Top 30 Post Pandemic Stocks to Buy

This pandemic will fade off into history. It’s ruined the economy, but the US economic outlook and stock market forecast will brighten each and every month this year.

The next 3 months might be grim, but as the stimulus kicks in, vaccinations grow, and people return to their workplaces, the end of the 6 month forecast is stellar. Below you’ll find 30 post-pandemic stocks that could be the keys to your stock portfolio for the next 5 years.

Many of these are also picks from expert stock analysts. Of course, stock market analysts have not fared well with their predictions and outlooks. And you can buy a stock for many different reasons.

This list has the advantage of being hot companies in hot sectors where the recovery can give them a big boost. It is unlikely these stocks will lose in 2021 and a basket of them is a good hedge against market disasters.

As the US economy returns (with a stimulus boost and company reopenings) investors like you are on the hunt for those specific stocks bound to excel in 2021 and beyond. Whether it’s 5G stocks, housing stocks, or airlines and hotels, or surgery related stocks and retail apparel, some bright stock market investors are going to profit.

Finding the Best of the Best Stocks for Higher Growth

You could look for some post-pandemic ETFs, but most investors today are confident they can pick the best stocks. With all the data available in a monopolized marketplace, it’s easy to see which companies enjoy the biggest earnings boost. And, don’t forget to check out the Russell 2000 small caps for rising hot stocks in 2021.

The surge in stock prices is on its way by June of this year, for certain. The 3 month forecast is slow, but the 6 month forecast is much brighter. Keep your eye on the vaccination totals.

And the housing market could be smoking hot by early summer as well. That means home builders and real estate brokerages are worth a look. Home prices are ridiculously high now, and could rocket higher.

Post-Pandemic Euphoria

We may all be depressed right now, but our gloomy mood won’t last as the summer sun warms us next June. There will be a growing euphoria among hundreds of millions of people as they are released from their Covid 19 prison cells. And as people head out to retail stores, they’ll be buying to rehabilitate their lives, and preparing for the new not-at-home lifestyle.

Many will even be looking to the commute to work and a long workday. They will be buying new office clothing and eating restaurant meals again. They will certainly be traveling too for business. This won’t be a sudden thing of course. It’s likely to slowly build through March, April and May and heat up in June.

And as the Covid 19 case counts dwindle to few, consumer confidence will result in a 2nd half 2021 spending explosion.

Where Will Americans Spend the Most?

While investors have worries about the Dem’s plan to tax the wealthy, there are more than enough drivers of the 2021 stock market including continued low-interest rates. In fact, this is one of those great opportunities to pick some profitable stocks.

The work from home sector is strong so the long-term damage to retail/in-person expenditures is mitigated through the spring. The stimulus will ease the pain and get businesses ready for full reopening sales and revenue.

Some experts say the market is as low as it’s going to go (next 3 months) so holding back too long from a buying decision may not be the wisest move. Of course with this list of 30 post pandemic stock picks, you’ve got time to conduct your research.

Don’t forget to see the Russell 2000 index best picks, best tech stocks and of course the best 5G stocks. Why not the Faang stocks? They’ve done well in the pandemic, however a Google stock forecast, Amazon stock forecast, and Facebook forecast is clouded by persistent anti-trust charges. Keep an eye on the roller coaster Tesla stock price as Day Traders love it and experts feel it has a lot of room for price growth.

You’ll have 3 months to pick up bargains (and sell your lame Covid 19 stay at home stocks, whose prices will decline over the summer).

So the question is, which stocks in which market sectors will rise the most in 2021?

Of course, Jim Cramer has listed a pile of good equities in a number of sectors (return to normal stocks). You’ll want to review his Youtube video on the best post pandemic stocks to buy.

Take a look at this list of 30 post pandemic stock superstars, with a brief description of why they will soar.

1. Disney (DIS:NASDAQ)

Disney’s multiple enterprises that include ESPN and the theme parks make it especially desirable. The Disney stock price has risen strongly already as investors began to jump on the post covid travel and entertainment bandwagon.

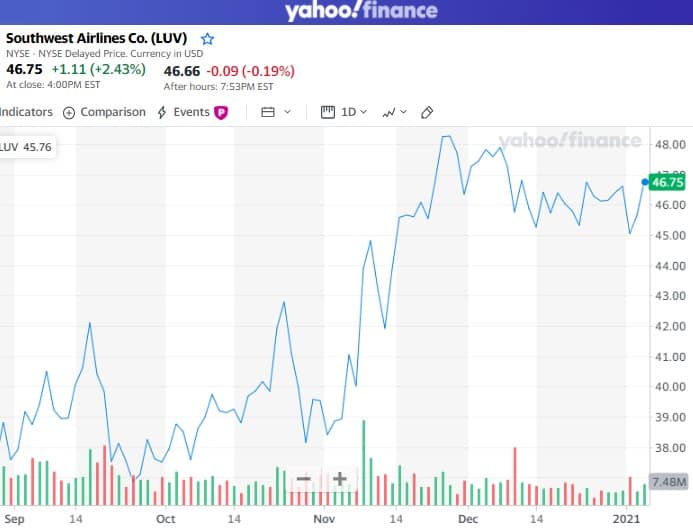

2. Southwest Airlines (LUV:NASDAQ)

When people travel, it’s usually to the sunny south and southwest, and this airlines more upscale customer base makes it more profitable.

