The Future of Real Estate

The Future of Real Estate

While housing markets in US cities waffle back and forth between market crash and price peaks, homebuyers, property investors and Realtors are wondering how real estate will look 5 to 10 years from now.

It’s a certainty that new real estate technology (Fintech and Proptech) will shape the path ahead for the real estate industry. These new tech tools, apps, platforms will help Realtors sell better, faster, get maximum buyer reach, help buyers find the best time to buy and help sellers sell at the best time.

And technology will help Brokers cut costs dramatically, cut fraud, and make their brokerages more profitable. The total number of benefits are unknown, and many new ones will be created as the years pass.

And as any new wave that hits an industry, you must get on it before it crests. Consider the wave called AI Marketing that’s going to revolutionize the marketing industry.

Smart marketers are learning the technology now to understand how to perfectly optimize it. Their companies will find themselves with huge advantages.

The platforms don’t just optimize tasks or transactions, they optimize market share, profit and even enable monopoly.

And so it will be for the future of real estate. It may be a winner take all scenario, because some people are just plain smart.

Is it About Digital Currency or Blockchain Real Estate?

The race for digital currencies in particular is quickening. Facebook is promoting its digital currency alternative called Libra to compete the Bitcoin and other others.

Of course, the US government is firmly against allowing FB to “print its own money” so their product may not get off the ground despite support for it. There are businesses visualizing potential of a Facebook-based cryptocurrency.

The future of real estate will depend on the outcomes of elections and government fears. Governments may not want to give up the freedom to print its own national currency when it wants, to get out of trouble or stimulate the economy. Can international based currency help or hinder nation’s best interest?

Regardless of the issues, they will have to be worked out, because on a global basis, it’s impossible to stop blockchain and related technology. It has security (fraud and money laundering) and transactional advantages that countries want.

When is All This Happening in Real Estate?

Changes are already underway. Some Realtors and Brokerages are altering their roles, practices and value propositions to add new value rather than being transaction facilitators, and find new opportunities in Blockchain real estate which are appearing.

New tech-based brokers have already arrived and they’re trying to figure it out and keep up with rapid changes.

When usage hits what’s called critical mass, that’s when real estate businesses will adopt it completely as the new standard. It’s about more than blockchain in real estate alone.

Who Is Resisting Technologies Such As Blockchain?

For government’s blockchain and digital currencies are

Of course there’s resistance to new tech such as blockchain and bitcoin in real estate. Blockchain is transformative and it will disrupt the current broker dominated business of real estate sales. It may weaken their control, or they could jump on the technology and monopolize it as they have with home listings.

Yet when someone like rexmls lost $1.3 million mistakenly sending cryptocurrency to the wrong address, we know there is risk all round. And big business doesn’t like risk.

Realtors, investors, lawyers, mortgage agents, title/escrow people, and homebuyers are about to see the real estate exchange and financing business streamlined.

For instance, it’s estimated that 50% of major corporations will switch to blockchain business technology this year. Blockchain by itself is rocking every industry including real estate.

I’ll introduce blockchain and bitcoin below in more detail. In a nutshell, blockchain is the software platform that’s underneath Bitcoin and other cryptocurrencies. While Bitcoin is well known, it’s actually blockchain that has the best potential for all industries. For some of us, this change is exciting. Change means opportunity.

I know you’re curious about Bitcoin cryptocurrency and blockchain, but understanding them technically is really tough. You don’t need to be an expert, but you may want to know what is driving this coming change.

Housing Market Reports

Check out the Sacramento Housing Market, San Francisco housing market, Los Angeles Housing Market and Florida housing market , California, and new reports on Canada, Chicago and Tampa FL.

The Blockchain Opportunity

Instead of being threatened by the progress to digital real estate via blockchain and other technology, Realtors, lawyers, investors, builders, property managers and mortgage agents should welcome the opportunity of this new era.

Here’s a small list of blockchain startups that have jumped at it.

And the key opportunity might be in first mover advantage. Realtors might redesign their brokerage to utilize RETS IDX listings, AI driven marketing, and blockchain-based transactions. It’s early, but the right time to learn.

What’s coming is an era of weakening monopolies, greater efficiencies and perhaps lower home prices.

You can imagine how the establishment would like to maintain the old paper-based, complicated transaction process that allows the banks and big real estate brokerages to guarantee their cut of this $116 Trillion dollar global real estate market.

New tech entrepreneurs relish usurping the dominant role in an entire, lucrative industry. They’re motivated. The high rising price of bitcoin should tell you that something big is brewing. They’re already at it in real estate.

