Housing Metros Likely to Crash

As the US moves toward the end of the Covid pandemic, flush with cash from stimulus bailouts and payments, it’s hard to imagine a risk for a housing market crash.

But it’s not right now, or even 2021 that is the real risk. It’s the pressure of a housing bubble getting more intense with out of control prices. That situation (mostly due to the stimulus money) combined with slow construction and very high demand for housing, pushes prices to ridiculous extremes.

At some point, the various governments are pressured to suppress demand, rather than increase supply. And when recessions meet high indebtedness, with rising mortgage rates, and a new round of unemployment, mortgage holders may panic and bail out of their “big debt” before prices fall too much. We shouldn’t forget the threat of panic selling.

It could play a roll in a stock market crash too. What do the academic experts say about a housing downtuun risk?

According to Susan Wachter and Benjamin Keys, the risk is not the same as the sub prime 2007 disaster. But listen to what they said:

“the primary mistake that fueled the housing bubble was the rush to lend money to homebuyers without regard for their ability to repay. As the mortgage finance market expanded, it attracted droves of new players with money to lend. “We had a trillion dollars more coming into the mortgage market in 2004, 2005 and 2006,” Wachter said. “That’s $3 trillion dollars going into mortgages that did not exist before. — from Wharton.edu’s study, The Real Causes — and Casualties — of the Housing Crisis.

Susan Wacter added that the investor group were much more involved in the crash, and that low income mortgagees weren’t the only reason. Those who were investing in 2nd and 3rd homes were a big factor.

Okay, and aren’t we getting hundreds of billions of stimulus money resulting in mortgages that never existed before in the last year? If rates rise, taxes go up, dollar falls, with massive government debt to service, and we have job losses, would mortgage holders try to bail out? If you thought a big crash might happen, and you could lose your job and savings, would you sell fast to beat the rush?

Home prices are expected to by up at least 20% more than 12 months ago. At some point, prices become too high, and with rising mortgage rates, and increased supply in the last half of 2021, and you have mild crash scenario.

Each state and metro has its own real estate, tax and business rules. Those who impose radical real estate rules could see an exodus. Tack on stricter work from home rules, cost of living increases, and local employment changes and certain cities have higher risk of a downturn.

Can the Current Manage the Massive Debt He’s Creating?

The stimulus payments ongoing will generate huge massive debt loads, and worsen trade deficits. Further to this, cryptocurrencies are rising and threatening the US dollar. If the USD loses its premium currency reputation, at the same time as Cryptocurrency becomes preferred, it could bring massive losses to US businesses and maybe collapse the US banks.

6 Characteristics of Cities Ready to Crash

- new higher unemployment rate

- cities dependent on tourism

- cities dependent on the oil industry

- cities with most recent new housing releases

- cities with higher foreclosure rates

Which Cities Are Most Likely to Collapse?

Two Cities rise to the top of the most likely scale: New York City, New Jersey, and Dallas. New York’s shutdown induced unemployment levels will continue for at least another month and only slowly come back to life. The cost of living in NYC is ridiculous due to a lack of housing. Mortgages and rent prices are sky high, yet if workers aren’t earning paychecks, how long will the stimulus money last?

