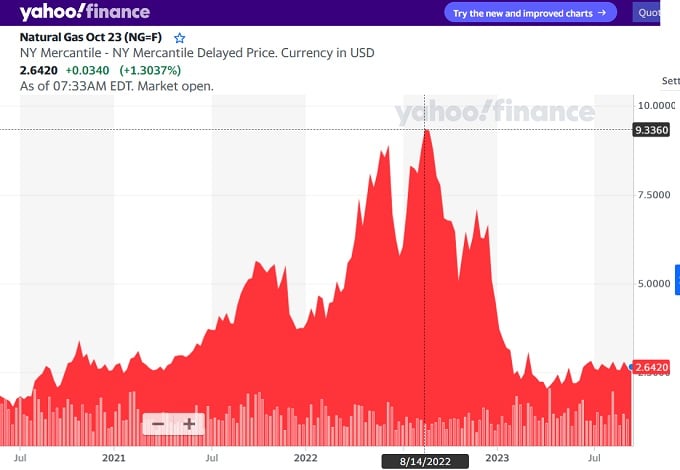

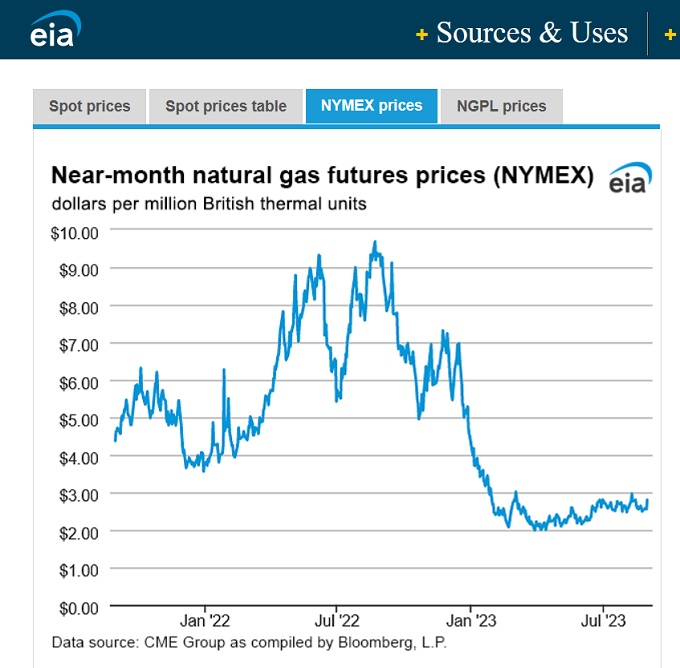

Natural Gas Futures Prices

Smart investors pick the best stocks but they also know to invest in a dip. Right now, one investible commodity is in a dip period. It is the last?

Everyone might think the dip stocks or commodities are all gone, yet natural gas remains at very low price levels. For investors such as yourself, some of the natural gas production companies might be the ticket to spectacular gains. Nat Gas will hit another peak and even with a 40% gain, it will create many new millionaires.

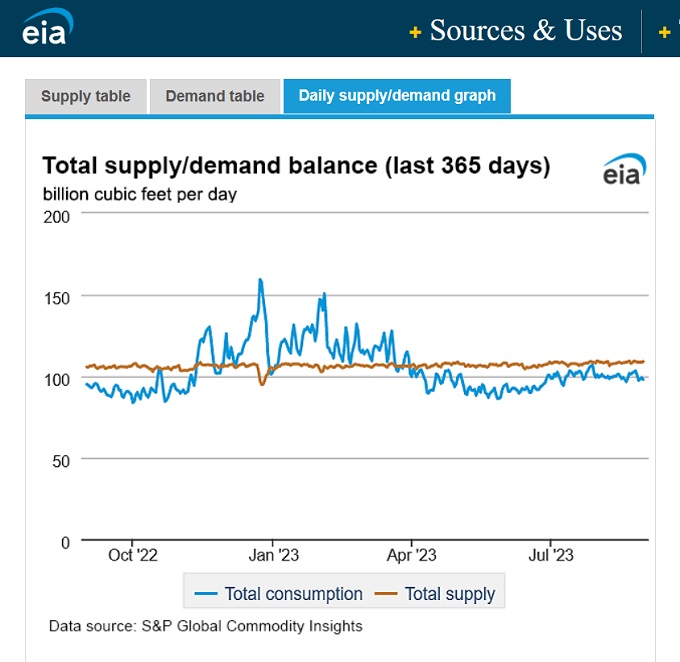

As the Yahoo Finance nat gas price chart reveals, the peak price in 2022, was almost 4 times what it is now. If anything should cripple the market vs high demand in winter, the upside is pretty inviting. Of course, years ago it reached an even higher price. Yet, this winter the price will be volatile which creates opportunities for swing traders. As cold weather fronts hit the US and Europe, it will ease supplies, which are almost 100%