“Real estate sales using Bitcoin or Ethereum are adding legitimacy to the use of cryptocurrencies in the real world” — Manuel Perez of the Coral Gables, Fla.-based Elizabeth Perez Team. Screen Capture courtesy of Housing Wire

What’s Driving the Push to Blockchain and AI?

The real cause of this future is the high cost of real estate, monopolies, and the over-complicated/regulated process that real estate professionals must follow to buy and sell homes. It raises prices and slows transactions. And younger consumers don’t like the ring of “million dollar homes.” They like this new technology because they think it will save them money.

From smart contracts to Bitcoin currency to fractional ownership, and artificial intelligence driven buying and selling, the entire real estate industry is about to be streamlined. From finance to construction, blockchain technology in particular is about overwrite the sector. Real Estate will be hard to recognize.

But can the big companies control blockchain to keep the market to themselves? That’s very unlikely since blockchain opens everything up to innovation, transparency, ease of purchase, and lower costs. Buyers will find that very hard to ignore, as will real estate professionals. The smart Realtors will be on this now, to give themselves an advantage in branding and expertise.

Realtors may not have to be blockchain experts, they can use the myriad of blockchain applications and services that will be available. It could be a period of entrepreneurship and creativity for Realtors, and for home buyers and sellers as well.

Who Guards the Status Quo?

Brokers, marketing, banking, retail agents and others facing sudden disruption may enjoy their monopoly and legal power to keep the old system intact.

This new wave of well funded cryptocurrency, blockchain and Realtech startups change the game and playing field. The new blockchain based system is a completely new approach to transferring ownership of property from one party to another. With Cryptocurrency, the banks, mls associations, forex companies, and others could be completely bypassed.

Even the mortgage industry is seeing new startups that offer reduced costs, fees and fraud, and improved efficiency, speed, and transparency.

Change from Many Directions and It’s Just Starting

The future of real estate will see disruption from many sources, technological, cultural, financial, and political.

The $36 Trillion US real estate industry is pressured by issues of complexity, affordability, frustrated demand, housing development restriction, rising interest rates, competition, big data, blockchain, and more. They’ll all play a role in a complicated forecast amidst an uncertain economic outlook beyond 2020.

Will you be buying your next home via an app using Bitcoin? Should you even buy a home, or rent? It’s not only about techno changes in 2018. The future of real estate involves lifestyle, economic, and investment factors.

Will Realtors and Financier’s Roles Change?

While removing the middleman might be the uber utopia for tech-obsessed 20-Somethings hoping for a price break on a million dollar house, it will not be easy to push big banks, MLS’s, state govnernments, and real estate companies out of the future of real estate. Politics, law, habit, and need for expertise will ensure Realtors don’t fade away too quick.

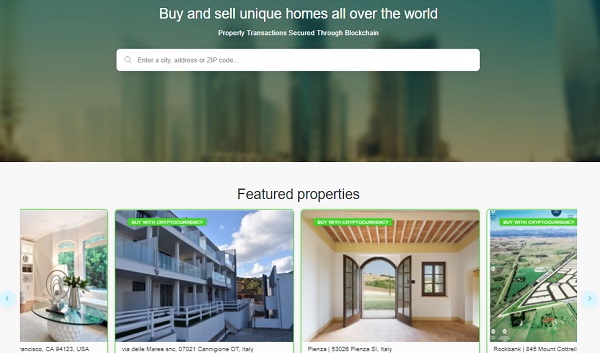

Propy is a new blockchain based online brokerage serving the world

Realtors, MLS associations, and big brokers control the mls data and in this day age data monopoly is how you eliminate competition or gain monopolies.

A number of tech driven competitors are disrupting and trying to weaken the current megalopoly in real estate markets. Thus far they haven’t been able to land a decisive blow. Big Data may be the weapon to topple the traditional system unless the big brokerages learn to utilize it somehow.

Technology driven companies such as Zoocasa, Zillow, and Compass are growing fast and making inroads on various MLS and Realtor competitors. The fact that the majority of Realtors have few listings or sales and aren’t well supported by the big brand brokerages means these tech companies have opportunity with their own hungry masses of agents. The fact the big brokerages don’t share information with agents now, tells you that Realtors would jump ship quick.

And for consumers, a reduction of commissions and expansion of marketing capabilities means consumers might gain from new tech entrants. And in terms of streamlining, it’s estimated that closings could be reduced to 10% of their current duration.

Yet the MLS associations and brokers hold a lot of data and can keep it out of the hands of real estate startups. Legal battles are raging, but the MLS’s aren’t winning the wars.

