Next Generations of Millionaires and Billionaires?

I’m sure you’re well aware that opportunities to grow wealth are rare and difficult.

They happen so fast, and by the time we’re aware, they’re gone. That’s why preparation, research, open awareness, and reliable, objective advice is so important. That next opportunity is almost here.

Acknowledging the possibility of big gains creates an awakening to actually generating a big gain. It’s the first step — that it might happen if take a chance. Gradually, as we open to the idea, the paths to wealth become clearer. The less funds you possess, the more risk you’ll be taking and the more audacious you’ll need to be.

Being the Audacious Investor

The point is, that cautious investors and savers never get anywhere. Their gains are pulled back by economic tides and inflation. The wisdom of buying a house and paying for 40 years makes sense for some investors (i.e., rental properties) but in the stock market, you need to pick stocks with huge upside. Perhaps knowing that upside potential is all you need to know. Pick the best growth stocks?

The point is, that cautious investors and savers never get anywhere. Their gains are pulled back by economic tides and inflation. The wisdom of buying a house and paying for 40 years makes sense for some investors (i.e., rental properties) but in the stock market, you need to pick stocks with huge upside. Perhaps knowing that upside potential is all you need to know. Pick the best growth stocks?

Fortunately, if you buy and hold a wide variety of stocks, you’ll at least double your money. That’s getting rich of course but much better than bank accounts, ETFs, and other low-return securities.

It’s all about finding those stocks like Bitcoin, Tesla, Nvidia and Athabasca Oil where big fortunes will be made. I don’t like Bitcoin, but if the economy rolls, millions of investors will throwing speculative cash at it. Same with Tesla, whom some advisors believe will rise outrageously within 5 years. Get a stock quote.

We have to admit, the potential is there. So why are we not investing in these stocks when they’ve already shown what they’ll do in the past? Does past predict future? It likely does because the economic fundamentals have changed. More risk and audacity is the only way some investors will become rich. Finding those upside stocks is our goal.

Pretend You’re the Gifted Investor with what You Have to Invest

Most people, including those inheriting money from parents, get their funds from someone else. They’re fortunate enough to leverage someone else’s wealth and be able to skim the cream off the top for themselves.

Many of them do this in the real esatate / housing market and stock market where it’s easier to pull it off. Real estate has created a lot of wealthy people but won’t this time around.

And if we look back at the 2014 boom in China where a record number of millionaires were created, we can see the same thing happening in North America in 2024. Because the US government is conscious of the financial bleeding and wants to end dependency on China.

That alone suggests US companies will get an advantage in the biggest economy in the world, and China will lose its easy source of money. US stocks are going to jump in value.

Yes, the stock market at least is giving us one of the grandest, and rare openings in the get-rich-quick arena this fall. And we’re staring at the bottom this fall as the FED rate lag hits the economy. The FED is pushing the bottom down the road a little, but it should be soon.

This post is all about those equities that could make you filthy rich.

Being Wealthy, A Bigger Challenge than Ever

According to Swiss bank Credit Suisse. By the end of 2021, 45.5% of global wealth was in the hands of just 1% of the population, compared to 43.9% in 2020. So winning at the wealth-building game is difficult and will get tougher.

A Yahoo Finance report predicts a 40% growth in millionaires by 2026 and that private fortunes should jump 36% by 2026 to $169 trillion, Credit Suisse reports. Investorplace in a new article, believes the AI-powered evolution will fund many of tomorrow’s millionaires and billionaires (so AI stocks might be worth a gander).

Although stocks have been elevating (S&P and NASDAQ), they still have lots of room to grow. Mega Cap companies such as Apple, Google, Nvidia and Tesla have incredible cash reserves and market dominance such that no competitor really poses a serious threat.

Although they’re doing well in 2023, this might be nothing compared to what’s coming in the next 5 years. And even by 2025, investors should get their big payday, but with the long-term picture even better, those who buy and hold the top growth stocks will perhaps be the next millionaires and billionaires.

Many of them will be Gen Z’s and Millennials flush with inherited money and in new job positions vacated by retiring babyboomers. It’s the perfect storm for some them to rocket upward like a Bezos, Musk or Jensen Huang.

And let’s not rule out stocks such as Bitcoin or Exxon. The upside is real and the hype might not be wrong.

