Why do Prices Rise?

Stock market volatility is by no means over, as we enter the end of the imposed economic shutdown. The events of Black Friday help us see clearly what the threats and sell off signals are.

It really brings home the potential for a significant sell off and this might prime us for the possibility of a stock market crash perhaps in 2023. Crash or not, it’s wise to dig in to help you predict market directions, and perhaps opportunities to buy.

The 3 and 6 month outlook still look really good as vaccinations continue to roll out by the tens of millions.

And don’t feel bad if your portfolio sunk recently with the sell off. Many stock market experts including Warren Buffet also took a bath and he has all the stock loss evasion tools at his disposal. Stock market forecasting isn’t easy. Winners and losers change places almost on a daily basis and expert forecasters can’t figure this market out.

What Will Drive Prices in 2022?

It’s easy to look ahead to next week and perhaps the next 3 months, but where will stock prices be in 6 months or in 2025? The 2022 stock market forecast is fairly bright, but it’s being weighed down by talk of rising interest rates, big inflation numbers, government debt defaults now the new Corona Virus variant.

It will slow progress for the next few years, however once out of these troubled waters, with a new US government in place, and taxes headed back downward, the 3 year, 5 year and 10 year forecasts aren’t so bad.

A significant amount of demand factors will float the economy for the foreseeable future. Corona Virus pandemic aid should provide a nice boost if it’s delivered. Infrastructure spending may or may not give a boost.

Have you wondered why stock prices jump the way they do, and then sought out what you are sure are the very best stocks? Let’s hope you’re focused on the longer term 5 to 10 year goal, because there’s going to be a lot of ups and down coming. Let’s get right to the 20 factors below which drive stock prices up.

While investment experts announce they have the situation under control and cite technical indicators, stock buyers lose a lot of money every day. Which stocks are at bottom right now? Check the Dow Jones, S&P, and NASDAQ reports and review the best sectors, before you choose the best stocks. Also, review what the AI stock prediction tools are saying.

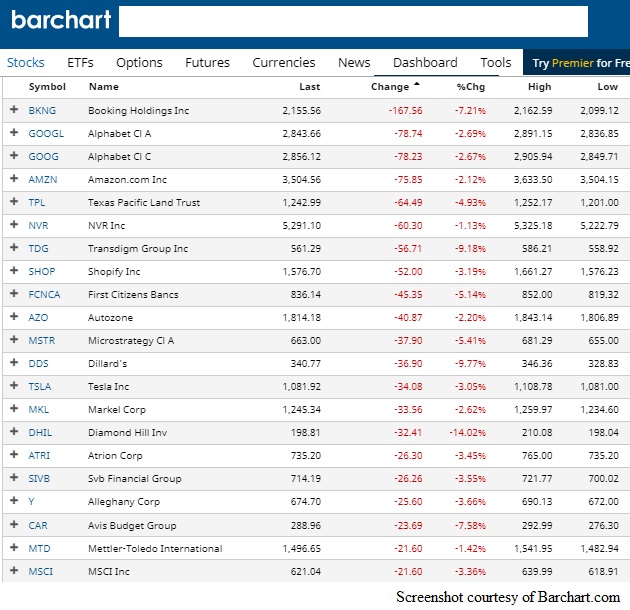

Top Gainers by Price

Stocks in Some Sectors Are up In Smoke

For instance, investors in some of the pot stocks are taking big gambles. Despite what we now know is a defined and slightly growing demand for marijuana, investors joined in the frenzy to buy pot stocks. Many of the pot growers in based in Canada.

Should you buy pot stocks? There is no short term returns in pot stocks. The long term value is simple, when the US legalizes pot there will be a big win fall. However, US growers would want first dibs on that big market.

Mega Cap Stocks that Are Rising

For stocks that are rising, and have the characteristics most investors look for, see the Facebook stock price, Google stock price, Tesla Stock price, Amazon stock price and Apple stock price pages. Also please check out the Russell 2000 forecast for the best small cap opportunities.

What is it that Drives Value in the Best Stocks?

That leads us to the key discussion in this post. What are the top 20 forces that move stock prices and generate real value?

- market factors: is this type of product in demand now and beyond 2020?

- competition: how intense is the competition and do they erode market share?

- cost factors: can they produce the service/product more cheaply than competitors?

- branding: have they established their brand to consumers

- new technology: are they riding on a tech wave which floats all boats?

- monopoly? are they trying to be a market leader and generate a monopoly?

- what is their P/E ratio history?

- what is their earnings each quarter?

- what is their valuation multiple?

- are they impacted by international trade tariffs?

- how much debt do they have and what are the interest rates?

- what is the demographic target in the marketplace?

- how is their industry trending in sales?

- what do the experts say about their stock value?

- how liquid is the company and what is their cash flow like?

- what is the market sentiment about the sector and that company?

- who is trashing the company and are they effective at it?

- are they growing, flat or decaying?

- do their customers need an upgrade to stay competitive?

- are the stocks underwriters able to make money off its stock plunge?

Which Market Sectors are Hot?

Hot sectors show up when company’s earnings reports take a big rise. That might happen just after announcing new products. Apple and Disney just announced their new subscription services and product arrays for streaming TV. Market sentiment has always been negative toward streaming. But these companies plus Roku, and Youtube Live, and others are viable entrants too.

Suddenly all of the streaming technology is in place and consumer demand is changing. Disney, Apple and Netflix are competing in the space. They’re all providing a new value proposition with more content available. And the content from the TV networks is very negative (CNN) and poor quality. A big shift to streaming subscriptions is the result.

They’ve announced their new subscription numbers and they’re off the charts. It seems to be a big success but are their value propositions solid? ESPN was offered as part of a streaming service and only a few million subscribers wanted it. It basically failed.

What Does a Bad Stock Look Like?

Freshii Inc Closing Price: $2.71 (now in April, it’s fallen to $1.36)

Freshii Foods came on strong when it appeared on the TSX, but from there it’s all down hill, losing 75% of its value since its IPO. It arrived on the fanfare of fresh health food which was a trend. However, competitors have also moved to fresher foods. Freshii’s value proposition and branding simply isn’t up to par.

It recently announced its plan to open 760 stores from the current 400 locations, citing problems with new franchise time delays. It’s same store sales dropped. It’s stock just plunged 50%.

“Freshii’s results and rescinded guidance reflect a clear and substantial deceleration from already slower growth evidenced in recent periods,” John Zamparo, director of institutional equity research with CIBC Capital Markets.

Stocks can be rated low for a lot of reasons. But a good company is one that has a market leader or monopoly position, big earnings, potential new markets and customers, are leveraging a new technology, and riding on a significant cultural trend (such as streaming TV). That can generate high stock prices.

See more on the Stock Market Today and the stock market forecast for the next 3 months.

Stock Trading Platforms | Oil Price | S&P 500 | Best S&P Sectors | Tesla Stock | Stock Trading | Lines of Credit | Reverse Mortgages | Low Mortgage Rates