Propify, an Australian startup, hopes to leverage the technology into a one-stop shop for home buyers. Drawing from various listing sites, governmental databases and social media, the software company aggregates all available information about available properties into a single space, sourced from a blockchain – from Real Estate Weekly.

Who Owns Big Data?

Big Data is owned by big tech, finance and retail companies right now and the battle over who gets access is being waged. The data is so important, it stands to reason that a few companies would not be permitted by government to own it or leverage it for massive monopolistic wealth. However, that conceivably could happen in the Amazon era.

Big Data is owned by big tech, finance and retail companies right now and the battle over who gets access is being waged. The data is so important, it stands to reason that a few companies would not be permitted by government to own it or leverage it for massive monopolistic wealth. However, that conceivably could happen in the Amazon era.

If everything from finance, real estate to AI driven robots, having it locked and controlled by any money hungry company could bring the system and economy to halt. Big data and open source access will have to be made a basic freedom.

For that reason, how could the NAR or MLS or anyone hope to monopolize their data and market access? It’s a losing battle.

The Coming Blockchain Revolution in Real Estate

According to Forbes, real estate venture investors deployed over $5 billion in real estate technology in 2017. That’s 150 times the $33 million invested in 2010. Blockchain is just one part of that investment.

Blockchain technology is important to the commercial real estate market since it streamlines processes, reduces fraud and cuts costs

What is Blockchain?

A blockchain is a secure network of computers that creates as a living ledger for transactions. When the record is updated with new information — the signing of a contract, the movement of funds, the transfer of ownership — it is updated and time stamped in every computer simultaneously, whether there are two dozen or 2,000. The records are the blocks, the network is the chain — from Real Estate Weekly.

Blockchain technology and cryptocurrency may influence how real estate is transacted in future and who will participate in buying and selling.

Coinify states that blockchain will speed up real estate transaction, decrease fraud, and increase transparency. For those who worry about international money laundering and organized crime, Blockchain could cut police and investigation costs. Blockchain offers a real digital paper trail.

Blockchain leverages mls type housing data and makes it usable on a larger scale. So the potential power of blockchain systems will threaten the data monopolies that exist in some states and mls districts.

Direct Transaction between Buyers and Sellers

The rewards of listing on a blockchain accessible system will be too much for homeowners and real estate agents to resist. With blockchain technology property and transaction information is published to a public ledger giving all parties access to the home-buying or leasing process. Owners, tenants, operators, and service providers will have access to this stream of incorruptible data. The buyer and seller deal with each other directly.

According the IBREA, “Blockchain offers an open source, universal protocol for property buying, conveyancing, recording, escrow, crowdfunding, and more. It can reduce costs, stamp out fraud, speed up transactions, increase financial privacy, internationalize markets, and make real estate a liquid asset.”

How To Buy Real Estate Using Bitcoin

Yes, a lot of people want to know. I’d advise reading this post on HGTV to get started. Will you still need a real estate agent? Yes, and a real estate lawyer to review all the documents. And these people are insured just in case something does go wrong.

However, make sure you trust the second party if you’re thinking of buying into real estate. “If you want to reverse the transaction due to any litigation, then you need both parties to be compliant,” says Jake. “Bitcoin transactions are not reversible.” — HGTV

Bitcoin and Real Estate

Cryptocurrencies such as Bitcoin are highly volatile right now, however once they stabilize, homeowners will not balk at selling in Bitcoin. The bitcoin cryptocurrency is set to rock the banking and retail industries, so why not real estate?

Need to know how to Buy a House or Condo using Bitcoin?

Real estate can be a lucrative business yet the drive for cost savings and high prices makes players investigate and try out different solutions. Real estate agents, landlords, mortgage agents, and others have been reluctant to adopt software solutions for fear they would lose competitiveness. The future of real estate is technology in almost every area.

However, that intense competition is yet another driver of the kind of change that could see agents and brokerages disappear. I hope that’s not you, but let’s say the flock is culled. What kind of new real estate sales environment is being created and how will you adapt? There’s opportunity in everything.

Younger Buyers Love Choice and Apps

Millennials are the biggest, most wealthy group of consumers now and they’re proving to be brand agnostic and want open source everything. Throw in millions of wealthy young Chinese immigrants/investors, and you can guess that tradition in real estate is about to be replaced by a new culture — the Uber culture mostly online. On Tech.co, Boris Dzingarov suggested 3 factors will change real estate marketing greatly:

- Video

- Mobile devices

- Online reputation management

Yet, many agents are using video, have already set up mobile friendly sites, and even dressed up their Linkedin and Facebook pages. And they’re not anymore disruptive than anyone else. I think what may mark the new agent is using technology and digital marketing to connect with more prospects. What may be difficult for them though is that homebuyers and sellers may not accept their pitches. If you can’t go to them, then you’ll have to show up online so they can reach you.

