Top Trending Stocks

Top Trending Stocks

Should watching the top trending stocks be part of your everyday investment and trading activities? Every rise in stock isn’t critical, but some rises reflect major company/product/market breakthroughs that send the company to another level of profitability.

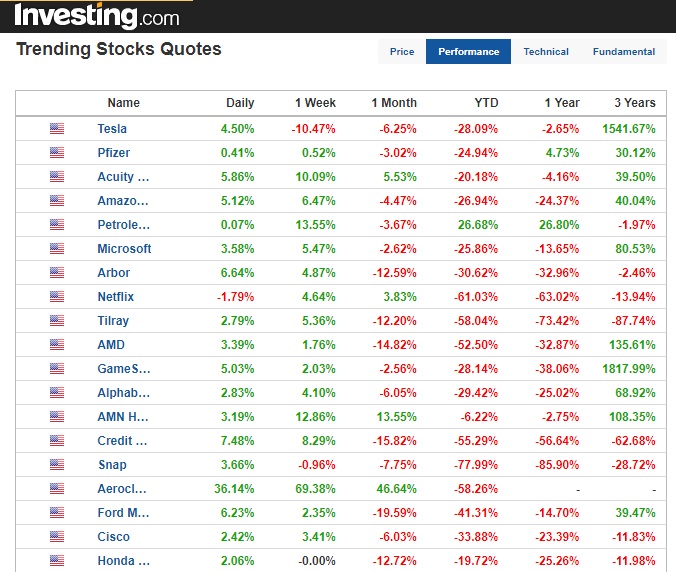

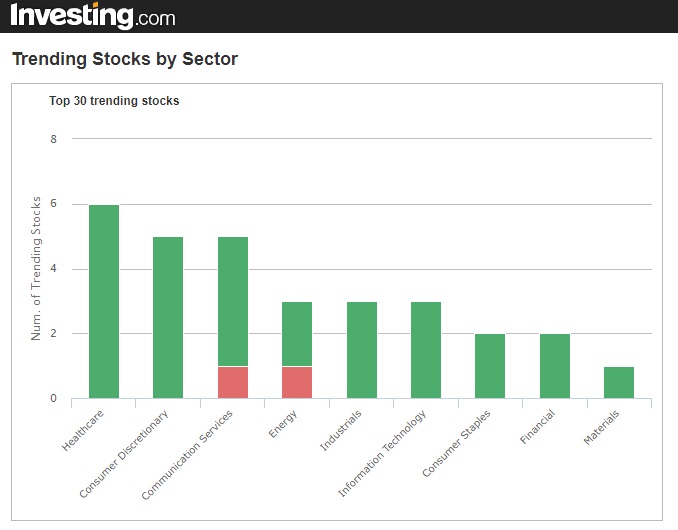

Which stocks are going up or down? Which sectors are growing or falling? It’s important to know if your portfolio is heading in the wrong direction. For instance, if you’re loaded up with Cryptocurrency, marijuana and oil stocks right now, you must be scratching your head.

Today’s Trend: Big Market Rally

But is this just a big bear market rally, with some horrible casualties ahead? Will the Fed ratchet rates up another 75 basis points in November as experts suggest? Have another look at all the factors, signals and indictors before jumping on this rally.

The Dow Jones, S&P, and NASDAQ stocks are enjoying quite an upward trend in price in October. NASDAQ and S&P technology stocks are having quite a lift. The stock market today is showing a 5% growth, but with high volatility of recent, there is huge risk for the euphoric buyer. See below for more of trending news, and see the stock market predictions for the next 3 months and 6 month periods.

Such trending financial data can tell you a lot about where the market is headed in 3 months, in 2023, or 3 to 5 years ahead. Right now, biotech company stocks which might deliver a Covid 19 cure are hot. However, is the euphoria over a potential inoculation shot for Corona Virus going to pay off? For some firms, including Johnson and Johnson, it might be worth a gamble. Even if J&J fails, they will still do well with the booming economy later this year.

Stock market trends tell us about sentiment and changing individual stock evaluations. You can be sure when there’s a price jump or slump, something has happened that you need to know about.

What Is Stock Trend Analysis?

According to Timothy Sykes, a penny stock trader, “trend analysis is a technical analysis technique or a type of comparative analysis. The goal of trend analysis is to use past data to predict the future movements of stock prices. A trend is the overall direction that the market seems to be moving in over a given period. As a stock trader, what’s happened in the past can give you a solid idea of what to expect from a stock in the future. Investors look at short, intermediate, and long-term trends. They use trend analysis in an attempt to identify bull runs in the market and find trend reversals that show it might take a downturn.”

Top Trending Stocks Via Yahoo

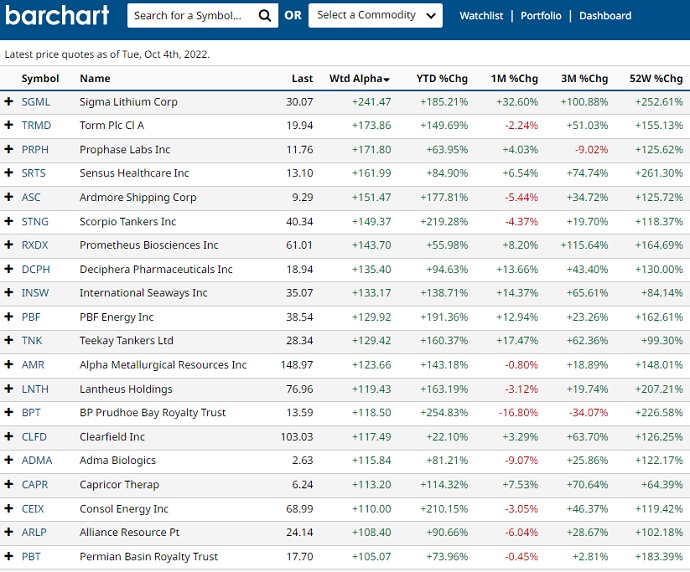

A variety of technology companies have rocketed in early October 2022. Everyone is waiting to see if this new rally takes hold and whether these stock prices have lasting effect.

Those who respond lightning fast to the news reports stand a chance to make a little money. But day traders can tell you whether anyone can benefit as a big company news bite is released.

Read more about stock market trend analysis on Timothy Sykes blog.

Are you wondering where the S&P, NASDAQ, Dow Jones, TSX, and Russell Indexes will be in 3 months, 6 months, or in 5 years? Check out some of the best stocks to buy and then enjoy the ride in 2023.

Please do Bookmark this page for more updates on the latest trends on the stock market.

The year of 2021 promises to be exceptionally good, unless one specific political upset takes place. I don’t want to mention that right now though, because our goal here is to find once in a lifetime bargain stocks to buy.

* the above post includes opinions of the author and do not connote recommendations of any kind regarding stocks to invest in. The material is provided as general information only. For all your stock investment decisions please refer to your financial investment advisor.

3 to 6 month Stock Market Outlook | Stock Market Forecast for 2024 | 2024 Outlook for US Equities | Oil Price Forecast for 2024 | Stock Market News Today | Market Rally | Tesla Stock Forecast | Stock Market Today | Stock Market Next Week | Housing Market 2023 | 5 Year Stock Forecast | AI Stock Forecasts | ChatGPT Stock Market Forecasts 2024 | Dow Jones Forecast 2024 | Dow Futures | NASDAQ Forecast 2024 | S&P Predictions 2024 | Stocks Next Week | Stock Trading Platforms | Stock Trading | Stock Prediction Software