Best Auto Insurance Quotes

Auto insurance rates just keep climbing in 2020, and I’ll bet you’ve done little about that.

Even with fewer drivers on the road during Corona Virus, most are paying old rates while insurance companies are seeing low accident claims.

If you’re working at home all week or only commuting for a partial week, it makes sense that you shouldn’t be paying the usual commuter level rates as before. Should you be paying higher car insurance rates than you need to? There are options that could help reduce what you are paying!

Are Car Insurance Rates Up?

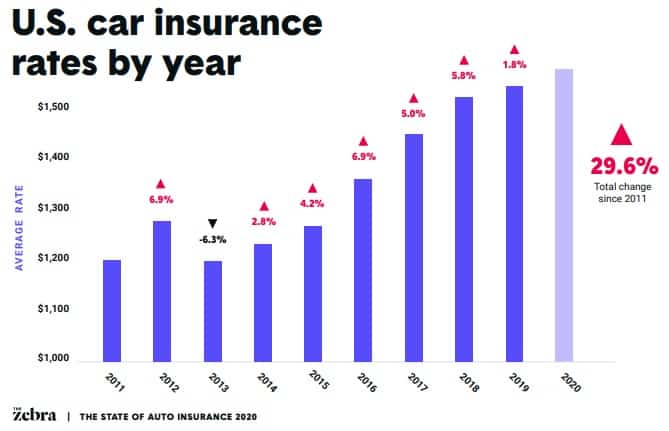

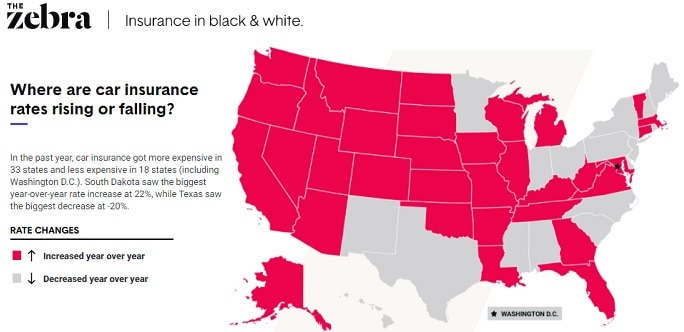

Zebra Insurance, in their 2020 State of Auto Insurance Report reveal that in most US states, car insurance is rising.

Infographic courtesy of theZebra.comYou’re likely looking for substantially lower auto insurance rates, so are you willing to get policy quotes from a number of insurance companies or brokers? That’s just plain smart. Especially for students, those who have troubled driving records, or who have filed claims, the car insurance quote you want might be out there.

But as we know, older drivers are overpaying for auto insurance.

More to Look for in Your Auto Policy

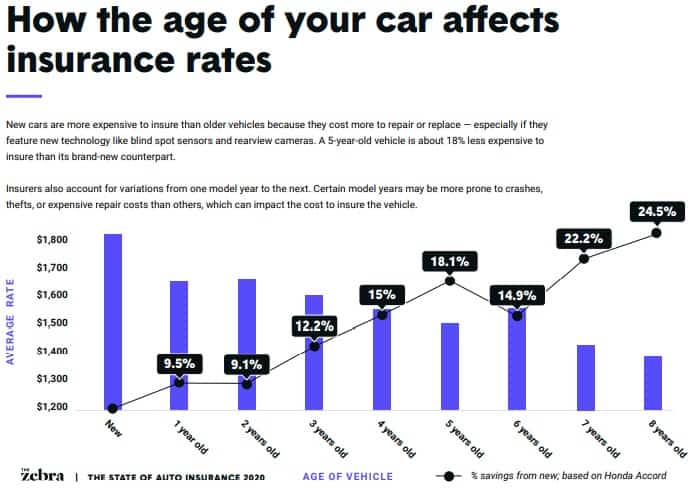

Did you know insurers typically give you a specific cash value on your claim for a total write off? The blue book rate is not used and you might only receive a couple of thousand dollars for your car. Not quite what you’re expecting. If you’re paying $200 per month, and your car write off value is $2400, it means you’re paying the full actual insured value of your automobile every year!

