Will Sellers Rush Online to Find a Realtor?

Many Realtors are thinking there’s no way residential real estate can fail. Housing markets are too hot with wealthy buyers, high employment, strong banks, along with strong millennial buyer demand and very limited supply of housing.

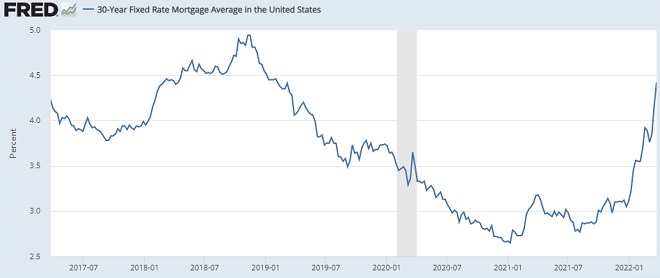

Yet the narrative seems to be changing despite the economic strength. Rising rates, persistent inflation, Fed balance sheet reduction are conspiring to pull the rug out from all North American housing markets including Toronto. After extending themselves ridiculously in the last few years, buyers and theose using their homes to finance debt face huge mortgage rate challenges ahead.

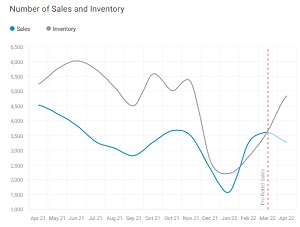

The latest report from Zolo shows sales are declining while listings are jumping. Something is in the wind at a time of the year when prices and sales should be climbing. July is seeing big changes. Is the Camel’s back being broken?

Home prices keep heading up even while buyers become more scarce. In some states such as California, home sales above $500k are up, but at lower prices have almost disappeared.

There are some concerns about an economic downturn that can’t be ignored. And buyers are constantly asking when home prices will fall. A lot of people want to see a price crash. The crazy doomsday market prognosticators are being heard these days.

Buyers see the news too. They’re not fools. Sticking your neck out with a home that’s 30% overpriced, could create bankruptcies. One of the points of the Fed’s higher interest rates is to stop new buyers from getting caught in an economic downturn. But this meddling is concerning because the rate tightening may contribute to a housing crash.

Some economists suggest the Fed will have to crash the economy to save it. Last week, the Fed showed it has given up on 2022, and is trying to cool inflation in 2023. But that’s the year the Republicans take the house and senate. Could they do much anyway? So, we’ll see how this plays out.

Fed Goes Too Far – The Accidental Avalanche

But for Realtors, does the downside of the market generate big sales, as homes are desperately flung onto the market? A commission is a commission but sales may drop considerably too.

And then, if the downturn is quick (driven by the Government to act as a reset button), then there may be growing sales again by 2024. If the Repubs win the coming elections, they will certainly look to stimulate and cut taxes. That could jumpstart the housing market considerably. There may be additional incentives for builders too.

Realtors want seller leads and a whole bunch might be coming soon. The 2023 housing market crash signals are flashing and amidst a volatile market is opportunity. However, if your real estate website is dysfunctional and you’re not getting traffic, then obviously those leads won’t be happening.

Realtors Should Prepare Now

Before discussing the economic outlook, let’s look at what Realtors must do to capitalize on the sales opportunities coming in 2022/2023.

- well designed real estate website that reflects a professional brand

- web site content that reflects knowledge, good judgement and builds trust and relevance

- web content that builds excitement about the seller’s selling experience

- social media content that encourages connections and more frequent communications

- content that encourages sellers to contact you now to prepare for the sale of their home (price drops coming)

- content that indicates your strengths in marketing and negotiation

For Realtors, what’s really important is being visible on Google when searchers type in sell home fast. Being the first Realtor seen is proven to be the biggest factor in capturing a good lead. Capturing others failed leads or cast offs, isn’t the road to success. You know how difficult those leads are.

The wise response to this opportunity is to look for a provider of powerful real estate marketing packages which will generate immediate and long term leads and sales commissions. Most Realtors are too passive and reluctant in online marketing, and it’s handing over this glorious opportunity to other agents.

