Investing and Global Diversification

If you scan the 5 year forecast or 10 year forecast for US stock markets, you might conclude that US price and earnings growth doesn’t look as inspiring versus China, Vietnam, Brazil, Germany or other markets.

But those investors thinking of investing internationally in Mexico, Japan, Australia, Viet Nam, Germany, Korea, Hong Kong, or China might think it’s a simple issue of P/E earnings ratios and GDP forecasts. Investing internationally whether in 2022 or now gives you access to some good equities, but the risk may be a stopping factor. And foreign equity ROI (dividends too) might be overestimated.

There’s a lot of theory and rationale on global diversification in stocks, but one investment advisor cited below believes they’ve found some unique market behaviors and you could time your investments for a big profit.

Global stock diversification refers to investing in stocks markets in companies across the globe.

The basic rationale behind global stock investing suggests that a variety of investments will generate higher ROI and possess lower risk compared to a domestic portfolio. The idea is to invest where returns are highest. That’s the theory. Long term forecasts of foreign company profits might not be accurate and foreign governments may act in radical ways, as the China government is doing right now.

Investors who are concerned about the stability of their 401k and other investments in the US, and the possibility of low US GDP and flat stock prices and earnings, will be tempted to protect their wealth by investing elsewhere. The economic tide can certainly shift, as many believe the US is mismanaged and in terrible debt.

Some advisors believe the US is on the downside of a long bull run. Have stock prices peaked? Are earnings about to tumble? Certainly for 2022, that’s not the case, however in 2023 as interest rates head up and taxes loom, the US could be hit hard. If so, do you just take the hit and hang on for the 5 year or 10 year long term recovery?

US Economy Lifts Global Ships

However, since the US economy drives the world economy, if the US turns sour, the rest of the world might tank too. Thus you would be foolishly moving your money into global stocks that may collapse completely in value. World markets don’t offer the same legal protections, so it is much more risky. So rather than eliminate risk, it actually adds risk.

Only an experienced financial advisor would know how to navigate international investing. It might be more risky than buying Bitcoin, and is the upside really all that great?

Performance: US Stock Markets vs The World

Investors.com found that up to 2019, the U.S. Stock Markets enjoyed 10 Years Of Strength. Using the S&P 500 vs. the MSCI All Countries Index (minus the U.S.) as a benchmark — US equities far outperformed shares in the rest of the world during that decade. U.S. shares grew 186%, compared with 50% for the rest of the world. In 2019 alone, as of December 27, U.S. shares rose 29% vs. 19% for the rest of the world.

Vanguard predicted in 2019 that global stocks would outperform US stocks by 3% to 3.5%. That didn’t happen. So is that forecast enough to justify taking a big gamble in the years ahead, and not choose stocks listed on the Dow Jones, S&P, or Nasdaq?

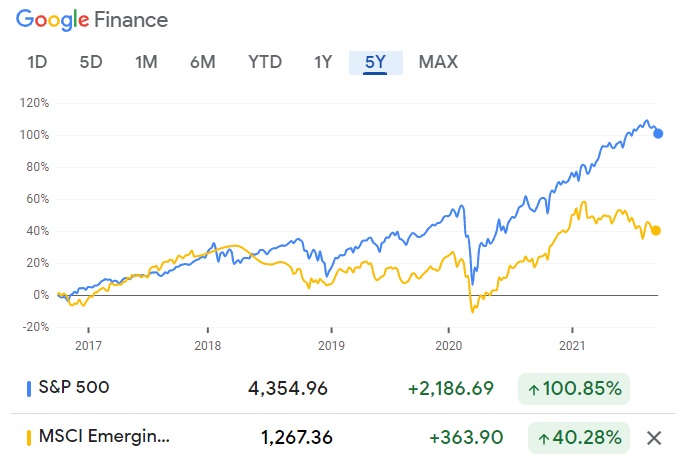

This chart below shows how much better the S&P has performed than competing stocks markets.

So, it appears whether China or all emerging markets, the US stock market has outperformed, and who do you trust will outperform again in the next ten years?

The pandemic changed the playing field and has actually put China in the driver’s seat given their lower debt and better trade position. Yet, China is not trustworthy, erratic, and investors risk everything as the country struggles with its international relations.

And China stocks have lost their lustre with US sanctions, trade complaints, and high tariffs cutting greatly into their exports. Recent reports have China’s GDP output falling. However, if you’re buying on the dip, this might be the time to invest in companies that might come roaring back in the next 5 years. Given that US stocks are overvalued and probably at their peak, you might be tempted to push some money offshore.

Everyone’s talking about South Korea, Taiwan, Thailand, Vietnam and Singapore which benefit from the exodus of companies from China. However questions arise about their high-end technology manufacturing competing with China or Japan.

Morgan Stanley Says Global Diversification is Worth It

According to Morgan Stanley in an older report, a global diversified portfolio is worth pursuing. They cite the European recession and slow US growth that’s forecast. They see it as an ongoing strategy and not just a response or reaction to a troubled Dow Jones, S&P or NASDAQ.

Most advisors see it as a hedging strategy, risk minimization tactics. Others believe China and the emerging markets will blow away profits made in the US. If you look at the 10 year stock market forecast, you might conclude that China in particular offers higher yields and growth. Yet the anti-China sentiment is growing. With US debt trouble, the pressure will be on to shut China out. How will China stock yields perform then?

In one report, Charles Schwab spoke of the benefits of global investing in terms of avoiding the bumps and drops of US markets, and of the likelihood that global stocks will outperform US stocks over the long term outlook. That may or may not be true, but if the world does go into a recession, foreign bonds will not perform as well as US bonds.

Russell Investments points out a brighter future for globally diversified stocks.

“And yet, when broadening the lens out to a 10-year time horizon, Russell Investments’ long-term forecasts suggest brighter days are ahead for non-U.S. equities. In fact, by the end of this decade, Russell Investments is forecasting a 11% annualized return for non-U.S. equity markets and a 10.7% return for non-U.S. developed markets, compared to just 5.5% for U.S. equities.” — from story on russellinvestments.com.

Market Watch just reported that only 47 of the 500 S&P stocks have fallen in price during the last year. That performance during the Covid recession is amazing. Of course, it’s due to the massive stimulus spending, but now that the recovery is under way, the US stocks might still be the investors best choice.

If the US becomes more protective with tariffs and international migration of funds, the rest of the world could see its fortunes sinking. With Europe in a recession, it doesn’t look like a haven for investors.

Take a good look at the US stock market forecast for 2022, the next 5 years and next 10 years. There’s a lot to consider before you solidify your long term plans, but these posts might help broaden your options and keep you aware of threats.

Note: the observations, data, charts, and opinions are the author’s only and not reflective of any company mentioned in this post. Readers are advised to work with a reliable investment advisor, not just trend charts on your self-directed trading account. Investing long term is risky given governments can change the picture drastically at any time.

3 to 6 month Market Projections | Tesla Stock | Mike Wilson | Stock Market Today | Stock Market Week | Alphabet Stock | Real Estate Market 2023 | 5 Year Stock Forecast | AI Stock Forecasts | ChatGPT Stock Forecasts 2024 | Dow Jones Forecast 2024 | NASDAQ Forecast | Software as a Service Marketing | Bleisure Travel Marketing | Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel Marketing | Travel SEO