Rosy Forecast for Apple Stock

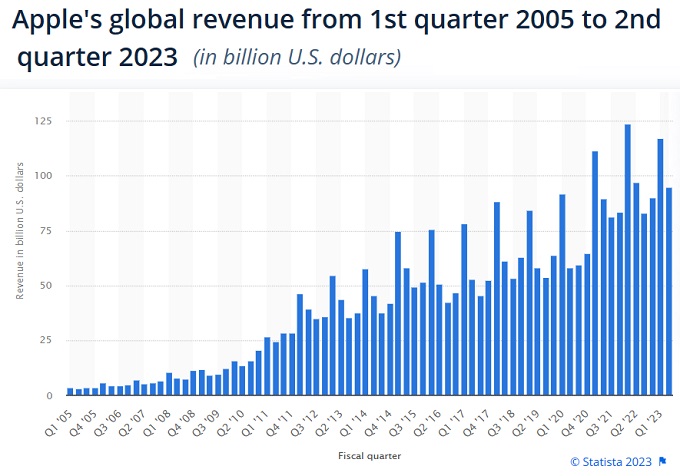

Gene Munster of Deep Water Asset Management believes Apple is headed for a $4 Trillion valuation. And so far in 2023, Apple’s stock price is up 15%.

He believes Apple is set to soar further another 10% consistently over the next 5 years. Tech (NASDAQ & S&P tech) has soared this year, and regardless of the direction of the economy, it’s hard to find a bad case for technology and Apple stock.

Is the Cuptertino California company the right pick for your portfolio? Let’s look at expert opinions and the driver of demand. Apple (APPL) for many institutional investors is a defensive stock and just happens to have a great 5 year performance outlook.

He says with AI, a huge service subscriber base, and the coming Apple Car, it is the solid stock that everyone loves and can sleep at night more easily owning.

Options traders too are liking Apple stock and traders correctly guessed Apple’s valuation would hit $3 trillion which it did this week.

He points to the active installed base of Apple subscribers is a huge, stable positive. So even if smartphone user don’t upgrade to iPhone 15, the service subscriptions give the company power to innovate in everything. They have lot of free cash.

Seeking Alphia points out Applies impressive strengths for investors:

- strong user base and brand recognition

- strong tech ecosystem which uses more AI inputs and innovation promising new products that are unrivaled by limited competition in the marketplace

- opportunities in wearables, VRI and autonomous vehicles

However, political risks persist, and short term worries for the next 6 months remain due to the recessionary trend.

Apple Stock Prediction by Dan Ives of WedBush Securities

Apple’s stock has rise impressively, yet it might be difficult to foresee a big rise, yet Dan Ives of Wedbush Securities is bullish on Apple too. Even if it has hit records, he sees another bull run to $4 trillion valuation.

In a CNBC interview, he said he sees Apple is just tapping into their installed user base and says the best is yet to come. He likes the Apple car coming in 2026 and gives Apple a $220 price target. He believes Apple’s services unit is worth $1.4 Trillion. He likes AI, and believes they’ll open an AI app store. Ives talks of how app developers will find more value in margin and applications within Apple iOS vs other platforms. And as well, he believes in CEO Tim Cook and believes Cook is a mastermind leader.

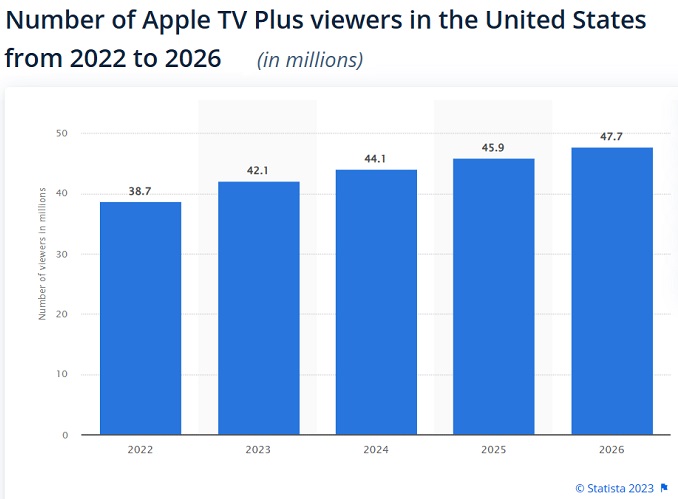

He says Apple is building the future and they could move into multiple sectors. Apple TV is only such revenue stream and it looks positive.

He points out stock market analysts have persistently given Apple a dour outlook which have been blown away. I’ves says it’s $4 Trillion by 2025 (2 years away). And he adds there is a new tech bull market and there’s cloud spending to back that up, and now investors are focused on the 2024 market.

UBS downgraded Apple’s stock but it retains its hold rating.

Martin Yang of Oppenheimer Securities believes Apple can continue its amazing path upward for 3 to 5 years at least. He points to high margin service revenues. He looks to 15% to 20% earnings growth over the longer term. He says Apple will remain a buy.

He points out that although earnings have flattened, they’ve done well in this macroencomic headwinds. He sees iPhone sales slowing down, however after 2024 it seems likely a resurgence of purchases by those who must uprgrade their old phones. The company has so many digital products, including the Apple Watch is doing better of late, that its brand continues to have reach and impact.

23 of 43 Barron’s analysts still give Apple a buy rating. That’s down 3 from 3 months ago.

See more on the 2023 2024 2025 Market Projections

3 Month Projections | Stock Quotes | 2023 2024 2025 | Q3/Q4 Forecast for Stock Market | Best P/E Ratios | Best S&P Sectors | TSLA Stock Forecast | 5 Year Stock Predictions 2024 | Google Stock Forecast | 10 Year Stock Predictions | NASDAQ Predictions 2024 | S&P Predictions 2024 | Dow Jones Futures | Oil Price Forecast | Stocks Today | Stocks Next Week | Best Stocks to Buy Now | Google Finance | Author Gord Collins