If you have no digital marketing strategy to connect with prospects, make an impact, and remain visible online (top realtors are taking it all for themselves) then perhaps the forecast is as stormy as Dzhingarov is predicting.

Why Agents Will Still Be Needed

Currently, 80% of home purchases are conducted using Realtors, and given the various services they handle, it’s hard to conceive they would be made completely redundant by blockchain or other technology.

Here’s where we can’t do without them:

- better knowledge of local neighborhoods

- assessment and advice on contracts

- real human advice on quality of the property instead of property data collected

- price negotiation with buyer or sellers

- spares you the anxiety of buying and selling real estate online

- help you get a higher price through staging, presentation and sales support

- arranges inspection and home showings – saving you time

The Outlook for Real Estate Brokers

I’d like to take a moment to discuss what I see happening in this industry. Here’s the top 15 disruptions that may hit the real estate biz in the coming years:

- Real Estate Teams – teams loaded with extra services will battle it out with discount brokers to offer better service, particularly in the luxury real estate market where Luxury realtors will go the extra mile.

- MLS Data Freely Available to Everyone – no secrets for realtors to use as a trump card. Homeowners will feed home stats to online vendors who will provide increasing marketing power for them.

- Social Media Growth – Realtors will expand their circle of contacts via Linkedin and Facebook, and home sellers will look to engage more buyers to get higher bids for their client’s properties. Social media engagement will keep them connected and actively top of mind to prospects, as other realtors impinge on all their clientele.

- Content Marketing – more sophisticated and engaging visual content such as interactive infographics and pdfs, and interactive home tours will let buyers drill down quickly to everything they want to know about the home and neighborhood.

- Sophisticated Video – slick videos with aerial shots and stunning quality will become templated much like WordPress web sites are now

- SEO & SEM– optimizing for whoever is looking for real estate or wants to prepare for sale. This means having a good SEO is critical for inbound marketing, link building and MLS listing optimization. PPC advertising and remarketing ads will play a role too.

- Trustworthiness – the insecurity of Uberization will mean parties will be scrutinized for their reputation and professional credibility. Those realtors that have this all laid out strategically will pass the cred test.

- Thought Leader/Advisor – generosity of key realty knowledge will influence because real estate is an expensive investment that the average Joe homebuyer doesn’t understand. The realtor’s role will evolve to become a trusted advisor.

- Complete Property Transactions Done Online – from bids to closing costs, every aspect of the transaction will be done online, perhaps via a large tablet device connected to a printer. See Realtypoint’s excellent post on this.

- Google, NAR and CREA will lose control of the online realty market – homeowners will list with online entities for exposure and pay minimal fees.

- Property Management – More brokers and agents will move into the property management and mortgage business to create more relevant clients, retain them, and build visibility.

- More Real Estate Agents Will Go Out of Business – deals will disappear, commissions will fall and competition will be intense and only those with huge client bases will make it.

- Clients will gravitate to Large, insuring Finance Companies – these firms are capable of insuring transactions, because regular consumers are likely to make big mistakes. Right now of course you and your brokerage and (CMHC in Canada) or (FHA/PMI) in US provides it.

- Niche, Boutique Brokerages – they’ll have an edge in relevance, usefulness, and attraction to many buyers and sellers – particularly brokers that offer a la carte services, and prove they have specific types of buyers for a property (e.g., Chinese or Middle Eastern buyers).

- Intense Hyperlocal Focus – realtors and teams will use outdoor advertising and social media to dominate local markets.

The Uberization of real estate has already happened. I’m wondering which new Zillows and Trulias rise up to serve this new market? No doubt it’s being discussed in boardrooms right now. [Note: I was invited recently for interviews for a senior digital marketing position with a big, new up and coming lead generation business in Toronto].

Where Will You Be in 5 Years?

The point of this post is to ask you where you’ll be in the coming years and whether you will have initiated the steps to build your future realty business. It’s wise to start planning and connect with the people who will help you grow and sustain it.

What are you thoughts? What changes do you foresee? Will The housing market in 2022 look much different for you and your brokerage? What are you doing to help you survive and thrive in the blockchain era?

3 to 6 month Forecast for the Dow S&P NASDAQ | Bitcoin Price | Stock Market Today | 10 Year Stock Market Forecast | Real Estate Market 2023 | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ 2023 Forecast | Florida Real Estate |Boston Real Estate | Los Angeles Real Estate | Forecast for Housing Market | Housing Market News