You might ask why you’d want to invest in natural gas stocks under full supply and lots of natural gas production available. The answer is in the coming economic bull market. It might take a few years, and perhaps we haven’t seen the bottom just yet, but natural gas is underpriced. Since it’s cheap, industries will find a way to use it. Given coal being used in China and India will increase carbon emissions and reignite the fight against fossil fuels. But natural gas is needed and US natural gas is the cleanest fossil fuel available.

This summer, the northern hemisphere was roasted in sizzling temperatures, so not surprisingly, demand for natural gas declined. Where it is now represents an investment opportunity, and finding the best nat gas producer stocks is worth looking into. See the list of best natural gas stocks below.

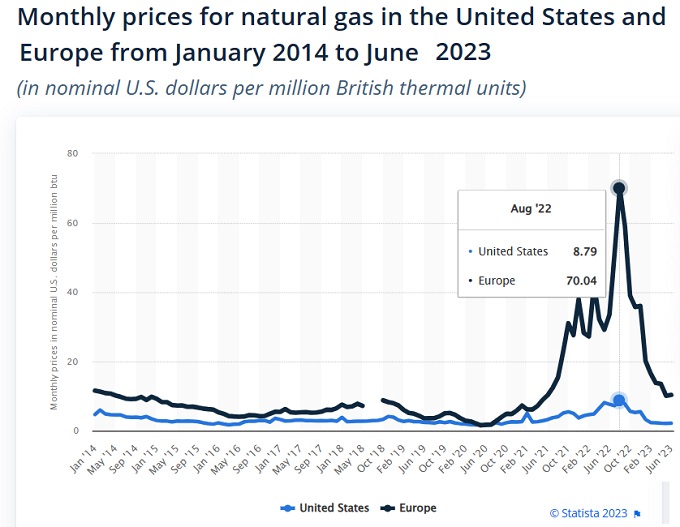

US vs European Nat Gas Prices

Europe’s price soared last year, and although they’ve captured storage, they’re never out of the woods.

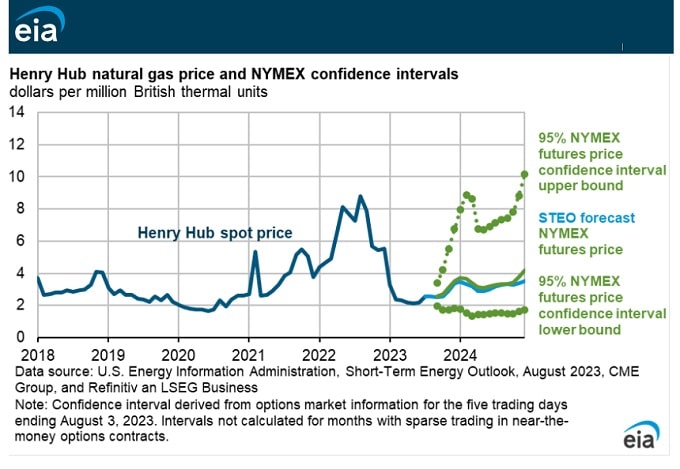

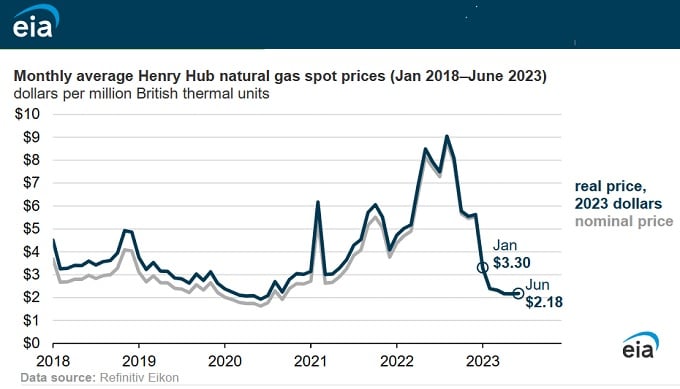

EIA Short Term Energy Report

EIA’s average forecast points to a return of nat gas prices to late 2022 levels. However, with strikes, reduced drilling and high interest rate financing, harsh 2023/2024 winter conditions in Northern US and Europe, and OPEC/Russia production cuts, the price of natural gas could hit record heights. Bets are that it will.

