Stock Market Pull Back Correction?

The down drop of AI stocks has many retail and institutional investors feeling worried that a correction or even a big pullback is coming soon.

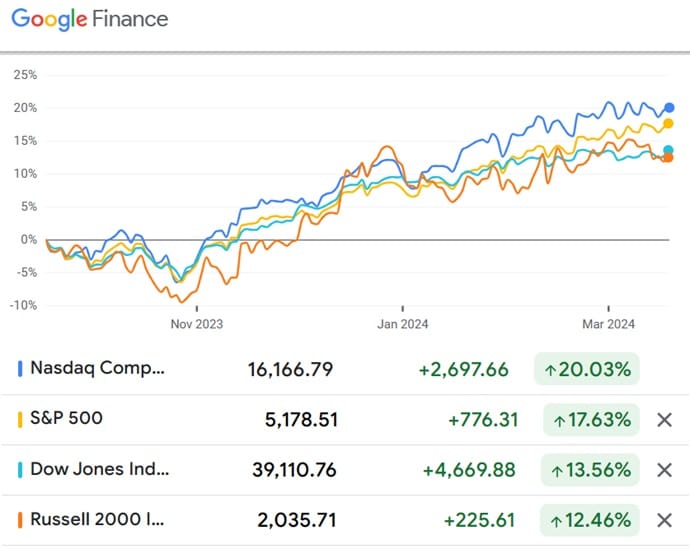

They have the believe that a pullback is necessary before the market can move on. The news from the FED isn’t good but it’s been dour for a long time now, and the markets have surged. The NASDAQ is up 20% since November.

Sure Nvidia, AMD and other AI stocks have taken a hit the last few weeks as investors take their profits and trim their holdings. But this phase will pass, and as the spring arrives, the new AI era already in action will continue. Perhaps that 3 month and 6 month outlook aren’t booming, but upon the first rate cut announcement, markets will surge. And the housing market too will surge and could drag the whole economy forward.

Other FED directors are saying there won’t be any rate cuts till summer and perhaps later. The fact is, the FED doesn’t need to do anything right now given the economy is okay, and not overheating.

The March FED rate announcement will once again be to keep rates where they are. There is a likelihood of inflation re-igniting as the 2024 economy gets rolling and that’s keeping enthusiasm constrained. Otherwise, we’d see markets a couple percent higher.

Due for a Market Pullback

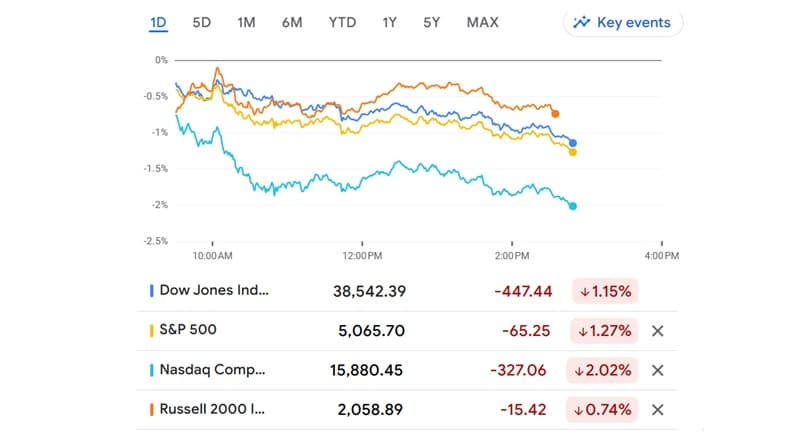

As Jay Woods, Chief Global Strategist at Freedom Capital Markets said in an interview this morning, the markets have been running freely for almost 90 days and are due for a pullback. It was widely expected, and it’s taken a quiet moment in the market to summon the negative bears from their cave.

As CNBC’s Jim Cramer said recently, the bulls threw a positivity bomb in the bear’s cave last week as the rally just kept going. Let’s not forget the strength of this recent rally. And if your stocks are taking a 5% loss this week, don’t sell off. The price will return soon enough. So hang onto your Nvidia, AMD, as they’re holding okay. However, some of the less bolstered stocks such as SoFI and Microstrategy suffered big drops. If you do sell off, you’re taking a cold shower. Swallow your pride and wait for the return.

Cramer was commenting on the fearful response today and says the Bears are in a bubble. That’s a great way to frame the fear of a pullback or market correction. It’s very difficult to be a bear, because the base economic case for the next 6 months is big infrastructure spending and commitments, summer season retail activity, rate cut by July, and corporate earnings continuing. And many inflation gauges are showing slower growth which supports a rate drop in H2.

