Will the Stock Market Soar in 2024?

Now in mid 2023, many investors are anticipating the reversal of the FED lending rate which would send mortgage payments back down to aid in affordability for hungry home buyers.

And with financing cheap again, investment in tech would likely roll on again too. Lots of positives when the government eases up on their own greed to let market forces prevail. I’ve been speaking out against government manipulation of the economy and indeed we got a full dose of misery when we just let Liberal governments spend their way into oblivion.

Some experts are forecasting near 4000 for the S&P this year, and of course the forecast would be much better for the next 5 years ahead. After the debt crisis negotiation, the Dems are able to get back to spending. With that huge budget, how could we possibly see a recession? I’m sure that’s the unspoken truth you won’t hear on the Dem TV network.

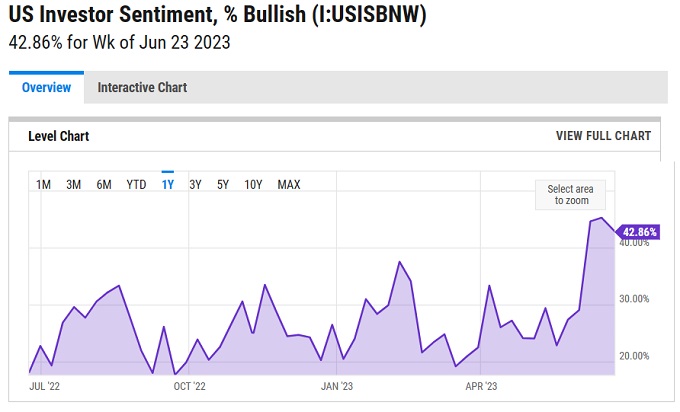

There is credence to the prediction of stock market improvement, if investors have fully shed their negativity and expect the worst is over.

Markets Right Now

Here’s how the markets look today.

Adding to the enthusiasm is the collapse of oil prices. With cheap energy, there will be significant downward pressure on inflation for transportation, manufacturing, agriculture, and more. That would support the notion that inflation will be lower for 2023. In 2024, demand will likely push inflation back however, and without the government backing off on legislation that stops market supply improvements, it makes it tough for the FED to lower rates back down. The inflation rate will never hit 2% because of supply constraints, money market mass, strong employment and consumer demand.

The globe is in a recession, and should come back out of that within 12 months. Till then, investors have a chance to buy this low point in the market. Still, there are those who would like to crash the stock market and crash the housing market, for their own potential gain. Some believe a total cleansing and full reset is needed before we move on. That thinking comes from the past that was the accepted traditional practice (which helped the wealthy pick up supercheap assets).

What are the Factors Coloring the Recovery?

What colors the 3 month and 6 month predictions of the markets? Given how much wealth is in the hands of billionaires and average investors, investor sentiment is a huge factor in the stock market forecast.

Last year at this time, optimism reigned, and market valuations climbed. This year, as the graphic below shows, investors are much more fearful. The presence of Covid doesn’t seem to be a factor now at all.

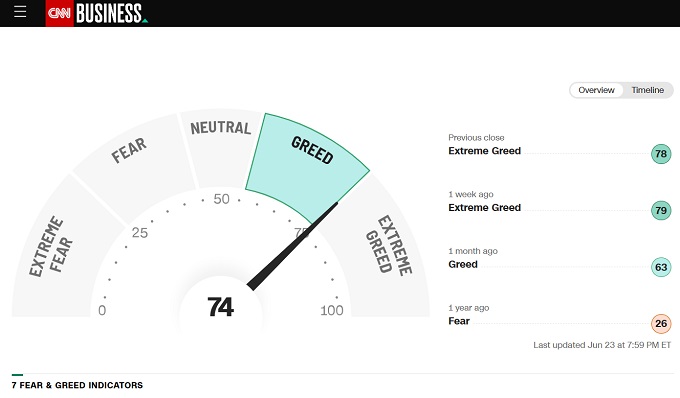

Fear and Greed Indicators

When greed reigns in investor sentiment, it means the masses believe good things are ahead. But When?

