Cheaper Mortgage Rates

What’s the immediate forecast for mortgage rates? Lower and perhaps even lower. If you’re buying a home or condo in 2018/2019, you’ll want to buy your mortgage in the next 6 months.

The economy is improving and mortgage rates will rise. Shopping online means time saved, no sore feet, no parking hassles or traffic stress, nor gasoline prices to fret over, better prices, and infinite selection makes shopping online compelling.

Shopping for a cheaper mortgage should be that way too.

Instead of accepting your own bank’s tired high interest offering, you’ll enjoy saving thousands by shopping online for a lower mortgage rate.

Instead of accepting your own bank’s tired high interest offering, you’ll enjoy saving thousands by shopping online for a lower mortgage rate.

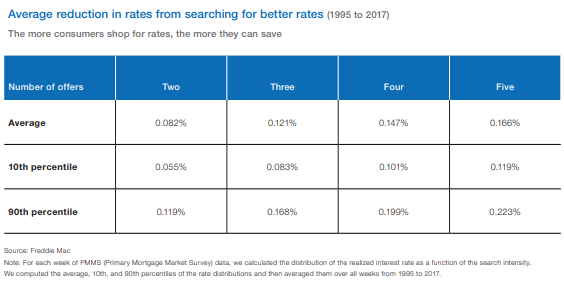

Surprising and proven savings of 5 to 22 points translates to an average savings of $2,914

Mortgage Rates are Rising

Yes, they will grow by the week, but that doesn’t mean you can’t break free of the rising costs, by switching mortgage companies and locking in at a guaranteed rate that will save you thousands.

| Type of Mortgage | Interest Rate | Weekly Rate of Change | Advantage |

| 30-Year Fixed Rate Mortgage | 3.79 % | 0.02 % | Fixed rate for the life of a loan |

| 20-Year Fixed Rate Mortgage | 3.83 % | 0.06 % | Fixed rate for the life of a loan |

| 15-Year Fixed Rate Mortgage | 3.81 % | 0.02 % | Fixed rate for the life of a loan |

| 10-Year Fixed Rate Mortgage | 3.62 % | 0.08 % | Fixed rate for the life of a loan |

| 7/1 ARM Mortgage | 3.51 % | 0.09 % | Fixed rate for 7 years, then raised thereafter |

| 5/1 ARM Mortgage | 3.84 % | 0.04 % | Fixed rate for 5 years, then raised thereafter |

| 3/1 ARM Mortgage | 3.72 % | 0.04 % | Fixed rate for 3 years, then raised thereafter |

Better terms, lower monthly payments and lower fixed fees will make this process an even more palatable one for you.

As you’ll find out below, when homeowners search for a better rate, they generally get a lower mortgage rate quote of an astonishing 5 to 22 points! And that translates to an average savings of $2,914 if the borrower receives 5 mortgage rate quotes. On a 30 year 5% mortgage rate on a $500,000 home loan, the savings are even bigger. By Shopping around yu ensure you don’t get sold a product you don’t really need.

With the experts forecasting lower mortgage rates, shopping for mortgages with lower broker or financing fees gives you even more justification for shopping around online. You’re on your computer or mobile phone! Fight back against the banks high rates by shopping right now.

You can ask about terms, rates benefits, and anything you don’t understand with those offering up a mortgage quote. Shopping online takes a lot of the friction, uncertainty, and effort out of getting the best mortgage possible.

Fixed Rates, HELOCs, Savings, and Debt Refinance

This summer, everyone’s thinking mortgage quotes because rates are rising. This rise will affect your mortgage approval, home refinancing rates, Heloc application, debt refinancing, and much more.

The banks are becoming more rejecting so it’s time to widen your search using all channels, including mortgage brokers. The Freddie Mac survey shows us the value is there. And you don’t want to wait for nasty surprises that could see you lose your home.

“Won’t my bank give me the lowest rate possible?” Why would they give you a rock bottom rate if you’re going to renew without asking? They’d be cutting their own big profits.

Questions: Does shopping around actually create a significant difference?

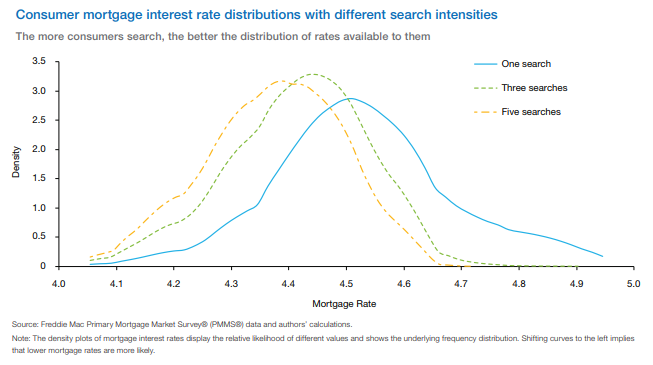

In these graphics courtesy of Freddie Mac’s recent mortgage shopping report, buyers saved at least 10 points on average (orange and green dotted lines) and some as much as 22 points. The more questioning and persistent you are, the further the savings you generate.

