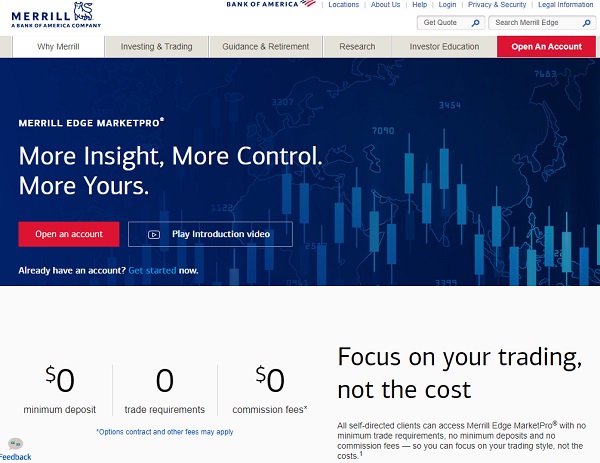

Merrill Edge

Enjoy unlimited $0 online stock, ETF and option trades, with no annual account fees or balance minimums. Invest your way with access to a wide range of stocks, bonds, ETFs and well-known mutual funds. Merrill Edge provides personalized insights and quick answers to the questions that matter most to you.

eTrade Self-Directed Trading Online

With eTrade, you can trade stocks, options, and ETFs for $0, options contracts $0.65, futures contracts for $1.50 and bonds for $1.00 per bond.

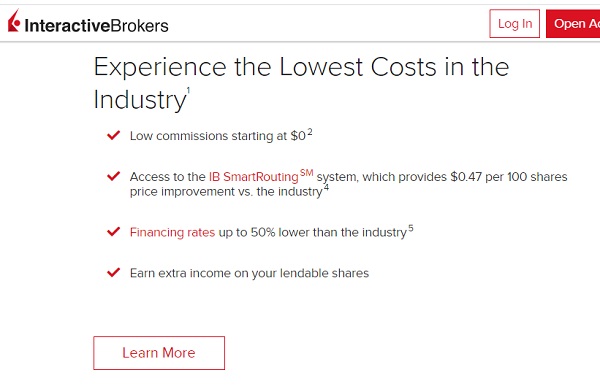

Interactive Brokers

IBKR focuses on International markets, which might appeal to those looking for higher returns. Lite clients enjoy commissions as low as $0 for US listed stocks and ETFs and the lowest commissions on stocks, options, futures, currencies, bonds and funds from a single integrated account.

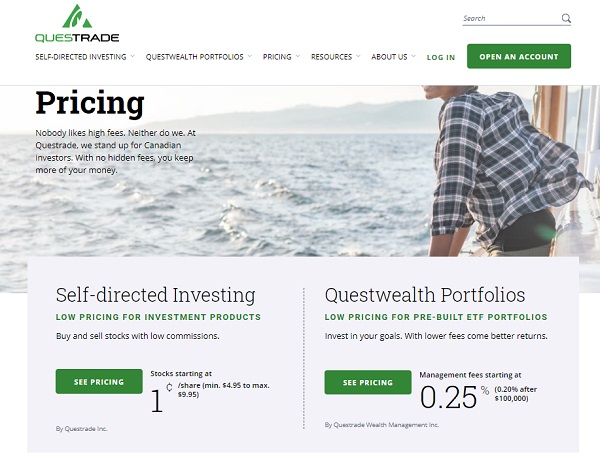

Questrade

Take advantage of fully customizable, intuitive and easy-to-use trading platforms to build your portfolio. Quickly access news, historical info and charting on the symbol you’re interested in to make more informed decisions. Monitor your investment performance and reports, manage your account, then quickly get back to trading.