That’s just plain wrong. Yet some major insurance companies charge higher rates for older cars!

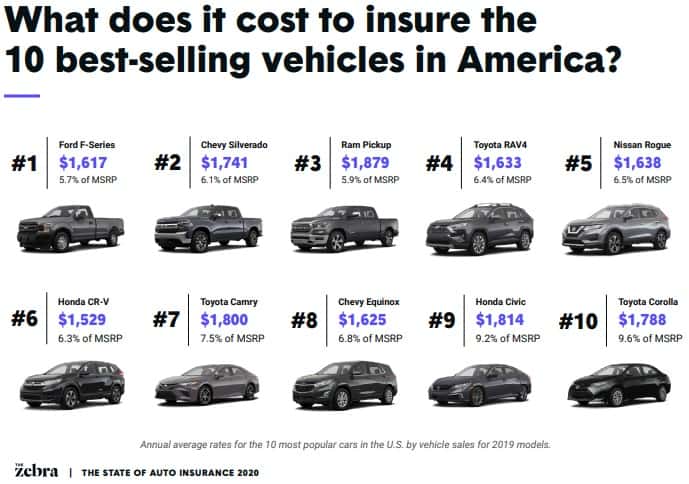

Infographic courtesy of Thezebra.comHappy motoring and personal finances is helped a lot by lower auto insurance rates. Yet insurance companies won’t just offer them. For better results, you should check out as many insurance companies as time will allow. There are discounts for usage based auto insurance policies, limited use policies, and based on the type of car you drive. Rates for Jeeps for instance is often much lower than other vehicles and there are special insurance rates for high value luxury vehicles.

Zebra conducted its annual survey of car insurance rates. Here’s the averages of the popular vehicles.

Compare Car Insurance Rates

If you’re not comparing auto insurance rates, you’re giving away money. In fact, car insurance shopping is the only way to can substantially lower your premiums and get better coverage. This post will convince you and give you some new options.

You get lower auto insurance by comparing quotes from different vehicle insurance companies. There are a lot of them out there in your state or nationally. There’s big and small insurance companies and independent brokers looking for your truck and auto coverage needs.

Rising auto and truck insurance isn’t a local issue. Car insurance rates are rising everywhere but it appears consumers are apathetic about it. If you look at the price charts below you’ll see how much people expend for auto insurance.

Self-driving cars could raise auto insurance rates for you and I, since the autonomous car companies would negotiate their own low rate coverage. They’ll save plenty, but you will have to negotiate your own insurance rate.

The insurance companies are awash in cash now however they’re facing tough times as their own pool of revenue erodes and claim payouts rise. Switching insurance companies might be a wise move. Consider this stat:

The average auto insurance premium in Ontario, Canada is $1,458, which is almost 55% higher than the average of all other Canadian jurisdictions — from a Globe & Mail report.

It’s nearing the end of 2020, and now’s the right time to take massive action to save your money. Have you investigated UBI or usage based auto insurance? Check out the auto insurance rate quotes for your city or state below.

Get the best auto insurance quotes in Toronto, Vancouver, Los Angeles, San Diego, Miami, Phoenix, Denver, Boston, New York and other cities where consumers are fed up. We’re all paying too much to insure our cars, SUVs and trucks. It’s hard earned dollars ($10,000) that you’re giving away but now that can change. Has your loyalty to one insurance company done much for you?

Look back at the last 20 years of auto insurance coverage you purchased (e.g., 20 x 12 x $150 = $36,150). Could you use that money right now?

It’s a Great Time to Switch Auto Insurance Companies

Yes, switching insurance companies is a wise financial choice. There are videos, charts, infographics and quote comparisons below that will open your eyes. When it comes to finding the lowest insurance rates, and a better policy, this might be a good starting point.

