AMD’s Silent Crisis

We’ve passed the big Nvidia big promo conference event which really helped stabilize support for the AI technology leader.

Their chips and systems are hailed as the market leader, the standard for AI systems being built today. Investors believe it and are pouring money into the company’s stocks to give it a Magnificent 7 cap value of $2.8 Trillion. It wasn’t really about the latest GPU they’re showcasing, it’s to showcase their market leadership.

The NVIDIA conference event says “we’re the number one dominant brand in the AI chip space” and there’s no reason to buy from anyone else including AMD.”

That event serves to give the media lots to talk about with material for their news stories and gives a focus for big advertising and PR benefits. The event too, brings top buyers and influencers together for an immersive experience in the leading edge of AI computing. This means Nvidia gets to shape everyone’s belief about where AI is and where it’s going.

Market Leadership Trumps Everything Else

Leadership can’t be taken for granted and Nvidia’s marketing team knows it. Copycats will be duplicating everything Nvidia is, has and can offer. Nvidia is seeing mounting attacks on all fronts from Intel, AMD, Broadcom and even consumer companies including Apple, Facebook, and Google.

Leading companies can’t abandon marketing at any time. Because when they do, competitors pick up speed and leave them in the dust. These quiet, missing periods are key times when competitors can pick up market presence, building brand, traffic and leads. When golden opportunities are handed to you, you should capitalize on them.

Nvidia’s magnificent 7 competitors have massive reach to audiences including B2B enterprise buyers and consumers looking for AI smartphones and laptops. They have the lead with their protected audiences in providing AI-powered services and revenue streams. They like the AI services market, which means AMD is in for a tough journey.

Nvidia’s tackling that competitive threat. The conference probably wasn’t even needed, other than to try to put a nail in everyone else’s coffin.

For AMD however, there are stories on investment websites about even more severe corrections for AMD stock, some technical explanations from the history of that stock. It’s probably bunk, yet in these quiet, scary times, negative sentiment, rumor and data can all work to destroy a stock’s value. Going back to $120 is a devastating thing for current investors, who will not return.

16% Drop in Stock Value

Here, courtesy of Google Finance, we see the stock has lost 16% of its value in the last month. So all of the most enthusiastic investors jumped on their bandwagon, only to get a good kick in the pants. Losses like this do have lasting memories and will affect the company going forward. Being the laughing stock of the stock market is not a good brand experience.

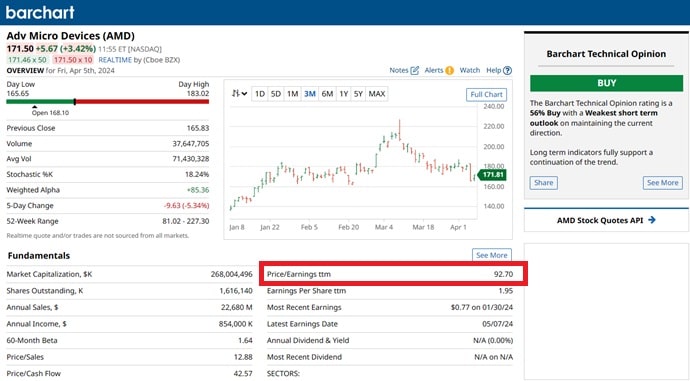

And AMD’s numbers don’t look good either:

- Total revenue: $22.68B (1Y), $6.17B (Q4) fell 3.9% since last year but grew 6.34% since last quarter.

- Net income: $854.00M (1Y), $667.00M (Q4) fell 35.3% since last year but held steady since last quarter.

- Earnings per share: $0.53 (1Y), $0.41 (Q4) fell 37.46% since last year and held flat since last quarter

- P/E ratio sits at a whopping 92!

These bad numbers need some defense, otherwise it looks like they’re accepting the view that this company is grossly underperforming and will keep doing so while Nvidia dominates. Making bold claims that AMD can eat Nvidia’s services side lunch seems questionable right now. And now the AI-powered smartphone/PC market domination claim seems questionable too. Their marketing and PR teams have to rescue them.

