Much Better Home Sales Season Ahead for Realtors

The US Fed is likely to reduce the central lending rate slightly in July. What goes up must come down, the way it’s done after every recession the FED has launched.

The rate decline will be minimal, however it still represents a signal of a trend and that’s what banks want to hear before they lower mortgage rates. That same downtick will set off the stock markets which can stimulate investment in the economy and investment in real estate of all kinds. Home sales are about turn around.

With respect to mortgage rates, experts believe the key moment will be when they dip below 6% from their current 6.6% levels.

“There is a magic number for fixed mortgage rates that I think would unfreeze the housing market — in other words, a price bringing together willing buyers and sellers; a market-clearing price,” says DoubleLine portfolio manager Ken Shinoda. “By my lights, that number has a 5% handle.”

13 to 18% forecasted Growth in Sales is Just a Signal to Get Your Business Rolling Again

The dour mood about real estate will begin its migration to happier times. For Realtors like you, 2024 is the year you need to accelerate your visibility, value proposition, and engagement with buyers and sellers. Work with a talented digital real estate marketer to help you integrate all lead gen channels and promote your stellar brand image. See my real estate marketing packages.

NAR’s forecast this year is for a 13% growth in sales in 2024, however, some regions and cities will see higher sales rates. Fannie Mae foresees an 18% uptick in sales.

NAR’s chief economist, Lawrence Yun says “In addition, housing inventory is expected to rise by around 30% as more sellers begin to list after delaying selling over the past two years.”

He cited 10 U.S. markets that will experience faster recovery in home sales, due to buyers returning to the market as mortgage rates decline. And as rates decline, some of those who wouldn’t give up their low-rate mortgage might be willing to sell, thus the increase in sales.

The 10 major metros with the highest pent-up buyer demand are:

- Austin-Round Rock-Georgetown, Texas

- Dallas-Fort Worth-Arlington, Texas

- Dayton-Kettering, Ohio

- Durham-Chapel Hill, North Carolina

- Harrisburg-Carlisle, Pennsylvania

- Houston-The Woodlands-Sugar Land, Texas

- Nashville-Davidson-Murfreesboro-Franklin, Tennessee

- Philadelphia-Camden-Wilmington, Pennsylvania-New Jersey-Delaware-Maryland

- Portland-South Portland, Maine

- Washington-Arlington-Alexandria, D.C.-Virginia-Maryland-West Virginia

These cities could benefit from the fact that first-time buyers will have access to more affordable homes (lower mortgage payments). NAR believes home prices won’t fall, however, a 13% increase in homes put on the market is bound to put downward pressure on prices. And that’s especially in cities where remote workers are leaving as they must return to head offices as per employer demands.

Here’s where NAR sees home prices growing the fastest:

| Strongest Home Price Forecast by City | Price Growth by % |

| Albany-Schenectady-Troy, NY | 11.1 |

| Augusta Richmond County, GA | 9 |

| Chattanooga, TN | 8.3 |

| Columbia, SC | 7.9 |

| Knoxville, TN | 10.6 |

| McAllen-Edinburg-Mission, TX | 13.7 |

| Miami-Fort Lauderdale-Pompano Beach, FL | 11 |

| New Haven-Milford, CT | 9 |

| Portland-South Portland, ME | 12.3 |

| Rochester, NY | 12.1 |

| Syracuse, NY | 10.3 |

| Milwaukee-Waukesha, WI | 8.7 |

| Providence-Warwick, RI-MA | 8.1 |

| San Jose-Sunnyvale-Santa Clara, CA | 7.3 |

| Hartford-East Hartford-Middletown, CT | 8.3 |

| Winston-Salem, NC | 9.3 |

| Toledo, OH | 8.8 |

| Youngstown-Warren-Boardman, OH-PA | 8.1 |

The lastest jobs report was particularly strong with unexpected gains and with higher salaries. This supports more buyers able to qualify for mortgages.