What About the Long Term 5 and 10 Year Forecast?

More investors are looking ahead to make calculations about the 5 year forecast and 10 year forecast . It was believed that the extended outlook would be one of much lower growth but still expansionary. The big questions then are about trade policy, trade deficits, technology, and government policy on energy and land development.

But so far in 2023, those aging predictions seem foolish, but where will growth come from 2024 to 2029? That 5 year period needs a forecast so you can ascertain those stocks to invest in after the big post FED era rate surge.

Home construction would have a big impact on the economy. Millions need homes and yet no government entity is coming to help them. The November 2022 Presidential election will determine whether the housing market will see a growth boom. Right now, homeowners and the wealthy see no reason to let their wealth fall in value. They’re in control now, but in 2025, the mood about real estate wealth might shift.

And housing is a big economic stimulus. Still it requires freedom from government (municipalities and states) to grow and prosper. That’s a war that hasn’t come to a final battle as yet. Once billionaires begin to sell their real estate holdings, then the stage is set for a rebirth of the US housing market.

So far the government has favored land development restrictions which is crushing the housing market and driving home prices sky high. And the government is crushing energy production and escalating home heating and vehicle gasoline prices. The obsession with climate change which has not hit Asian societies, will be a big downer for the US markets. It will suppress the global economy going forward as energy prices will begin to climb again, perhaps to record heights.

More of the world’s wealth will flow to Saudi Arabia and Russia, and tariffs will have to remain on imports from China to protect domestic market stability. With the US boosting its own manufacturing and GDP, the economic picture brightens.

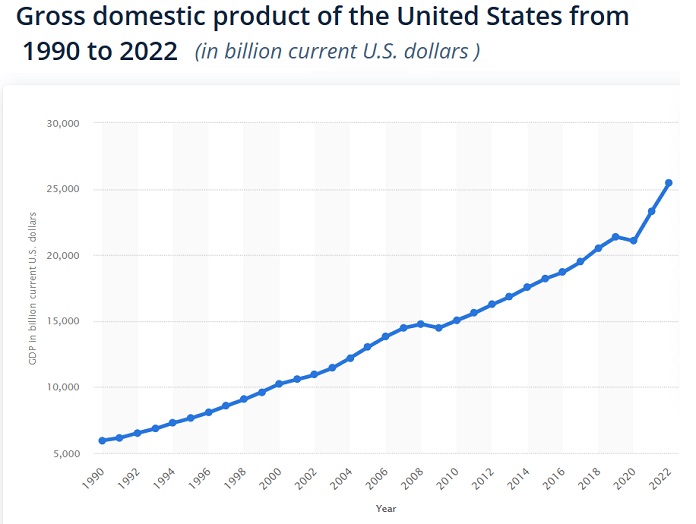

GDP growth numbers seem to be revised downward, however a lot of recovery production is being shifted into 2024.

With US GDP rising so steeply, and with $5 Trillion in money markets and a population eager to resume normal life free of disease and government constraints (FED rate), you can see why smart investors are so optimistic.

The when of this miraculous rebirth of the US economy is uncertain. The small minded Biden admin plus the hapless, out of touch FED party poopers have 16 more months to torture the American people. In November 2024, we might see a happy rebirth of American society and that free market spirit would lift the entire world. That’s how important the US is to the free world.

The Russian and China threat still remains.

The question remains about whether real estate is still a much better investment. The demand for housing including rental housing is very high and prices will ensure more housing will be built, especially as materials and labor become cheaper.

Tesla Stock | Stock Market Predictions | Stock Quotes | Stock Market Today | Stock Market Crash | 3 Month Stock Market Predictions | 5 Year Stock Forecast | Dow Jones Forecast | NASDAQ Forecast | Oil Price | S&P Predictions | Stocks Next Week | 6 Month Outlook | Travel Marketing Tips | Bleisure Travel Marketing | Travel Agency Software | SaaS Marketing Strategy | Travel Marketing | Business Travel Marketing | Travel SEO