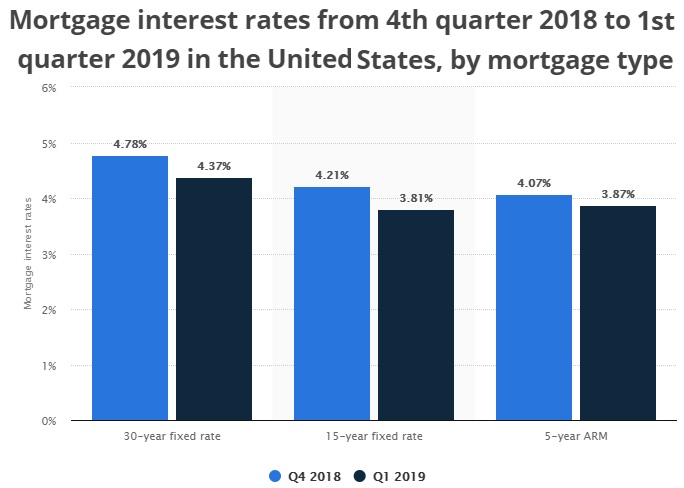

Rising Mortgage Rates in the US

In the US, rising mortgage rates werre a concern. Mortgage applications had dropped for a 4th straight time since March whic weighed down the US housing market. Now with a continuous lower mortgage rate forecast, buyers and refinancers are enjoying a break.

Tighter lending, bank reluctance, and higher rates will mean refinancing your mortgage will cost hundreds to thousands more in 2020. How many days does it take you to earn that money?

Cost of living is about to rise. With inflation on the upswing, flat home prices, and gasoline and oil prices being forecast to rocket, the next year could bring pain and stress for many homeowners who need to refinance.

The big banks have owned the mortgage market since 2008, but Freddie Mac is supporting non-banks who are providing mortgage related financing to more consumers. Quicken Loans, Freedom Mortgage, LoanDepot, and Caliber Home Loans are just a few of the other new online mortgage loan providers competing for your business now. There are many more in addition to brokers and banks.

Mortgage Rate Quote Tips:

⦁ research rates and know what is actually a good mortgage rate before you accept

⦁ get quotes from at least 5 different mortgage brokers or online providers

⦁ ask about special quotes for certain occupations

⦁ do maximize your down payment amount

⦁ lock in at fixed rates for at least 10 years

⦁ ask how much in interest you’ll be paying for the life of the home loan

⦁ ask for special benefits such as payment holidays

⦁ renegotiate in spring when more lenders are cutting rates to win business

Canadians are Facing Record Mortgage Refinancing Levels

In Canada, around 47% of all existing mortgages will need to be refinanced this year, according to CIBC estimates. And that’s up from the 25 to 35% range in a normal year. Canadians will be in a rush to capture better financing and they’ll likely be switching mortgage lenders to get it.

Dominion Lending (dominionlending.ca) for instance is seeing big growth but they’re also rejecting more mortgage applications.

Rising interest rates and tighter lending regulations in Canada combine with very high consumer debt levels, making it tougher for Canadians to qualify for and get mortgage refinancing they can afford.

US Mortgage Rates Falling

The Fed was on a rising rate binge for Donald Trump’s first 3 years in office, after zero rates for Barack Obama. Fed Chair Jay Powell, believes hard in a recession, yet wants to keep the rates up. At least home buyers and mortgage refinancers can enjoy slightly lower rates than 3 years ago.

Any rise in rates right now however creates a significantly higher monthly payment. Check the mortgage rate calculator to see how much your monthly payments will rise when rates go up a further 1%.

Mortgage Rate History – St Louis Fed

If we look at this graphic below, we can see how far up mortgage rates could rise again. The small increases in mortgage rates right now seem cheap in comparison with the early 1980’s. However today’s home prices are significantly higher and wages are lower in comparison.

The mortgage rate forecast is for lower rates. Homeowners in New York, San Francisco, San Diego, Los Angeles, San Jose, Seattle, and Denver stand to save a lot of money by refinancing.

The Secondary Mortgage Market and Brokers

You shouldn’t be accepting your banks offer without looking at what the secondary financing market can offer. A savings of a couple of points on a 5 year fixed term or a 30 year fixed rate loan is nothing to sneeze at.

Checking a mortgage broker in your city is just plain wise and there are many advertising online. You’ll have access to better mortgage benefits and find a lower mortgage rate.

It’s All About Finding a Lowest Mortgage Rate

If money is a commodity and there’s plenty of mortgage lenders, then it’s all about finding the lowest mortgage rate quote. Of course, those rates won’t just jump out at you. You’re going to have to do some searching for a better quote online.

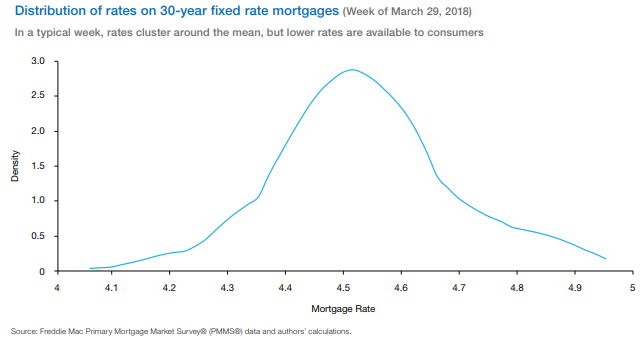

According to Freddie Mac, borrowers received rate quotes ranging from 4.2% to 4.8%. That’s way a patient search process is vital for you to get the best deal.

Good Luck with Your low rate mortgage search. Bookmark this page because it will be updated with more news on mortgage rate savings!

See more on current mortgage rates and what’s driving the real estate housing market as we approach 2024.