Best of the Dow Jones Stocks 2022

Best Dow Jones Stocks

The Dow Jones index is enjoying quite a couple of days now in October. The index has risen 1400 points in the last two days.

It might be just another bear market bounce, part of the volatility of a stock market that doesn’t know where it’s going. And these events are what make stock market predictions so difficult. Market rallies do mean something, even if the overall economic and market trends show recession is inevitable, even if it’s slow to evolve.

These rallies may reveal the stocks investors wish were rising. These are the ones they actually covet and want to own. That’s good information for any stockbroker or fund manager. And when the economy does turn around (it could on November 9th) these stocks may soar.

Right now, for stock traders they represent either stocks you could short (since they could plummet soon) or stocks to buy the dip on and set yourself up for a big profit in the 3 to 5 to 10 year time frame.

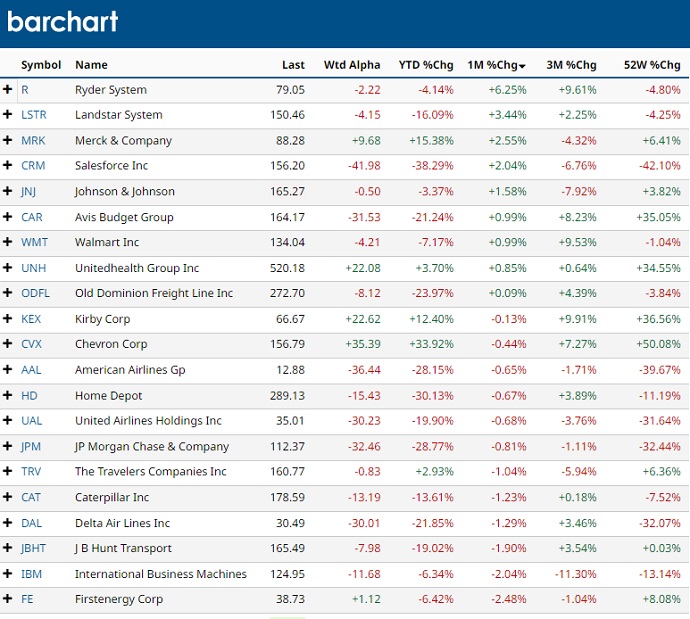

Top Performing Dow Stocks as of Today (October 4th)

Investor.com’s Dow Picks for 2022

Investor.com choose 5 Dow stocks to watch closely: Apple (AAPL), Chevron (CVX), Merck (MRK), Microsoft (MSFT) and UnitedHealth (UNH).

From these 5 stocks, Chevron might be the best bet. With OPEC+ planning a production cut, it will put upward pressure on oil prices globally. With Europe’s energy crisis this winter, it only exacerbates prices of gasoline and petroleum basic products for consumers and businesses who need them. With $100 a barrel price predictions, the oil stocks are worth a closer look.

The war in the Ukraine appears to be extending and will result in a complete embargo on Russian products. Oil will sneak out to India and China, but it won’t flow easily, given the need to punish Russia and Putin.

Higher interest rates, inflation, and rising unemployment will not bode well for IT and software companies. They are finding investment funding tougher to acquire, although the best companies will access some of the excess cash that exists.

If you were to focus on Dow Jones stocks, you’ll need more than just predictions and forecasts. You’ll need to drill down and use screeners, read opinions, get recommendations, and carefully consider which sectors offer a good fundamentals during this recessionary period.

If the economy turns around, then everyone wins and you’ll earn a profit on your purchase. But picking ponies on the Dow is not an easy thing.

Kiplinger’s Top Dow Jones Stock Picks

Kiplinger’s picks in the spring of 2022 included these below. We’ve noticed these stocks have been seen prominently in the business news of recent. Back in the spring the economy was sinking and markets were falling, so there may have been some clarity in that, which is not present now. Investors might be overlooking defensive stocks during this latest market euphoria.

McDonald’s and Walmart make sense, yet Boeing, Walt Disney, and Goldman Sachs seem unlikely candidates in the midst of a recession.