In their Markets With the Most Pent-up Housing Demand report available on the Nar.realtor website, 10 demand factors were cited as contributing to the growth in those cities:

1) more “returning” buyers

2) lower home price appreciation

3) more renters who can afford to buy the median-priced home

4) more potential sellers; 5) a larger decrease in remote workers

6) more affordable listings for first-time buyers

7) stronger job growth

8) faster income growth

9) most high-earner millennial renters moving into the area

10) lower violent crime rate

Cities with Highest Forecasted Price Growth

NAR predicts these major cities will see the highest home price rises:

| Major US Metro |

Price Growth 2024

|

| Spokane-Spokane Valley, WA | 5.3 |

| Providence-Warwick, RI-MA | 5.2 |

| Palm Bay-Melbourne-Titusville, FL | 5.5 |

| Madison, WI | 5.6 |

| Lakeland-Winter Haven, FL | 5.2 |

| Jacksonville, FL | 5.3 |

| Harrisburg-Carlisle, PA | 5.3 |

| Grand Rapids-Kentwood, MI | 5.3 |

| Deltona-Daytona Beach-Ormond Beach, FL | 5.1 |

| Des Moines-West Des Moines, IA | 5.4 |

| Durham-Chapel Hill, NC | 5.6 |

| El Paso, TX | 5.6 |

| Columbus, OH | 5 |

| Dallas-Fort Worth-Arlington, TX | 4.9 |

| Buffalo-Cheektowaga, NY | 5.3 |

| Cape Coral-Fort Myers, FL | 5.2 |

| Charleston-North Charleston, SC | 5 |

| Austin-Round Rock-Georgetown, TX | 5.1 |

| Atlanta-Sandy Springs-Alpharetta, GA | 5.3 |

| Albuquerque, NM | 5.1 |

| Durham-Chapel Hill, NC | 5.6 |

| El Paso, TX | 5.6 |

| Grand Rapids-Kentwood, MI | 5.3 |

| Harrisburg-Carlisle, PA | 5.3 |

| Lakeland-Winter Haven, FL | 5.2 |

| Providence-Warwick, RI-MA | 5.2 |

| Rochester, NY | 5 |

| Spokane-Spokane Valley, WA | 5.3 |

| Worcester, MA-CT | 5.2 |

Will Mortgage Rates Fall?

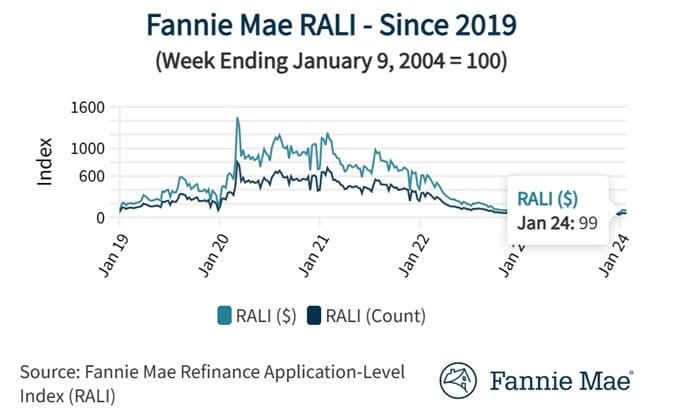

While NAR believes mortgage rates will dip to 6.6%, Fannie Mae (FNMA/OTCQB) Economic and Strategic Research (ESR) Group expects mortgage rates to decline below 6% by end of 2024.

ESR Group expects the annualized pace of existing home sales to grow 18% to 4.5 million units by the 4th quarter of 2024, compared to 3.8 million in Q4 2023.

The real question is how many homeowners must sell in 2024 or could if mortgage rates were to fall by .5%? The fact that more houses are coming onto the market and buyers are able to spend more could help sellers get their asking price.

Current Mortgage Rates (BoA rate offers)

See more on the complete US housing market forecast along with the Florida and California real estate reports.