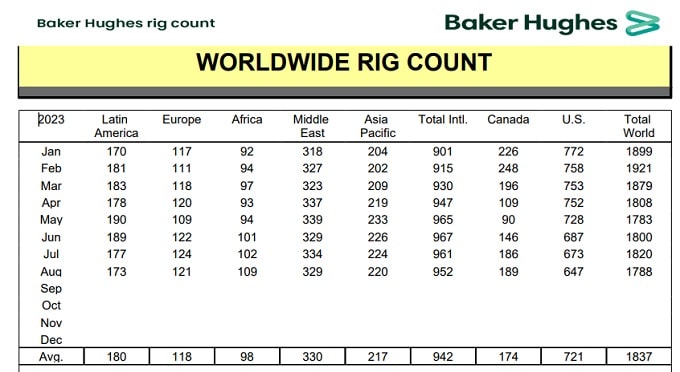

Natural gas production. Associated natural gas production growth in the Permian Basin, driven by higher oil prices, has supported U.S. dry natural gas production in 2023 despite a decline in natural gas prices. We expect production to average about 104 billion cubic feet per day (Bcf/d) through the end of 2024, compared with 103 Bcf/d in 2Q23. Flat production largely reflects continuing growth in associated natural gas production offset by declines in natural gas directed drilling — from EIA Short Term Energy Report.

The EIA’s price forecast of July 24th, 2023, was for the price to peak at $3.44/MMBtu in December 2023. It has already reached that price and is likely to go much higher.

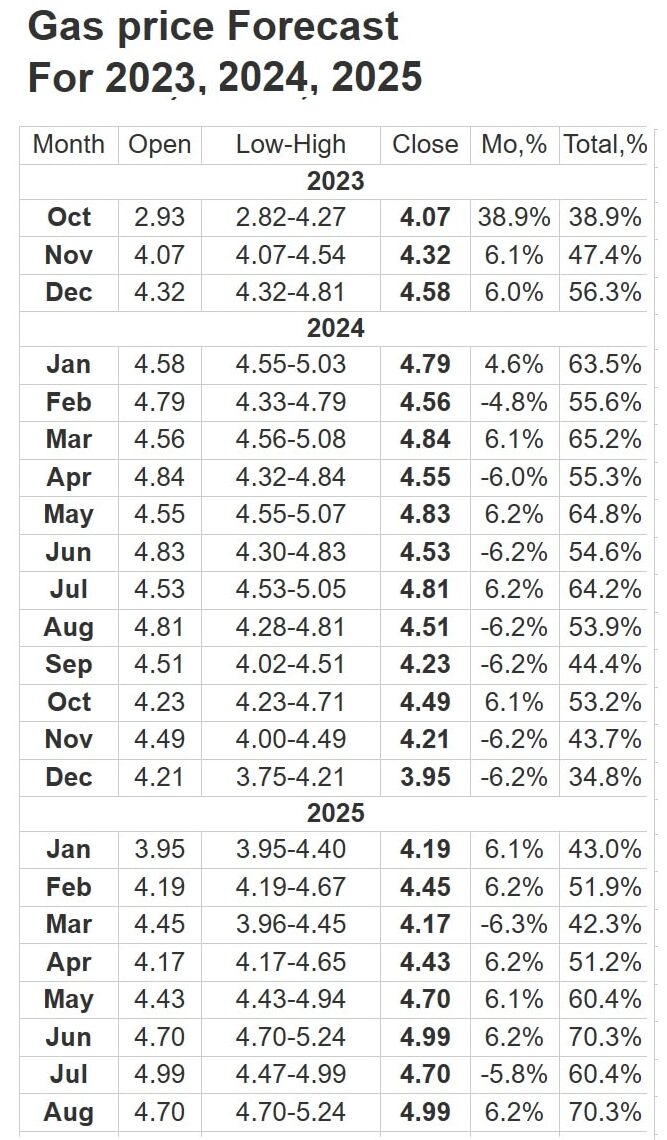

Longforecast sees gas prices reaching $4.58 by year-end and stay high until next July of 2024.

