Bay Area Housing Market

Sales and home prices recovered nicely in March in the Bay Area. San Francisco, San Jose, Oakland enjoyed a positive upburst. It looks like the recovery is beginning.

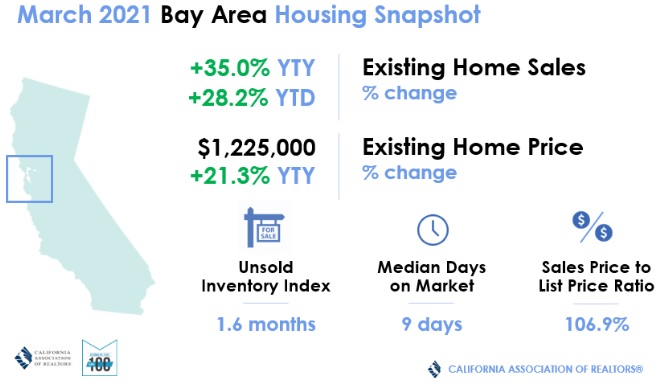

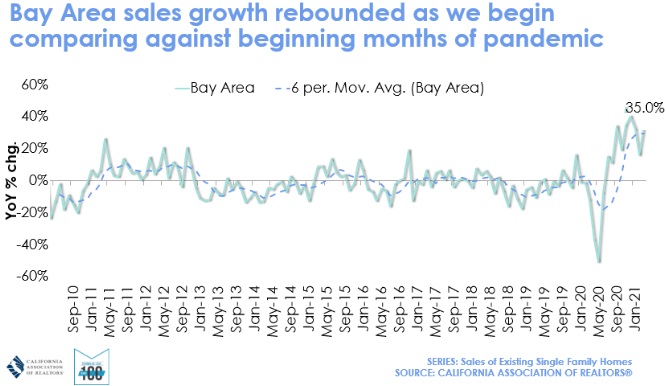

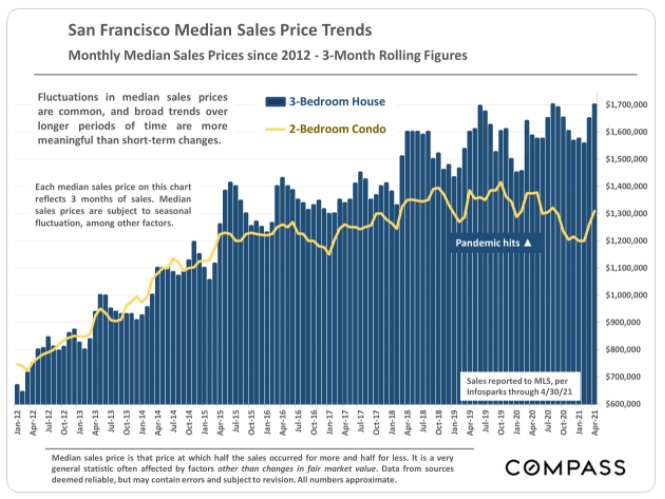

House prices in the Bay Area rose 6.4% ($53,5000) and sales jumped 51% versus February. And year over year, house prices are up 21.3% while sales rose 35% versus same time last year. The Bay Area’s housing market has been an outlier with similar urban markets such as Miami, New York, and Washington, hit by flight to pandemic destination cities.

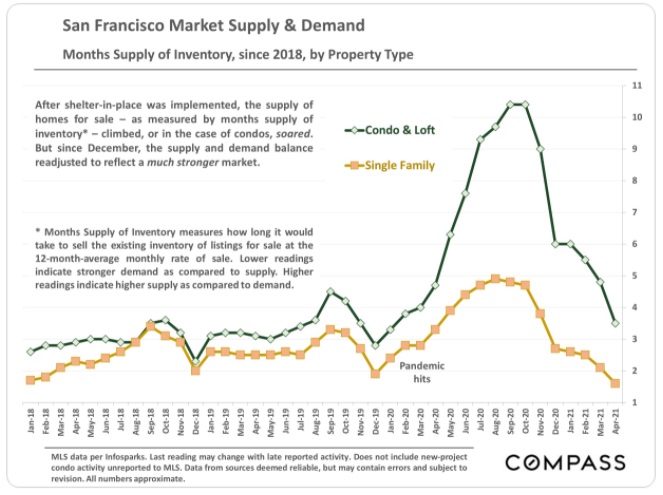

And the Bay Area condo market enjoyed similar growth. Condo prices rose $30,000 on average from February and are gaining ground versus last year, up 7.5%. Of course the pandemic hit San Francisco’s condo market extremely hard.