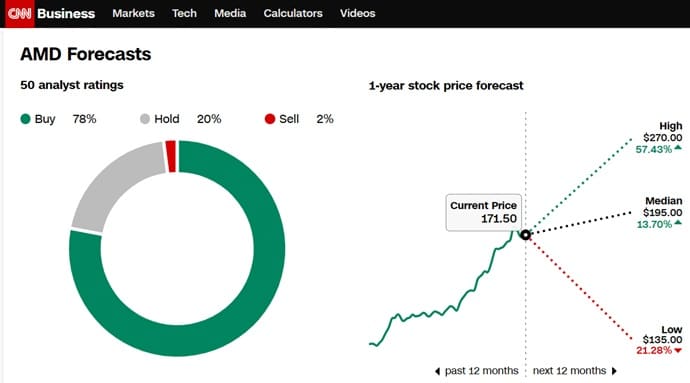

Incredibly, I still like AMD and believe it can and will surmount its obvious weaknesses and evolve as a manufacturer, software provider, and marketing force. However, it will need more euphoria.

AMD Stock Sinking With No Attempt to Revive

Nvidia’s stock has held its value, but AMD stock price has fallen. It’s down more than the others which means serious investors are full of doubts about the company’s management. Before they all get canned, they should push the reset button and become a marketing-first company. Allowing the company’s brand to be blown around by winds created by Nvidia is not wise.

Investors must be persuaded, and consumers too are lead by what tech experts say about AMD. That voice has to be enthusiastic, confident and trained to support AMD’s brand and stock value.

The silence during this dropping price phase is unsettling for AMD stockholders. And many are getting out of AMD stock. The recent announcement by China that AMD chips are being banned there, doesn’t help.

How Can AMD Turn it Around?

- get focused about the real value proposition for its products

- focus on key markets if that’s where they say the action is (AI-powered laptops)

- get serious about the overall marketing and brand awareness drive

- target and reach influencers/journalists/bloggers in the AI space

- increase advertising and promotion

- don’t rely on the benevolence of brand fans and instead give them the material they need to promote the company (free content)

- de-emphasize “here’s our stuff” communications for “here’s how we’re great” content

- talk about revenue/profit picture and don’t let detractors/competitors shape AMD’s outlook

- work with key AI technology influencers to showcase AMDs technology and popularity

- work with gaming community to promote AMDs amazing gaming products

- use advanced web/social analytics software to monitor key metrics such as website traffic, conversion rates, engagement, and customer acquisition costs.

Marketing Failure Will Hurt Long-Term Confidence

Failing at marketing loses a company’s fan base including influencers, experts, analysts, buyers and current customers. It’s an insidious downward spiral process that AMD’s marketing director should understand.

Lisa Su did an incredible job of taking this company from the bottom 15 years ago and building tremendous product and sales successes. However, she’s not a marketer or promoter. And that’s a big problem. Her lack of panache and believability as a star-level promoter (see Elon Musk, Steve Jobs, Richard Branson) makes the company invisible and forgettable. It’s completely dependent on its sales development team who are fully dependent on technical product superiority, which it doesn’t have.

AMD competes directly with Nvidia which pretty well lines it up for a daily beating in the media. So when Lisa Su positions it on technical superiority or niche markets (AI laptops) and up against the mighty Nvidia, it pales, and investors sell the stock. Is her silence a showing of calm confidence, frozen in fear, or a just a lack of confidence in their current marketing and communications strategy?

This long-run downward of late (-15% from the high) after the AI euphoria peak in March might not stop anytime soon.

Right now with rate cuts off the table, Americans are losing confidence in the 2024 economy. And that is certain to dampen development of AI systems and products. High-interest rates hurt because chip development and systems require a lot of capital.

However, experts point out that we’re in the early innings of AI ball game and of course these companies including AMD will come back. At some AMD’s stock will soar and then I and many others can cash out.

AMD hasn’t shown me that they can be a market leader, only a follower behind Nvidia. And with mounting competition of strong marketing competitors, AMDs going to have their small marketshare challenged.

The point I’d like to make is that marketing and branding are powerful business tools. Value is perceived value. Nvidia’s strength built via market leadership drowns everyone else out. If you’re invisible, not in the news, and actively promoting your chip’s strengths and market niche leadership, your brand dies.

AMD has a weak marketing effort and it does affect the stock price, brand value, and future sales revenue.

They can turn it around with a more substantial paid social media and Google paid click and remarketing campaign. They connect with and reach journalists, bloggers and industry analysts via Linkedin with remarketing campaigns. They can creative useful, credible and authoritative content on their website and in content marketing using expert SEO strategy combined with visuals that show they are competitive with Nvidia, and ahead of Intel, Broadcom, and the rest of the AI wannabees.

In this case, authoritative online content does have an impact on investors and brand ambassadors.

Let’s not forget that AMD has let down their followers and fans. We’re all disappointed in AMD’s leadership right now. It’s time for them to turn it around.

See more on the 3 month, 6 month, and current stock market forecasts.