Natural Gas Futures to 2025

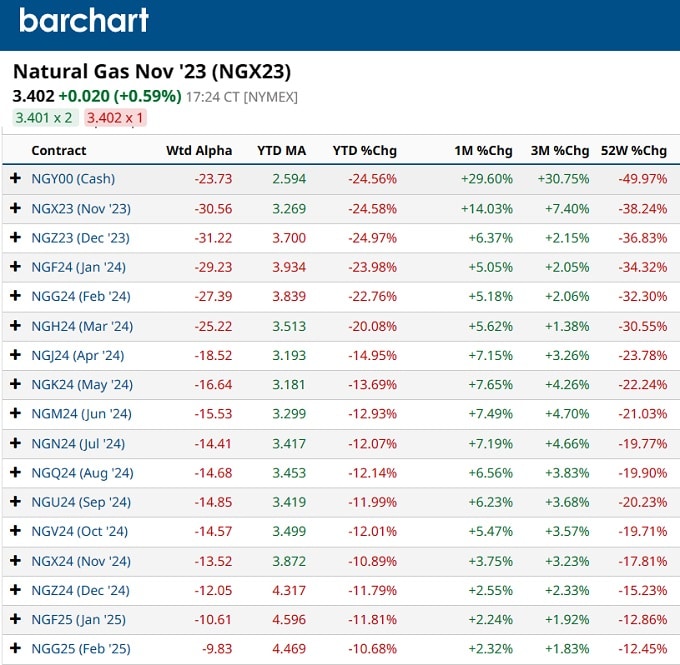

Barchart provides the latest Natural Gas Futures Contracts to February of 2025.

LNG Markets

The American Gas Association reports that European prices for natural gas have surged 40% amid supply fears brought upon by the possibility of labor strikes in Australia that could disrupt global LNG supplies. Those strikes are happening with both sides standing their ground. TTF prices closed at $11.02 (August 14th). Stats reveal record-setting levels of natural gas was delivered to US Liquid Natural Gas export facilities in the first half of 2023 (4% more than the H1 of in 2022).

Difficult to Predict Nat Gas Prices

It’s difficult to forecast natural gas prices, consumption, and all the production and political factors that contribute to volume and price changes. In fact, Zach’s analysts range from strong buy to strong sell recommendations. As you’ll read here, there are plenty of supply threats that can throttle supply.

Europe has refilled its storage capacity which bodes well for the union, however, other nations have not. And with that filling done, it means production greatly slows and delivery mid-winter becomes an issue, especially at much higher prices.

“Our simulations show that a cold winter, together with a full halt of Russian piped gas supplies to the European Union starting from 1 October 2023, could easily renew price volatility and market tensions.” — International Energy Agency

Are you ready to invest in natural gas energy stocks such as Southwestern Energy, BP, EQT, Exxon, Antero, Exxon, Ascent, or Chevron?

And if China’s economy is about to collapse in 2024 accelerated by the US China Trade Split, then wouldn’t the demand for natural gas plummet too? Energy companies are rated highly however with high oil prices and skyrocketing electricity costs.

With the global economy constrained by high-interest rates, there are few stocks legitimately worth buying, which is why advisors suggest not buying anything. But energy stocks may be stellar given their cash flow and massive profits driven by the demand of another global economic boom.

However, there is also word that Communist President Xi may try to stimulate its troubled economy to save it from collapse. If this happens in the next 12 months, it would definitely impact natural gas prices (along with coal).

Inflated Valuations, but Still a Lot of Optimism

Remember, the US economy wants to grow and it’s only central bankers that hold everything back. They look like they’re ready to lower rates and expand the money supply. Either way, stock prices are expected to rise (Dow Jones, S&P, NASDAQ).

The fact that NVDA and TSLA stock prices have risen strongly as the US and European markets are flattening shows that speculation is the key driver right now. It all assumes a rosy economic outlook for 2024, which it looks like it will be. Once interest rates drop, no one will want to get in front of the bull market train.

Winter 2023/2024 is Coming and it Might be Cold

The world needs energy, and we saw natural gas prices jump to nearly $10 per million BTUs last year. That was driven by the Russian boycott by Europe. It was looking really sketchy for Europe, yet they scratched up enough US supply and avoided a cold winter.

