The US Needs Lower Interest Rates Now

The current situation for the economy and the stock market is one of worry or fear over the US FED damaging the economy and ruining current investments and future business investment.

The FED was late reacting to inflation which the US government created. Now it’s overshooting with smiles resulting in future damage to the US economy.

Right now, many Americans are employed and feeling the road ahead is paved with gold. In fact, with wars stirring up amidst crushing debt levels, it’s seriously dangerous. While Biden is already spending like there’s no tomorrow, much of that is being eaten up by debt servicing and social programs. Spending’s benefits is weakening. But the FED could lower interest rates to allow the big economic engine to get moving again.

Currently, the mood is that the FED won’t cut rates until 2025. It’s not just not the loss of optimism from lower rate expectations that’s sucking the wind out of the economic sails. It’s the artificial stimulus spending that keeps fueling inflation so that rate cuts may never happen. That’s the no landing scenario that’s becoming favored.

The FED’s fedspeak is continuously launched to create harm at key moments in optimism in markets. When anything positive happens, it’s crushed. And no positive catalysts for the economy are present. This bullying, negative, dead-ended philosophy is wreaking global worries.

The single fact is that high interest rates and trillion-dollar government spending programs are causing most of the inflation. The remainder is the result of government regulations that strangle supply.

The lack of outrage toward the FED and Democrats is discouraging. The major damage is the erosion of spirit of business investment and confidence of SMB owners who are hoping to avoid bankruptcy. But bankruptcy seems to be a merit badge for the FED who are overly impressed with their 2% target. And their small-minded obsession is creating global damage and encouraging warfare conflict.

Weakening US Economy and No Life Preservers Available

The Biden/FED team have the US strung out and overextended in debt which means funding the military against the newly generated threat from enemies is unlikely. Putin, Xi, and Ali Khamenei are becoming partners in brewing conflict, reveling in the US’s weakening financial situation.

Continued out of control spending and high interest rates is a core problem for us all whether homebuyers, travelers, or stock market investors. And there’s more FED mismanagement to be concerned about too.

From debt default to wasted investments to dashed American confidence, high interest rates could plunge into a tough position, that the government might be powerless to deal with. The most likely scenario is a crippled, underperforming US economy at a time when it is risking everything in AI and automation.

And Americans are suffering from homelessness, and woke determination to make life as miserable as possible for Americans. The social, health, and opportunity costs are immense. And with the push into recession, the AI tech companies are seeing their fortunes fade after a trillion-dollar boost to build new AI chip-making factories. Now, that investment seems very foolish.

It is inappropriately inflated interest rates that are damaging the economic outlook at a time when the US needs to be booming. A flat GDP could leave the US vulnerable to shocks coming in 2025/2026.

Some doomsday prognosticators keep hyping the big crash scenario, and with a bubbled up home prices and stock market (just reached its record value), and a predicament of global trade wars/sanctions, are they that crazy?

The Current Economic and Market Condition:

The economic and markets state of affairs is characterized by:

- bubbled up stocks and housing

- GDP outlook is weak with lower tax revenue outlooks

- future GDP based on government spending (Infrastructure/Chips Acts)

- looming global supply shocks (oil, rare earth metals, trade sanctions)

- worsening geopolitical relations (Putin in conflict with Europe/USA, buying Iranian weapons, and threatening nuclear weapon use)