I’m still not predicting a housing market crash, or a stock market crash, but the International trade signals are concerning. With the US debt, trade deficits, international dependencies, and domestic restrictions, a downturn is almost certain. The question is how long the downturn will last.

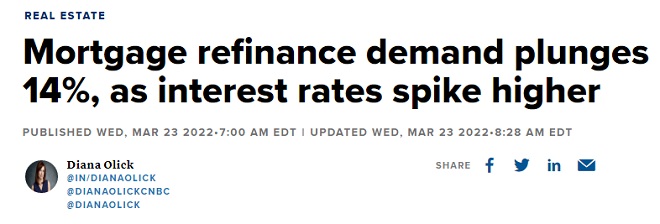

Doubters say that all fundamental aspects of the investment and banking systems are air tight and not in danger, but think about it, home prices are 30% to 40% overvalued, going vertical, and the mortgage business could be going belly up. Mortgage applications recently have taken a dive — a signal.

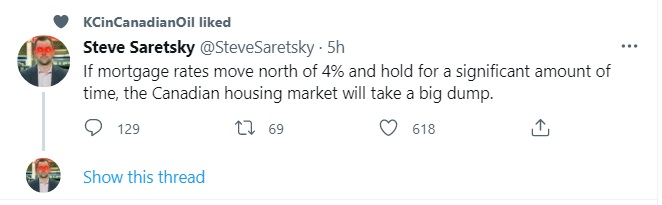

In Canada too, the risk of a market crash is real.

Those home buyers who are overleveraged and in debt will be the first if mortgage rates rise too fast. Who would offer a second mortgage right now? Who would buy a house right now with all of these threats? The point of this is that more homes could come on the market.

This latent selling frenzy has been expected for years now, but given government meddling, the market’s haven’t been able to take their natural course. Soon they may.

Even if production is moved back to North America, it will take time to capture supply and build their sales and distribution again. They have become totally dependent on China for everything. Keep in mind, Russia’s economy is collapsing and China’s is starting to topple. Without US and Europe cash, China could collapse. The China housing market is wobbling of recent. If we see a political breakup then it alone would crash all markets.

The discussion of sanctions against China, and China’s disregard of NATO commands is key right now. Everyone is way too calm about this. Because Xi doesn’t look like he’s going to be disciplined by anyone.

These chilling effects can’t be ignored if you’re in the real estate business. The risks of a real estate market crash are real and now present. Buyers can’t afford nor can get loans at these new mortgage rates. The luxury market is supporting everything. What happens in anything in life when intense pressure is applied for a long time?

Keeping Up on the News and Analysis

Keeping up on the signals, news and analysis of trends doesn’t mean it will happen. It just means you’re more aware of why you’re not getting leads right now and where those buyer and seller leads will be this summer.

Buyer leads are a dime a dozen, and even qualified buyer leads are not so valuable, unless they also have a current property to sell. If they do then they’re a seller lead!

The point of this post is that making yourself highly visible online and professionally relevant is a wise idea. A real estate marketing project can help you begin the upward direction. Smart Realtors now are building teams of other sales people. In some cities, this team approach is more successful every year.

That just proves that reach and visibility (big lead network) is the key principle. More people means more contacts. So why not do the same thing on Google, Bing, Facebook, Twitter and Instagram?

Get visible, communicate the right message and you’re in the right spot to capture these stubborn homeowners who are finally ready to let go of their property in 2022/2023.

And your new value proposition and selling offer has to be attuned to this new situation. You’re ready to help them reach a big group of buyers, pre-qualified so they can get this sale completed quickly. This whole fast selling thing reflects anxiety and it may only increase if the economy starts to tumble.

Once the selling avalanche begins, there’s going to be lots of sales, so being visible online is wise. Check out these real estate marketing packages for a comprehensive service. With one sale, you will have covered all of your marketing costs, then it’s all gravy going forward. There aren’t too many deals like this floating around today. See more on the real estate housing market forecast and why a selling bonanza is in the winds.

Housing Market Crash | Stock Market Crash | Will Home Prices Fall? | 2023 Recession | Florida Housing Market | California Housing Market | Housing Market Predictions | Realtor Marketing Service