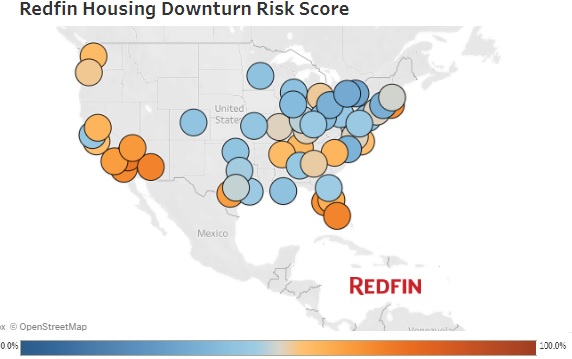

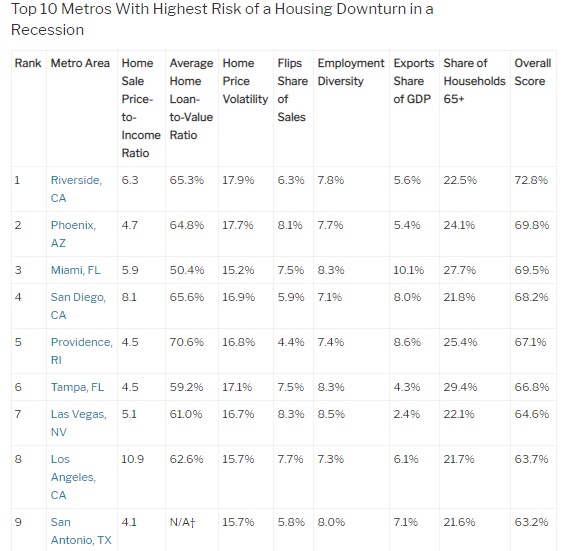

Redfin conducted calculations on US housing markets most likely to crash in 2019 before Covid 19. Now that the economy is coming alive again, those metros may return to near normal. The Dem’s bailout money will flow into a number of these highly indebted cities including New York, Chicago, Los Angeles, San Francisco, and others.

If there is an economic downturn for any unexpected reason, those cities would be in peril.

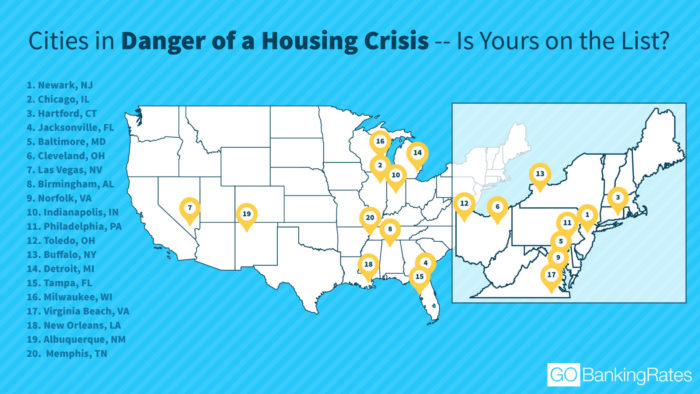

GoBankingRates Top Cities at Risk

Gobankingrates previously compiled a list of 50 cities most likely to crash. They include some general factors that highlight mortgage holder vulnerability. Of course, through a crisis, it depends on the Federal, State governments and the banks as to whether mortgagees are at risk.

GOBankingRates chose its top 50 housing markets, among the 500 largest U.S. cities. They used these statistical criteria along with Zillow and RealtyTrac data:

- percentage of homes having negative equity (underwater mortgages)

- city’s foreclosure rate (from RealtyTrac’s July 2019 index)

- average number of days on the market (DOM)

- % of current for-sale listings on Zillow

- one-year percentage change in median home listing price

- one-year change in median home listing price in dollars

- two-year % change in median home listing price

- two-year change in median home listing price in dollars

Of course that data is outdated.

Back in January 2021, Gobankingrates updated their cities with the greatest risk now. The risk has good similarities to the chart above, which tells you the risk is endemic, not an offshoot of the Covid housing crisis.

Of the cities, most at risk, are those that are most unpleasant to live in, suffer high tax rates, have high crime and cost of living, low wages, and a lack of housing, and decaying infrastructure. Gobanking’s rankings are debatable given how oil prices are rising. A rising in gasoline and energy prices will benefit Texas cities.