SF’s condo prices dropped $35,500 on average or down 2.7% again during March. Yet astonishingly, prices are still up 137.6% versus March of last year. The year over year stats are ceasing to have much relevance as the real estate market recovers and the economy grows.

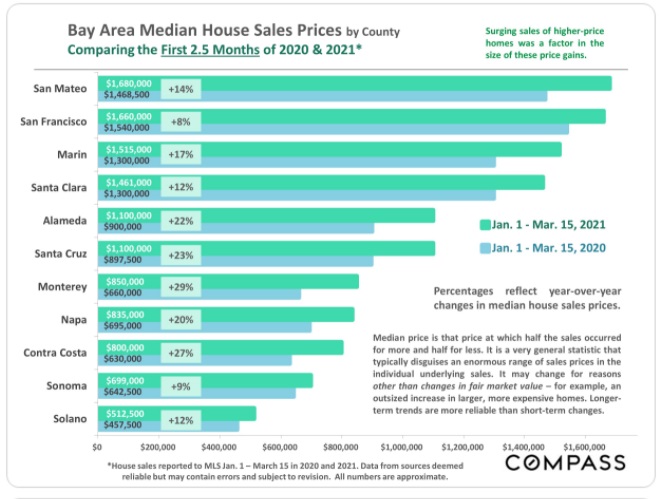

Over on the east side in Alameda, condo prices jumped $35,000 or +5.4% and houses rose $63,000 or 5.7%. In San Mateo county, house prices rose by $85,000 or +4.5% while condo prices there jumped 8.2% to $875,000.

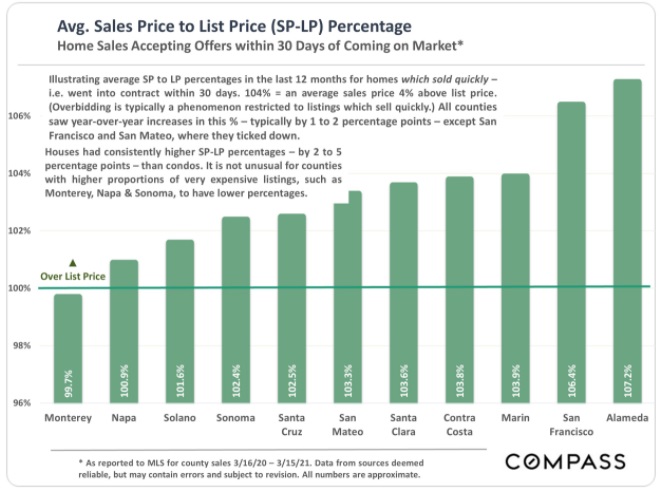

Homes selling above asking in the Bay Area shows strengthening demand.

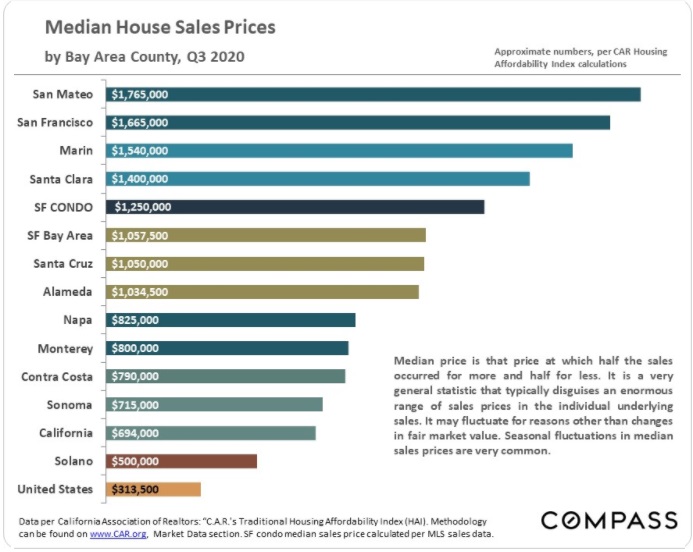

Bay Area median home prices: San Mateo, San Francisco, Marin, Santa Clara, Alameda. Screenshot courtesy of bayareamarketreports.

