Home Features Buyers Want

House Features Most Wanted Today

What are buyers wanting in their next home this year? It’s an interesting mix of features, yet are these features you’d be willing to upgrade for to sell your home at a higher price?

NAHB conducted a survey of new home buyers about what they were looking for in a home. If you’re a Realtor or a a homeowner putting your house up for sale, it’s important to consider closely what buyers want and what they consider premium, desired improvements. Value is being interpreted differently this year.

The report didn’t ask respondents what they believed the desired features are worth to them. But we can be sure that if buyers have a list of most desired features, there is an associated price tag they’d be okay paying. Below you’ll find a list of upgrades, their cost and the stated amount that was recovered or how much the home value was raised.

According to the study, few home improvements improve home value, yet that conflicts with the profit levels that house flippers earn on a renovated property. Further, many homes are not saleable unless they are upgraded. Estimated price for the reno may not really describe the real value, when for some buyers, the feature desired must absolutely be present in the home (swimming pool, 3 bedrooms, gas heating, A/C unit).

The Psychology of Home Buying

The psychology of it is that the house’s value falls severely if the desired features aren’t present. For example, how many buyers want to gamble on a house for sale if they must replace the HVAC system themselves, or if there’s no room for a swimming pool. The unknown cost to upgrade is a factor in a buying decision.

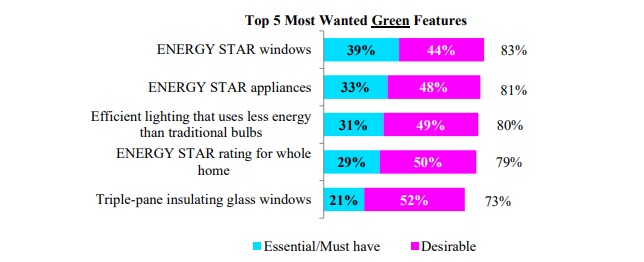

For instance, efficient A/C and insulation might be a higher priority in states such as California, Hawaii, New Mexico, Arizona, Texas, Louisiana, Florida and Georgia. The cost of electricity is a big concern to many homeowners, particularly those in Hawaii and New York who have the highest rates. California’s rates came at 43rd in cost, but as we know Californians can’t always rely on electrical supply.

The average price people in the U.S. pay for electricity is about 12 cents per kilowatt-hour. (Context: A typical U.S. household uses about 908 kWh a month of electricity. — from NPR.

What Home Buyers Want in their Next House

Yes, the housing market is changing in many ways, and what people would not pay for in past years, might be in demand in 2021/2022. For home builders and home sellers, knowing what buyers want in a home purchase is vital for positioning the marketing of their home for sale.

Builders are keen on knowing new home buyer profiles and understanding their motivations and needs and they are driven primarily by their own marketing research. Resale home sellers hoping to get the best price for their home and for Realtors marketing homes for sale, you can never know enough about buyer preferences.

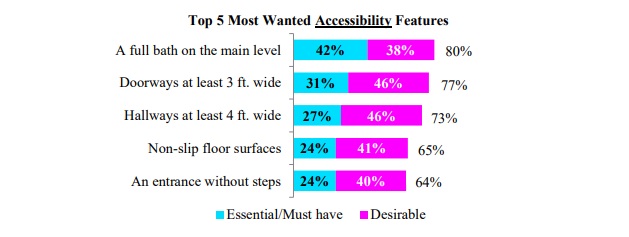

NAHB recently conducted a study of new home buyers and it seems the more esoteric features and benefits (non slip floors and wider doors) are more important to them. With the exception of a laundry room, rather than the real core, essential reasons why people need housing.

What this may tell us is that new home builders focus on buyer dreams instead of the functional benefits. That can tell us that any home buyer’s preferences can be repositioned for in marketing to communicate persuasively these benefits.

Few of the buyers surveyed asked for trees, swimming pools, or outdoor decks, but they did cite open designs, more space, and more bedrooms. House flippers and rehabbers would be well advised to try to achieve these values in their properties to attract a much bigger crowd. 2020 has made buyers want more from their homes because they now see it as a private haven where they can still grow, thrive, socialize, learn, and work from. Homes have to serve these needs to modern buyers.

