Canadian Real Estate Market Forecast

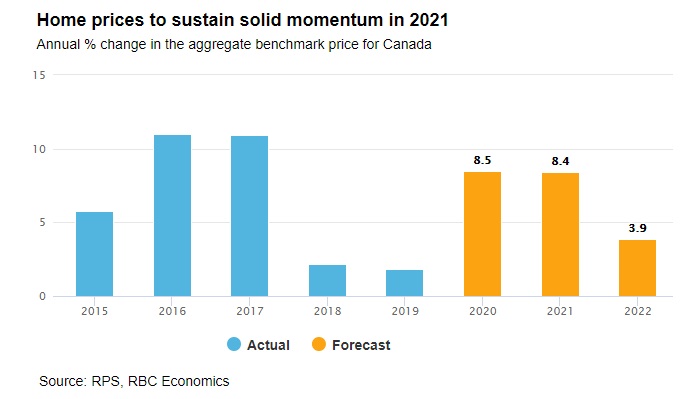

Just like the US housing market, the real estate market in Canada showed remarkable strength in 2020. The Canadian benchmark price increased 8.5% last year, almost five times the rate of 1.8% in 2019.

And forecasts for 2021 reflect a continued trend of high prices driven by low mortgage rates, limited availability, high savings rate, and growing demand. The demand from millennials forming families is still intense as well as the newest generation, funded by their elders can also factor into the 2021 sales numbers.

This should be heartening for property investors who want to see appreciation in their investment portfolio. And for foreign immigrants who want to migrate to Canada as the Covid 19 pandemic eases, it means having to pay much higher prices.

The prices of homes in Canada’s most desirable cities, Toronto, Mississauga, Montreal, Calgary, Vancouver and Kelowna will rise substantially.

Why Buy a Property in Canada?

- home prices are moderate vs the US

- economy is resilient and there is a strong rental market

- long term appreciation is strong

- many smaller Canadian cities and towns have much lower prices (in $CAD too)

- US economy is picking up

- post pandemic recovery expected to be solid

- fresh air and lots of space

- Cities such as Vancouver, Kelowna and Calgary most desirable places in the world

- Canada is financially safe and secure

- Canadian schools are very high quality for foreign students

Canada is an Excellent Place to Buy Property

Sure the housing market bubble prognosticators talk about a housing market crash at some point. Given the resilience of the Canadian economy and that the Prime Minister hasn’t had to spend like the Americans have on inflating the US economy, a rosy forecast is set for the spring 0f 2021.

As condo buyers and apartment renters return to Vancouver and Toronto, the statistics will reflect how tight the Canadian housing market is. Low supply is the key factor in any outlook.

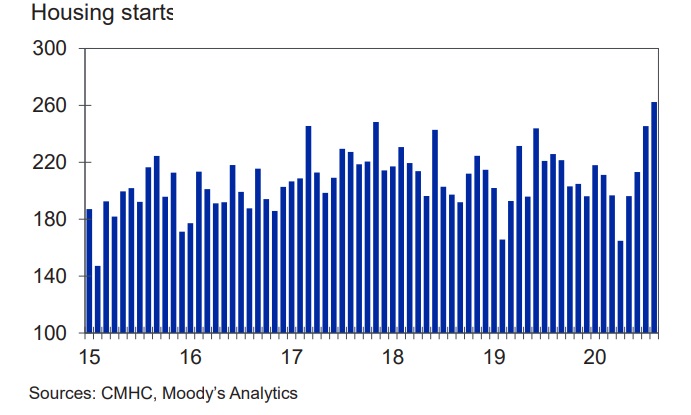

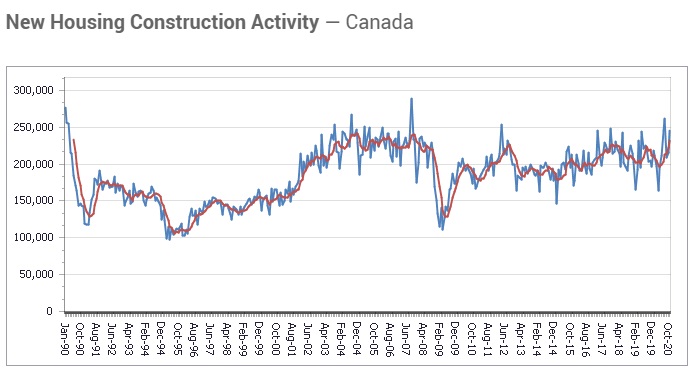

The markets are more moderate here, and yet demand is strong, and rarely do you see precipitous crashes. With construction growing, the bubble may not inflate as much as expected.