Business Recovery Will Revive San Francisco and San Jose

As the California economy recovers, we can expect the local businesses to call back workers to their jobs in San Francisco, Mountainview, Palo Alto, San Jose, Cupertino, Sunnyvale etc. Not all will return but the forecast is for rising real estate prices throughout the valley.

California’s economy, business outlook and housing market still face unresolved hurdles. And they are significant in the post pandemic era.

- techsodus drawing companies and talent out of California permanently to Austin, Dallas, Phoenix, Tampa, Charlotte, Las Vega etc.

- residents can’t afford the cost of living

- jobs lost won’t return

- new construction units may come on market in 2021

- higher taxes and government freezes due to low tax revenue

Techsodus is adding to the pain by removing workers from the Bay Area and thus increasing apartment and condo inventories on the market for sale.

It is strange that both house prices and condo prices in San Francisco County have risen as you can see in the many charts below. At the same time this summer and particularly fall season, apartment vacancies have grown wildly, leading to plummeting rent prices in the city.

Forecast: Techsodus Trend Won’t End Anytime Soon (recovery may be 3 to 5 years away).

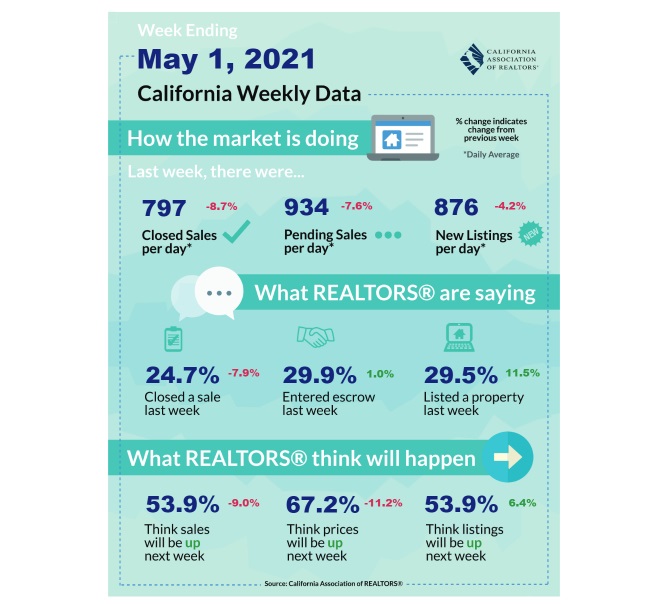

California Weekly Housing Data to May 6th

Let’s Look at the April Housing Market Data for San Francisco

Santa Clara (San Jose) Housing Market

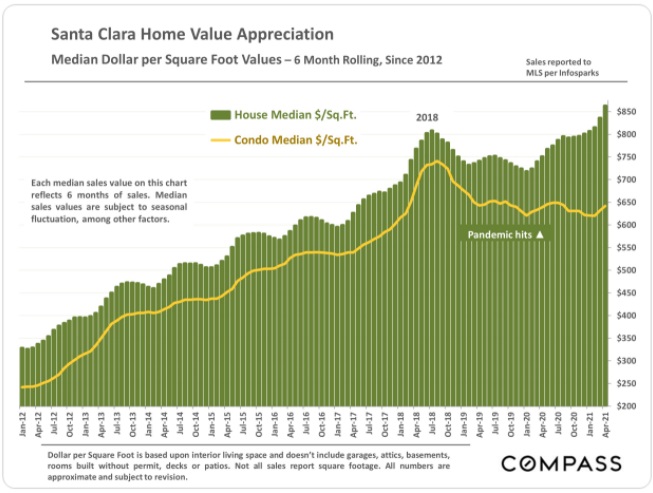

Compass reports that house prices in Santa Clara county rose 14% year over year and condo prices were up 2% over that time. Total sales volume is up 66%. April 2021 saw a significant jump in house prices.

And much of the sales are coming from the luxury class. The luxury market is where most sales are occuring,

Bay Area and California Governments Bitterly Criticized for Mismanagement

How big is the need for new affordable housing in the Bay Area? It’s a textbook case of supply and demand where demand is huge and development is stunted and where current homeowners have no intention of moving, even after retirement. This recent news about a Palo Alto commissioner quitting her job below, because it’s too expensive in Palo Alto, says it all for everyone in the Bay Area and City of San Francisco. This woman and her family are moving 40 miles away to Vera Cruz.