3. Las Vegas Sands. (LVS: NASDAQ) CNN’s panel of expert stock analysts forecast an average growth of 8.5% in 2021. Las Vegas and its casinos will be a key destination for those who love the desert air and gambling in person.

4. Qualcomm. (QCOM: NASDAQ)Qualcomm manufactures advanced microchips for iPhones and now arriving AI-based products. Apple will do well as monied smartphone buyers choose the iPhone Max 5G phones in 2021.

5. Airbnb. (ABNB: NASDAQ) Airbnb’s outlook is amazing as travel booms across the US and the world in 2021. Every year, the company learns more about its unique business model and how to beat the hotels at the short term accommodation game.

6. Booking Holdings. (BKNG: NASDAQ) Booking Holdings is an online travel powerhouse with their collection of travel-related services which include Booking.com, priceline.com, agoda.com, Kayak, Rentalcars.com & OpenTable.

7. Wyndham Destinations Inc. (WYND: NASDAQ) Travel will be big in 2021 and the next 3 years, and Wyndam is in the process of rebranding to better capture the post-pandemic traveler. They just bought Travel and Leisure Co. with its huge membership base. With its vast stock of hotel rooms in the US top vacation destinations, it’s poised to profit well from the post-pandemic boom.

8. Starbucks. (SBUX: NASDAQ) Business slowed for the coffee giant, but now that coffee drinkers will be out and about in the neighborhoods renewing social ties, Starbucks will enjoy unprecedented sales.

9. Texas Roadhouse. (TXRH: NASDAQ) A highly regarded American-styled restaurant chain with plenty of franchises across the country. The stock price is up about 25% since early October.

10. Urban Outfitters. (URBN: NASDAQ) This well-known apparel retailer’s stock price has doubled since late June, and is holding its own even as shutdowns occur. Cnn analysts see a median price growth estimate of 7.5% in 2021. It has over 520 stores in the US and more than 640 worldwide giving it excellent reach to the booming 2021 consumer market.

11. Kohls. (KSS: NASDAQ) Kohls stock price rose in 2019, but didn’t fare well in 2020. Kohls became a return location for Amazon in 2020 and integrated Sephora in its stores. It has a whopping 1158 retail locations in the US. Placer.ai believes it is well-positioned for 2021 against Macys and JC Penny.

12. Nordstrom. (JWN: NASDAQ) Nordstrom, the upscale apparel retailer with 378 locations did poorly in 2019 and last year. In the last 2 months, the stock price has more than doubled. As wealthier Americans begin buying again, the upscale apparel sector will see much better sales as American women in particular renew their wardrobes primed for their reappearance in public.

13. Vail Resorts Inc. (MTN: NASDAQ) Vail is the premier mountain resort company with some of the most popular venues. It owns 37 resorts in 3 countries including Whistler Blackcomb in Canada. It owns hotels, lodging, condominiums and golf courses. As the travel sector sweeps back, their golf, mountain biking, and skiing based revenue will surge.

14. Dicks Sporting Goods Inc. (DKS: NASDAQ) As sports people return to activity they’ll need shoes, baseball gloves, tennis rackets, golf clubs, and other sporting goods. A year later, kids are older and bigger and will need new equipment. Leagues will need new equipment ranging from goal nets to sports team bags, to team sports uniforms.

15. Madison Square Garden Sports Corp. (MSDG: NASDAQ) The return of fans to Knicks and Rangers games in 2021 will be significant. And music lovers will be returning to the concerts and plays in MSG. The company has venues in New York, Las Vegas and Chicago.

16. Nike Inc. (NKE: NASDAQ) Nike Inc is up 50% since August. Like Adidas, the shoe company is a no brainer to sell millions of sports shoes and clothing in the upcoming return to normalcy. Kids and adults will shed their shoddy pandemic wear for new sports clothes. It’s a global company tapping into a market of billions arising from the Covid 19 plague.

17. Lululemon. (LULU: NASDAQ) As women return to public, they’ll be wanting more of Lululemon’s yoga wear apparel. The stock has had a phenomenal run since 2018, rising continuously to a 500% higher price. It has built strength online as well and it has big growth plans for men’s active wear.

18. Planet Fitness. (PLNT: NASDAQ) With Covid 19 out of the way, millions of people will return to the gym. Those who need a low budget gym will likely choose one of Planet Fitnesses 2000 locations to work out. For a business that has been devastated with the pandemic, those fortunes will reverse in 2021. The stock has risen 50% since August. Experts doubt people will return to the gym, but anyone will tell you that you get a better workout at the gym, and people don’t want to be alone anymore. Goodbye Peloton.