It’s best to do lots of searching and get a wide variety of quotes from insurers. Just through persistence alone, you’ll get the best rates. You could save $10,000 over 6 years or as much as $1800 in one year.

Do you Need Collector or Luxury Car Insurance?

Here’s an auto insurance niche where you can get more price and appropriate luxury car insurance quote for your Porsche, Mercedes Benz, Ferrari, Lamborghini, Bentley, Rolls Royce, or Maserati.

I’m sure you’ll find the auto insurance quote comparisons below an eye opener. According to one source, the average price of auto insurance across the US is $1100 to $1200 per year — that leaves lots of room for you to start saving!

Virginia has become the 19th state to ban consumer price gouging – Consumeraffairs.com – fair warning that you are probably getting taken.

Searching for Insurance via Google

Google is certainly fast and you’ll get better rates than from an insurance agency in Los Angeles, Boston, Phoenix, San Francisco, San Diego, Seattle, New York, Indianapolis, Detroit, Philadelphia, or Chicago. Within seconds you can be on an insurance company website and buy an auto insurance policy. I’d advise looking first to the auto insurance comparison sites before you decide on an insurance company and take their coverage. That’s particularly true if you’re buying luxury auto insurance.

Not all of the big name companies such as Allstate, Progressive, Geico, Nationwide, State Farm, Mercury, StateFarm, and others offer great rates or the coverage you actually need. I know from my own searches that I tend not to be thorough enough. I get restless and frustrated and settle for a higher auto insurance quote than I should. I want to help you optimize your quest for the lowest auto policy.

