Homeowner Equity Rises

Homeowner Equity Looking Irresistible

Corelogic, a provider of premium housing sales statistics reports that in the 2nd quarter of this year, homeowners with mortgages (63% of all properties) watched their equity grow by 29.3% year over year.

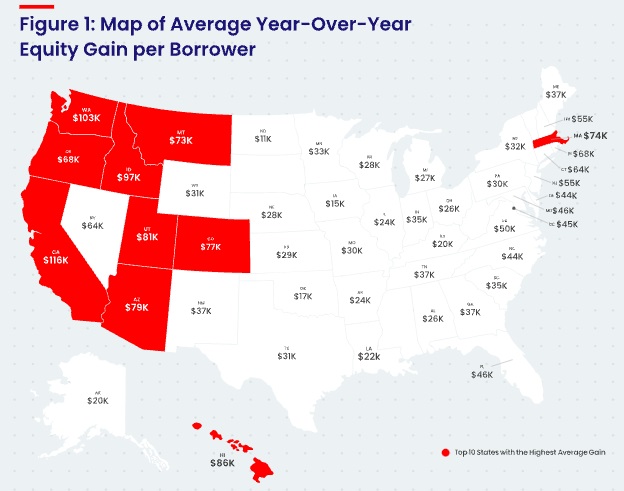

Collectively, in the nation, it was an equity gain of over $2.9 trillion, and an average gain of $51,500 per borrower, since the second quarter of 2020. In some cities the equity gain was much higher than the average of course. With housing prices increasing in the last half, this equity growth should grow consistently.

Miami, Chicago and New York real estate market came out the with the worst equity growth in that quarter. The graphic below shows which states enjoyed the biggest increases. California, Colorado, Utah, Massachusetts, Washington, Arizona and Montana came up big in year over year growth. Stats for Dallas, Austin, Tampa, and other high growth cities were not published.

Frank Martell, president and CEO of CoreLogic took a pragmatic perspective on the equity growth by adding: “The growth in homeowner equity provides a strong financial cushion for tens of millions Americans. For those most impacted by the pandemic, equity gains will help play a critical role in staving off foreclosure.”

Corelogic also expects a reduced number of mortgage holders underwater. This would reduce the potential for foreclosures this year. In the 2nd quarter of 2020, 1.8 million homes, or 3.3% of all mortgaged properties, were in negative equity. That amount fell 30%, or 520,000 properties, during the second quarter of 2021 to $268 Billion.

If US home prices were to decline by 5%, 211,000 mortgagees would fall underwater. If mortgage rates were to rise a couple of percent, when these mortgagees were to refinance, it would result in default risk and likely foreclosure perhaps by 2023.

Screenshot courtesy of Corelogic.

Stocks vs Real Estate

Investors have a mind to build equity whether in stocks, bonds, or commodities, yet lets not forget real estate. If you compare stock investment vs real estate investment, you discover housing is not as volatile and is easier to borrow against. And rental income and tax breaks are big incentives for investors.

This is one more reason why home prices are so high. Investors see a form of equity that is solid, reliable and may be recession proof. Depending on your stock market forecast, stocks may be a risky investment as the bull run begins to peak and P/E ratios and earnings struggle.

Since most condo and house buyers today are looking for a home to live in, they forget how wonderful real estate is as a retirement asset. The big trend to building income suites makes buying some homes a truly productive investment vehicle. See more on the stock market forecast for the next 6 months.

Real Estate Housing Market | Home Equity Rising | Reverse Mortgages | Housing Market | 3 to 6 month Market Outlook | Stock Market Tomorrow | Housing Market 2023 | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ Forecast 2023 | S&P Predictions | Backyard Offices | Realtor Marketing