Toll Brothers: The Best Homebuilder Stock?

It’s too well known that the housing market is undersupplied. Even the affordable luxury market as it’s dubbed is insufficiently supplied.

So while you’re scanning for the most investable, lower-risk stocks, there are a few new homebuilder stocks that stand out. One in particular, Toll Brothers Homebuilders has a special cache, and you may want to put this on your stocks to buy now list.

Their 3rd quarter results, just posted last night were approved of by investors. The company’s stock rose a couple of percent in after hours trading. Toll Brothers forward guidance spoke of higher prices and more sales as the economy begins to revive and buyers try to get ahead of rush to buy a home.

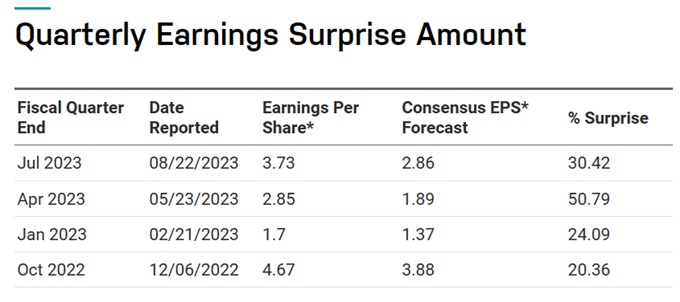

To give you a taste of this exciting investment opportunity, you should be aware the stock has performed exceptionally well of late, however today Tuesday December 5th, after hours, the company released its Q3, 2023 earnings report. Wall Street analysts believed they would post quarterly earnings of $3.64 per share, down 22.1% vs Q3 2022 and revenues are forecasted to be $2.78 billion, a year-over-year drop of 25.1%.

Here’s a summary of TOL earnings report:

- net income fell from $640.5 million in Q4 FY 2022 to this Q4 FY 2023 at $445.5 million

- home sales revenues dipped 18% in Q4; yet net signed contract value surged by 53%.

- adjusted home sales gross margin improved to 28.7% for Full year 2023, up from 27.5% in FY 2022

- revenue per share fell to $4.11 per share diluted to .63 per share diluted one year ago

- home sales revenues increased by 2% to $9.87 billion, despite a 9% decrease in delivered homes

- The company expects to deliver between 9,850 to 10,350 units for the full year 2023, with an adjusted home sales gross margin of approximately 27.9%.

Gurufocus chips in with a stellar rating of Toll Brothers, ranking them near the top in important criteria.

NASDAQ predicted a surprise to the upside which is counterintuitive given the tough environment and chatter by home builders about that. They appear to have forecasted correctly.

If it’s disappointing, then the stock could take a drop. And that means you might buy it at a discount on Wednesday morning. It would be wise to wait because this stock has unrealized long-term potential. So why don’t we learn more about Toll Brothers and its earnings potential?

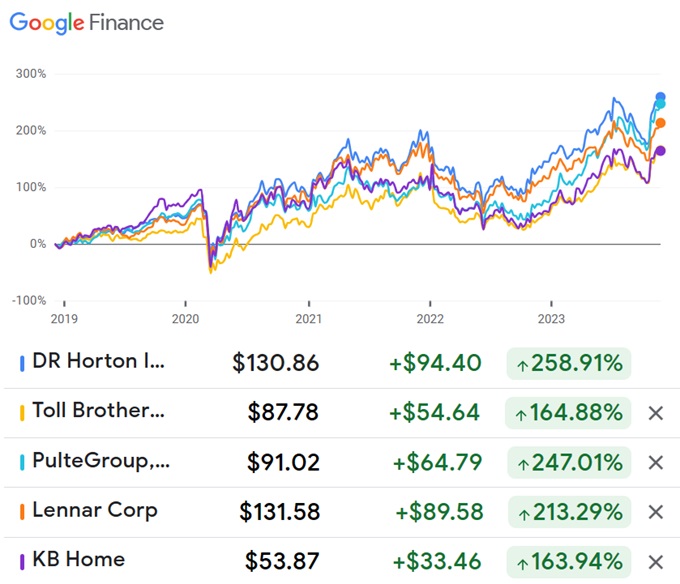

As the chart below from Google Finance reveals, the homebuilder stocks have enjoyed amazing growth. With the resale housing market locked in, the only source of homes are new construction units being released. And there’s a big shortage. Homebuilder companies have been working in this difficult market for many years, and have learned to be creative.