- Microsoft with a strong recommendation

- Salesforce with strong buy recommendation

- Visa with a Buy recommendation

- Nike with a Buy recommendation

- Apple with a Buy recommendation

- United Health Group with a buy recommendation

- Walmart with a buy recommendation

- McDonald’s with a buy recommendation

- Home Dept with a buy recommendation

- Walt Disney with a buy recommendation

- Coca Cola with a buy recommendation

- Boeing with a buy recommendation

- Merck with a buy recommendation

- Chevron with a buy recommendation

- Goldman Sachs with a buy recommendation

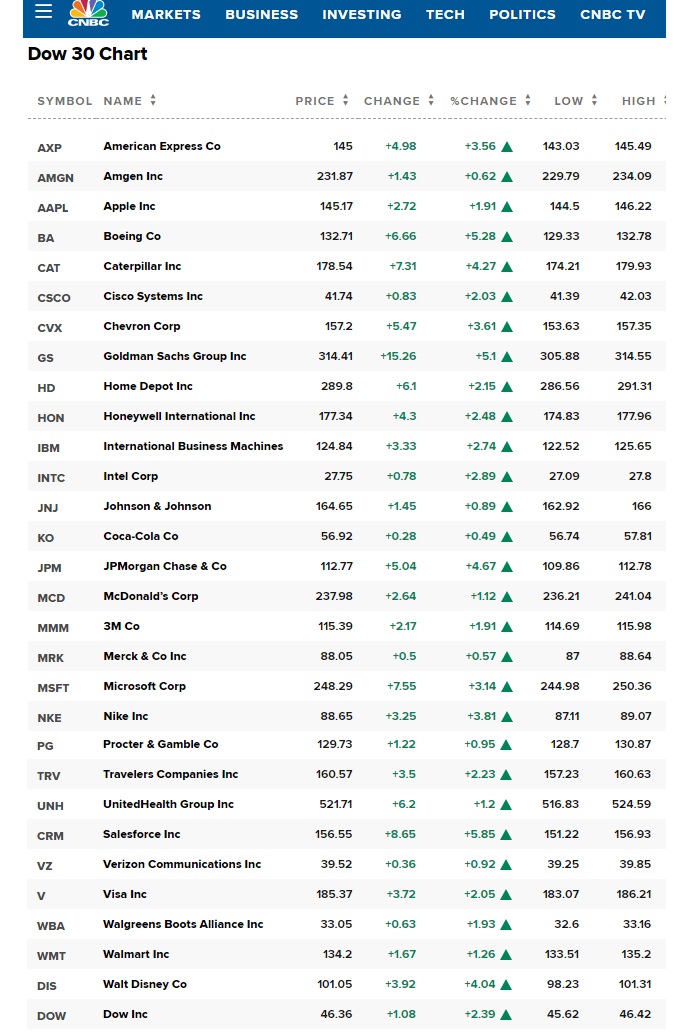

Dow 30 Stocks Today

The DOW 30 shows us some of the best stocks going on the stock market today. Compare them to the best of the S&P stocks and NASDAQ stocks, and even oil stocks, and see which might be the best stocks to buy.

Stay up to date on all the trends and news of the Dow Jones, S&P, NASDAQ and Russell indexes.

More on the: Stock Market Forecast for 2024 | 2024 Outlook for US Equities | Oil Price Forecast for 2024 | Stock Market News Today | Tesla Stock Prices Today | Market Rally | Dow Jones Forecast 2024 | Stock Market Today | Stock Trading | Dow Jones, S&P Forecast for 2024, NASDAQ Forecast for 2024 | Best Stocks to Buy | Dow Jones Futures | Stock Market Next Week Quarter 6 Month | 3 Month Stock Forecast | AI Stock Forecasts | ChatGPT Stock Forecasts 2024 | Stock Market News | US Housing Market Forecast | Hedging Strategies | Stock Market Crash Signals | Will Stock Market Crash in 2024?