Keep in mind that list prices don’t tell the real story but rather the final selling price which is much higher than list in many cities. Here’s the list of top 10 cities at risk of a crash:

| City at Risk | Median Listing Price | Median Price 24 months ago | Foreclosure Rate |

Mortgage 90 days delinquent

|

| Hartford CT | $214,000 | $134,999 | 1 in 8758 | 1.2% |

| Pittsburgh PA | $235,000 | $180,000 | 1 in 5438 | 1.1% |

| Hampton VA | $219,000 | $175,000 | 1 in 55 98 | 1.1% |

| Clearwater FL | $295,000 | $199,999 | 1 in 6321 | 1.0% |

| Corpus Christi TX | $239,000 | $214,387 | 1 in 10,732 | 1.0% |

| Newwark NJ | $369,000 | $249,900 | 1 in 4226 | 1.1% |

| San Antonio TX | $244,400 | $215,000 | 1 in 8142 | 1.0% |

| Killeen TX | $180,000 | $149,900 | 1 in 10414 | 1.0% |

| Louisville KY | $200,000 | $170,000 | 1 in 3666 | .9% |

| Jacksonville FL | $229,900 | $199,000 | 1 in 4082 | .9% |

An Economy in Deep Flux

Current national economic trends and conflicts (China and Free Trade) have left some local economies weak. They are on the mend due to the Trump tariffs. However, there are many mechanisms the Demons and the US Senate could use to paralyze the President and create havoc. That could bring gridlock and unwittingly cause the whole house of cards to collapse instead. The Demons have less to lose with an economic collapse and may actually get more anti-trump votes out of it.

Big economic weakness + high prices + high inventory + big indebtedness equals highest likelihood to crash

Which Cities Will Have a Housing Crash First?

Which cities will collapse depends on mortgage holder status (underwater mortgage rates), homeowner debt to income ratios, employment levels, local population migration, price trends, new construction, and current delinquency rates.

See more data on all housing markets including Chicago, Atlanta, and New York on the US Housing update.

Housing Crash History and Timelines Might Not Help

Housing crash history might not help us much. After the last recession, some cities crashed hard, and despite the national recovery of the last 10 years, their home prices haven’t recovered. Some have problems with underwater mortgages, negative equity, and defaults as you can read below.

Now with US trade altered, the distribution of wealth among America’s cities has been changing. However, we have to consider which cities can actually benefit from the return of industry to the US.

Will cities such as Newark, Cleveland, Detroit, Chicago, Kansas, Baltimore, Pittsburgh, Philadelphia, Las Vegas, Jacksonville, and others be apart of the great American revival? Or are they doomed no matter what happens?

Which Cities Will Have their Bubble Burst?

Which states and cities will benefit or stagnate depends on additional factors including old debt, demographics, construction readiness, business investment, technology, geo-location, and state taxation levels.

Local economic health, current underwater mortgages and mortgage default data might help identify those markets which can’t tolerate economic downturns.

No one is sure which way the national housing market will go, and it’s even more uncertain at the local level. However, it looks as though the new economic and trade situation in the US is the driving factor behind which city housing markets will crash and which may just have a downturn. Old cities will need an extra lift from investment.

With China gone, which cities in the US will take over manufacturing glory and become insanely prosperous? And which will miss the boat again for another business cycle?

Here’s the City Level Crash Factors

- end of Free Trade dissolves markets for products manufactured/exported from specific US cities

- import tariffs mean companies in some cities will find American consumers/businesses suddenly buying their products (e.g., solar panels, computer chips, power tools, drill bits, mufflers, electric cars, steel products, agricultural products)

- we’re edging toward the tail end of the longest business cycle ever, which means demand for certain products may diminish beyond 2020

- specific cities have better younger and better educated demographics (age, experience, skill) supporting manufacturing and service businesses

- some cities are in bubble territory with mortgage holders who would bale out quick

The point to be made is that some cities really are more at risk. The cities of San Francisco and San Jose are cited by most likely to crash due to their Asian/International trade positioning, high housing prices, and how tech startups might vanish. However, in a fast rising Trump economy, Silicon Valley still has a huge US market to serve. And why would world markets end?

Old cities in New Mexico, Wisconsin, Idaho, Kentucky, Illinois, and Michigan are weak and vulnerable to the next recession.

