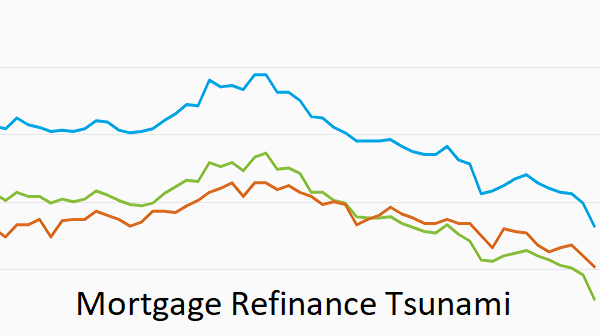

The FED Needs to Get its Act Together

The US Needs Lower Interest Rates Now The current situation for the economy and the stock market is one of worry or fear over the US FED damaging the economy and ruining current investments and future business investment. The FED was late reacting to inflation which the US government created. Now it’s overshooting with smiles…