Cramer in this video talks about the Bears and the haters who want to talk down the market. He mentions the expectation of a pullback, but we know these blips are the market volatility much predicted by market analysts. His advice is to wait and buy the dip.

And experts believe the market will broaden to include small caps on the S&P and Russell 2000.

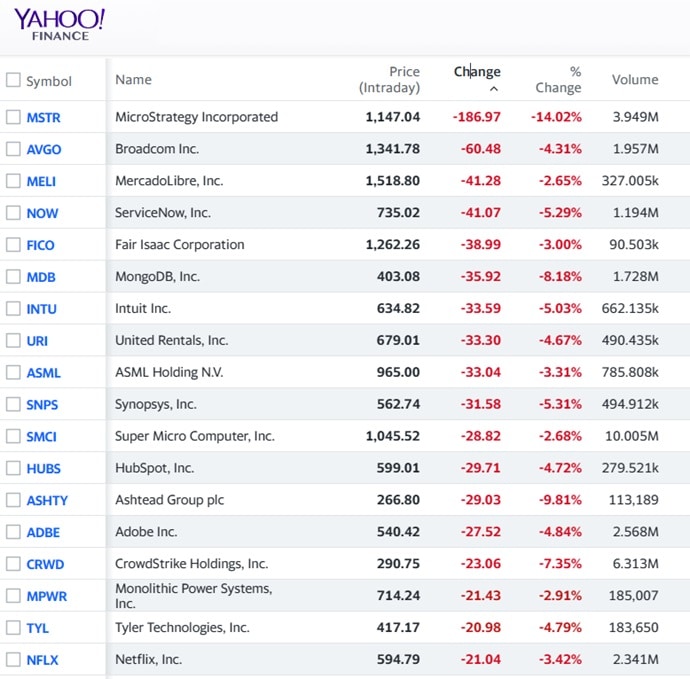

Top Losers Today

It’s important to see which stocks investors are jettisoning in these fearful days. Taking note of which stocks get hit hard are those where confidence in them is shaky. The market is giving you insights into future behavior. Take note of stocks rocketing during the next euphoric days.

Here are the stocks that lost the most today below courtesy of Yahoo Finance. Gitlab, SoFi, MicroStrategy, Marathon Digital, Riot Platforms, ServiceNOW, Broadcom, ASML and Super MicroComputer are top losers and Tesla and Apple are taking a beating in the last 5 days due to real sales outlook concerns. Elon Musk spoke on 2024 being a really tough year for them and short sellers will be descending on TSLA.

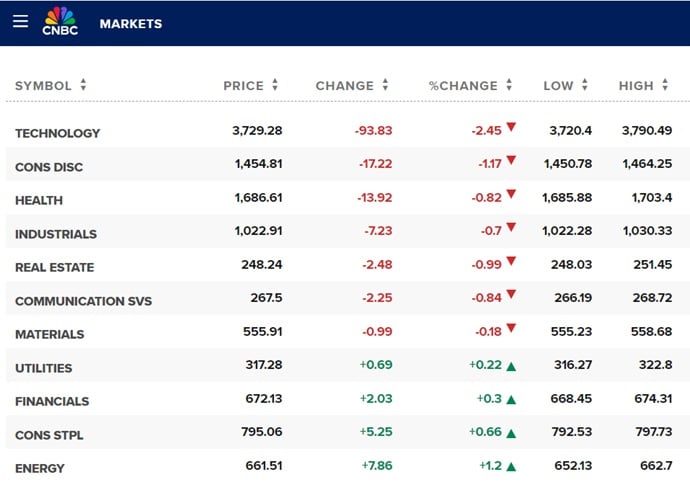

And courtesy of CNBC, here are the sectors rocketing downward (NASDAQ down almost 2% right now). Technology is rate sensitive, and consumer discretionaries and health show concern about the economy. However, during the next lift, these will show the biggest jump.

See more Market Projections:

2024 2025 2026 | Next 3 and 6 Month Forecast | Nvidia Stock | Stocks with Best P/E Ratios | Best S&P Sectors | 5 Year Stock Market Predictions | 10 Year Stock Market Predictions | NASDAQ Predictions 2024 | S&P Predictions 2024 | 3 Month Market Projections | Oil Price Forecast | Stock Market Today | Stock Market Next Week | Best Stock Picks | Google Finance | Author Gord Collins