My Car Insurance Quote

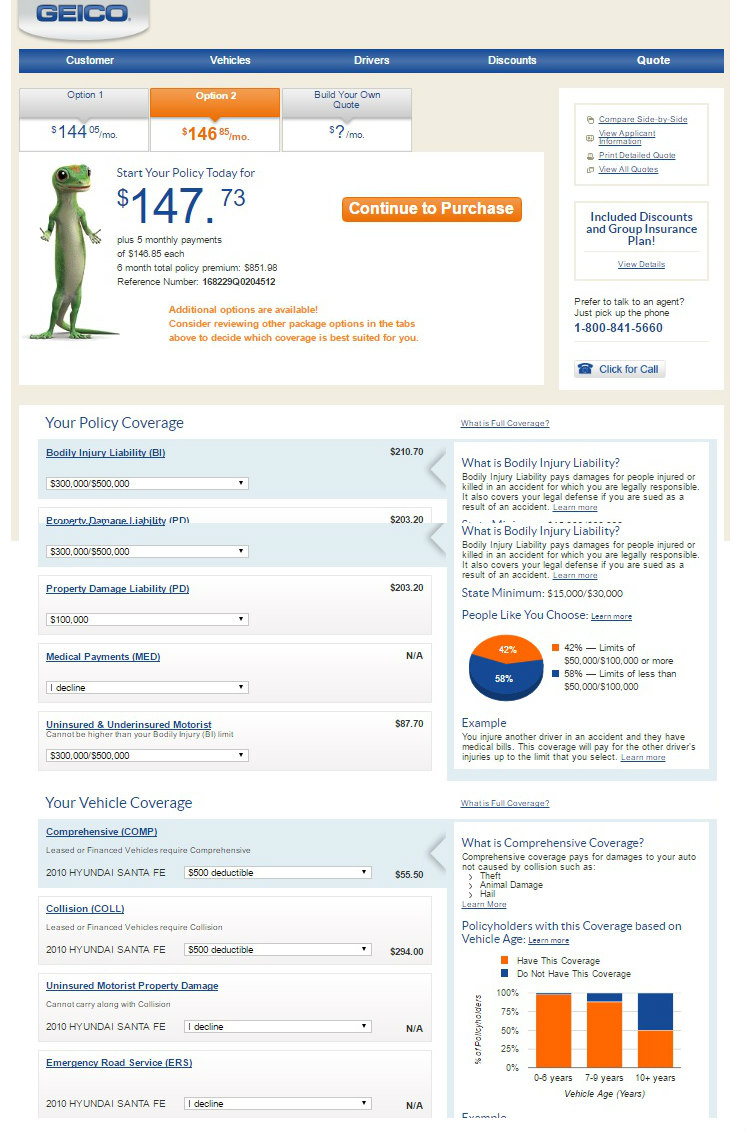

I conducted a search directly on the insurer’s websites of Geico, Progressive, Statefarm, Liberty Mutual, Mercury, Allstate, AAA and Farmers. In the chart below, you can see the quote for a male driver living in Santa Ana, California, driving a 2014 Hyundai Santa Fe 4 dr sedan to work 30 miles away daily, and having one non bodily injury accident (hit a car).

We need an example to analyze an auto insurance quote, so let’s take a quick look at this one.

State Farm’s auto quote was about $1300 less per year than Liberty Mutual’s. Over 6 years, that translates to $7800 in savings if I chose State Farm. Further below, I sought quotes via insurance hotline and the variation was bigger. With your own search, you may find one local insurance company who may be willing to insure you at much less.

Is a 40 year old driver with one accident statistically that risky? Obviously Liberty Mutual, Statefarm, and AAA believe there is huge risk. Each company processes the statistics differently, and they’re entitled to. However, are they being reasonable about it. Is the auto quote abnormally high?

Compare Quotes: Major Auto Insurance Companies

| Auto Insurance Provider | Price per Year |

| Geico Auto Insurance Company | $1772 |

| Progressive Auto Insurance Company | $1884 |

| State Farm Auto Insurance Company | $1654 |

| Liberty Mutual Auto Insurance Company | $2909 |

| Mercury Auto Insurance Company | $1760 |

| Allstate Auto Insurance Company | $1655 |

| Nationwide Auto Insurance Company | $2071 |

| AAA Auto Insurance Company$ | $2673 |

| Farmers Auto Insurance Company | $2796 |

Some of these companies make you answer endless quetions, some of which you have to wonder are even legal. I liked Progressive’s online auto insurance quote process the best. It was quick and the least painful. They seem to respect your time the most. Their quote was a little higher than Allstate and Statefarm, but I suspect Progressive has a better corporate culture — a signal of how they’ll treat you after becoming their customer.

Car Insurance Quote In Canada

Here’s another example auto insurance quote for a 2014 Hyundai Santa Fe, 4 door, for a fictitious 48 year old male with one ticket. See the huge difference in quotes from individual brokerages? That’s right, in this case there are two Aviva brokerages competing.

The lowest quote was from Travelers insurance. It equates to $1700 savings per year and more than $10,000 over 6 years. That’s a significant amount.

Auto Insurance Rates by US State

Just in case you’re curious, here is Insure.com’s auto insurance rankings of States for car insurance policies for one year.

