Best Energy Stocks to Buy: Southwestern Energy

Competing with behemoth oil & gas companies such as BP, Exxon, Shell, Chevron, Phillips, and others is Southwestern Energy Corp which draws most of its revenue from natural gas production.

Is this the sleeper stock that could rocket to new heights as the Winter of 2023/2024 arrives? Let’s look past the short-term outlook to the 5 month to 5 year time frame, where demand for natural gas may be intense. As you’ll learn, there are many growing sources of demand for natural gas.

Smaller oil and gas firms may have a much bigger upside, but then there’s still the risk, which research will help you manage.

The company headquartered in Spring Texas is principally focused on the development of natural gas and natural gas liquids in the Marcellus and Utica Shales in Pennsylvania, Ohio and West Virginia as well as Louisiana’s Haynesville and Bossier formations. Southwestern Energy had a tough Q2 for a variety of reasons including a low price for natural gas.

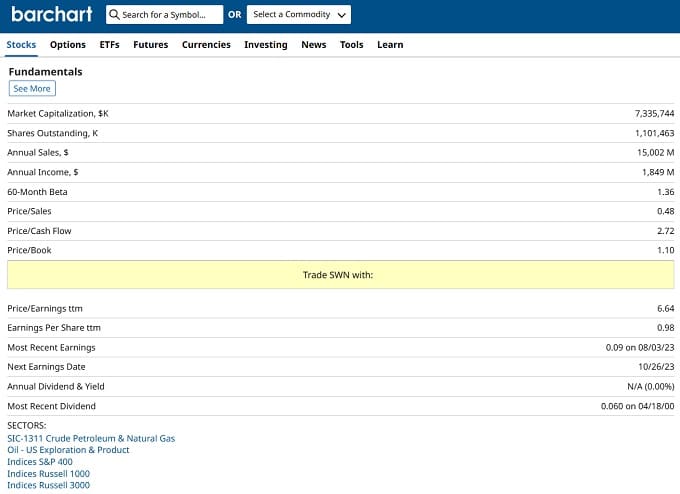

But let’s remember that this company boasts $10.115M in revenue per employee with a price-earnings ratio of 1.26. Its sales have grown from $6 billion in 2021 to $15 billion in 2022. It had a gross profit margin of 52% in 2022, but had a 95% growth in costs of good sold. It has fantastic stats, but also a debt issue.

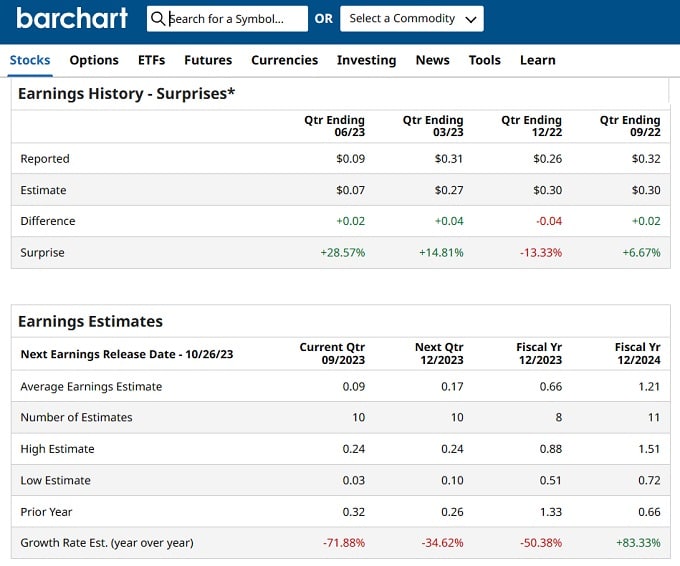

Analysts as you’ll see are positive on this stock.

Southwestern Energy

The year to date growth in this chart below from Google Finance shows a clear growth trend for SWN, in the absence of a rise in the price of natural gas.

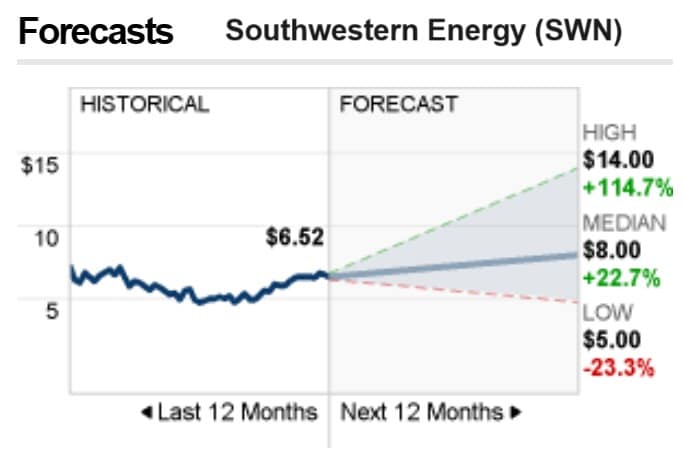

CNN Business’s analysts have a forecast price range for (SWN) of between $5.00 at a low and $14 at a high, with a median of $8 per share in the next 12 months. Even at $8, that is a 22% price growth, and well worth a stock market investor’s attention. Southwestern also has oil production and other fuels.

Over the previous 3-month period, SWN’s price has risen 24%.

Will Nat Gas Prices Jump by December?

If you’ve read the natural gas report, you might be inclined to believe we’re just ahead of another big jump in natural gas prices as we near winter. The winter cold and snow might be just the demand factor. It’s political tensions that may once again create massive shortages of supply. These factors might not be discussed on any Democrat media network, and this is why some of these companies aren’t regarded as the best stocks to buy now.

Today, September 11th, SWN fell slightly, with the overall energy market. Its main competitors, Antero, Range Resources, EQT, and Marathon suffered similar price drops as the first day of trading for the week began.