As the chart below from Google Finance reveals, the homebuilder stocks have enjoyed amazing growth. With the resale housing market locked in, the only source of homes are new construction units being released. And there’s a big shortage. Homebuilder companies have been working in this difficult market for many years, and have learned to be creative.

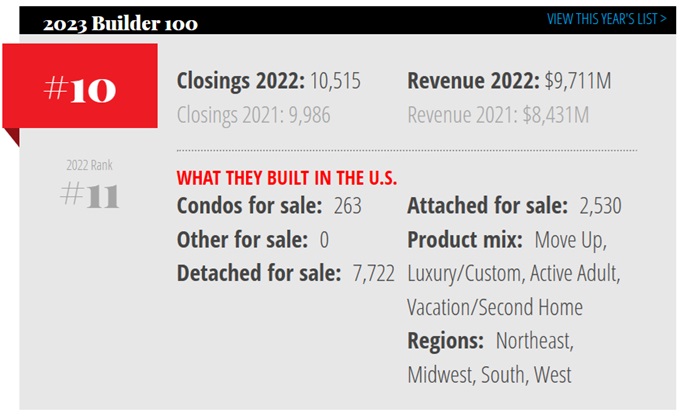

Aside from that, the profitability that Toll Brothers has achieved is impressive. You can read all about it plus their financials below. Builderonline ranked Toll Brothers #10 last year. A rise this year could come with much higher stock price gains.

The major homebuilders still have it tough with stifling regulations, high-interest rates, and high costs of construction. No matter whether they’re building single-family houses, lowrise multifamily or tower condominiums, it’s a difficult challenge. Yet, despite that, their stocks have performed very well, rising 180% to 300% over the last 4 years. Like most stocks, if you had bought at the depths of the Covid shutdown, you would have done very well.

Stocks such as Nvidia and Facebook of course performed much better. Yet, the housing market has been deeply suppressed, a victim of anti-building regulations, high mortgage rates, immigration and inflation. So, as the FED rates drop, the housing market will begin to come alive. But it will take a while for the resale sales market to get moving, as locked-in mortgage holders will need to see rates drop much further before they can sell.

For that reason, demand will push up prices of any available homes on the market and make them unaffordable. The new construction home builders might have an advantage in producing more homes and thus their profitability should soar.

It might be worth it to look at all the major homebuilders including DR Horton, Toll Brothers, Pulte Group, Lennar Group, KB Home, Taylor Morrison, NVR, Meritage Homes Corp, Clayton Properties Group, Century Communities, LGI Homes, MDC Holdings, M/I Homes, Hovnanian Enterprises, Ashton Woods Homes, Tri Pointe Homes Inc, Dream Finders Homes, Richmond American, and more.

It’s always wise to review a stock’s price over the last 5 years, and Toll Brothers stock looks steadier than the rest which might suggest there is less risk. And it doesn’t appear to have rocketed the way DR Horton and Pulte Group have. To choose the best stock to buy, you’ll need to review many analysts outlooks on the stock and the home builder sector.

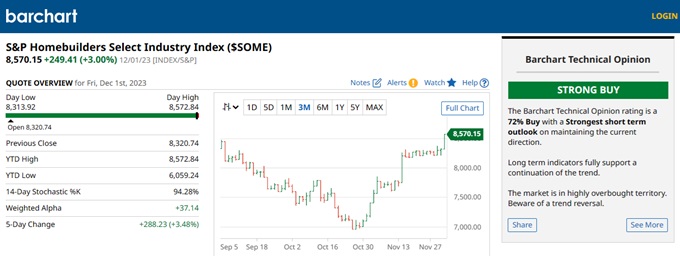

The S&P Homebuilders Select Industry Index ($SOME)

The S&P Homebuilders Select Industry Index chart below shows the sector comes with a strong buy rating.

