Southwestern Energy Share Prices Jump 8%

While most oil and gas stocks were sinking in a market of rising inventories and warmer weather forecasts, one stock jumped in value.

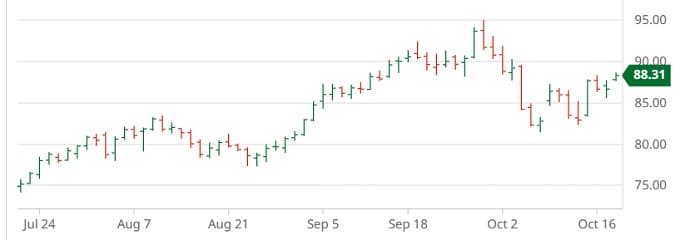

It’s a stock I highlighted recently, Southwestern Energy. The company’s stock price (SWN) had been rising (22% in last 3 months) since many investors believe natural gas has a better outlook than some analysts believe. Chesapeake Energy, a major US gas supplier thinks so positively on the market, they are rumored to be interested in buying Southwestern. That pushed the price up by 40 cents.

That’s a vote for the future of natural gas.

Now with the war in the Middle East heating up, the risk of losses of supply are increasing. The market hasn’t priced this bonus in for natural gas stocks. WTI oil is up around $90 a barrel. It is vulnerable to war activity, yet President Biden could choose to release 30 million barrels anytime he wants. Natural gas is a different story.

Big Oil & Gas Takeovers and Acquisitions

Of late large energy companies have been on the hunt for takeovers and acquisitions. Recently EXXON (XOM) agreed to acquire Pioneer Natural Resources (PXD.N) for $60 Billion. Pioneer is rich in gas assets in the Permian Basin, which is the biggest oilfield in the US.

It’s rumored, that Chesapeake Energy is in talks to acquire Southwestern Energy. The two companies share an overlap of oilfield properties in the Appalachian shale formations and the Haynesville Basin in Louisiana. They’ve also had a previous transaction where Southwestern purchased some property from Chesapeake.

If the Merger happened, the new company would be larger than EQT Corp (EQT.N) as the largest natural gas-focused exploration and production company in the U.S.

Chesapeake only 3 years ago went into bankruptcy and of course later came out stellar when natural gas hit astonishing, record-breaking prices in 2022. It is now one of the largest natural gas companies in the US.

Southwestern Energy Price Today

For SWN shareholders the day’s jump is positive. The stock is up 22% in the last 3 months and its price earnings ratio sits at an incredible 1.4. The company stated in its last report that it is focused on reducing its debt, which caused short-term traders to abandon it. Against a backdrop of a recovering economy in 2025, demand for natural gas will grow. Right now is one of the few excellent buying opportunities.

And given Chesapeake’s own stock price rose, it seems investors like the deal. Southwestern’s assets would make Chesapeake one of the largest nat gas producers in the US.

Strangely, Southwestern’s goal itself was to become one of the largest ahead of Cheniere, Chesapeake and others. It might happen as they’re gobbled up as part of a larger company. That’s why this deal will likely not happen. In January, during the next big winter freeze, we’ll see natural gas jump in price. Buying SWN soon would make sense, especially in the shadow of the failed Chesapeake bid.

A Reuter’s news release quotes Mark Viviano, managing partner of Kimmeridge Energy Management which owns 2% of Chesapeake: “A potential merger between Chesapeake and Southwestern aligns with our views on industry consolidation, given the high degree of operational overlap, opportunity for material synergies and valuation re-rating opportunity.”

Southwestern’s shares ended trading on Tuesday up 8.3% at $7.33 on the news, at their highest finish in almost a year. Chesapeake’s shares closed up 0.7% at $89.59. SWN continues to hold its price in after-hours trading.

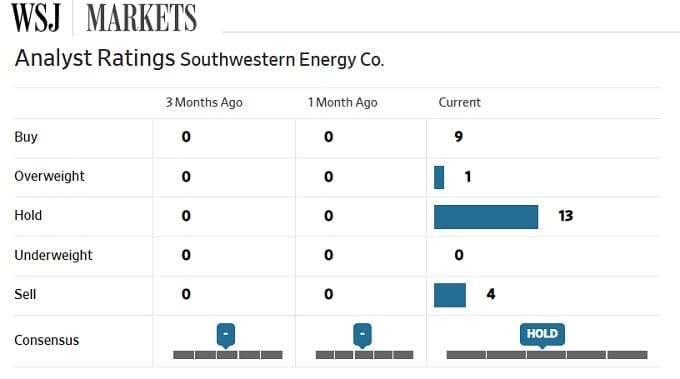

Wall Street Journalists analysts are giving it a buy rating thumbs up, with a price target range of $8.21.

If the deal falls through, SWN remains a company with a strong revenue outlook. The outlook for natural gas is uncertain given global politics, however if sanctions against Iran and Russia are imposed, which will likely happen, we’ll see natural gas shortages again. Likely, Putin and Iran’s regime would enjoy making Europe and the US suffer.

With electricity rising in cost during an economic slowdown, natural gas seems an affordable alternative for electric power plants. Cold weather snaps in the fall and January in the US may send nat gas prices upward giving all nat gas stocks a lift.

See more on the oil price forecast and the best energy stocks to buy.

* note that all information on this page is for insights only, and is not a recommendation to buy or sell. Markets change quickly and indicators may reverse. Be well-read on stock market trends and work with one of the stock investment websites to gain a broader view of stocks to buy.

Natural Gas Stocks | Southwestern Energy Stock Price | Oil Price Predictions | Canadian Oil Stocks | Stock Market Forecast 2024 | Bull Market | Exxon Stock | BP Stock | Tesla Stock Price Forecast | Stocks Next 6 Months | Stocks Next 3 Months | 5 Year Forecast | Google Finance | Winter Weather Forecast | Travel Marketing | SaaS Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel | Travel Author Gord Collins