US Inflation Takes Big Jump in June

US Inflation Jumps 9.1% in June

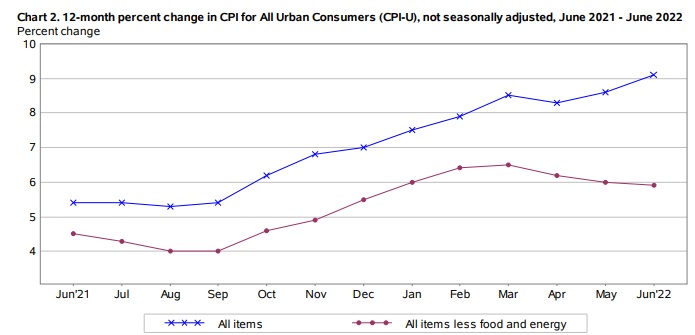

Despite the recent series of increases in the Fed interest rate, the Bureau of Labor Statistics has reported US inflation soared 9.1% in June, the highest rate since 1998.

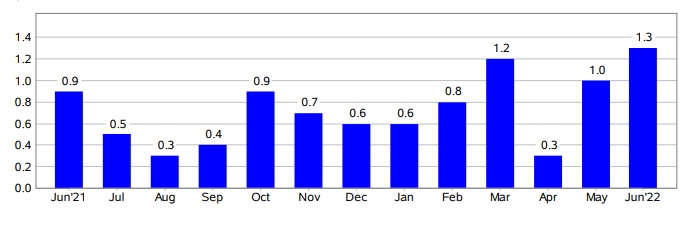

The new rate is also up a whopping 1.3% since May making us believe that July’s rate might be even higher. The producer price index rose more, by 11.3% which suggests inflation may stay persistent.

Investors are wondering how long this high inflation will last, and some believe strongly that it could be with us to 2024. David Payne of Kiplinger of the Kiplinger Letter states that “The inflation rate is likely to stay close to 9% the rest of the year, then decline gradually after that, ending 2023 at about 3%.” He mentions rent prices which will stay high, yet others believe oil prices will fall (including IEA). The only scenario that supports that is a global recession.

Kiplinger believes these Fed hikes will continue to climb.

May’s inflation rate was 8.6%, a 40 year high, and a rise of 1% from March’s reading. The only bright news for most is a drop in oil and gasoline prices, yet when China reopens its economy and oil production falls, that downtrend might be for a limited time.

What if Economies Resume their Activity?

Two wild cards in the inflation forecast for the next 3 months is: China resuming economic activity and, Europe’s food and fuel crisis due to the Russian invasion. There are so many variables in the inflation equation, the experts can’t hazard a guess for the 6 month, 5 year or 10 year outlook. It’s just guess work. Their previous forecasts aren’t good.

Some in the media predicted we had hit peak inflation in May (Avery Sheffield, of VantageRock in CNBC interview), and their experts predicted June would be peak inflation.

Joe Biden predicted we hit peak inflation in December of 2021. Jerome Powell and Janet Yellen both believed inflation would be temporary. Having them at the helm of the banking system might be the key factor in how this problem will spiral completely out of control.

A moment in US history: The inflation of the late1970s and early 1980s peaked at 14.8% in spring of 1980 before the Fed used ultra aggressive rate hikes that caused brutal back-to-back recessions in 1980 and 1981-1982.

While American’s savings are eroding fast, it’s the hard to seniors on pensions and the marginally housed population who could experience extensive suffering for the rest of 2022. Biden’s government has created a troubling situation.

Charts Direction Hard to Argue

BLS revealed the troubling inflationary trend continues as the charts show. When combined with lower US production output, it may support the dreaded stagflationary spiral which can generate massive unemployment, bankruptcies and more homelessness. Housing and rent prices have begun to ease from record heights, yet with construction abated, when will a lack of supply only rekindle inflation?

No one is sure that a housing market crash or stock market crash are out of the question.

The question being asked is whether inflation can continue rising quickly or whether an economic downturn in the coming months will finally send rates falling.

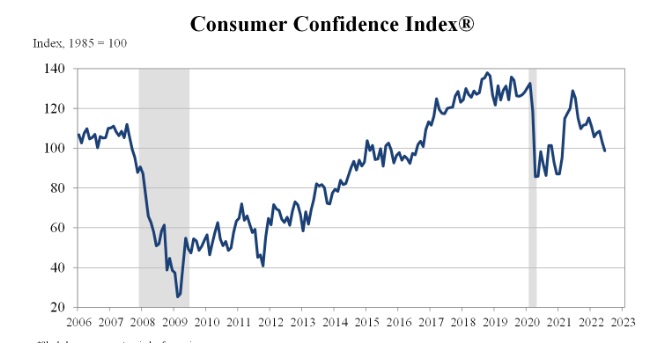

Consumer confidence in the US is heading back to pandemic lows, just as another wave of Covid 19 quickens.

US PMI (manufacturing output) fell precipitously in June, not a wonderful signal in the forecast. Although the stock market is holding its own so far, new earnings reports amidst rocketing inflation and consumer cut backs, it is likely to produce a drop in the fall after the summer travel season. See more on the 3 month to 6 month stock price forecasts.

Key commodities, products and services in this latest CPI report which grew the most included:

- gasoline up 59.9% YoY and up 9.9% vs May

- fuel oil at 11.2% YoY

- natural gas up

- transportation services at 2.1%

- electricity up 1.7% vs May and is up 13.7% year over year

- food at 1% (up 12.2% in last 12 months)

- meats, poultry, fish, and eggs up 2%

- food at home up 14.4% YoY

- fruits and vegetables up 8.1% Yoy

- cereals and bakery products up 13.8% YoY

- food away from home up 7.7% YoY

- rent prices up .7% vs May

- used cars and trucks up 1.6%

- clothing up .8%

- alcoholic beverages up .4%

- personal care products up .4%

- airline fairs up 34.1% YoY

The Consumer Price Index for All Urban Consumers (CPI-U) increased 9.1% year over year to a new index level of 296.311 (1982-84=100). For the month, the index increased 1.4 percent prior.

Business confidence has suffered another 3% drop and consumer confidence fell 4.5 points in June as well.

What Happens Now?

Given the rising belief that the Fed might raise the benchmark rate by .75% and since the manufacturing PMI index took a deep dive in June, the supply shortages that are driving inflation are still intact.

As the Fed suppresses the economy, US suppliers are less able to meet supply needs, thus creating another round of inflation activity. Lowering import tariffs on China goods also threatens US companies with the influx of cheap China products.

A recession doesn’t have to happen. The Biden government can choose to remove regulations on US companies, lower taxes to encourage producers to ensure adequate supply. This scenario is unlikely given the political fall out before the mid term elections (in 4 months).

A realistic forecast is for high inflation again in July, perhaps down in the 8.5% range, depending on the China recovery.

See more on the markets: Stock Market Crash | Stock Market Predictions | Housing Market Crash | Stock Market Forecast 6 Months | Stock Market 3 Month Forecast | 2023 Stock Market | 5 Year Stock Predictions | Software as a Service Marketing | Bleisure Travel Marketing | Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel Marketing | Travel SEO