Each builder has their own unique served market and the demand factors will be unique to each. As the economy recovers however, those builders who make houses and townhouses will likely have unlimited demand. Demand will still be there for apartment buildings and condos as there is a small government effort to support multi-housing, and there is a massive number of Americans needing affordable housing.

As baby boomers are handing down their wealth to their children, the younger crowd will be looking increasingly for single-family type dwellings perhaps to raise families or enjoy their newfound wealth.

USA Investing Spotlight: Toll Brothers Home Builders

In this post, we’re focusing on a USA home builder which I feel might have the best growth prospects from here on and the stock is at an affordable level and the downside risk is low.

Jim Cramer spoke with CEO Doug Yearly in a very informative interview about Toll Brothers’ market opportunity. This was 6 months ago, and Yearly speaks of the coming market change for 2024.

Who is Toll Brothers?

This company is a reknowned and prominent luxury homebuilder in the United States, with a focus on building high-end residences in upscale communities. The company was launched in 1967 as local builders. Despite the luxury tag, you’ll find houses below the $500k price point on their website.

It’s now one of the nation’s largest and specializes in designing and building luxury homes marketed to the affluent segment of US homebuyers. They build houses with a range of architectural styles and customizable features to meet the diverse preferences of its discerning clientele. Toll Brothers has developed a reputation for attention to detail, quality craftsmanship, and innovative design, positioning itself as a leader in the luxury homebuilding industry.

Toll Brothers brings an emphasis on luxury, comfort, and sophistication. Their customers seek exclusive, finely crafted residences with high-end amenities and architectural excellence. By targeting this niche market, Toll Brothers distinguishes itself from other homebuilders, setting the standard for luxury living and creating aspirational communities that reflect a commitment to quality and elegance.

The company’s portfolio includes a wide range of home types, from expansive single-family homes to luxury condominiums, all designed to meet the high standards of the luxury housing market.

Analysts Outlook for TOL: NYSE Stock

According to MarketBeat, in August, equities research analysts such as Keefe, Bruyette & Woods upped their price for Toll Brothers stock from $94 to $101. And Oppenheimer upped their price target on shares of Toll Brothers from $99 to $110 and gave the company an “outperform” rating. Raymond James raised their price outlook from $100 to $110 and gave the company a “strong-buy” rating.

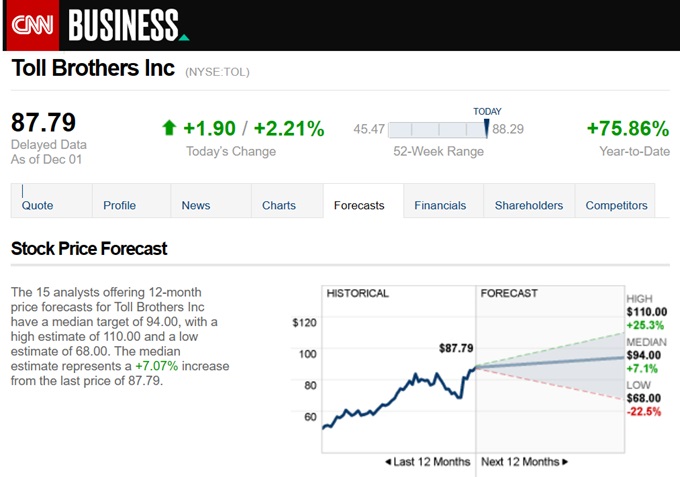

CNN forecasts a meidan price of only $94 and a $110 top end price for 2025. Of their 20 analysts reporting, 12 give it a buy rating and only 2 a sell rating.

So based on Q2 results, analysts like them a lot, and it’s likely a key reason why the stock has risen strongly. Yes, like most stocks today there is volatility, but for a steady investor with a 1 to 3-year investment timeframe, this stock will likely continue its amazing bull run.