Top demand-side factors which affect nat gas prices:

- cold, windy winter

- level of economic activity

- availability and price of alternative fuels (oil, gasoline, coal)

- demand for electricity (gas fired plants)

Another slight factor is China’s increasing use of coal and cheap fuels. That increases carbon emissions thus they’re not meeting the climate accord agreement. Necessity will cause countries to choose natural gas and coal, and governments will need to encourage them to at least use natural gas (least harmful).

This winter, the Russian boycott may be steepening due to Putin’s continuous, murderous rampage, along with a very cold winter may hit Europe. Do hot summer days foretell the reverse in winter? It was an unusually hot summer driven by the El Nino event. Experts do note the mercurial price effect of extreme changes in temperature. Will the El Nino disrupt the flow of warm water up the Atlantic that warm Europe? See the winter weather forecast.

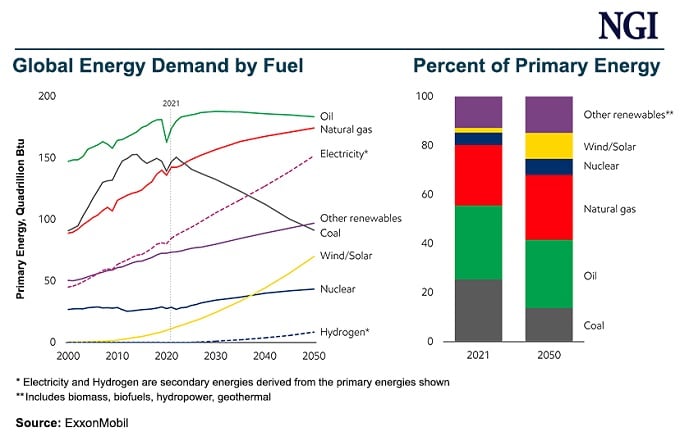

Global Demand for Energy

Despite the info in this chart, natural gas is cheap, and other sources very costly, and coal will likely grow by so many countries in financial trouble due to high rising cental bank interest rates.

Rising costs for energy-dependent US states such as New York, California and Illinois will be an issue for their governors who are also opposed to fossil fuel use.

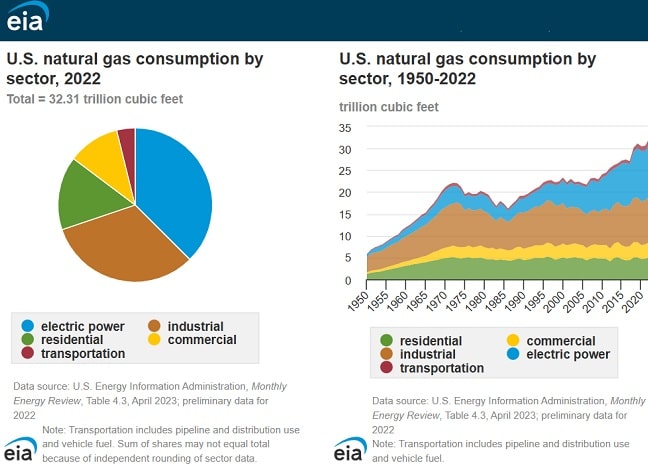

Demand Outlook for Natural Gas

Natural Gas demand is driven strongly by weather, boycotts, and gas-powered electricity production plants. 47% of electricity in the US is produced from gas-powered plants. EIA reports a huge number of new gas-powered plants being built. There is stronger demand for electricity, and Natural Gas is also used in fertilizers and thus when the economy grows, demand for Nat Gas surges.

But as cold weather returns, Europe will be demanding more, as will North America and Northern Asia. The World Bank and Capex.com see natural gas prices rising to $6 in 2024. That’s a 140% increase from today. If it hits $10/MBTUs, that’s four times price growth. These company’s stock prices will surely respond.

European nat gas prices hit a maximum of US$70 per million Btus, exactly one year ago.

Global Gas Rig Count

Rig counts are rising globally, but falling in Canada and the US. A harsh winter might strain reserves.

The Situation in Europe

A clampdown by Europe and the US of India and China buying Russian energy could drive prices up significantly. In Asia and the Middle East, demand for natural gas demand is expected to increase by 3% and 2%, respectively according to a Yahoo Finance report. Purchases from Iran and Venezuela are political issues and that may be a point of contention for the Biden admin negotiating spending increases with the GOP.

More huge LNG tankers will be crossing the Atlantic to deliver much needed US and Canadian natural gas to the European continent. And perhaps to India and China as well. The G20 will have to convince China and India not to use coal, and instead switch to natural gas. That will be a hard sell but with trade sanctions, they could help.