A Powerful Economy Till 2020

Economic experts are predicting the obvious — a great economy till 2020. That’s not far away. Demand for housing is very strong, low mortgage rates continue, and American consumers are becoming wealthier.

So it’s a long shot to call a recession or general housing crash happening. Yet, some experts actually believe we’re at the end of a record business cycle (for corporations) and they predict that a crash is absolutely coming. We’ll see.

Big Bubbles Forming in Other World Cities

We’d be wise to keep an eye on bubbles in China and Australia’s major cities, and even up in Canada in Vancouver and Toronto. These markets are far more likely to crash. In China, Shanghai and Hong Kong are cities that could collapse if China’s easy exports suddenly ended with Europe and North America. Which US cities benefit most from the Asian markets (San Diego, San Francisco, Seattle) and would perhaps suffer from a China crash?

Will the Great American Revival Need Oxygen?

We’re only 2 years into the great American revival with Free Trade now in the rear view mirror. Any attempt to return to the old high debt/high deficit trade situation, would be disastrous. Capital flight is a big risk for cities with big debt and overpriced housing.

Will infrastructure money for many older cities such as Chicago, New York, Boston, Washington, Indianapolis, Atlanta, Newark, Baltimore, Philadelphia, Cleveland, Detroit, etc. be terminated? Does this make housing market crashes more likely?

Would the Ds try to turn back the clock if they returned to power? Or would they simply claim Trump’s successes as their own and carry on with what he was doing? The phrase political expedience might give the correct answer. Yet, it’s this political mess that’s the real danger at the end of 2020.

As laid out in the housing crash post, there’s a number of general and specific reasons why housing markets crash.

Miami, Chicago, New York, Las Vegas, Denver, Indianapolis, Minneapolis, and Seattle all have different dynamics and export markets. Given each city’s unique economy, housing affordability, pricing relative to average income, mortgage indebtedness, and home equity, it’s tough to forecast right now. But the picture will clarify by 2020.

City Most Likely to Have a Housing Crash? — Chicago, Illinois

Chicago seems to have been going the wrong way economically for some time. As with many rustbelt cities, there’s not much to protect Chicago regardless of which way the national economy goes. They seem to be the poster child for a double calamity.

High taxes and poor job growth made Chicago the last major market to recover from the previous recession. Prices have only risen 2.7% (national average 6.3%). Illinois has lost more residents than any other state.

During the 2008 to 2018 trade imbalance era, Chicago’s jobs were created mostly downtown and most of Chicago’s population growth has been from Mexicans. All in all, the metro area seems unattractive for high tech business.

If this is the most likely or only housing crash scenario, Miami, Detroit, Philadelphia, Cleveland, Minneapolis, Baltimore, Las Vegas, Denver, Atlanta and Orlando would likely see big declines too. Chicago had more underwater mortgages than any other city — 250,000 homes have mortgages higher than the homes are worth. That’s a whopping 16.6% of homeowners in metro Chicago. And 20% of them owe twice as much as their homes are worth!

What is the Outlook for Realtors in 2020?

The ups and downs of the stock market are not the same forces that drive the housing market. People don’t need stocks but they always require housing. The question for Realtors has to do with optimism about real estate and their own self-image as a high performer.

Agents who invest strategically in themselves and their market visibility will become market leaders. My services help to create awesome visibility, which I’ve done for so many big and small companies. The only limitations that exist are those that you put on yourself. Contact me to get your business to the next level.

Bookmark this page and return for further housing market forecasts, which may include 3 month forecasts, 6 month forecasts, 5 year predictions and 10 Year projections of housing sales and prices.

Find answers to your pressing investment questions including: Is the housing Market Going to Crash? and is a Stock Market Crash Ahead?

Home Equity Line of Credit | Home Equity Rising | Reverse Mortgages | Housing Market | 3 Month Stock Market Predictions | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ Forecast 2023 | Oil Price | S&P Predictions | Stocks Next Week | 6 Month Outlook | Stock Prediction Software