Analysts Recommendations

If we head over to Barchart.com, we’ll see their analysts offer a 100% buy recommendation, up from one month ago when it was 88%. That’s improvement. Only the short-term 20-day moving average leads to a sell rating. Everything else is buy, buy, buy.

Out of 20 analysts from Barchart, 7 offer a strong buy, 10 advise holding, and 3 give a strong sell rating.

Beststocks.com reports that Neal Dingmann, securities analyst at Truist Securities, maintains a positive outlook on Southwestern Energy (NYSE:SWN) and increased his price target to $9 a share. Share volume today was well down from the usual 19,000/day average, so investors are obviously preoccupied with other things. That report doesn’t explain why it happened, however closer scrutiny of SWN shows a large debt to equity ratio. Is that a big problem, if that debt was used to expand its ability to drill, produce and distribute natural gas.

Southwestern Energy revenues were up an astonishing $reported annual revenue of $15.0 billion and a profit of $1.8 billion. The net profit margin for SWN is 12.33%. Southwestern’s had an earnings growth of 125% in an unusual year for natural gas, and of course this year’s earnings are down 52%. That’s just the math of a post boom sales event.

It released its 2nd quarter 2023 financial results just last month and that was taken well by investors as the price rose.

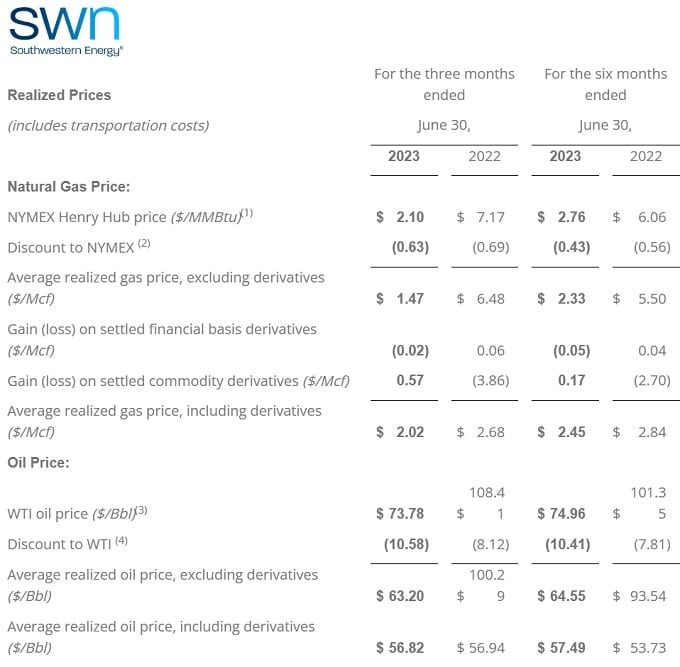

As this chart shows, from their report, the reduction of natural gas price is significant. For instance, the average realized natural gas price dropped from $6.46 (Mcf) to $1.47 for a 75% loss of revenue.

As those numbers indicate, the drop in performance is due to lower oil and gas prices and that the company has run operations clean and managed to invest in new production wells.

It could be the issue of repaying debt may turn off some investors with an immediate return strategy. Their president speaks to their long term goals.

“Southwestern Energy continues to improve the resilience and free cash flow generation capacity of our business. With our successes mitigating inflationary pressures and driving operational efficiencies, we expect to deliver our 2023 plan with less activity and corresponding investment. Debt reduction remains our top capital allocation priority, which we accelerated with a non-core asset sale. Our disciplined strategy to manage through the commodity price cycle maintains the Company’s financial strength and productive capacity. We are well positioned to increase shareholder value in the supportive longer-term natural gas environment,” said Bill Way, Southwestern Energy President and Chief Executive Officer.

Benzinga Rating: SWN

Benzinga has SWN at the top of its list of best natural gas stocks. That lists includes: Exxon Mobil, Cheniere Energy (LNG), Chesapeake Energy (CHK), Antero Resources (AR), Blackstone Minerals (BSM), EQT (EQT), Earthstone Energy (ESTE), and Range Resources (RRC).

Not a New Kid on the Block

Southwestern Energy is an old company founded in 1929, and the owners still own 50% of the stock. They’re not selling at a time when this stock could explode to the upside.

You can learn more about Southwestern Energy on their website.

Larger oil companies generate revenue from multiple products so their balance sheets don’t show such a huge drop in revenues and earnings. Yet, if natural gas leaps this fall, SWN will likely leap with it.

At $6.52 a share, SWN is much more attractive to investors who want a small cap with the potential to perhaps appreciate more, as well as perhaps to be bought out by hungry majors who want to build a bigger piece of an undervalued commodity.

Free cash flow as reported by Google Finance is up 52% year over year, and cash from investing operations is up 10% while cash from operations is about even from last year.

What if Southwestern sees a repeat of 2022’s incredible performance? Admittedly, investing in natural gas stocks is a gamble, but this particular stock is unlikely to lose its value. Over the next 3 to 6 months, as oil prices rise too, it will surely hit its peak. Southwestern can earn money, and as some suggest, this might be a stock with great upside.

And nat gas has to move higher from its historically low range with winter approaching.

See more on the oil price forecast and the best energy stocks to buy.

S&P NASDAQ Dow Jones Predictions | Oil Price Predictions | Canadian Oil Stocks | Stock Market Forecast 2024 | Bull Market | Exxon Stock | BP Stock | Tesla Stock Price Forecast | US China Split | Stocks Next 6 Months | Stocks Next 3 Months | 5 Year Forecast | Google Finance | Travel Marketing Tips | Travel Company Software | SaaS Marketing Strategy | Travel Marketing | Business Travel Marketing | Travel