Market Experts Give their Predictions

If you’re relying on predictions and forecasts, or just guidance from fund managers, investment advisors, and economists, we have the opinions of a few right here.

Would investment and fund managers speak honestly if it affected the value of their funds and caused investors to sell their shares? Just something to think about as you take in forecasts and decide how to invest in 2024.

What strikes me as humorous about them is how they are constantly revising their forecasts as the months go by. Generally, a forecast is supposed to be carved in stone, not updated daily in a memo. Either you have real vision about what’s going to transpire or you don’t. These flexible forecasts don’t help investors with their 3 month, 6 month, 5 year or long term outlooks.

And what is the data they have access to that gives them authority to speak on what’s happening to the economy? Did the experts forecast the big rally in October? Did they see it falling the last two days? No? Then do they really understand the markets, because the market does involve investors, whether retail or corporate, making their own decisions.

Do day traders pay any attention to economists? Do popular media gurus like Jim Cramer, Warren Buffet and Cathie Woods have the reliable, proven knowledge to guide everyone through this new bear market?

I guess the point here is that getting the perspective and opinions of experts is nice, but it has to be weighed against an objective standard of investment criteria to generate a view you can trust. Advisers are unlikely to express a truth that would get them fired or criticized by their investors. if you can’t say what you believe, how can investors trust you?

Interested in the S&P Forecast, Dow Jones Forecast and NASDAQ predictions? Keep up on the US stock market and find some great stocks to hedge this recession with.

So let’s begin discovering what this diverse collection of stock market experts say about the stock markets and the underlying economy.

Gary Shilling

Gary Shilling, an Investment Adviser of A. Gary Shilling & Co., Inc. predicted a recession would begin in late 2022 and continue into 2023, and he’s forecasted a 40% peak-to-decline in the stock market. He believes this bear market is over when investors throw in the towel and leave. He believes stock prices declined in 2022 because of rising interest rates and how they impact price-to-earnings ratios.

Yet price to earnings ratios are way out of whack these days, so are they a reference point for most investors? Meme stocks and cryptocurrency have miserable price/earnings ratios and no real, underlying value. The energy industry had incredibly attractive P/E ratios as low as 2 to 1, and US investors avoided the oil stocks. There’s something missing in his estimations.

Shilling believes falling consumer and business demand over the next year will corrode interest rates. He believes the S&P/NASDAQ/Dow Jones will fall a further 21%. So we’re assuming that would be a slide but not a crash?

Barry Sternlicht

The CEO of investment firm Starwood Capital Group wants the Fed to pull back on interest rate hikes. He believes the economy is going to crumble, and there are signs the economy is slowing. Yet, this week’s good employment report says the economy is good.

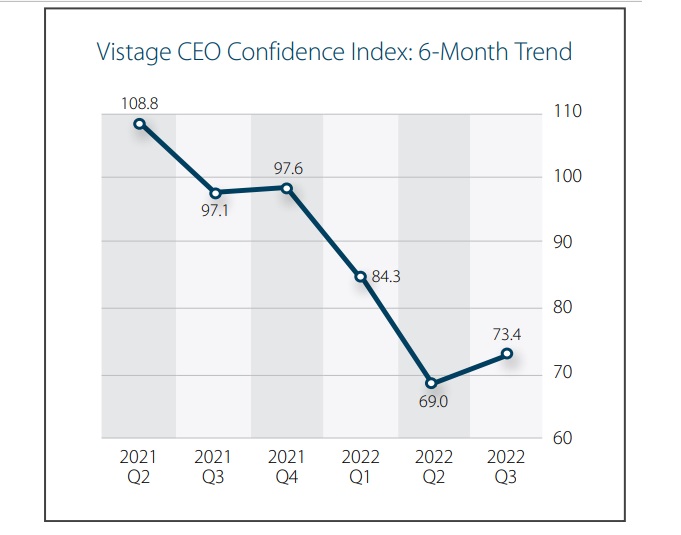

Stenlict said in a CNBC interview that the Fed is going to cause “unbelievable calamities” if they keep hiking. He pointed out that “The economy is braking hard, and CEO confidence is also miserable.”

Sterlict’s field is the real estate market, and it’s a given the housing market is going to be hit very hard by what the Fed is intending to do, and home builders may need to bail out of unsold and planned projects now. Some are selling to large rental property management firms.

Goldman Sach’s David Kostin

Goldman Sach’s has revised it’s S&P Forecast down 700 points or about 15% to 3600 by year end. This bleak forecast is due to climbing interest rates. Kostin said “The tightest yield gap between equities and rates since the pandemic further tilts the balance of risks to the downside.”

Goldman Sach’s forecast for 2023 GDP has been revised downward to 1.1% which is at least not below zero. They believe the Fed will hike 50 basis points in November and December. They now see unemployment reaching 3.7% by year end (up from 3.6%) and will grow to 4.1% by the end of 2023. Yesterday’s report may be somewhat embarassing to them.

Of course, that low projected rate of unemployment might not be enough to contain inflation and get it back to 2%.

Morgan Stanley Strategist Michael Wilson

Michael Wilson predicts the Fed will Pivot “it’s only a matter of time before a ‘fast and furious’ market event convinces the Fed to back off on interest rate hikes.” Morgan Stanley believes the S&P will bottom between 3,000 and 3,400 points which is another loss of 15%.

Wilson says investors will need to see more damage before they throw in the towel.

Scott Minerd of Guggenheim Investments

The stock market is poised for a swift 20% sell-off by mid-October with recession increasingly likely.” That’s what Scott Minerd warned about the current direction of the Fed. He believes the Fed will pivot and stop or slow raising rates. He also believes poor seasonals and overvaluations will take a toll on stock prices in the short-term. Like Gary Shiling, he points out poor price earnings ratios. We’re nearing the point where he says this “mini crash” will happen so we won’t have long to wait to see.

See more on the 3 month and 6 month forecast for the markets.

Michael Burry, Scion Asset Management Founder

Burry, the bringer of bad news offers a bleak view of the stock market ahead.

“Remember the savings glut problem? No more. Covid helicopter cash taught people to spend again, and it’s addictive. Winter coming,” said Burry via a report on TheStreet.com

Burry predicts the mother of all stock market crashes because of the stimulus fueled bubble and the fact small investors dove into risky meme stocks and cryptocurrencies.

Further he’s forecasted the S&P could plummet to a scary 1900 points by the end of this recession, based on the benchmark index’s bottom tick during previous crashes.

KPMG CEO Paul Knopp

Knopp spoke after the results of the KPMG survey of American CEOs revealed that 91% said they see a recession in the next 12 months. He added that only 34% thought the recession would be mild and short.

Catch up on the latest in the stock market now.

More on the: Stock Market Forecast for 2024 | 2024 Outlook for US Equities | Oil Price Forecast for 2024 | Stock Market News Today | Tesla TSLA Stock Price Predictions | Google Stock Forecast 2024 | Market Rally | Stock Trading Platforms | Stock Trading | Reverse Mortgages | Low Mortgage Rates Today | Yahoo vs Google Finance | Best Dow Jones Stocks 2024 | S&P 500 Forecast 2024 | Hedging Strategies | Stock Market Crash Signals | Top Trending Stocks