Stock Market Forecast Now

While there may be a cyclical uptrend in the markets that’s intriguing investors, they may want to hold on and back away from their FOMO buying impulse.

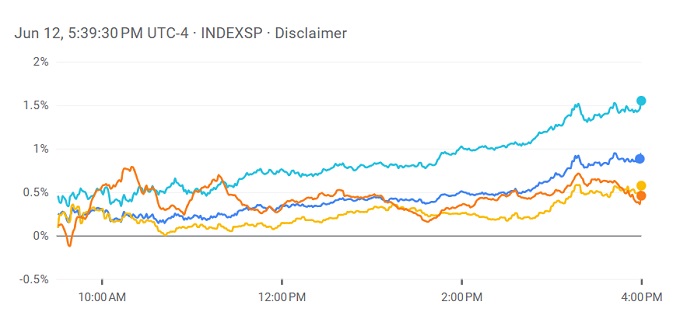

Certainly, the mood this Tuesday morning is good. S&P and NASDAQ futures are up again, however the Dow and Russell index are down. Their investors are feeling mixed about what the FED might be planning.

The CPI for April will be revealed today. And Bloomberg consensus estimates that May’s Consumer Price Index (CPI) is will only have been 0.2% over April’s (.4% rise) and an 4.9% annual gain. Inflation has been dropping sharply for many months now from it’s peak last summer, and that momentum should take it to unthreatening levels. So perhaps investor enthusiasm is warranted, if your investing time frame is beyond 3 to 6 months to the 5 year outlook.

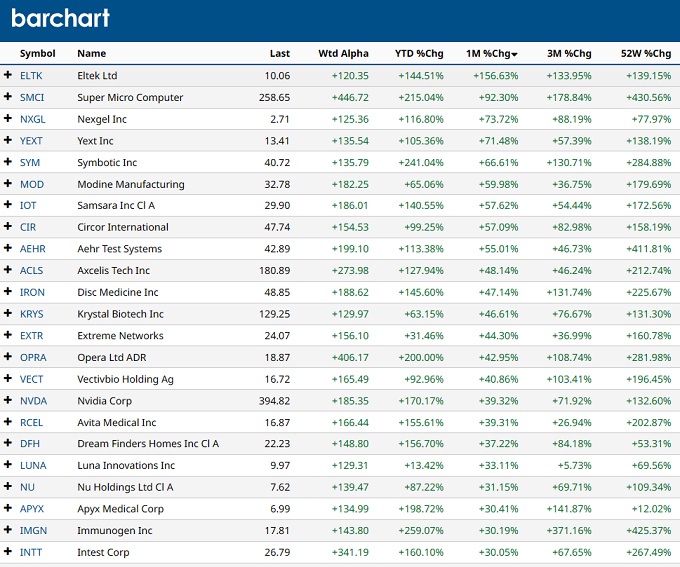

Barchart shows the hottest stocks of recent with tech and biotech stocks performing very well. However, are these wise given a downturn is awaiting this fall season?

Reports from a variety of stock market experts feel this market rally is about to take a tumble, perhaps in a few months. It’s wise to be cautious. Julian Emanuel, Evercore ISI senior managing director, said today in a CNBC interview that the S&P could fall below 4000 by summer’s end after rising close to 4500 in the next few months.

For those who will wait, stocks could hit their bottom in October/November providing the grandest opportunity for investors to capitalize on the next bull run. And of course, you may have to pick the winning ponies which is difficult work. Hopefully, here on the blog, the winners will show themselves.

In fact, Emanuel warns that after this surge in the S&P and NASDAQ of late, we could see a sobering drop due to the FED rate, rising unemployment, and shorting of equities.

That’s advice to ride out this rally and wait perhaps to 2024. Reasons for the pessimism come from:

- market liquidity shrinking

- lagging effects of FED rates finally arriving in earnest

- rising jobless claims

- yield curve inversion is getting worse

He’s suggesting a deeper recession could happen late this year, and the last time this trend happened, it took 3 years for the recession to play out. That kind of slump could chase investors right out of the market since they could get better returns in the money markets. Yet the banks and the money markets themselves are in doubt as rates stay high. And we haven’t seen bad vibes coming from the housing market yet, and commercial office real estate remains in peril.

Jeff Kleintop, Charles Schwab chief global investment strategist is trying to coin this as the cardboard box recession, with packaging, manufacturing and trade taking the first hit. He points to a rising glut of labor too as another indication of slowing economic activity.

Kleintop points to weakening earnings, and in fact only the top mega caps were posting good earnings anyway. The summer spending and revenge travel movement will tail off and that could result in a plunge by October.

Oil prices took a $4 dive on Monday showing doubt about demand from China and in the manufacturing and transportation sectors.

CPI will be out tomorrow with jobless numbers later. Some are forecasting a 4% CPI which would be a big, scary drop. Retail sales are forecasted to be down slightly in May. The consensus is that the FED will likely pause because of a lack of economic activity.

Eric Johnston, Cantor Fitzgerald’s head of equity derivatives and cross asset mentioned in an interview is that past mini rallies eventually led to downturns. They were considered a head fake to investors. See more on the interview with Mike Wilson of Morgan Stanley who gives his warnings about the market direction from here on out.

Keith Lerner, Truist Co-CIO and Chief Market Strategist is talking bubble markets in the tech sector. There’s a huge boom in AI and many are concerned it is looking similar to the 2000 .com bust.

With the FED pausing or keeping their foot on the brake pedal, it’s hard to get euphoric about the 6 month forecast, and even the 2024 forecast is being tainted by a drag in the recovery. Bad actions by the FED could indeed drag this downturn out a long time, and contribute to this rally fading quickly.

If the markets were driven by unrealistic zeal and euphoria, there is a risk of momentum shifting the other way too.

The big fear for this 3 month period is a FOMO surge followed by a mini crash.

An S&P below 4000 means a drop of about 10% which we know is a noteworthy drop. Which stocks will take the plunge? And which of those stocks are the ones to rocket back in 2024?

Wharton Economist Jeremey Seigel said “This recent bull market move is no guarantee we are out of the woods from the downturn. With that caveat, my feeling is that the October low will hold, but I remain cautious and do not think we have the start of a major up move here.”

Siegel expects the Fed will consider raising its inflation target to 3% from 2% once inflation normalizes. But the FED has low credibility and not much confidence thus they will likely not change their goal, but rather just keep the rates elevated into 2024 to crush inflation so they can feel more confident of their work.

The question is whether the market really has priced in this FED led recession, and is a way ahead of itself in believing the bottom has happened.

Any inflows of money market funds and consumer earnings into the stock market is likely to slow in a few months time. The bad news will grow and investors will be shaken.

Of course, this is one of those events that will help launch a strong market comeback in 2024 and create rising returns across the next five years.

It’s just one more signal of the need for belt tightening across the economy needed, if 2024/2025/2026 are going to be great years.

Stock Market Today | Morgan Stanley Forecast | AI Stock Forecast | Money Market Forecast | Best S&P Sectors | Stocks with Best P/E Ratios | 5 Year Stock Forecast | 10 Year Forecast | Dow Jones Forecast | Tesla Stock Forecast | NASDAQ Forecast | Oil Price Predictions | S&P Predictions 2024 | Stock Quotes | Stock Market Crash | Stock Forecast Blog