When Will It Be a Great Time to Buy a Home Again?

In September, prospective homebuyers once again sat on the sidelines, and even backed out of intended purchases.

The task for a good Realtor near you has never been greater, whether you’re selling or buying.

Stats from the latest housing market report show home prices sliding and closed sales falling. The Florida housing market and California housing market showed weakening in August, and the recent September reports aren’t much better.

Zillow September Housing Report

Zillows report says the home price moderation trend stopped in September. Prices are the same in September vs August.

Zillows report says the home price moderation trend stopped in September. Prices are the same in September vs August.

Here’s Zillow activity report highlights:

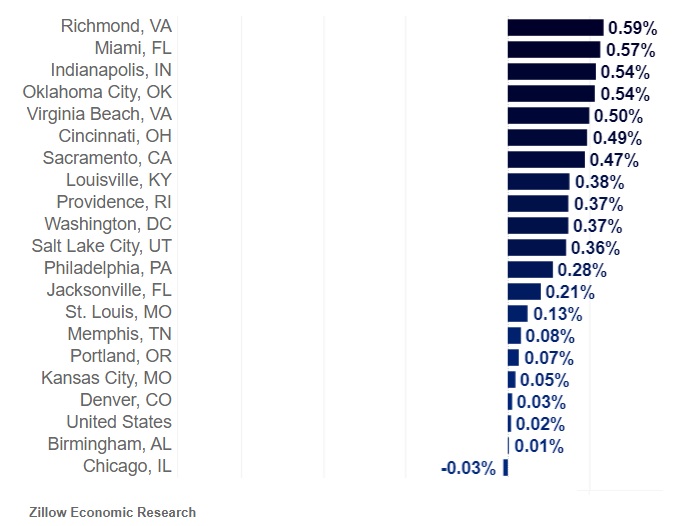

- Home values fell in formerly-hot markets, including Phoenix (-2.3%), Las Vegas (-1.9%), New Orleans (-1.0%), Riverside (-0.9%) and Austin (-0.9%)

- Active inventory rose 3% year over year

- new for-sale listings coming fell 16.2% year over year similar to August’s 16.5% decline.

- newly pending listings in September dropped a whopping 29.3% compared to last September

Despite this depressing news, buyers are still looking forward to 2023 and wondering when they will be able to buy. Yes, people want to own a home that bad and in a perfect world they should have their wish.

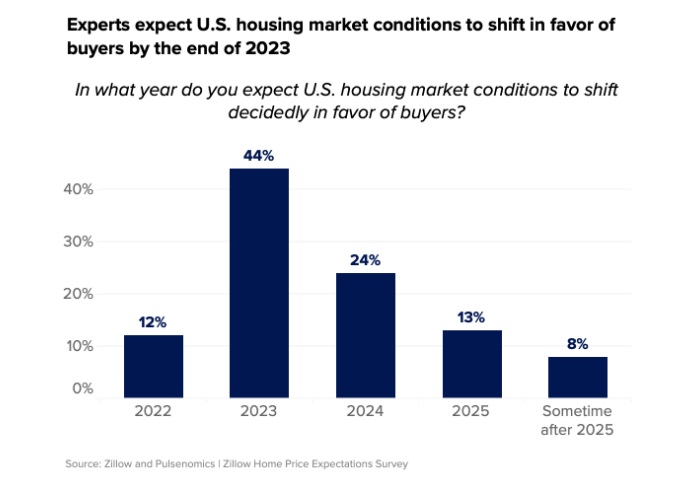

Zillow’s survey of housing market experts showed they believe 2023 will be a buyer’s market. So they’re of the belief the market is about to take a tumble — in price, and that sellers will be forced to sell. I’m not sure the proof for that assumption is in. Seller’s seem to be firmly affixed regardless of what buyers want or any economic trends.

It will take a talented Realtor with reach to sellers to persuade them to let go and sell.

Zillow’s panel expect home prices to fall fastest in Boise, Austin and Raleigh. Their panel believe rents will cool off in 2023, thus reducing pressure on some renters to consider buying.

Home Prices Are Still Extraordinarily High

A cooling economy, worse consumer sentiment, and rising mortgage rates are making home ownership nearly impossible for most. It might not get much better next year and even 2024 is a question mark. However, prices in some cities are trending downward. Depending on where you are, there is hope.

And sellers aren’t selling which means no seller leads for Realtors you’re hoping to work with. One year from now, perhaps owners will be in a position to sell, should mortgage rates tumble. They’ll wait until rates fall, so buyers can bid up home prices again. However, mortgage rates look like they’re rising right through 2023.

The Fannie Mae Home Purchase Sentiment Index® (HPSI) decreased 0.8 points in August to 62.0, its sixth consecutive monthly decline, as high home prices and elevated mortgage rates continue to weigh on consumer sentiment, particularly home-selling sentiment — from Fannie May report.

Rising Rates and Mortgages Make Buying Difficult

The cost of buying a home in 2022, and the difficulty of buying one increased as well. Today, US mortgage rates surged to a 16-year high of 6.75%, marking the 7th straight weekly increase.

Monthly mortgage payments have rocketed too, which means buyers from 6 months to one year ago, may find they’re having difficulty meeting payments. Anyone who needs to refinance is in for a shock which is refinance activity has plunged.

MBA’s index of applications to purchase a home plummeted 12.6% to 174.1, the lowest level since 2015, while the gauge of refinancing dropped 17.8% to a 22-year low — from Yahoo Finance Report.

