ChatGPT Stock Market Forecast

How profitable would it be for you to have a personal robot (far better than Siri or Alexa) with deep data driven insight to give you reliable advice on your investments?

The recent introduction of OpenAI’s new content generation tool called ChatGPT is a big progression for researchers, bloggers, digital marketers and even stock market investors.

Some refer to it as the most disruptive and fastest growing app ever and while few are overlooking at it as investment tool, it actually is revolutionary in this sector too. And it’s just beginning. It incorporates a powerful form of artificial intelligence that learns, improves and opens doors to finding answer to any investment questions you have.

Microsoft recently bought OpenAI for billions and now it may have the funding to become commercially viable. And what a list of what it can already do. What’s coming is something to understand because this AI tool will make an impact on the economy. A more enhanced version will arrive in 2023.

ChatGPT is controversial, but it’s the first mass tool (publicly accessible) that might help the average stock market investor to collect the mood and understanding of the overall equity markets. There are AI stock forecasting tools available but this app has potential well beyond.

After all, the stock market (Dow Jones, S&P, NASDAQ) is an average evaluation of all investors in those markets, not just a database of technical trading events (data).

In concert with AI stock market forecasting tools, the ChatGPT app might provide valuable inputs to sophisticated investment decisions. Developers are no doubt planning to enhance its capabilities for full stock trading and sentiment input. Microsoft might not see that as a priority, so private entrepreneurs are likely launching this opportunity. It could spawn new AI stock price forecasting services and be very profitable.

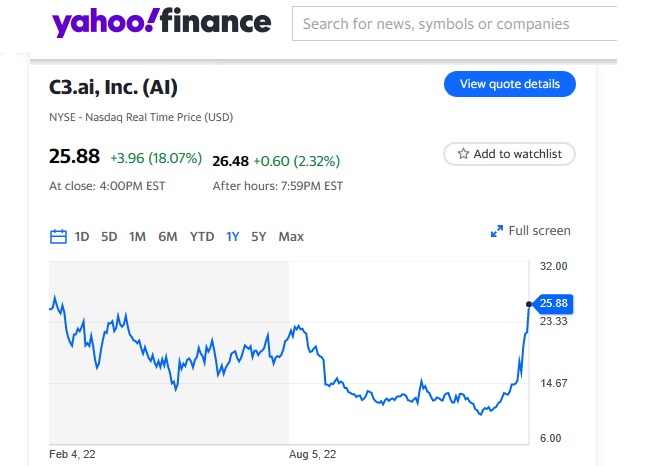

C3.ai is one company benefitting from all the hype surrouncing ChatGPT. Analysts aren’t thrilled with the company however speculators were bidding it up in January. I’ll be producing another post on AI stocks.

Ask ChatGPT to Make a Forecast

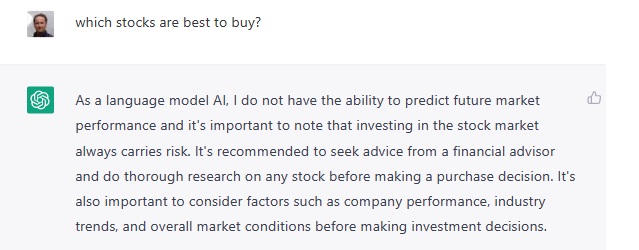

ChatGPT responds with a disclaimer when the request is too specific or beyond it’s guidelines. It’s response to “seek advice from a financial advisor” is not something an average investors or expert would suggest. It’s framework is still basic programmed in via Openai programmer’s novice understanding of the topic challenge.

Stock forecasting for Programmers

ChatGPT allows you to ask many type of questions including those of programming code. You can ask it to provide executable code (Python programming) to pick the best stocks. it’s still early in its evolution but those who have tested it are impressed with the future possibilities.

A Tool that could plumb the minds of Investment Experts

We might want to only access the opinions of the stock market investment companies and other high profile investment experts, but the market itself is the valuation of all investment enthusiasts. The Dow, S&P, NASDAQ, DAX, and other indexes are the register of price and volume of trading for everyone (not just Warren Buffet or Cathie Wood). How could that be ignored?

