Incoming President Will Create Booming, High Production Energy Market

Are you still on the fence about investing in oil and gas? This sector is doing very well and it’s poised to grow substantially.

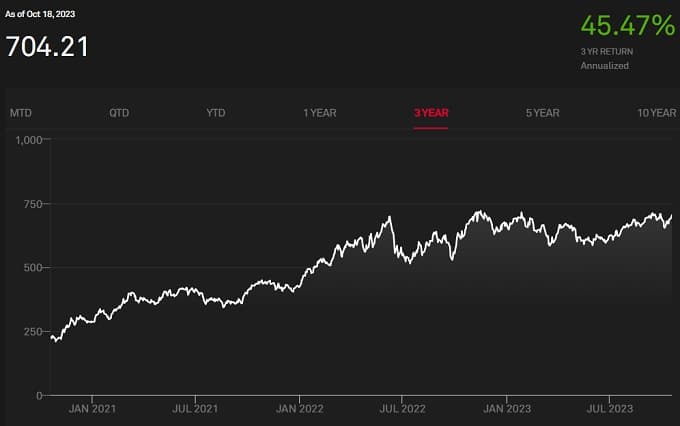

Experts are talking $100 a barrel of oil again, and natural gas is outperforming predictions. As the investment stats below prove, it offers the best value on the stock market. P/E ratios, dividends, price growth, revenue outlooks, acquisitions, and global growth in demand for oil & gas provide confidence in this investment sector.

Many fund managers have avoided the energy space for political reasons. That’s suppressed price for their true value. It’s resulted in oil stocks and natural gas stocks that have incredible P/E ratios of 1 to 2, — a huge price upside! Investing in energy stocks makes sense now as they’re underpriced.

Incredible P/E Ratios and Earnings per Share

Since 2010, the highest P/E ratio of oil & natural gas was 261.48! Average earnings per share of oil and gas stocks stands at $30.00. These numbers could balloon in 2024/2025.

The P/E ratio for Nasdaq stocks stands at 22.19 as of Oct 17, 2023. Earnings per share in the NASDAQ has slid to a paltry $2.25.

And oil and natural gas stocks offer generous dividends. Since 2016, energy companies’ dividend amounts rose 80% for that five-year period. How about these 3 outperformers for dividend yields:

- Pioneer Natural Resources (just acquired by Exxon 12.5% payout & $25.44 per share)

- Coterra Energy – 9.75% payout ($2.49 per share)

- Devon Energy – 9.48% payout ($5.15 per share).

ESG Investors Waste their Money

Are hedge funds and banks really doing themselves any favors by focusing on stocks that look like they’ll fall further in the next 6 months? Does ideology belong in capitalist markets?

A few investors might avoid the energy market due to fears Biden will release more SPR oil to flood the market and crash oil stocks. He did that in 2022 and it deflated prices and suppressed drilling for new production. That set us up for this current shortfall, which could be much worse if the economy had re-ignited.

If the economy should be allowed to return in 2024, demand for energy will rocket. 40% of electricity pushed through the power grid comes from natural gas-fired plants. Renewable energy has hit its limits of production and can’t meet additional demands. Sadly because of the high prices and shortages, many countries like India and China are returning to using coal. That of course defeats the effort Europeans and North Americans have made to reduce carbon emissions.

This may be another reason why the FED and President Biden are thwarting the economy through high-interest rates. The solution for the supply-starved US economy is less regulation of housing, cheaper materials, and policies that allow greater supply.

It’s commonly understood, yet the Democrats have the power to suppress the energy sector and make it expensive for manufacturers, farmers and transport companies to operate at lower cost and provide lower prices. It harms US GDP.

Energy Sector Grossly Undervalued

So the energy market is grossly undervalued and underbought. It holds incredible opportunities for small investors who rarely get a chance to make such massive gains in profit.

The 2024 Election Still Hasn’t Been Priced In

In one year, the United States people will elect a new President. We don’t know who that person will be, only that Joe Biden will not be re-elected.

Iran, after capturing $44 billion in oil exports while under sanctions that were not enforced, is about to end Biden’s Presidency for sure. As sanctions against Russia and Iran are reinforced, the price of oil and natural gas will rocket. This will be painful for consumers who will be paying incredible prices at the retail gas stations. More domestic production is needed. Otherwise, America’s two key enemies will profit.

With the war, the cost of goods and services will likely rise because funds are being diverted to support the war effort. No one wants to invest during a war, so the stock market in general is likely to teeter toward a downturn. Food, energy prices, and housing shortages will not let inflation ease, as the economy revs up again.

These facts haven’t been priced into the equity markets yet. There is huge optimism that can’t be contained even though it looks like the FED rate can’t be reduced (the government needs high rates to sell treasury bills and raise money to fund the government and pay the interest on the national debt which is $33+ Trillion.

Although the Dems and Dem media channels are brow-beating and blaming the Republicans for threatening not to increase the national debt, this recurring issue could result in a massive market drop. This may be why investors are keeping their cash in the money markets. That’s very wise.

But the oil and natural gas sector is a better place to park your money. The very best quality oil stocks and natural gas stocks will perform much better than a savings account. In fact, someone I know made a 10% return in two days on a buy of Southwestern Energy stock (SWN).

If the economy falters, will investors dump their Bitcoin in a panic? Are BTC buyers value investors or speculators?

Without government spending, will tech companies, pharmaceuticals, and microchip producers maintain their returns? If everything is perfect in 2024, they might. Right now though, with wars, debt ceilings, government shutdowns, and high inflation and interest rates, how can you be positive?

A Powerful Solution for an Underperforming Economy

A new US President and a Republican-controlled Senate (they lost by one vote for majority in 2020) will deregulate and free up market supply. It will be a glorious event for Americans signaling the end of a 4 year period of intense suffering.

There will be plenty of high-performing stocks in all sectors, especially in real estate, consumer discretionary, services, and manufacturing. You’ll have to decide whether to sell your oil and natural gas stocks for the S&Ps best performers.

That will be a nice problem to have.

Best Stocks to Buy Today | Oil Stocks | WTI Oil Price | Best Oil Stocks | Oil Stocks Best Investment? | Natural Gas Stocks | SWN | Travel Marketing | SaaS Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel | Travel | Stock Market Forecast 2024 | 3 Month Forecast | 6 Month Forecast | Google Finance | 5 Year Forecast | Author Gord Collins