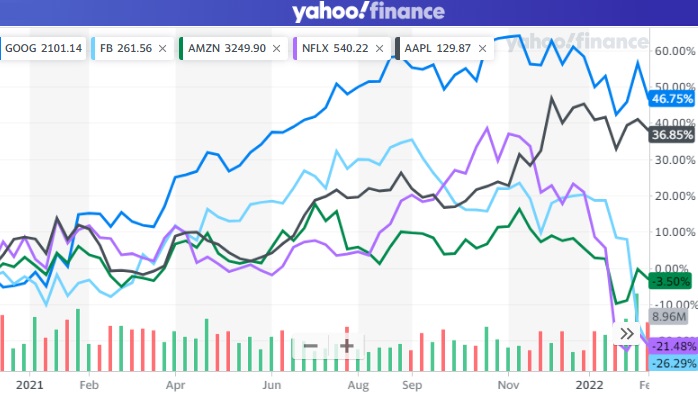

Facebook, Amazon, Google, Netflix, Apple

With stock volatility, rising interest rates, and an economic recovery underway, are the big tech FAANG stocks the choice for risk off investors?

While NASDAQ did well last year, it may be the Fed stimulus and low interest rate policy that created those big gains. When Cathie Woods says tech stocks are really undervalued, she’s not looking at the scary heights its achieved and could plummet from.

Google Alphabet, Facebook, Amazon, Apple and Netflix are stocks named as part of Jim Cramer’s FAANGS (or Fang stocks). Tesla stock should be part of that group. 2021 was a good year, and some might predict that with a returning economy, the FAANGs are ready to roll in 2022.

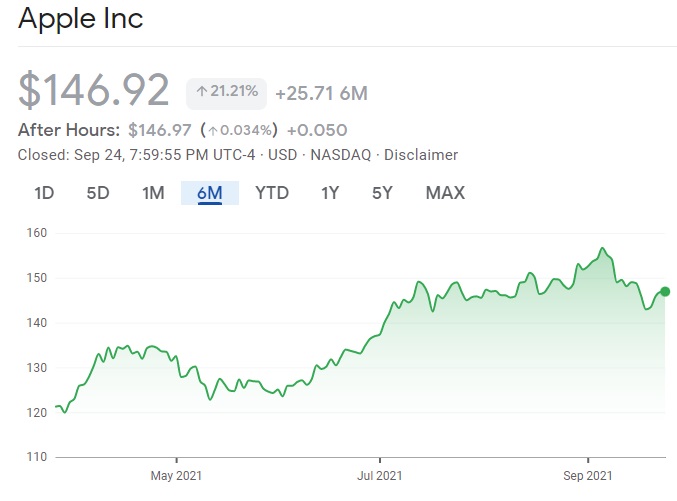

A post pandemic consumer eager for travel, dining out, and entertainment, might not be interested in Netflix. Apple on the other hand seems to be performing best, and a rising economy might support APPL as long as microchips and other materials are available.

As a good replacement for Netflix in the big tech sectors would be Microsoft or Tesla.

As these charts reveal TSLA stock has seen more volatility and hasn’t risen in price despite Tesla’s sales success this year. Do the Faangs have a better upside than travel stocks or oil stocks? Oil prices are soaring and fund managers may be unable to avoid reinvesting in the oil sector. If not, the rest of us have a golden opportunity to take the profits ourselves. Either way, oil stocks may have higher returns.

2021 Was Good for the Faangs.

In the 12 months of 2021, Google and APPL have been awesome up 65% and 37% respectively. Add Tesla and Nvidia, two other companies succeeding well post-pandemic and you can see why investors want these big tech Faang type stocks.

Google, Facebook, Apple excelled in 2021.

Barchart gave Google Alphabet a strong sell rating, so pessimism seems to abound. Facebook, the company that’s disappeared into the metaverse, also has a strong sell rating. They give APPL a moderate buy rating.

Given their stability, security, and persistent profitability, they’re a primary tech stock pick for most institutional investors and those with 401k or retirement savings plans.

Here, a bull market commentator says not to worry, that the Faangs are through the October sell off and are ready to rocket whether interest rates rise or not. Certainly, the stock market forecast suggests 2022 is going to be great year, and Google stock at least is a good bet. Apple is struggling with microchip issues and trade worries with China. Amazon’s sales would likely fall as the retail economy comes back to life as Covid disappears.

Overall, the 2022 forecast for FAANG stock prices is positive for most of Jim Cramer’s FAANG stocks, but each has its own head winds. Apple stock price has become a little flat, but as we enter 2022, consumers will be looking for Apple 5G phones. See charts below.

Should you buy FAANG stocks? Some experts believe you should buy them and never sell. If you’re a long term investor, it is reasonable that these companies will come out shining through any economic outlook. It seems the economic outlook for the next 5 years is bright. But there is a lot to know about each individual stock.

Some analysts are turning negative on the FAANG stocks. They’re suggesting small business stocks will have greater earnings growth from 2020 to 2024. These companies are cash rich, have vital consumer data and minimal competition, and innovative business models that will help them adjust in any economic climate. There are almost 40 FAANG ETFs you might buy as well. Check the performance.

Investor’s Positive Outlook on FAANGs

The FAANG stocks were doing fine until the China tariffs set in. Earnings season brought everyone back to earth and either the FAANG companies didn’t want to pay out, or investors realized their China exposure was a big sell sign.

Amazon Stock

With Jeff Bezos leaving the helm of the Amazon ship and pushing off into space on Blue Origin, Amazon is getting more press, but will it be as successful and comfortable for investors in the post pandemic period? See more on the Amazon price forecast.

Betting against Amazon, given the shift to online shopping and cloud computing is probably not wise.

Google – Alphabet

Google’s revenue growth is the key issue for Google stock price for many investors, as it’s all about future earnings. Google’s ad revenue, including its revenue from Youtube are something to focus on. See more on the GOOG stock price forecast.

If the monopoly type companies under perform, the talk about anti-monopoly action might die down. However, these companies have plenty of threats during a highly volatile, transitionary economy. Take a look at Longforecast’s Google outlook for 2021.

Apple Stock

Apple’s fortunes have fallen quickly. Revenue’s continue to fall although the company is making adjustments with a focus on services. Apple stock price just hit an all time high. Apple’s cost control issues foretell vulnerability to big stock market corrections or perhaps a price crash in 2022? Still, take a look at Moneymorning’s prediction that Apple’s stock price would reach $300 by 2020.

Facebook Stock

Facebook stock price has had a steady decline since last summer. Last year Facebook missed projections and the stock price plummeted 25%. Facebook has a huge customer base and they don’t share revenue with anyone almost, unlike Google who pays out revenue share to publishers. See more on the Facebook stock outlook.

See more on the stock market forecast for 2022 and the factors/signals that produce corrections and crashes.

* the above post includes opinions of the author and do not connote recommendations of any kind regarding stocks to invest in. The material is provided as information only.

Stock Market | Tesla Stock Forecast | AI Stock Forecasts | ChatGPT Stock Forecasts 2024 | Stock Market Today | Housing Market | Energy Market | Crypto Market | Stock Trading Platforms | Stock Trading | New Homes Market