SPDR Fund SPY Stocks

Exchange traded funds are a popular investment vehicle for millions of stock trading enthusiasts. One of the original and most prominent ETFs is the SPDR, or SPY stocks as they’re known.

ETFs are composed of stocks purchased and when actively managed, the ETF manager decides on which stocks to buy and include in the fund. Presumable, the ETF is a pool of great stocks which deliver the price appreciation, dividends, etc. that investors are hoping to attain.

ETFs can incorporate the best individual stocks from any exchange or index (S&P, Dow Jones, or NASDAQ), bonds, commodities and currencies. And most indexes have equities and bonds from almost any index.

Buyer Beware

Not all ETFs perform well. Some may show disastrous returns for any number of financial or economic reasons. Fees are taken for fund management, and some of the managers of the funds earn billions. It is a profitable thing to launch an ETF.

A good example of a popular ETF is the ARKK Innovation ETF managed by Cathie Wood. The ARKK ETF is an actively managed ETF that seeks long-term growth of capital by investing in disruptive innovation companies.

ETFs and mutual funds that track an underlying stock index are described as passively-managed funds. This is because the fund manager does not decide on what to buy or sell and instead, he or she simply holds the securities in the index as a trust account.

SPY ETF Growth & Performance

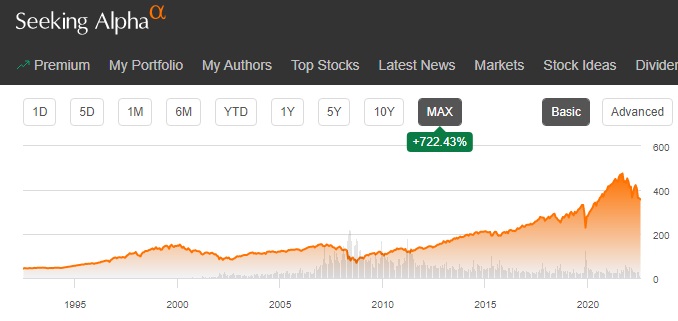

Currently, SPY SPDR shares sell at $362.73. This is SSGA’s reading on SPY performance:

During the boom years between 2012 and 2021, ETFs enjoyed excellent growth providing investors with impressive returns. Since 2020 however, ETF performance has declined significantly. YTD, in 2022, ETFs have suffered severe losses and the SPY is included in that club. SPY ETF has one of the lowest gross expense rations at .0945% giving it credibility and assurance for investors.

However, like other investment vehicles hitting the 2022 market bottom, they may once again be a good buy.

Investors buy this ETF for its stability and to avoid choosing individual stocks. It’s an ultraconservative fund that may not perform as well to the upside, but probably won’t lose to the downside as individual stocks would.

As a recession, risk off investment, the SPDR SPY fund might have a good upside in 2023. If you’re investing with a 5 year time vision, the returns may be positive.

Contrast this with trying to pick the best individual stocks on the Dow, S&P, NASDAQ or Russell indices, and you’ll find it’s a good alternative. Although retail investors believe they can pick winners on the markets,

One of the most popular and much sought ETFs is the SPY ETF.

The SPY contains a variety of stocks listed in the S&P 500 index. It’s like a basket of stocks from those 500 securities.

Should You Buy SPY ETF Shares?

The wisdom of buying into the SPY ETF depends on your investment goals, profit goals, risk tolerance, and other factors. Of course, it is wise to research all potential ETFs for returns and safety and choose one that fits your investment aspirations.

How Do I Purchase the SPY ETF?

You would invest in it through your stock brokerage and you’ll be subject to the usual commission fees and other service fees.

How Has the SPDR ETF Performed?

During the last year, the performance of the ETF mirrored the S&P itself. It lost 17.75% of its value. If you had purchased it 5 years ago, you would have doubled your money. During September, the fund dropped by 38%.

The SPDR fund is composed of S&P 500 stocks in these sectors:

- Technology (28%)

- Financials (15%)

- Healthcare (12%)

- Consumer Services (12%)

- Other (32%)

With tech stocks suffering this year due to higher interest rates, cautious banks, recession expected, and Fed balance sheet reductions, and thus less investment money available, the fund is skewed in the wrong direction.

Arguably, the time to invest in the SPY ETF is when tech stocks plunge in value. Buy the dip is always a good investment strategy. As the economy recovers and interest rates fall, the tech sector will come alive.

With respect to technology stocks and companies, the future is increasingly about technology and the power of scaling production and management via software. Technology creates better performance boosts than other sectors and actually supports profitability in all other sectors. All roads lead to tech stocks, so poor performance won’t last forever.

It’s important to remember than the S&P 500 stocks are chosen to be included in that index because they are solid, strong performing companies — the best 500 in the world. That’s saying a lot to investors.

Currently, the SPY ETF comes with a short sale, strong sell recommendation. Short selling is risky even when it appears the equity is sliding over the 3 to 6 month time frame.

You have to remember many of the stock market investment research firms can be conservative themselves. It is likely the US economy will tank in 2023, and the S&P will slide further this winter, unless some new events intervene.

See more on the latest events and trends on the stock market approaching 2024 and next year’s housing market forecast.

More on the: Stock Market Forecast for 2024 | 2024 Outlook for US Equities | Oil Price Forecast for 2024 | Stock Market News Today | Stock Trading Platforms | Market Rally | Stock Trading | Lines of Credit | Reverse Mortgages | Low Mortgage Rates Today | Best Dow Jones Stocks | Best Stocks to Buy | Stock Market Today | US Stock Market Prediction | Stock Market Forecast | Stock Market News | US Housing Market Forecast | S&P 500 Forecast for 2024 | Dow Jones Forecast 2024 | Best Oil Stocks | Stock Market Today | US Stock Market Crash?