Tech Stock Sell Off

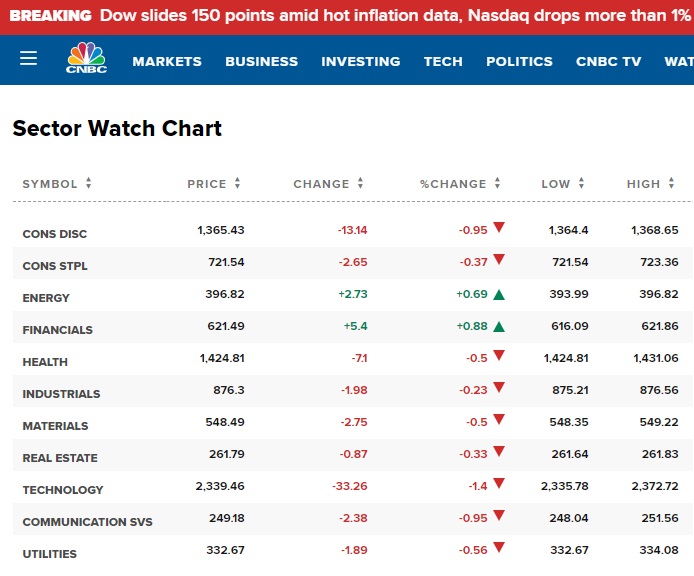

Amidst the stock market sell off this week, we’re seeing an abandonment of tech stocks in particular. Stock market experts are citing inflation as the key factor, but you’ll see the full list of tech deflating factors below.

Recently, the tech-led sell-off saw the S&P 500 and Nasdaq suffer their largest single day losses since March 18. Tech stocks are down 4% this month and through this week, scrutiny is clearly on the tech sector and whether it’s been flying high with smoke and mirrors.

Today, Wednesday May 12th, we’re seeing the tech stock carnage continue, and now new rumors are arising that could lead to big economic trouble ahead — government meddling. Yesterday, tech and consumer discretionaries bled the most.

The key factors driving tech stocks lower listed below are just the start of a re-evaluation of the tech sector. Perhaps, for institutional investors and small retail investors, this is a reset button moment? Those considering buying tech stocks on the S&P, NASDAQ or Russell 2000 are going to think harder about the volatility and stock price trends. The fact is, financial markets are difficult to comprehend (information hidden) and investor and government intent not clear.

If the economic recovery surges in the 2nd half (without India and Brazil who are plagued with Covid 19) are investors wiser to pursue energy stocks or consumer discretionaries. Is travel and leisure offering a better upside than tech stocks?

How will this trending topic affect the stock market overall, and is it time for you to abandon the S&P and NASDAQ?

It wouldn’t take much to generate a big correction in the markets, and we saw the Dow fall 800 points over a 24 hour period yesterday and futures are pointing down again today. The DOW’s price plunge was confounding since home depot and travel companies took a surprise beating.

With the economy stuttering a little, that revenue shock could be rippling through the tech sector for a few months.

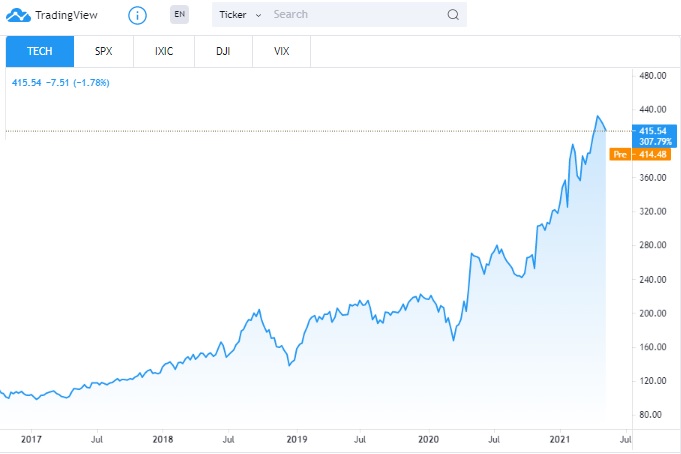

Tech has been on a fun ride for a couple years now, but especially in the 2020 stimulus period. But is that party over?

Experts are noting that tech stocks are in a down phase and the S&P and NASDAQ will be weighed down for a while. That might give major investors a moment to exit and result in some severe drops. One thing for sure, that as more attention is put on tech stock performance, the more downward pressure will be put on stock prices.

What is With the Tech Companies?

Is the Bull run for tech stocks over? Are there any tech stocks to buy in the short term? Is Bitcoin and Ethereum worth it? What does Dogecoin’s price success really tell us about tech? Are institutional investors starting to bail out of Google Alphabet, Facebook, Amazon, and Tesla?

Below, TradingView offers a good look at the success of Tech stocks in the past few years.

Why Are Tech Stocks Getting Dumped?

Investors can see tech stock as dumpable for many reasons, and if the economy turns sour, it won’t take much for investors to use any excuse to get out. Sometimes emotion can go the other way and cut through the euphoric high, and with government meddling, a bigger correction or crash is still on the table.

However, here’s a list of key reasons that could add up to some big price drops:

- uneven economic recovery

- tech is overvalued and is elevated only by stimulus and is thus in a corrective phase

- internet attacks (colonial pipeline are going to encourage more regulation in the tech space

- tech has had a bull run and is due for a big fall or at least a deceleration

- money is rotating into industrials and post-pandemic stocks that were suffering in 2020

- China has too big an advantage and China tech can be imported

- tech space is crowded with too many stock offerings

- capital gains will cut profits for many of the big FAANG companies

- labor shortage and high labor costs could hit tech companies hard this year and next

- workers don’t want to return to work because Fed funding is so generous

- inflation running hotter (4% in April) will subdue consumer spending on electronics

- electric vehicle manufacturing costs rising faster than gas powered vehicles and sales would fall

- B may have trouble implementing pollyanish anti-fossil fuel policies

- ant-trust and anti-monopoly charges keep putting pressure on Amazon, Google and Facebook

- semi-conductor chip makers facing big bottlenecks

- rising interest rates means cheap money is tougher to rely on

There’s much more to the story affecting tech stock prices so please bookmark this page to keep up to date on new issues, news and opportunities to invest. Please do visit the epic stock market forecast report for insight on complex market trends/factors and how to cut through the information weeds.

More interesting market insight on the Stock Market , predictions for the Stock Market Next Week , Stock Market Today and about a possible Stock Market Crash.

Stock Market Forecast | Tsla | Stock Market Crash 2023 |3 Month Stock Market Predictions | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ 2024 | Oil Price | S&P 2024 | Stocks Next Week | 6 Month Outlook | Stock Trading Platforms | Stock Trading | Lines of Credit | Reverse Mortgages | Low Mortgage Rates