We might want to only access the opinions of the stock market investment companies and other high profile investment experts, but the market itself is the valuation of all investment enthusiasts. The Dow, S&P, NASDAQ, DAX, and other indexes are the register of price and volume of trading for everyone (not just Warren Buffet or Cathie Wood). How could that be ignored?

In fact, it might be instrumental, with training, for it to tell us which stocks to buy based on a database of real experts, tempered by a group of moderates. It’s possible to game the ChatGPT processing, but as it improves, it learns to identify the source of errors, and thus will be difficult to trick in future.

Although ChatGPT and coming AI robots are fascinating, they are fully dependent on data available. And data behind firewalls, misleading data, and irrelevant inputs have to be filtered. This AI system has data up to 2021, but I’m sure they’ll get up to date at some point, just like Google’s AI system has.

It won’t give you a forecast for a specific stock as yet.

Although this new research tool provides some entertaining answers and insights overall, at this point, it’s an automation tool for “how to make money blogging” and to explore topics. It can write an app, but you wouldn’t use it because you’d get hacked fast.

Yes, this is the leading edge of adoption of any technology and it has something practical to do in its first iteration.

How well do you understand market factors? Which stocks are you certain are worth investing in? Does listening to the TV stock pundits give you confidence about investing? How good is your investment advisor? What’s his/her background? What research tools do they access?

MicroSoft Bought OpenAI

AI-based software has tremendous potential. Now that Microsoft has purchased OpenAI (creator of ChatGPT AI computing platform) a big infusion of cash and optimism will make ChatGPT the icon of AI information to the masses.

That’s a big responsibility and frankly, Microsoft isn’t the worst owner imaginable. Others would have evil purposes and significant harm could result from them owning it. It could be skewed for political purposes. For instance, ChatGPT was programmed to filter out political bias. When results were analyzed, they found it’s output was contaminated by Liberal views.

When any bias is strong, it’s difficult for the system to ignore it, as it becomes part of the system’s frame of reference. So there’s still some significant issues with ChatGPT.

On the bright side, is the ability for users to train it and optimize it for their particular purposes. Your own stock market advisor will be using ChatGPT (financial version) to assess attitudes about sectors and the best stocks to buy.

This technology is more powerful than we realize right now. Yet up until now, there’s never been a service at the level of ChatGPT. I’m delighted of course at this fusion of AI-based apps and information hungry consumers. There will be many business opportunities (and ChatGPT might even explain them to you!).

ChatGPT’s Forecast for the 2023 Stock Market

I asked ChatGPT to produce its stock market forecast for 2023 and here is its response verbatim:

Stock Market Forecast for 2023

The stock market is one of the most important barometers of a country’s economic health and growth potential. It reflects the aggregate sentiment of millions of investors and traders, who buy and sell shares of companies listed on stock exchanges.

In this article, we will take a closer look at the stock market forecast for 2023 and some of the key drivers that are likely to influence its performance in the coming year.

Overall, experts predict that the stock market will continue to grow in 2023, although at a somewhat slower pace than in the recent past. This is due to several factors, including a tapering off of economic stimulus measures, rising interest rates, and a possible slowdown in corporate earnings growth. However, despite these headwinds, the stock market is still expected to remain relatively strong, as long as the global economy continues to recover from the pandemic-induced recession.

One of the most important drivers of stock market performance is the state of the economy. In 2023, the global economy is expected to continue its slow and steady recovery, driven by rising consumer confidence, increasing employment, and a pickup in consumer spending. This will likely translate into higher corporate earnings, which will in turn drive stock prices higher.

However, the growth of the economy is likely to be tempered by a number of factors. For example, interest rates are expected to continue to rise, as central banks seek to control inflation and stabilize the economy. Higher interest rates can lead to a slowdown in consumer spending, as well as higher borrowing costs for companies. This can impact corporate earnings and, in turn, stock prices.