Toll Brothers Financials

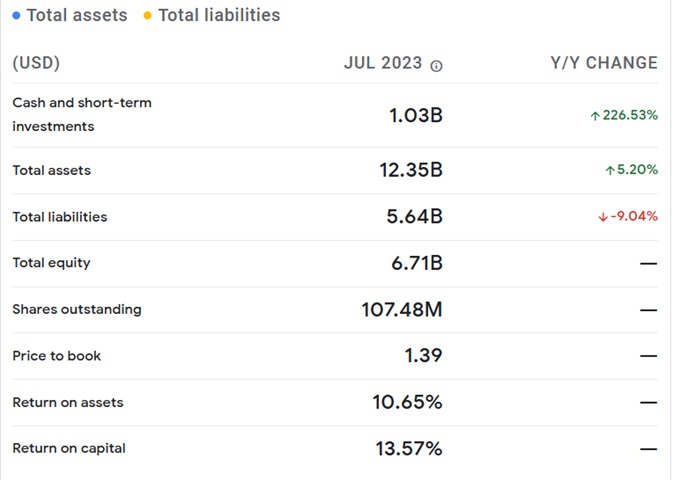

The company’s financials look much better than the more well-known DR Horton whose stock is preferred by investors. The ROI doesn’t support that preference however. DR Horton and others target the general home building market where there is more potential. However, as we all know, it’s easier to find land and build high-priced luxury homes than it is to build affordably priced homes.

And with the affordable buyer market financially challenged for many years yet, and high mortgage rates ending their home buying dream, that market won’t take off like the luxury market will when the economy grows.

The wealthy will enjoy booming wealth from growing revenues and their stock wealth, so they’ll have plenty of money to buy another luxury home. And they’re buying luxury homes with cash at a continuously high rate.

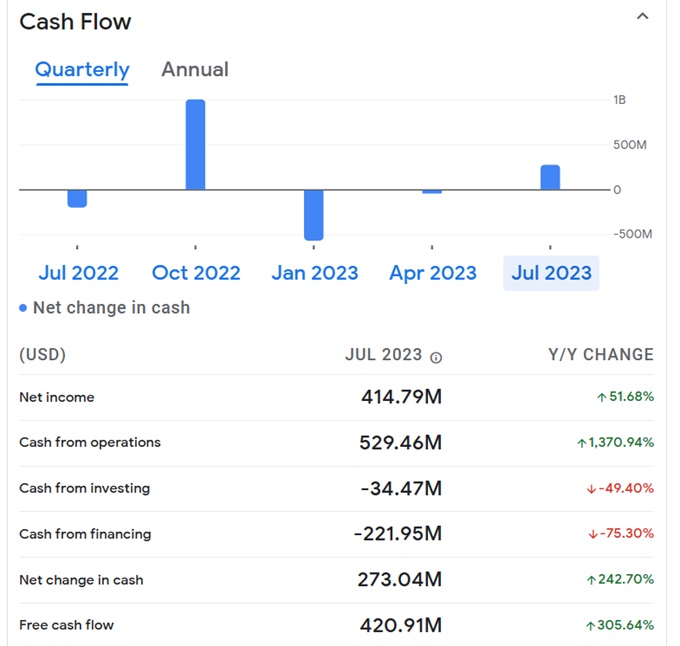

As you can see in these financial statements provided by Google Finance, the color green is frequent which is the best color on any chart. The year-over-year increase in cash from operations is unbelievable at +1370 year over year and free cash flow is up 305%.

Free cash flow (FCF) is the money a company has left over after paying its operating expenses (OpEx) and capital expenditures (CapEx). The more free cash flow a company has, the more it can allocate to dividends, paying down debt, and growth opportunities — Investopedia.

Despite these tough times for builders, their net incomes grew 50% year over year and their earnings per share rose 60%.

Toll Brothers stock is also up 87% year over year. That has produced a lot of happy investors. And this wonderful performance isn’t over. From macroeconomic trends to local market opportunities, their prospects look very good.

See more on the 2024 housing market outlook and the new home construction market.

Best Homebuilder Stocks | 2024 Housing Market | California Housing Market | Florida Housing Market | Dallas Housing Market | Boston Housing Market | Successful Realtor Business | Real Estate Marketing Packages | Los Angeles Housing Market | Tips for First Time Homesellers |Housing Market Blog | Will Home Prices Rise in 2024 | Best Cities to Buy a New Home