“We rent our current home with another couple for $6,200 a month,” she wrote. “If we wanted to buy the same home and share it with children and not roommates, it would cost $2.7 million and our monthly payment would be $12,177 a month in mortgage, taxes, and insurance. That’s $146,127 per year — an entire professional’s income before taxes.” – experpt from a news report in Bizjournal.

Here’s the source of the problem in California communities:

The Legislative Analyst’s Office found that California’s coastal metros take about two and a half months longer, on average, to issue a building permit than in a typical California inland community or the typical U.S. metro,” the report admits. The result is housing gridlock. From a post in sfchronicle.com.

San Francisco home prices are $1 million above the average detached home price of a home sold across the US. The forecast for San Francisco is an extreme version of the Los Angeles market and San Diego housing market.

Housing Affordability Sucks in California

Why? The housing affordability rate has dropped 21% in 6 years. Key drivers of unaffordability are immigration, high tech business success, and development bottlenecks. In San Francisco, people have to pay whatever the market demands. And renters haven’t been looking really to buy. Only 16% bother to contact a realtor.

New Home/Condo Development in SF

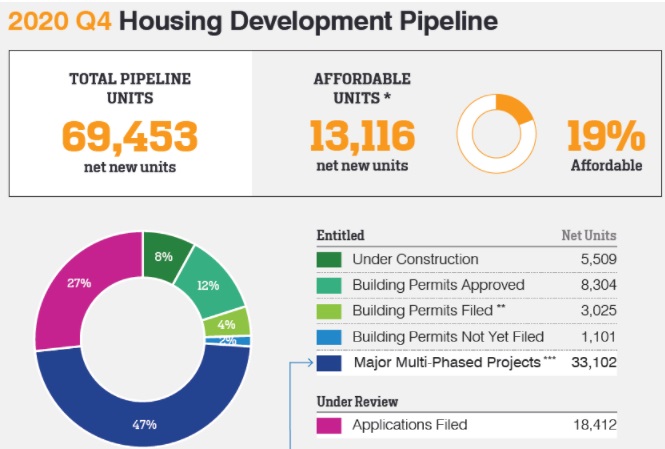

Looks like developers are gearing up for even greater supply. As this graphic from SF Planning, a good number of units were being constructed. Of course, labor and materials shortages will cramp the market this spring and summer.

Overall, the US real estate market and the California housing market looks improved however, if workers and companies stop leaving, the market will become very pressured this summer and into 2022. Employment outlook: SF now has 547,000 employed people compared to 448,000 during the dot com boom era an increase of 99,000. Lots of high earning renters and buyers.

This recently published chart from Zillow reveals the California cities of San Diego, Los Angeles, San Jose, Sacramento, and San Francisco are the most expensive and least affordable places to buy a home. Combine the stressful commute times in LA, and the Bay Area, and you have a population feeling on edge, uncertain of their long term future. The word rent is one of the foremost ones in the vocabulary of Californians. Only 30% own their own home.

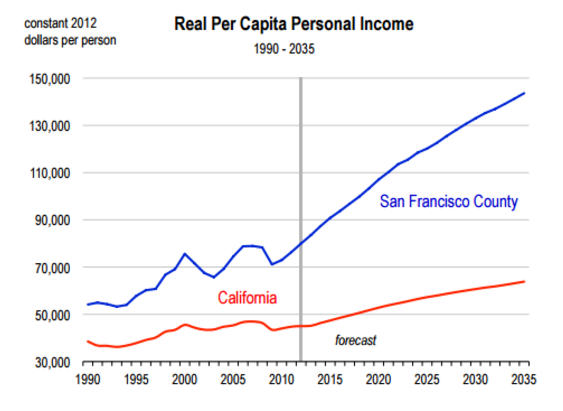

Will the Average Bay Area Salary Drop in 2021?

Fueling the frenzied demand for San Francisco apartment rentals is a growing affluent and young population whose incomes are rising. San Francisco has the highest apartment rentals prices in the US.

As a result, the Southern California and Central Valley regions will see moderate sales increases, while the San Francisco Bay Area will experience a decline as home buyers migrate to peripheral cities with more affordable options.”

Bookmark this page and return for further forecasts, predictions and real estate market data for most major US cities including Los Angeles, Manhattan Real Estate, San Diego, Miami, and Dallas.

Read more about the Housing Market Forecast and whether the Housing Market will Crash?

Real Estate Housing Market | Travel Software Marketing | Bleisure Travel Marketing | Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel Marketing | Travel SEO | Advanced SEO