And investment in homes or condos doesn’t come without risks. There are good many experts that warn of a housing bubble, particularly in Vancouver and Toronto where home prices have rocketed in 2020.

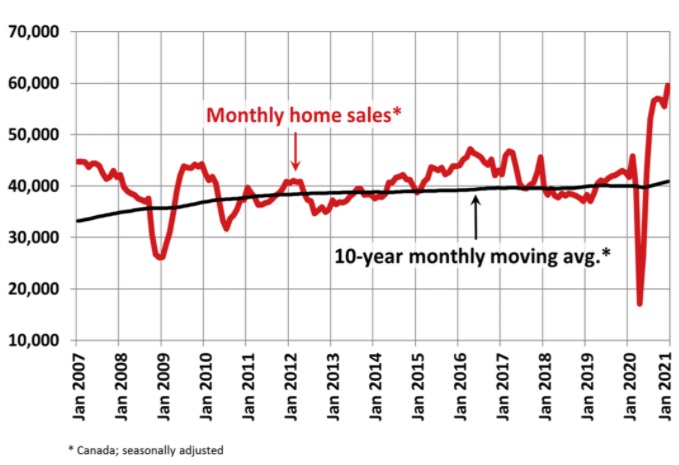

An RBC report forecasts another record breaking year for home prices and home sales in 2021. They predcit the Canadian benchmark price will rise 8.4% to $669,000 and home resales will grow 6.5% to 588,300 units with almost all provinces showing gains.

In a moderating statement, RBC says 2022 might be a soft landing year with prices flattening due to the passing of the pandemic but they still see home prices rising 3.9% in 2022.

The Canadian index covers the country, but the Vancouver real estate and Toronto real estate markets should get really heated. The exodus of the Trump government in the US, hints at friendlier trade relations with the Americans. And with US inflation becoming heated, cheap Canadian products and services will be in demand.

In 2021, RBC calls for price trends to stay firm in most regions of Canada pushing real estate property prices up 9.6% in Ontario, 9.0% in Quebec, 8.6% in BC, 8.3% in Nova Scotia and 9.5% in PEI.

The call for moderation in Alberta might be premature. Oil prices are on the rise again, and with the current US President’s push to green energy, investment in oil exploration will cease. As oil supplies and fracking are lowered, oil prices could conceivably rise to $80 again on the heels of an overheating US economy flush with stimulus money and a reopening businesses.

Royal Lepage 2021 Housing Forecast

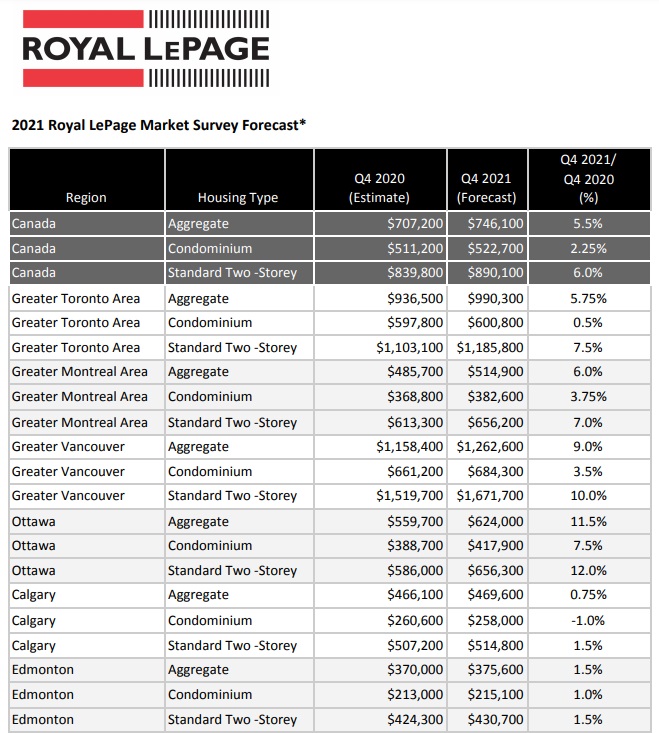

Canadian real estate brokerage Royal LePage forecasts home prices will grow in 2021 by 5.5%. They predict the median home prices will grow year-over-year to $746,100. They believe the median price of 2-storey detached homes will rise 6% to $890,100 and condos will rise 2.2% to $522,700.