Interestingly the study found 67% of home buyers in the study report the pandemic has not impacted what they want in a home or a community. That’s a strange response when we know home prices have increased more outside of urban areas and that a record number of buyers are looking in rural towns for a new home.

43% of work from home people claimed the pandemic has changed their preferences. Households with more people such as students, and grand parents want larger homes. The data seems to suggest for most buyers, it’s the status quo, but for others, the pandemic has driven desire for change, and these buyers may be the group who are willing to pay much higher prices.

Most home buyers are hoping to buy a single-family detached house (67%), and 60% would prefer to buy a newly built house over a resale home. New single-family detached homes are the desired prize for most buyers.

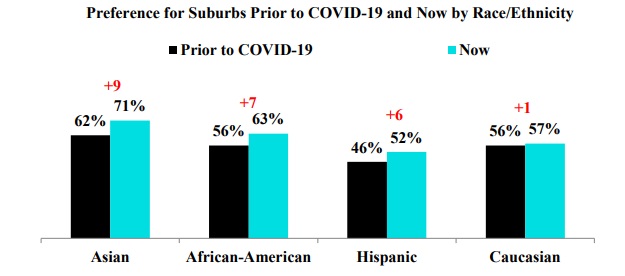

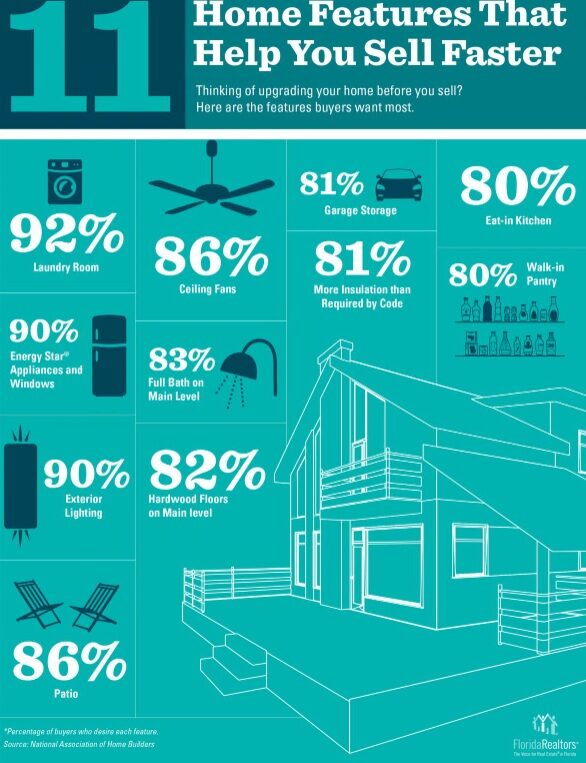

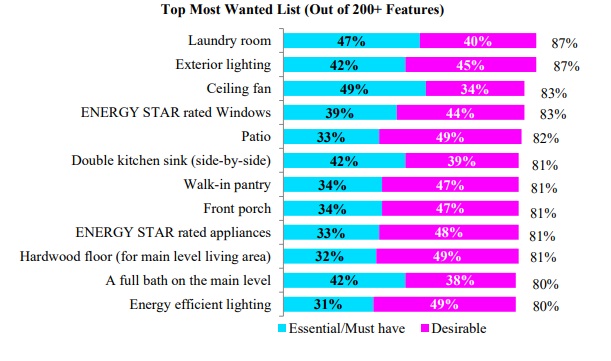

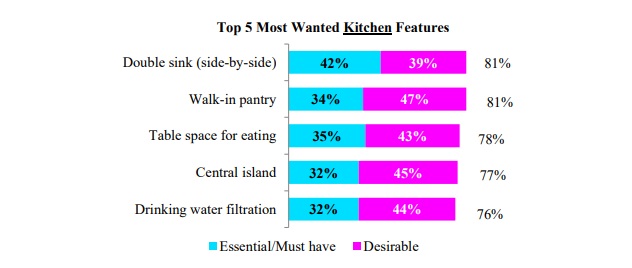

According to the report as depicted below in the infographic produced by Florida Realtors, laundry rooms are the most desired feature. As expected, the Covid 19 pandemic has altered preferences in that buyers want larger homes with more space for living, studying, and working. More buyers want to live outside cities in the suburbs. Asian buyers are even more interested in suburban living rising 9 points to 71% of those responding in the home buying survey. Outdoor features are strongly wanted including exterior lighting, patio, front porch, rear porch, and a deck – cited by 75% or more of home buyers.