Another important factor that will influence the stock market in 2023 is the pace of technological innovation. The rise of technology has been a major driver of stock market growth in recent years, as companies in the tech sector have seen rapid growth in revenue and earnings. In 2023, this trend is expected to continue, as new technologies such as artificial intelligence, blockchain, and the Internet of Things continue to gain traction.

However, there is also a risk that the pace of technological innovation could slow down, which could impact the performance of technology stocks. This is because as these technologies become more mainstream, the rate of growth in their adoption may begin to slow, leading to a slowdown in revenue and earnings growth for companies in the sector.

Another key driver of stock market performance is geopolitical risk. In 2023, this is likely to remain a significant factor, as tensions between major powers continue to escalate, and as new geopolitical risks emerge. For example, the ongoing conflict in the Middle East, the rise of China as a global superpower, and the threat of a new cold war with Russia are all factors that could impact the stock market in 2023.

To mitigate the impact of geopolitical risk, it is important for investors to have a diversified portfolio, and to allocate their assets to different types of stocks and bonds. This will help to reduce the risk of exposure to any single event or market, and will help to ensure that their portfolio remains resilient in the face of geopolitical or economic turmoil.

In conclusion, the stock market forecast for 2023 is one of continued growth, albeit at a slower pace than in recent years. Key drivers of stock market performance will include the state of the economy, technological innovation, and geopolitical risk, among others.

By keeping a close eye on these factors, and by having a diversified portfolio, investors can help to ensure that their portfolios remain on track, and that they can take advantage of the opportunities that the stock market will present in 2023.

ChatGPT’s Response

ChatGPT began answering with its general context to the question. It didn’t respond to me personally as a unique individual person. It said, “In this article, we will take a closer look at the stock market forecast for 2023.”

It expounds a theory (which is enlightening) that technology is the key to the stock market. That’s debatable. In fact, its summary of the stock market forecast is a theoretical exercise about what may affect the stock market. This is good for beginner stock investors who need to cling close to the macroeconomic cues.

It references unknown experts, discusses current conditions, and speaks of a prediction of growth. It references geopolitical risk which very few popular finance websites mention is a key factor. Is this political bias or an unappreciated factor?

For expert level investigations, it offers little of value, just a theoretical context built by its creators. It makes no mention of strong sectors and best stocks to buy, thus missing the real reason why we’re asking — to make money. AI should be able to understand the user’s end goal and get us there.

Its response mentions many things as stock market factors, but missing is global demand, debt crisis, monopoly control, and shut down supply sources, issues that may be politically sensitive. Right now, ChatGPT may be biased by its creators values and beliefs. They are going to work on eliminating that bias (if it’s possible).

Obviously, market supply is the crisis issue and supply would highlight those companies capable of ending the supply crunch. It doesn’t even mention jobs, wage demands, oil prices, inflation, P/E rations, debt, costs, and other factors that are key to growing corporate profits.

The OpenAI programmers have skewed the original programming such that it can’t answer realistic questions. We’re left with doubts as to political manipulation and bias. This could damage ChatGPT’s reputation.

The Future of ChatGPT

ChatGPT however, has an uncanny focus on its information mission which is great for professional users. Once the political bias is ironed out, it does have the power to deliver on expectations. There is a waiting mass of people hoping to avail of its objective, mass observation system. Yet political bias is a concern.

ChatGPT is limited in its database and in its ability to filter and process that data. Once that is fully evolved and plugged into real time data, the results will be phenomenal. And the best thing is that it can be trained to improve and provide more value for specific purposes.

Even if ChatGPT for investment is weak right now, the new inputs and guided training give it a positive outlook.

Foe stock market forecasts, what if the data inputs were limited to the top 1000 stock market experts? The app could be focused on 3 month, 6 month and 5 year outlooks.

Find out more about the stock market forecast for 2024.

Stock Market Predictions 2024 | Market Rally in 2024? | TSX Forecast | Housing Market Downturn | Stock Market Crash | Software as a Service Marketing | Bleisure Travel Marketing | Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel Marketing | Travel SEO