Are Housing Prices Heading Down?

Housing Prices Dropping Nationwide

Everyone knows home prices and condo prices are falling right now, but no one is reporting data on the rapid decline. One recent unofficial report was a 10% decline recently, but that’s before the state of emergency.

The Corona Virus Pandemic was sudden and it’s beginning to take its toll on the housing market forecast. Governments are declaring states of emergency, enforcing stay at home isolation, and offering bailouts to some failing companies. With no buyers, home prices will be falling yet a lack of availability will soften the landing through the next few months.

As the stock markets crash, unemployment begins to climb, spending drops, and buyers give up on the home buying season, we can expect horrible sales results for March and April. If you’re locked in your home, it stands to reason few sales will be happening for the next 3 weeks.

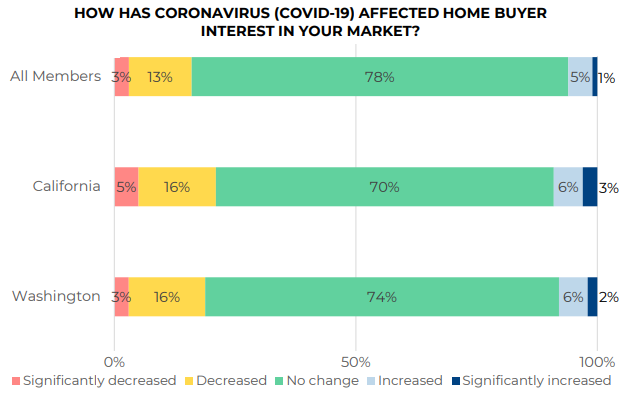

NAR declined to conduct a homebuyer sentiment flash survey, but did carry out one regarding consumer sentiment on the economy and member Realtor self-reports.

“Though mortgage rates will remain supportive to housing, COVID-19 will likely take a heavy toll,” — Ryan Sweet, a senior economist at Moody’s Analytics. from Reuters news release.

Some are beginning to forecast the housing markets will crash as buyers worry about their employment outlook. Mortgage refinancing dropped 8% last week while new home mortgages dropped only 1%.

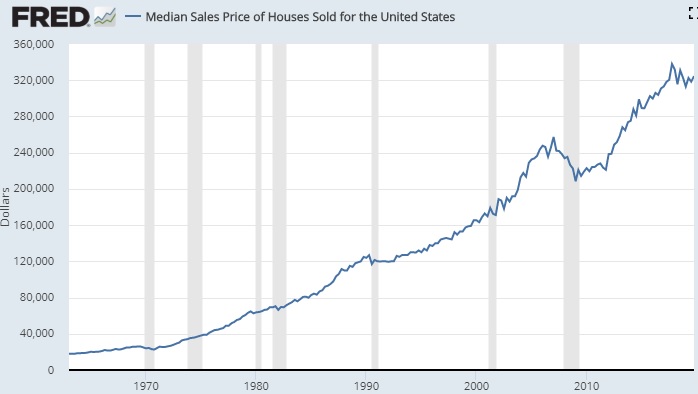

Real Estate Values Have a Steady Inclining Value Over Time

Steady upward prices tells you real estate is a solid investment and a hedge against nasty downturns, inflation, and crashing stock markets.

If you’ve looked at past housing market downturns, real estate values didn’t drop much. Given the lack of housing available and high demand from a large buyer base, how could prices stay down long? New construction was strong but is already taking a nose dive, and that will put more price pressure on available housing stock.

“The U.S. housing market has weathered all recessions since 1980, with the exception of the Great Recession.” — from First American.

California Housing Market

In high priced California, the toll may be highest. California home prices are set for a big drop this spring. Oddly, this is the moment some of my readers say they were hoping for. I hope they’ve saved for their down payment.

For Realtors and anyone else involved in the real estate or property industry, it’s important to begin planning for your businesses survival. More than a few economists believe we’ll come out of this shutdown period fine. The pandemic will pass, and governments will begin stimulus to bring the economy back to life.

The alternative would be to cut back and watch the housing and stock markets collapse for years. So while it took a while for the financial crisis to resolve, today’s economies don’t have the same circumstances.

70 percent of U.S. economic growth is driven by domestic consumer spending. If the outlook for the domestic consumer remains strong, then the risk of recession is reduced — First American.

Why the Housing Market Will Come Back

The US housing market is based on consumer power and these recent factors give them strength:

- high employment rate

- businesses alive and up and running

- low oil and energy prices

- low mortgage rates

- high savings rates

- prices will fall

So US consumers are sitting pretty, as long as this recession doesn’t go past July. That’s when the funds would get tight and outlooks would change. If this happens, home prices would fall drastically.

Typically, in bail out situations, workers themselves get very little help, although President Trump is offering extended unemployment benefits to some. Those who were ready to buy will find lower priced homes, lower down payments, low low mortgage rates, and friendlier buying rules.

Of mortgage seekers may have to shop around for lower mortgage rates as the big banks behave like sharks.

So the housing markets in Dallas, New York, Boston, Chicago, Atlanta, Miami, Los Angeles, San Diego, Tampa, San Francisco and Denver will look different in April.

We’re not at the end of the Corona Virus Pandemic, but consumers lives and home buying ambitions will return to normal by summer. One or two quarters of disaster isn’t enough to take down the bull markets. Most experts believe 2021 will be the year the US economy really takes off again.

6 month Stock Market Outlook | Stock Market Tomorrow | Housing Market 2023 | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ Forecast 2023 | S&P Predictions | Stocks Next Week | Stock Prediction