Home health and security were top of mind too, with buyers wanting thick, high MERV air filters, a programmable thermostat, security cameras, video doorbell, and a wireless home security system.

Buyers cite as essential, laundry room, a dining room, a great room, a home office, and a separate living room. 85% want an open arrangement between the kitchen and the dining room. 47% of married couples with children want at least four bedrooms, compared to only 13% of one-person households.

House buyers prefer those with 2 bathrooms (37%) while 21% prefer 2.5 baths, and 26% want three or more bathrooms. Only 17% are looking for fewer than 2 bathrooms.

With respect to energy usage, just over half of buyers want electrical heating while 33% prefer to do it with gas. The reverse is true for homebuyers who like cooking with 51% prefer to cook with gas and 39% with electricity. With respect to heating water, buyers are split between water heating at 45% and 40% electrical water heaters.

Buyers expect to pay (or recently paid) a median of $264,634 for a home and they’d like a a house with a median of 2,022 square feet of finished space, about 8% more than the 1,877 they occupy now.

The key message in buyer’s wants is that resellers can integrate some of these features in any renovation they might do to really elevate the home’s value and appeal, then promote the most salient features of the resale home to get a much higher price.

So, rather than sell your house as is, you could put into another category of desirability through intelligent upgrades. Sure homebuyers have preferences, but most do not want to renovate at a time when renovation contactors are few and are expensive.

Kiplinger rated these upgrades and applied an associated recovered value.

| 2020 US NATIONAL AVERAGES (courtesy of remodeling.hw.net) | |||

| Type of Upgrade | Cost Estimate | Resale Value Estimate | Cost Recovered |

| Manufactured Stone Veneer | $9,357 | $8,943 | 95.60% |

| Garage Door Replacement | $3,695 | $3,491 | 94.50% |

| Minor Kitchen Remodel | Midrange | $23,452 | $18,206 | 77.60% |

| Siding Replacement | Fiber-Cement | $17,008 | $13,195 | 77.60% |

| Siding Replacement | Vinyl | $14,359 | $10,731 | 74.70% |

| Window Replacement | $17,641 | $12,761 | 72.30% |

| Deck Addition | Wood | $14,360 | $10,355 | 72.10% |

| Window Replacement | Wood | $21,495 | $14,804 | 68.90% |

| Entry Door Replacement | Steel | $1,881 | $1,294 | 68.80% |

| Deck Addition | Composite | $19,856 | $13,257 | 66.80% |

| Roofing Replacement | Asphalt Shingles | $24,700 | $16,287 | 65.90% |

| Bath Remodel | Midrange | $21,377 | $13,688 | 64.00% |

| Bath Remodel | Universal Design | $34,643 | $21,463 | 62.00% |

| Roofing Replacement | Metal | $40,318 | $24,682 | 61.20% |

| Major Kitchen Remodel | Midrange | $68,490 | $40,127 | 58.60% |

| Master Suite Addition | Midrange | $136,739 | $80,029 | 58.50% |

| Bath Remodel | Upscale | $67,106 | $37,995 | 56.60% |

| Bathroom Addition | Upscale | $91,287 | $49,961 | 54.70% |

| Bathroom Addition | Midrange | $49,598 | $26,807 | 54.00% |

| Major Kitchen Remodel | Upscale | $135,547 | $72,993 | 53.90% |

| Grand Entrance | Fiberglass | $9,254 | $4,930 | 53.30% |

| Master Suite Addition | Upscale | $282,062 | $145,486 | 51.60% |

Do the obvious upgrade improvements to appeal to these most desired features and your bidding war may go very well.

Get up to date on changes in this year’s real estate housing market and what forecasts are really saying about demand and home prices in the next 5 years. Need help with real estate marketing? Contact Gord Collins to build reach to home buyers and build credibility to home sellers who are checking you out.

Home Equity Line of Credit | Home Equity Rising | Reverse Mortgages | Housing Market