19. Square. (SQ: NASDAQ) During the pandemic, Squares stock price rose from $38 to $235. As many people have switched to digital wallets, Square, now one of the biggest fintech companies offers value in its retail payment solution, something PayPal, it’s rival doesn’t. Square has the Square Cash app for money transfer and its testing a short term lending feature. It will be offering a bitcoin buy and sell feature too, and bitcoin is gaining ground with consumer acceptance.

20. Intuitive Surgical. (ISRG: NASDAQ) There is a huge glut of surgeries backlogged in the medical system. As the ICU units are cleared of Covid issues, people will be headed to the hospitals for surgeries ranging from gallbladder removal to hip replacements. This company listed on NASDAQ produces robotic surgical equipment which creates minimally invasive surgeries. This speeds recovery, causes less infections and law suits, and frees up hospital beds so hospitals can make more money. It has an installed base of 5,582 da Vinci Surgical Systems, including 3,531 in the U.S.

21. Quest Diagnostics. (DGX: NASDAQ) Quest is the world’s leading provider of medical diagnostic testing, information and services. From blood tests to gene testing, the spectrum of testing services is immense. And with the return of normal doctors visits in 2021, the company should see a boom year. The company has done very well during the pandemic and it tends to surprise investors with much better than anticipated profit performance.

22. Edwards Life Sciences. (EW: NASDAQ) This company is a leader in producing artificial heart valves. Given the aging of babyboomers and the poor overall health of Americans, there will be no shortage of demand for heart operations, valves and related medical technology. Again the pandemic has put off most heart and other invasive surgeries in 2020. It’s back to business in the medical field.

23. DR Horton. (DHI: NASDAQ) Amazingly, DR Horton, one of the US biggest home builders did very well in 2020 with earning per share growth of 66% year over year. The company believes favorable demographics coupled with the realization of pent-up demand will drive continued housing market strength over the next decade. The company forecasts home sales growth of 18 to 22% in 2021. The housing shortage combined with a growing work from home trend and job along with American worker income growth, and in lieu of millennial family formation will support big sales growth for DR Horton and other home builders. See more on housing stocks.

24. LBrands. (LB: NASDAQ)Victoria’s Secret and Bath & Body Works comprise LBrands stable of products. The company was in a free fall since 2017 and has only pulled out of it since July of this year. Despite that, experts believe that the return of the consumer to malls to find things to pamper themselves will bring this company back. It’s done well on digital and it has restructured Victoria’s Secret. The recent price rise gives it momentum going into 2021.

25. Visa Inc. (V: NASDAQ) Visa’s stock has soared since 2017, driven up even further by the Covid 19 ecommerce boost. Despite the rise of cryptocurrency and digital payment competitors, Visa, American Express and Mastercard are still in the driver’s seat with consumers. And they’re coming back to the retail stores soon. With travel and vacationing set to boom next summer, Visa is sitting pretty. Capital.com sees an average price growth estimate of 7.9% in 2021 for Visa.

26. Mastercard. (MA: NASDAQ) A carbon copy of Visa’s stock price performance. Mastercard earns about 24% of its revenue from cross border traffic which includes traveling vacationers.

27. Levi Strauss & Co. (Levi: NASDAQ) As vacationers and travelers begin their outbound adventures, they’ll want several pairs of new jeans to wear. They’re rugged and easy to care for and the returning vacation market means sales will rebound from a disappointing pandemic period. The stock is already up 65% since September. Its online business has grown 52%.

28. Tesla. (TSLA: NASDAQ) Some analysts believe Tesla is a future $1 Trillion company. The TSLA stock price rose 700% in 2020. Its last report is very positive after ramping up production. The new Tesla Gigaplants being constructed will help the company grow marketshare. There are new entrants in the EV sector, and all will be assisted by a Federal Green new deal plan. See more on the Tesla stock forecast.

29. Alaska Airlines. (ALK: NASDAQ) Yet another company crippled by Covid that is ready to bounce back due to adventurous travelers who want to experience nature at its grandest. Everyone is thinking about the airline stocks. Alaska Airlines stock hit a high of $100 in 2017 and now sits at $52. The company continues its growing focus on “sun and snow” leisure routes to expand its market presence.

30. Ericsson. (ERIC: NASDAQ) Ericsson’s stock has risen about 70% since June. The company makes a lot of products, but none might surpass the promise of 5G. Ericsson is one of the global leaders in 5G products including 5G network infrastructure including iOT, security, AI, touchless tech and green energy sustainability. Learn more about 5G stocks to buy.

Good luck picking winning stocks for 2022, and please do share this post with others on Facebook and Linkedin.

6 Month Stock Market Forecast | Tesla Stock Forecast | Forecast for the 2023 Stock Market | Stock Market Today | Stock Market Next 10 Years | Will the Stock Market Crash? | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ Forecast 2023 | S&P Predictions | Stocks Next Week | 6 Month Stock Market Forecast | Stock Trading Platforms | Stock Trading | Lines of Credit | Reverse Mortgages | Low Mortgage Rates