Are Home Prices About to Rocket?

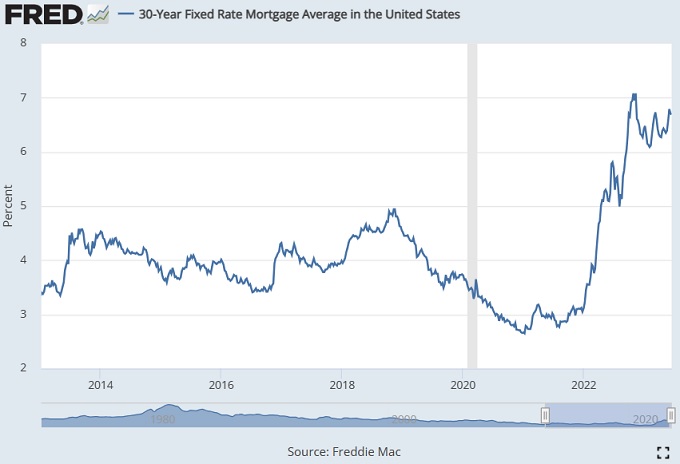

Everyone is waiting for interest rates to fall.

That’s because those rates are what’s stopping the housing market specifically. High rates harm a lot of industries, but real estate is worst hit. It will recover quickly when rates go down.

It’s those unwelcome interest rates that are preventing most sellers from selling, and prevenint most prospective buyers from buying. And when the rates pivot and head back down it’s a signal that the housing market could open up again strongly. To stimulate the US economy and resume international trade, rates must decline. High rates are a global economic cancer, more than just a US problem.

Allowing markets to manage themselves free of government manipulation is the solution everyone wants.

A coming housing market boom, would help support home construction which supports a healthy, robust economy, not the cancer-stricken one being delivered by the Democrats. A boom is a healthy response that everyone should support.

In fact, common sense tells us the demand behind the FED dam is going to be a flood event. The housing market is the most significant market because of the intense demand and how it’s most harmed by excessive rates.

Barbara Corcoran’s Predictions of Price Rises

Barbara Corcoran, a well respected Realtor, investor and member of the hit investment show Shark Tank believes we’re going to see a price boom, if not a sales boom.

She says this next event could be a repeat of 2022 sales boom, but much larger given more buyers and sellers will be activated. The pandemic is gone, and everyone is free to resume their lives, employment and business. Which is why FED restraints are entirely inappropropriate, drawn up by people who work in dark rooms without windows.

In an interview with Fox News, Barbara Corcoran said “sellers don’t want to move from their apartment or their home because they don’t want to take on higher interest rates. Buyers are too afraid [to finance a new home] because they are getting less value for the money. So you’ve got a standoff going on. But things are changing.”

“The minute those interest rates come down, all hell’s going to break loose and the prices are going to go through the roof.” she said. With sellers staying put to avoid refinancing at high rates, they’ll finally be able to move on with their lvies “if interest rates go down by two points.”

“It’s going to be a signal for everybody to come back out and buy like crazy, and the house prices [will likely] go up by 20%,” she said.

The key to a booming housing market is and undying demand from buyers. And demand is there from all those who want to relocate, including baby boomers wanting to find a retirement nest to millennials and Gen Z’s who want their first home and get out of high-priced rental and their parent’s homes, to new immigrants, given their ages, want a house to own.

And Gen Z’s, previously left out of all discussions are getting older and starting to buy homes too. That group represents the biggest market going forward.

Nothings Changed: Development Stopped While Demand Grows

No one knew real estate was going to be so valued and desperately sought, because they had no idea strong the NIMBY’s and real estate wealth holders would become in stopping housing development. They’ve been instrumental in stopping all construction, renovation, and repurposing and come hell and high water, they’ve evaded being blamed for the real estate market and home price nightmare.

More focus is needed on the NIMBY’s and local governments.

The FED rate is designed to wipe out demand, but it’s not fake demand. It’s real, from real people who want to live real lives, so it’s not going away. It’s just builds and can’t go away. People have to live on land in buildings somewhere. So when the Fed rate reverses and the M2 money supply returns, millions will be buying homes. Hopefully, the homeless will find a place to live too.

It’s a buying tsunami waiting to happen. That means house prices are going to rocket. And if the US and Canadian economy reawaken in late 2024, there are even more buyers ready to leap into the housing market with both feet.

As Corcoran says, don’t expect a housing market crash, given that people aren’t overleveraged and consumers still have a lot of savings. That means most prospective buyers have the resources ready to buy when enabled. And many more will buy when the cost of buying drops in 2024.

Of course, the FED knows this. The FED is the cause of inflation now with other sources receding (4.1% in May). And housing propped up by high mortgage rates and lack of construction is next. Some see the housing market as ground zero for inflation. The FED is trying to win a war by itself with a high spending US government continuing its spending ways despite whatever they do.

Housing Market Crash 2023 | Housing Market Predictions for Next 5 years | Housing Market 2024 | Stock Market Forecast 2024 | 6 Month Stock Outlook | Austin Texas Housing Market | California Housing Market | Florida Housing Market | Dallas Housing Market | Los Angeles Housing Market | Boston Housing Market

The FED indicates they may keep high rates for several years, but the political pain from angy voters won’t let it go that long. Everyone knows a great economy beckons and its just a few politicians and unelected FED managers in the way.

The dam will burst because it has to.

In order to stop the home buying surge, the FED would need to exact huge suffering on all Americans (same in Canada, UK, Australia) and these include unfortunate low income people who can’t afford to buy. In the name of suppressing home price inflation, they’re willing to cripple the US economy which causes much greater harm.

They’ll be forced to make this decision and voters will help them in November 2024.

The Democrat and Republican media channels will tire of the endless saga of suffering and a new “fashion trend” will rush in with optimism and the American dream making a comeback.

That success for the US is positive for other countries too. It’s going to pave a path for ridding us of the urban decay that’s happening and higher wages for US workers (something the FED is dead set against).

What the experts might be intimating is that this narrow-minded pursuit of justified repression can’t hold on much longer. Even the uninformed can see that politically motivated mess makes no sense.

The housing will return, home prices will rise, and it will drive the US economy for the next 5 years.

Housing Market Predictions for Next 5 years | Housing Market 2024 | 6 Month Stock Outlook | Austin Texas Housing Market | California Housing Market | Florida Housing Market | Dallas Housing Market | Los Angeles Housing Market | Boston Housing Market | Mortgage Rates | Economic Outlook US