“In Europe, natural gas consumption fell by almost 55 billion cubic meters year-over-year during the 2022/2023 heating season, marking the steepest decline in consumption for any recorded winter season. Furthermore, to avoid further pressures due to the cut-off from Russian exports, the European Union has also unveiled a 210 billion euro plan to completely be rid of Russian fossil fuel dependence by 2027” — report on Yahoo Finance.

Political tensions are rising again which means Russia could pull the plug on Europe at some point this winter.

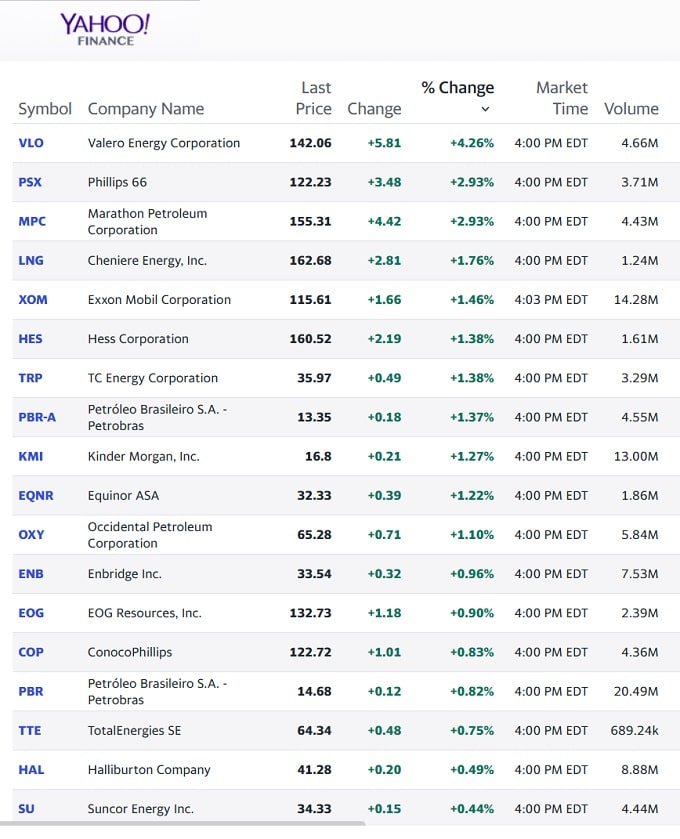

Top Oil and Gas Prices September

Best Natural Gas Stocks to Buy

The most profitable natural gas stock is from a company with a strong portfolio of natural gas assets and operations and a history of producing stable returns. Some of these companies have oil assets too which can make them more attractive given oil is in shorter supply.

USNews picks these 5 stocks as their favorites:

- EQT Corp (EQT)

- Cheniere Energy Inc. (LNG)

- Plains All American Pipeline LP (PAA)

- Enbridge Inc. (ENB)

- Kinder Morgan (KMI)

NASDAQ’s top Natural Gas stock picks:

- Cheniere Energy Inc. (LNG)

- Chesapeake Energy (CHK)

- APA Corporation (APA)

- EQT Corporation (EQT)

- Williams Companies Inc. (WMB)

- Range Resources Corp (RRC)

- Devon Energy (DVN)

- Coterra Energy (CTRA) (Jim Cramer’s top pick)

- Southwestern Energy Company (SWN)

- Antero Resources Corporation (ARC)

If small caps are of more interest to you, check out these small cap natural gas stocks:

- Northern Oil and Gas (NOG)

- Tamarack Valley Energy Ltd. (OTCPK:TNEYF)

- Crescent Point Energy Corp. (TSX:CPG)(NYSE:CPG)

- Ring Energy (NYSE:REI)

- PDC Energy (NASDAQ:PDCE)

- Plains All American Pipeline LP (PAA)

See more on the oil price forecast and the best energy stocks to buy.

S&P Dow Jones NASDAQ Predictions | Southwestern Energy Stock Price | Oil Price Predictions | Canadian Oil Stocks | Stock Market Forecast 2024 | Bull Market | Exxon Stock | BP Stock | Tesla Stock Price Forecast | US China Split | Travel Marketing | SaaS Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel | Travel Stocks Next 6 Months | Stocks Next 3 Months | 5 Year Forecast | Google Finance | Author Gord Collins