Stock Market Correction Today | Dow NASDAQ S&P Russell Drop in Price

Tech Stocks Drag Down the Markets

Investors greeted a new week in the US stock markets with a major pullback. The DOW, S&P, NASDAQ, TSX, and Russell lost value on Monday. Experts are offering different reasons for these losses and differing stock market predictions.

One report suggested this latest correction resulted from comments from a stock analyst employed with Wells Fargo. He suggested the foreign manufacturer of Apple iPhones saw big cutbacks in orders from Apple. That means less demand for chips and a thumbs down on sales for the Xmas season.

That apparently was enough to send the whole tech market and other stock market indices tumbling. However, as you can see below many non-tech stocks plunged too. There’s something more subtle and complicated going in this correction.

A Bloomberg expert believes investors are losing faith in the tech sector and are pulling back from them and the FAANG stocks. It’s a loss of confidence which if true could make a big winter correction much more plausible. It could be the midterm elections and the persistent hiking of interest rates could be weighing on the minds of many.

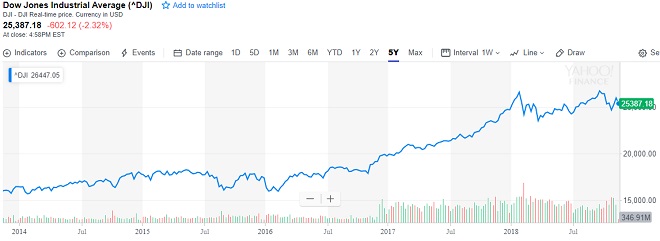

This graphic shows how strong the DOW has been, yet being dominated by huge monopolistic multinationals producing products outside the US, it has the most to lose.

Screen capture courtesy of Yahoo Finance

Jim Cramer: This is a Very Serious Correction”

Stock guru Jim Cramer says this is “a very serious correction” which is not going to help investor confidence. The FAANG stocks suffered big one day losses. Facebook Inc. FB dropped 2.35%, Apple dropped 5.04%, Amazon Inc. fell 4.41%, Netflix Inc. declined 3.10%, and Google Alphabet pulled back by -2.57%.

This graphic shows the biggest losers on the day.

Economic Transition Really to Blame

The real cause of today’s stock slide is a slip up in self-deception. Every once in a while, the reality of the pro US business policies of Donald Trump slips through. Big, foreign or domestic multinationals are undergoing a major change or correction in how and where they’ll be doing business and which labor markets they’ll be leveraging.

These corrections will continue for another year when most businesses will have fully moved back to the US. More than a few investors are still concerned about a potential stock market crash.

After all these small corrections, and a couple of big ones, investors will settle into a new US focused stock market. As the US economy grows with manufacturing and service repatriation, the exit from foreign stocks and multinationals will quicken. New smaller US businesses will be the new rock stars of the stock markets.

Keep your eyes and money focused on small US startups, and other companies listed on the Russell exchange for instance. Growth potential is awesome.

Major Stocks to Review: Tsla | Google | Facebook | Amazon Stock | Netflix | Apple Stock