Bitcoin Still on Many Investors Radar

Are you considering buying Bitcoin this year, during the coming dip? You might want to investigate now given investors have gained the scent.

Some analysts believe it’s headed for $200,000 or perhaps $500,000. Is that likely? If there is an economic recovery and bull markets, and if money market funds need to bet on a growth equity, then it does seem likely.

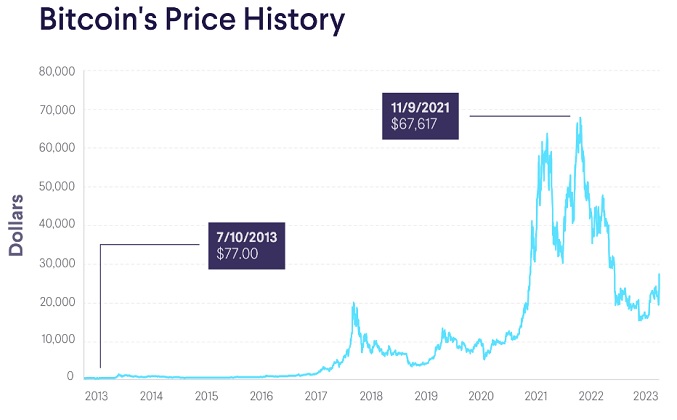

We know that in the past, BTC grew up to 80 times its value. From its current $30,000 price, a jump to $200k is a 600% return on investment. In this post, let’s see what the experts are saying about BTC and what the predictions are for its price up to 10 years into the future.

Let’s begin with Changelly’s forecast chart:

Cathie Wood and BTC Price Projection

One notable major fund manager, Cathie Wood, Wood projected a base case BTC price target of over $600,000 and a bull case of over $1 million by 2030. If you’re investing for your retirement fund, and don’t need immediate results, that kind of upside is much better than almost all the stocks on the S&P 500. Even stocks such as Tesla, Nvidia, Google and Apple pale in comparison.

Young investors aren’t afraid to invest in BTC and are on the hunt for investments not for security and safety, but instead their full upside potential. Gen Z’s and Millennials are a huge investor group coming into their big earning years (Next 10 years). Will they gamble a little on Bitcoin?

As the chart shows, you might have bought it at $5,000 and then in 3 years, would have enjoyed a price of $67,000 per coin. That is a 1200% increase. Many millionaires and billionaires were created by that price rise.

Will FOMO in investors result in another spike in the years ahead? We’ll see what the experts say about Bitcoin futures and the price within 5 years. Of course, with BTC and current economic anxieties, we might predict that at some point between now and then, it will jump. We just don’t know the date.

The surprising recovery and resilience of cryptocurrency Bitcoin is making more investors consider jumping back on crypto ETF’s, BTC and Bitcoin backed securities this year.

BTC has risen 84% so far in 2023. Even if the economy suffers and takes it down in the 2nd half, it stands to reason that as money moves back into the stock market, speculators will put a sizable amount into BTC.

The US government would like to squash cryptocurrency and any other threat to the US dollar. Crypto and blockchain are complaining about how the US government is trying to regulate the sector and stifle technology and innovation.

130 countries are looking into cryptocurrency development, that’s 90% of all countries. The push is on, but would it be easier for them to instead use Bitcoin or Etherium? Developing cryptocurrency is beyond the capabilities of most countries, and that might include the US too.

Holding Bitcoin and blockchain off might one way of buying time in order to learn the infrastructure and technology of blockchain. The Jury’s out about whether US finance department can come up with a US digital coin that would work in a blockchain environment. Of all Biden’s pet projects, cryptocurrency might not be at the top of the list of must-do’s for the next 16 months.

What will drive the next BTC Rocket?

- scarcity – US dollars can be printed and will be making them less valuable in comparison

- BTC is hard and expensive to mine and generate

- everyone knows about Bitcoin and its past run-up

- US dollar will sink in value

- Investor fear of missing out (FOMO)

- institutional investors have avoided oil and gas market and thus have fewer options as a store of investors’ wealth

- Cathie Woods keeps backing the value of BTC

- no real cryptocurrency rival (Ethereum is a long shot)

- as the FED interest rate falls and more money goes back into the economy, the USD, Yen, and Euro will fall in value

- regulation will knock out rival digital coins (alt coins)

In a CNBC report, Jamie Sly, head of research at CCData, told CNBC “Bitcoin’s recent surge in value has largely been driven by large trades within a less liquid market.. Our analysis of market orders over 5 BTC reveals an aggressive surge in market buying, suggesting large players are seeking to gain exposure to digital assets. “When combining large orders with thin books, the market is subject to more volatile movements.”

In an Investorplace report, 3 analysts back up the high predictions including:

- Crypto analyst Dan Tapiero say BTC will surpass $100,000.

- Standard Chartered’s head of digital assets research Geoff Kendric reports their belief in a $100,000 price target.

- Crypto analyst PlanB’s BTC price prediction model forecasted that Bitcoin will surpass $100,000.

Of course, there many threats for BTC and cryptocurrency to handle, and the scares are magnified because of the government’s control, self-interest, and that BTC is not backed by assets.

BTC prices swings up and down according to sentiment. It’s waiting for an anchor or key supporter that will make it a permanent asset with real value.

The US government’s plan to regulate, cripple and diminish it could backfire against a deflating US dollar. Once legitimized, and with BTC ETF’s established amidst the 2024 recovery, institutional investors and billionaires may pour money into it.

All we have right now is a rational forecast and the right to gamble.

Bitcoin Stocks | Bitcoin Price Forecast | 10 Year Forecast | 5 Year Forecast | Tesla Stock | 2024 Stock Market Predictions | Stock Market Today | Stock Market Crash | 3 Month Stock Market Predictions | 5 Year Stock Forecast | Dow Jones | NASDAQ | Oil Price | S&P | Stocks Next Week | 6 Month Outlook | Stock Quotes | Google Finance | Author Gord Collins