Should I Buy a House Now or Wait?

With the US economy doing well, and amidst a record bull run in the stock market, buyers here are asking again whether they should launch efforts to buy a house. They’re also asking when is the best time to buy a house?

Young buyers in particular have a lot of dreams in their heads pressuring them to buy. It’s a matter of self-esteem, pride, financial responsibility, focus, and personal growth that push them to get a mortgage and purchase a house. The house is a symbol tied to getting on with their life.

The question of whether you should buy a house is unique to your situation. However, while it was smart to buy a house in 2010 to 2013, this is 2022 now. We’re up near the peak in the cycle and there’s people who want to push the recession button.

Let’s drop the academic look at house buying, and take a look at the real factors you have to weigh.

This Isn’t 2012

If you still have memories of the big profits enjoyed by those who bought back in 2010 to 2012 and enjoyed $300k profits, it’s not going to happen for you. Buying near the peak is risky with low potential for windfall profits. If you’re a home flipper or buying a house with a rental unit, you might do okay in some cities.

The answer to the question of whether you should buy a home or condo should come down to the price. Look at the price. Is that number something you can actually afford based on your income?

Forget about mortgage qualifying because your income could fall leaving vulnerable to bankruptcy. That’s a bad thing for your life. And what price can you qualify for a mortgage in Los Angeles, San Diego, Riverside, Sacramento, Phoenix, Las Vegas, Dallas, Houston, Miami, Denver, Toronto, Vancouver or Boston? The prices of detached houses can make you plain crazy.

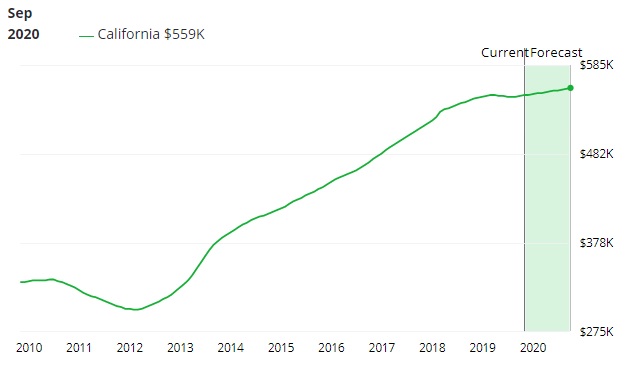

You might not live in California, but take a look at their “cool market.” Zillow says US home prices will rise another 1.7%. That’s a conservative zesstimate based on a current lull in the economy. The median California home price of $500k price still means a lofty mortgage amount. Many in Los Angeles dream of something that will never happen. They need to be strategic to buy a house.

Housing stats show most buyers can’t afford what’s available. It’s called the home buyer gap.

Forecasts for interest rates is that they’re expected to stay low for a long time, even without the recession the experts predicted. If interest rates do jump, a lot of people would default on their mortgages. So interest rates can’t be allowed to rise.

Sure President Trump is fighting to keep the Dems from crashing the economy. But what if he gets impeached and the Democrats with the 2020 election? What is Elizabeth Warren’s real intent?

The fate of President Trump is more worrisome than most consumers believe.

The 2022 Real Estate Market Outlook

Take a good look at the latest housing market forecast. It tells you home prices are high and rising, with supply dwindling. And it says American buyers dominate the market and their earnings are growing. That means home prices will only rise. Of course, your current rent will rise too.

The price really is the issue, not the mortgage payments. The question is whether that house you’re thinking of buying is really worth $400k to to $1 million. And if home construction picks up in the next few years and then a recession happens, you might save $100k by buying then.

Paying Rent Creates No Equity

However, if you’re paying $2000 in rent for another 4 years, that’s $120,000 down the drain. So even with high home sales prices, there is some justification for buying now.

If you do buy now, will the house you want be available? Desperate home buyers end up buying houses or condos that don’t suit their goals or lifestyle. Sometimes the property has issues and brings big unforeseen costs. Never rely on the home inspection company to get everything uncovered.

If you do buy, you may be living house poor. That means giving up other dreams, pressure on your marriage, having kids at the wrong time (kids are really expensive), and be handcuffed financially. If the roof needs to be repaired, you’re in for a shock.

In some ways, renting does mean keeping out of trouble.

The Real Cost of Renting

If you buy 60 to 90 miles out of town as many people in California (and Tampa, Miami, Boston, New York, Vancouver and Toronto up in Canada) do, you have that costly, grueling commute to contend with. Let’s face it, those people age fast. That house in the outskirts could wear you down.

Of course, there is no guarantee your landlord won’t give you notice. Many landlords do that after they get a big offer from a buyer. In an improving equity market, ownership changes hands frequently.

Buying would protect you from homelessness. And today, that is no small threat for renters.

Rents continue to raise at above 3% per year in most locales. Some are seeing outrageous rent rises which fuels the intent to buy. That pushes up home prices, perhaps creating a bubble. If the price bubble bursts, that would make some renters happy.

There are a lot of people who are wishing for a recession and they may be voting Democrat to get that done. They don’t care about prosperity. They want lower rents and a chance to buy a house. With layoffs, price pressures would drop definitely, but without sufficient supply of homes and minimal turnover in the market, buyers would still be frustrated. Maybe staying put with a rental isn’t so bad?

Construction Lags

The home construction industry is doing okay. But they’re not keeping up with demand. Experts said there is a need for 4 million new apartments in the US. That won’t happen for another 10 years.

The home construction industry is doing okay. But they’re not keeping up with demand. Experts said there is a need for 4 million new apartments in the US. That won’t happen for another 10 years.

The cause of the low construction numbers isn’t builder’s fault. It’s persistent government restrictions that prevent home and multifamily building.

If rules changes and land was freed up, that could definitely bring home prices down. But why would Billionaires and homeowners with mortgages be okay with that?

The financial world, including banks with their low margins would not appreciate asset depreciation. They’ve got to keep home and apartment building values high. Banks would love higher mortgage rates and will lobby to get them.

The residential building shortfall means home prices will continue upward. The stats bear that out. Only the severe great recession caused home prices to fall. And that was temporary.

When Will Homes Prices Fall?

Never. Well, they could drop 5% to 10% in a recession (not going to happen until 2025 with Trump). Worker and material shortages add to the construction costs and taxes won’t go away either. Job numbers have persisted even with the Trade war with China. The end of the trade war may push prices up another 10%.

So home prices likely aren’t going to fall. The question comes back to price. Is the pain of a mortgage payment worth it for the benefits you’ll receive?

If you find a great house in a good neighborhood near to where you work, the pain might be worth it. A 2 hour commute times 270 days a year worked per year times 5 years = 2500 hours of your time, plus transport costs is not fun.

Where could you buy safely? Try Florida. The Florida housing market is thriving, the economy is booming, and is set to really go forward if trade squabbles cease. Areas such as Tampa, Orlando, Sarasota, Panama City, Jacksonville, etc have low home prices. You can build cheaply there too for much less than $300k. The Miami Fort Lauderdale area is whole other story.

Check here for the best cities to buy and read up on which cities might be vulnerable to a housing crash.

When Will Home Prices fall? Not anytime soon!

See more on the outlook for the US real estate housing market for 2024/2025.