- refusal by the FED to understand the harm it is doing

- refusal by the FED to acknowledge the damage of current stimulus spending

- refusal by the FED to be forward-looking

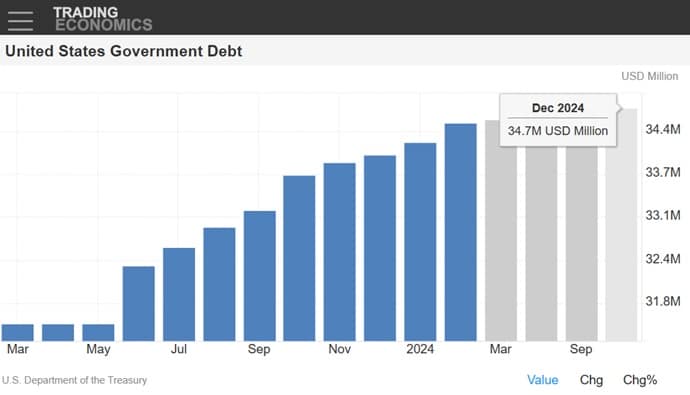

- mounting government debt crisis that could crash all markets in 2025/2026

- the FED’s pedantic focus on last month’s economic details

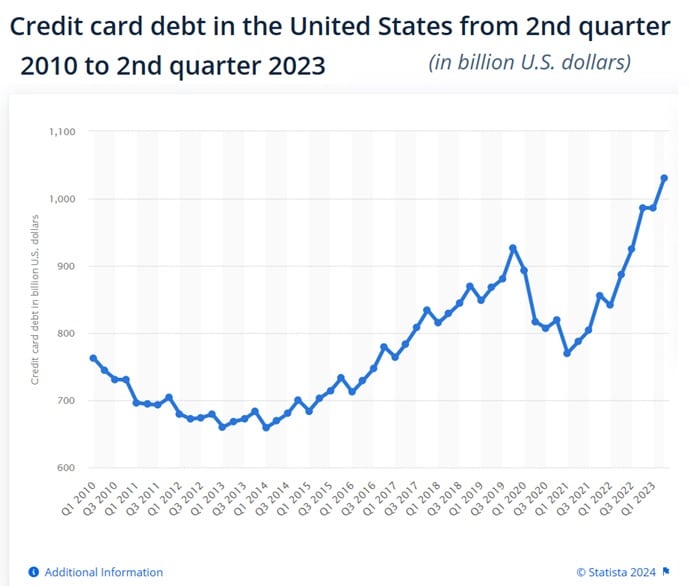

- sharply rising consumer credit card debt loads are unsustainable

- fragile China economy floods globe with dumped product

- bubbled up stock market that could crash

The point here, is that J Powell and the FED’s indecisiveness, lack of courage, and lack of economic vision is threatening business. And with every month of high rates, government tax revenues decrease and the national debt and deficit rise.

The best response to this awful predicament is to lower rates right away. The US economy needs to be unchained and those facing default need relief now.

Powell’s own lack of courage is a problem. He has indicated there isn’t much the FED can do to respond to what Biden is doing, with his massive spending bills, which begs the question of why Powell has control of anything. If his situation is impossible, then why doesn’t he resign? What does the fakery mean?

3 Key Situational Factors

Situation 1: Supply Shock — With the conflicts with China, Russia and Iran escalating, we could see a supply shock. The US is still dependent on these countries for low energy prices and many consumer goods. This shock could be very damaging and why would the US risk getting shut down for the sake of pursuing an academic 2% inflation goal?

A good example of the damage of high rates is seen in the housing market. With demand for homes so strong, the market desperately needs a big supply of newly constructed homes. It needs rehabilitation of properties, lower costs, and easy access to capital to build to fulfill real, actual demand for housing.

Situation 2: Damage to the Housing Market — When rates are lowered, homebuilders can access the capital they need, can take the risk asked of them, and be able to build homes affordably. When housing material and product suppliers go out of business, the supply is reduced thus contributing to higher input costs. And with higher mortgage rates, buyers can’t buy, which means builders will stop building. Going forward, more housing inflation is generated. The FED is continuously creating an inflationary wave ahead.

Situation 3: Focus on US Debt Servicing: The US debt is surging toward $34 Trillion and the Biden regime is desperate to pay the interest on it which may hit $2 Trillion a year.

“The national debt is projected to climb rapidly over the next several years, and higher interest rates could make the nation’s fiscal outlook even worse. The Congressional Budget Office (CBO) released long-term projections last month, showing that debt held by the public would climb from 98 percent of gross domestic product (GDP) in 2023 to 181 percent in 2053 if no changes to current law are made. Rising interest rates are a significant contributor to that growth in debt.” — from G Peterson Institute.

At some point, the debt issue is going to create a shock to the system. Some economists have suggested that the only way to deal with the debt crisis is to grow the way out, as was done post World War 2.

An Outdated Agency that Needs to be Replaced

The FED says it’s dependent on economic data which we know reflects a view to the past of “government-induced shortage of supply.” Demand isn’t all that ridiculous for products. Experts agree that supply is the problem. Rising interest rates damages the creation of supply.

Raising interest rates do precious little to reduce inflation and instead raise prices for services, housing, credit, and more. The FED is generating the very problem they say they’re solving.

This has gone on way too long and the Republicans need to show some backbone and the get US economy going again.

The demand should focus on economic growth, small business support, increased supply support, lower regulations, and tax raises for profiteering conglomerates. And Biden has already charged the monopoly conglomerates with excess greed. But nothing’s been done about it.

Investors liked what they heard from Jerome Powell in today’s speech (press conference), but it’s clear that he and the FED governors have no solution for the economy, housing market or stock market.

He mentioned potentially 3 rate cuts this year which is better news than the stock market indicated this afternoon as the indexes jumped back up. The S&P actually passed 5200, a number that no one predicted and which seemed ludicrous given the super high, higher-for-longer FED rate intent.

The negativity of the FED’s stance on inflation and rates is serving to deflate the AI-powered rally, especially AI stocks.

The Economic Path Ahead

The FED’s backward-looking outlook is damaging the future economy. That’s the key problem. How much damage can Americans suffer before there’s a call for J Powell’s firing? There is no value in killing the economy. It’s self-punishment and only reduced American prosperity and health will result.

If they’re going to announce 3 rate cuts this year, then why not do them now? If the cat’s out of the bag, how does waiting fool anyone who might be contributing to inflation? And is Powell’s

The threat of a stock market downturn and even housing market crash will heighten in the next few months as this uncertainty over high-interest rates really takes hold. We could have a significant stock market correction/pullback soon.