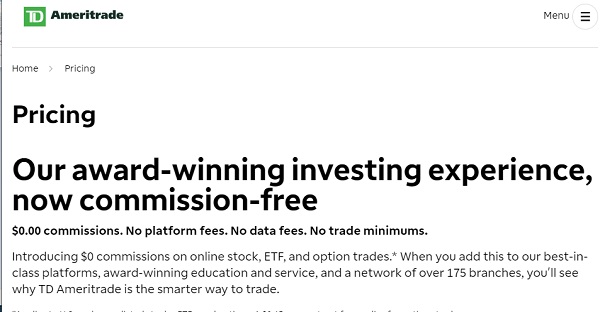

TDAmeriTrade

TD Ameritrade and Schwab are the same company delivering a best-in-class experience for self-directed investors and traders. Their desktop, web, and mobile platforms are designed for performance and built for all levels of investors. $0 commissions on online stock, ETF, and option trades.*

SoFi Invest

Social Finance Inc. is a mobile-first investing services. They provide a suite of financial products that includes student loan refinancing, mortgages, personal loans, credit card, investing and banking through both their mobile app and desktop interfaces. Get started with as little as $11 and trade stocks and ETFs with no commissions. Participate in upcoming IPOs at IPO prices, trade stocks, ETFs, and crypto—or start automated investing.

TradeZero

Free Online Stock Trading SoftwareAccess your online stock trading account wherever you go with ZeroMobile. In addition to commission free stock trading, TradeZero provides free limit orders, higher day trading leverage, 24 x 7 customer support along with four different state-of-the-art trading software and more.

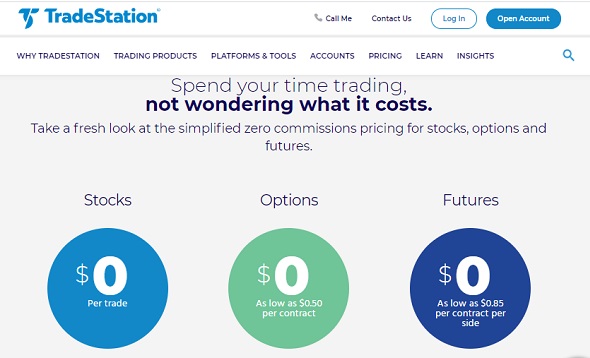

Tradestation

Assist the self-directed investors via a full suite of powerful trading technology, online brokerage services, and trading education. Trade stocks, ETFs, futures, options, or cryptocurrency with reliable execution on powerful platforms, broad market access, and competitive pricing models. Enjoy trading commission-free on equities, equity options and futures trades.

Vanguard

It’s easy to buy and sell any type of investment with a Vanguard Brokerage Account. Take a hands-on approach to give you better control of the investments in your portfolio. Start with only a $20 account fee, and pay $0 commission to trade stocks & ETFs online.

ZacksTrade

Our clients have the tools it takes to make the most of their trading: competitive commission rates, no inactivity or maintenance fees, and access to powerful platforms. ZacksTrade is built for self-directed traders, but offer dedicated support when you need it: responsive licensed reps and complimentary broker-assisted trades.

Trades from $1. margin rates start at 3.59%. No inactivity or maintenance fees.

Ally Invest

Self-directed trading for the hands-on investor. Zero commission fee on U.S. listed stocks and ETFs and Zero commissions on option trades and competitive contract fee of just 50¢ per contract. Enjoy in-depth research and market analysis tools to support all types of investment strategies.

Webull Self-Directed Trading

Diversify your portfolio with a comprehensive suite of investment products including stocks, options, ETFs, and ADRs and enjoy zero commission trades and no deposit minimums.

Fidelity

Manage your Investments yourself. Enjoy $01 for online US stock, ETF, and option trades. no account fees and no minimums to open a retail brokerage account, including IRAs, plus 60 cents per option trade. And $0 for Fidelity funds and hundreds of other funds with no transaction fees.

Wealthsimple Canada

Wealthsimple Trade lets you buy and sell thousands of stocks and exchange-traded funds (ETFs) on major Canadian and U.S. exchanges. No commissions on any trades ever, no account minimums, TFSA, RRSPs and taxable accounts. Sign up and download the Wealthsimple Trade mobile app.

After you set up your online trading account, check out tech stocks, penny stocks, 5G stocks and other best buy opportunities.

Stock Market Forecast for 2024 | 2024 Outlook for US Equities | Oil Price Forecast for 2024 | Stock Market News Today | Tesla Stock Forecast | Stock Market Crash 2024 | 3 Month Stock Market Predictions | 5 Year Stock Forecast | Dow Jones Forecast 2024 | NASDAQ Forecast 2024 | S&P Predictions 2024 | Stocks Next Week | 6 Month Outlook | Stock Prediction Software | Market Rally