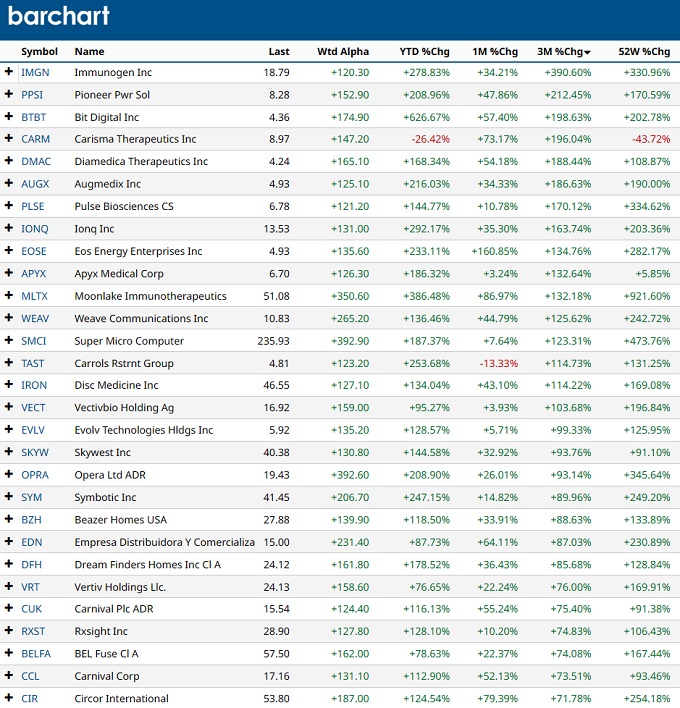

Top Performers Last 3 Months

The last 3 months are a good guide because they’re doing well under bad circumstances. As the economy seriously recovers, these are perhaps some that might outperform.

They’re certainly under the radar of acquisitions people for buy outs which could jump their value considerably. But even on their own, companies such as Immunogen, Pioneer Solar, IonQ, Super Micro Computer, Nvidia, and Beazer homes look good.

Home builder stocks are another option as the housing market comes alive in late 2024 and into 2025, trying to catch up with overwhelming demand. With high employment, rising wages and lower mortgage rates, the housing market is positioned to explode.

You can drill down further with a premium account on Barchart.com, which is a bargain for investors.

Speculative Stocks to Consider

InvestorPlace cites 7 super speculative stocks they believe could make you very rich.

- MTRN Materion (advanced materials) $109.46

- MGNI Maginte (tech advertising) $13.55

- LAC Lithium Americas (alternative energy) $22.80

- RUN Sunrun (solar energy) $24.08

- ALGM Allergo Microsystems (IC Chips) $43.04

- ICAD iCad (medical imaging and diagnostics) $2.72

- STEM Stem (energy reduction EV charger connections) $8.14

Energy Stocks for a Growing Global Economy

Alternative energy stocks aren’t doing well currently, however when the oil and natural gas prices rise over the next 5 years, these stocks will do well. If Biden can hold onto the Presidency, he’ll persist with suppression of fossil fuel energy which will shore up alt energy stocks two different ways. If the Republicans win, the alt energy sector could suffer a big setback as traditional energy pours back into the US economy. And throughout the third world, fossil fuels will be the preferred fuel source and oil will be the soup de jour of investors.

Consider too that Russia, Iran, Venezuela and other enemy countries could flood their oil onto the markets in the next 5 years.

So you may want to closely at the best oil stocks such as Exxon, BP, and others which will hold a volume-based production potential that makes them very rich.

The Motley Fool advises on the potential of these highly speculative stocks:

- Tesla (NASDAQ:TSLA) 40% EV Automotive

- Shopify (NYSE:SHOP) 52% E-commerce

- Block (NYSE:SQ) 56% Digital payments

- Etsy (NASDAQ:ETSY) 48% E-commerce

- MercadoLibre (NASDAQ:MELI) 63% E-commerce

- Netflix (NASDAQ:NFLX) 18% Streaming entertainment

- Amazon (NASDAQ:AMZN) 22% E-commerce and cloud computing

- Meta Platforms (NASDAQ:FB) 22% Digital advertising

- Salesforce.com (NYSE:CRM) 21% Cloud software

- Alphabet (NASDAQ:GOOG), 22% Digital advertising

Again, these stocks are safer than other higher potential stocks on the Russell2000 index. You would be wise to spend time studying the Russell for the very best speculative stocks, because their upside is the greatest.

If you have thousands or hundreds of thousands to invest, you might not mind these investments. The fact is, during a big recovery, you’re not going to lose any money, and it’s far better than keeping your investments in a bank with low-interest rates.

Audacity is the key characteristic wealthy people have. They have their fallback security, which allows gambling and risk but they have good investment advisors too. You don’t have to bet it all on speculative stocks. I would say Google, Apple, Exxon, and Tesla are risk-free growth stocks. They own their markets and there are few competitive threats. Will they 5X value in the next 5 years?

Just allotting a portion of your retirement savings or money to them gives you big potential.

Another approach is to buy a basket of the very best stocks which again shields you against any worrying big losses. And you’re comforted in the knowledge that the US economy and global economy look good and will certainly recover by 2025.

Real Estate Housing Market | 5 Year Stock Market Forecast | 3 Month Predictions | 6 Month Predictions | 2024 Outlook | Stock Market Today | Best Stock Market Sectors | Stocks Best P/E Ratios | Best Stocks to Buy Now | Bull Market Rally | Google Finance | Yahoo vs Google | Stock Quotes | Google Finance | Travel Marketing Tips | Bleisure Travel Marketing | Travel Agency Software | SaaS Marketing Strategy | Travel Marketing | Business Travel Marketing | Travel SEO