| State | Insurance Quote | |

| 1 | Michigan | $2738 |

| 2 | Montana | $2297 |

| 3 | New Jersey | $1905 |

| 4 | Louisiana | $1842 |

| 5 | Oklahoma | $1778 |

| 6 | DC | $1773 |

| 7 | California | $1752 |

| 8 | Florida | $1654 |

| 9 | Maryland | $1610 |

| 10 | Rhode Island | $1608 |

| 11 | Delaware | $1607 |

| 12 | Georgia | $1559 |

| 13 | Texas | $1510 |

| 14 | West Virginia | $1456 |

| 15 | Wyoming | $1421 |

| 16 | Colorado | $1393 |

| 17 | Connecticut | $1367 |

| 18 | South Carolina | $1353 |

| 19 | Arkansas | $1345 |

| 20 | Alabama | $1337 |

| 21 | Massachusetts | $1325 |

| 22 | Pennsylvania | $1305 |

| 23 | Kentucky | $1295 |

| 24 | New Mexico | $1277 |

| 25 | Mississippi | $1277 |

| 26 | Oregon | $1267 |

| 27 | Minnesota | $1257 |

| 28 | Nevada | $1221 |

| 29 | North Dakota | $1200 |

| 30 | Nebraska | $1188 |

| 31 | Arizona | $1188 |

| 32 | South Dakota | $1168 |

| 33 | Washington | $1168 |

| 34 | Tennessee | $1145 |

| 35 | Kansas | $1135 |

| 36 | Indiana | $1113 |

| 37 | Alaska | $1078 |

| 38 | Utah | $1061 |

| 39 | Missouri | $1056 |

| 40 | New York | $1050 |

| 41 | Hawaii | $1049 |

| 42 | Illinois | $1035 |

| 43 | Virginia | $1020 |

| 44 | Iowa | $989 |

| 45 | North Carolina | $987 |

| 46 | Vermont | $942 |

| 47 | New Hampshire | $941 |

| 48 | Idaho | $935 |

| 49 | Wisconsin | $912 |

| 50 | Ohio | $900 |

| 51 | Maine | $808 |

Cheapest Cars, Truck and SUVs to Insure

Are you looking for the cheapest auto insurance? Check out usage based insurance and consider buying an old car. Here’s Yahoo’s list of the cheapest cars and SUV’s to insure:

1. Honda Odyssey LX – annual insurance premium: $1113 per year.

2. Honda CR-V LX – annual insurance premium: $1,170.

3. Dodge Grand Caravan – annual car insurance premium $1,174.

4. Jeep Wrangler Sport – annual car insurance premium $1,181.

5. Jeep Compass Sport 2WD – annual car insurance premium $1,190

6. Ford Escape S 2WD – annual car insurance premium $1,194.

7. Buick Encore Sport Tour 2WD – annual car insurance premium $1,200.

8. Jeep Cherokee Base 2WD – annual car insurance premium $1,203.

9. Nissan Frontier S King Cab – annual car insurance premium $1,204

Here’s something to think about to motivate you: a savings of almost $1000. How long does it take you to earn $1000 x the next 4 years = $4000. Because, insurance buyers tend to be loyal (or just lazy) and stick with the insurance company that’s sticking it to them. If that’s you, then, spend a whole afternoon or evening searching for a lower auto insurance quote. Save your money.

Sharing is Good for Your Social Health, and good for others bank accounts. Help them save by sharing this post! Who couldn’t use all that money?

A survey by carinsurance.com (they do these studies for PR and for wider exposure in social media and Google) so take it with a grain of salt. Carinsurance.com stated that in California, the average annual premium across the six top carriers was $1,428 (significantly higher than national average of $1,277). The cheapest car insurance averaged an amazing 33% less, at $960.

The Type of Car you Drive is a Key Factor

You may not realize that the insurance companies offer cheaper insurance for a certain type or brand of vehicle. Jeeps for instance have very cheap rates. Why? Who knows? They’re not divulging anything that will cause them to lose profit. Obviously, your age, and recent driving record will determine if you can get those best rates. Are new electric cars like the Tesla Model 3, Chevy Volt or Nissan Leaf the way to go?

Auto Insurance Resources

Car Insurance requirements in California:

Car Insurance requirements in New York:

Auto Insurance Coverage Requirements in Texas

Auto Insurance Coverage requirements in Florida

Auto Truck Insurance requirements in Illinois

Car Insurance minimum coverage requirements in Ohio

Car Insurance coverage requirements in Massachusetts

Stock Market Forecast | Stock Market Today |FAANG stocks | Real Estate Market 2023 | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ 2023 Forecast | Florida Real Estate |Boston Real Estate | Los Angeles Real Estate | Forecast for Housing Market | Housing Market News