Royal LePage chief executive Phil Soper said “The upward pressure on home prices will continue supported by alack of supply to meet surging demand and policy makers promise to keep interest rates at record low levels.

royal lepage home price forecast.”

In the Greater Toronto Area, RBC forecasts the median price will increase 5.75% year-over-year to $990,300. The median price of a standard two-storey home is expected to rise 7.5% to $1,185,800. And they predict the median price of a Toronto condominium will grow 0.5% to $600,800.

With the vaccinations growing throughout the year and a commitment to low mortgage rates, it seems incoming immigrants and those who fled Toronto would return. I wouldn’t count on low condo prices toward the end of 2021.

Phil Soper said a balanced Vancouver real estate market has about 15,000 active listings, and currently there are about 10,000. Given the pandemic shutdowns due to the new Covid 19 strain, big growth in construction in Janary and February is highly unlikely. That will make the spring 2021 housing market in Vancouver an especially strong one.

For Vancouver, the median home price (house and condos) in 2021 is forecast to increase 9% from 2019’s median price to $1,262,600. The median price of a 2-storey home is expected to rise 10% to $1,671,700, and the median price of a Vancouver condominium is predicted to grow 3.5% to $684,300.

In Calgary, Royal Lepage estimates the median price of a home in will grow only .75% to $469,600. The median price of condos in Calgary should fall 1% to $258,000, and the median price of a 2-storey house should rise 1.5% to $514,800.

Moodys Canadian Home Price Forecast

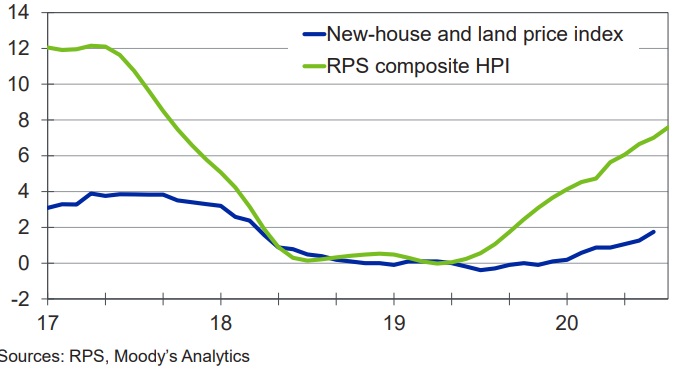

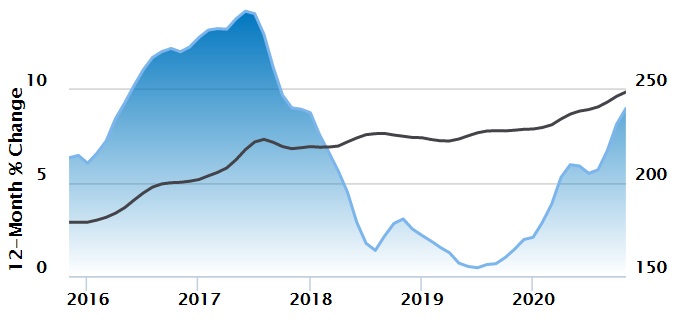

As this chart from Moody’s indicates, land and new house prices haven’t rocketed, which means there is room for real estate investors and home builders to make money satiated what will be very high demand after the pandemic.

Canadian Home Construction

New Housing Construction Canada

That’s a look at the 2021 Canadian housing market outlook. The consensus is rising sales and prices yet some cities may still hold their own and climb well above the national average in price. With US economic growth for 2021 looking very strong, the benefits for trade will spill over into Canada. Toronto, Vancouver and Calgary will benefit.

Forecast for the 2024 Stock Market | Real Estate Housing Market Outlook | Will the Stock Market Crash? | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ Forecast 2024 | S&P Predictions | Stocks Next Week | 6 Six Month Outlook | Stock Price Prediction Apps | Home Equity Line of Credit | Home Equity Rising | Reverse Mortgages