Buyers Backing out of Home Purchase Deals

HomeBuyers Backing out of Home Deals

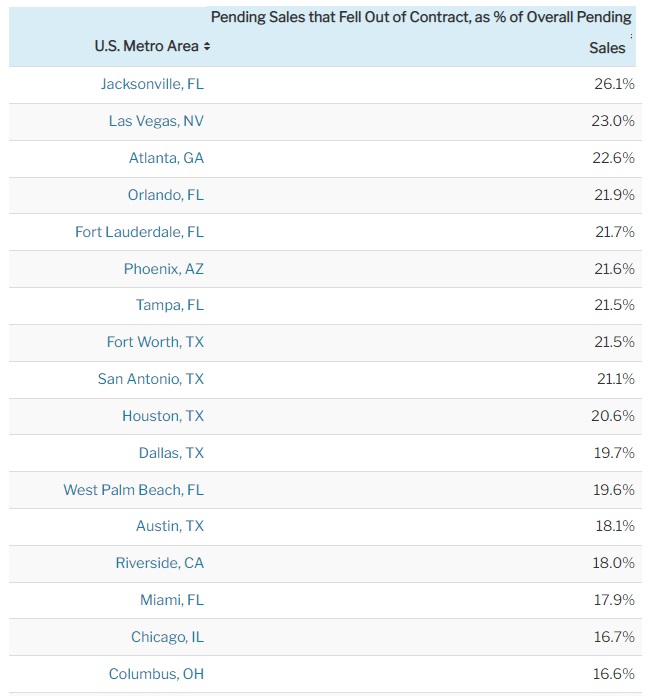

A new report by Real Estate Firm Redfin on August’s pending home sales stats shows buyers are backing out of deals in the US Sunbelt cities. In particular, Phoenix, Tampa and Las Vegas. Jacksonville Florida were cited as suffering the greatest increase in cancelled deals.

It comes as buyer traffic across the country is increasingly sitting on the sidelines, given rate hikes and economic outlooks, thus reduced buying traffic, reflecting the faster slide in demand and prices in some cities.

It shouldn’t come as a surprise that housing markets is cooling across the US. It’s just a question of which states and cities are seeing the fastest declines in deals and prices. It appears, according to Redfin’s housing report that Florida has the cities with the highest price growth, and are thus most likely to see a strong price drop this fall.

The recent hurricane that hit southwest Florida will likely show biggest declines in the October report as Florida Realtors head back to work in those cities. In many, cases the homes are severely damaged and buyers will be able to back out of pending deals.

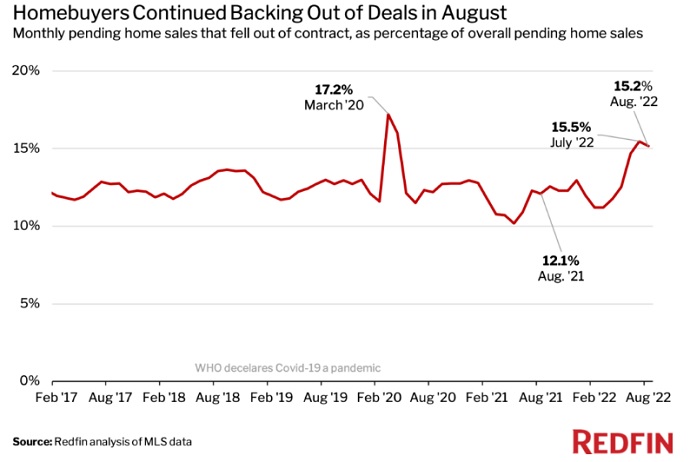

Buyers backed out of pending sales in contract at a 12% rate last year, while in August that has risen to 15%. In July it stood at 15.5%.

“House hunters today are taking their time and exploring their options, whereas six months ago, they had to act quickly and pull out every stop to compete because homes were selling almost immediately,” said Tzahi Arbeli, a Redfin real estate agent in Las Vegas — from Industryintell.com report.

Reports show those cities that grew during the pandemic are seeing the fastest declines in their sales transactions.

This trend of backing out of home purchase deals is due to several factors:

- buyers aren’t agreeing to contract contingencies which force them to continue with the purchase

- buyers can cancel for any reason or issue with the home (appraisal differences, inspections, financing)

- buyers back out due to the expectation that home prices are going to fall

- buyers back out because there is another house they want more

- mortgage rates are rising making financing an impossibility

- employment issues are of concern to buyers and to banks

Overall then, it’s becoming a buyers market and they’re able to be more patient and wait for a better opportunity. Owners on the other hand appear to be withdrawing homes from the housing market because they can’t get the price they want for their property. The challenge grows for real estate agents.

Mortgage rates are surging, with the 30-year fixed rate mortgage hitting 6.29% last week, the highest rate since 2008.

Buyers find that by the time they go under contract, their financial situation has changed dramatically.

This recent Redfin report shows buyers called off homes at the highest rate in Florida cities even though home inventories have been reduced. Jacksonville Florida (26.1%), Las Vegas (23%), Atlanta (22.6%), Orlando, Florida (21.9%), Fort Lauderdale, Florida (21.7%), Tampa, Florida (21.5%), San Antonio (21.1%), Dallas (19.7%) and Houston (20.6%), Miami (17.9%) and Austin Texas (18.1%). Seattle WA also saw a 10.3% fall, and Chicago fell (16.7%) and Boston had a 10.1% drop as well.

Hurricane Ian’s massive destruction will have a profound impact on Florida’s real estate market, and Naples, Punta Gorda, and Fort Myer’s housing market in particular will see a massive backing out of deals in the September/October stats.

See more on local housing markets in Denver, Dallas, Houston, San Antonio, Austin, Salt Lake City, Salt Lake City, and Los Angeles.

Real Estate Housing Market |Home Equity Line of Credit | Home Equity Rising | Reverse Mortgages | Housing Market | Housing Market 2023 | Housing Market Crash | Stock Market Predictions | California Housing Market | Florida Housing Market Forecast | Housing Market Predictions for Next 5 years | Dallas Housing Market | Atlanta Housing Market | Boston Housing Market