The price of homes has only been receding slightly the last few months nationwide, while some jurisdictions continue to see rising prices. And this is all due to a lack of housing supply.

The situation is horrible for everyone involved since sellers can’t sell for technical, financial or other reasons such as a poorer selling price.

When Will it be a Buyer’s Market?

The matter of when it will become a buyer’s market with better prices and more supply depends on how the US economy progresses. The intent of the Fed is to induce a recession with higher interest rates to fight inflation. But the source of inflation is varied and intense. The battle will be lengthy and damaging.

For instance, OPEC+ cut oil production this week by a serious amount and experts feel this could raise oil prices to $100 a barrel and push gasoline and other fuel prices up. WTI Oil price hit $92 today, up $6. Energy is a big driver of inflation in food, housing, manufacturing, and transportation, so it will push up US inflation rates. That means continuous raises in the central lending rate, thus even higher mortgage rates.

So although housing prices may drop in 2023, mortgage costs will make purchasing impossible. The debt on a $300,000 to $500,000 home loan is mountainous. You could pay $200,000 to $300,000 more for the full long term loan repayment. Do you want a home that bad?

Few can afford to finance a home purchase in pricey cities such as Los Angeles, Miami, Boston, New York, Seattle, San Francisco, San Diego, Denver, Dallas, or Washington DC.

When will interest rates fall? Some experts suggested inflation could ease by mid 2024, while others say it will be done in 6 months. There are few published, publicly available data sources that show inflation will quit soon. Employment and wage data has been good so help is not coming from employment.

The stock market took a jump this week because investors felt the Fed will back down on rate rises, which is very unlikely. It’s the only inflation fighting tool they have, and with oil prices rising, and China opening up again, inflation is coming back.

What’s Preventing Us from Buying a Home Soon?

- persistent high house and condo prices

- ultra-limited supply of homes in the affordable price range

- high mortgage rates and monthly payments

- high down payment requirements

- stricter lending criteria — better credit ratings required

- persistent, strong demand/need to buy a home

- people don’t want to rent because they could be evicted anytime and they build no equity

- investor buyers are grabbing any homes coming available

- new home construction will plummet

- current construction is focused on the multifamily rental market

- high inflation means we’ll be living “house poor” if we buy

In August, we enjoyed a temporary lower mortgage rate and it not only spurred more loan applications and purchases, it even stimulated more home building and completions from the nation’s home builders. That ended, but the latent demand for homes remain.

This is why home prices can’t fall. When home prices fall, someone is able to purchase, with loads of cash, and will buy a house.

A lot of investors have plenty of cash after selling stocks and moving into US dollars. Those people may see real estate as a solid investment, if prices fall. There’s a lot to stop prices from falling.

This recession is artificially induced, and is to put out the fire caused by artificial stimulants called stimulus payments. The solution to inflation is to increase supply, to cut regulations and let the markets balance naturally. The current US government is ideologically opposed to expanding supply. They are focused on demand suppression. They will push with that until inflation comes well down from it’s 8% rate.

The mid term elections in November could be a turnaround point, if the Repubs win. It’s difficult to know how much influence they can have, however they could block any further recession inducing legislation introduced. It would be dead on arrival.

The President has a lot of power, however he might have to give up on the demand suppression agenda and begin to open up sources of supply, including a national program to build homes. With that, the Fed would likely give up on the rate hikes, which some suggest they’re going to pivot on shortly.

When this all blows over, will you be able to buy a home? Perhaps in 2024, you might have your first shot at buying again. If the Dems continue with their agenda, it could be 2025 before you’ll get the opportunity. And that is after the 2024 Presidential Election.

One thing for sure, 2022 and 2023 look to be bad years to buy a house, and most Americans won’t be able to buy.

Will the Housing Market Crash?

There’s a lot of speculation about a housing market crash and there are some experts who predict we’ll see up to a 30% drop in prices as the economy plunges. Americans who can buy a home have a lot of money, and they’ll have first dibs on properties as they come up for sale. Not many homeowners appear to be vulnerable to home foreclosure, even though the foreclosure rate is up strongly.

So there’s little to cause most homeowners to consider selling, especially as their home value falls. They’d rather hold onto their precious real estate asset to see if there’s a change in government and economy. Most can’t sell anyway because refinancing another home is impossible, and there’s nowhere to go. It’s a stalemate.

Overall, US homeowners are well fixed financially and their debt isn’t extreme. That contrasts with most Americans who rent and may be in dire straits in 2023. Those renters may lose their down payments and damage their credit ratings. The government’s actions will hurt them more, and yet be unable to change the spending habits of those who are well off.

It’s wise to plan ahead and prepare for opportunities in 2024, the first year that the Fed rate should fall.

Some of the most respected economists and stock market experts warn we’re in for a terrible time in 2023, the year of the recession. Given rising unemployment, dropping wages, and huge mortgage payments, few will be forking out big money when they can wait till 2024.

Reverse Mortgages | Home Equity Lines of Credit | Home Equity | Low Mortgage Rates Today | Best Dow Jones Stocks Low Mortgage Rates Today | Best Dow Jones StocksBuy a House | Sell my House | Real Estate Leads | Seller Real Estate Leads | 2024 Housing Market | Florida Housing Market | California Real Estate Market | Housing Market Crash | Toronto Housing Market | Housing Crisis | Housing Prices